MH Daily Bulletin: May 31

News relevant to the plastics industry:

At M. Holland

- M. Holland is exhibiting during the WAI Operations Summit & Wire Expo on June 7-8 in Dallas, Texas. This event focused on wire and cable manufacturing offers industry forecasts, technical presentations, networking and more. Join us at Booth #621 to learn more about our supply solutions for wire and cable.

- Nick Chodorow has joined M. Holland as Chief Innovation Officer. In this role, Nick will lead efforts to enhance the company’s technology platforms and accelerate its digital journey. Click here to read the full press release.

Supply

- Oil prices settled higher Friday, with Brent ending the week up 6% compared to a 1.5% gain for WTI.

- The EU’s agreement on an embargo on Russian oil sent crude prices higher in mid-morning trading today, with WTI futures up 2.8% at $118.50/bbl and Brent up 1.8% at $123.90/bbl. U.S. natural gas was down 3.4% at $8.43/MMBtu.

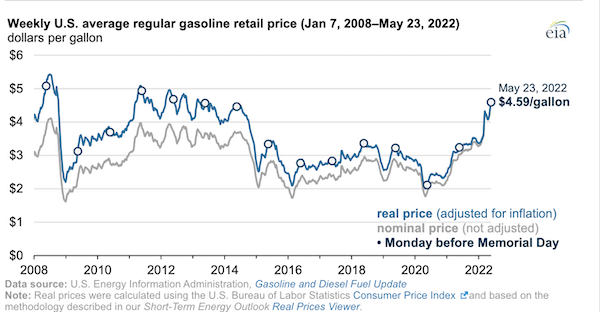

- The average U.S. gasoline price hit $4.619 a gallon Monday, a new record high and 52% above a year ago.

- A 10-week strike at a Chevron refinery in Richmond, California, has ended.

- More oil news related to the war in Europe:

- After a month of wrangling, EU leaders agreed on a modified Russian oil embargo Monday. The plan, set to be imposed tomorrow, makes an exception for the roughly one-third of Russian oil imports that come via pipeline, a concession made to secure approval from landlocked nations such as Hungary.

- Russia’s seaborne crude exports rose 4% last week but will soon decline after the EU agreed on an embargo.

- Bank of America predicts Brent could hit $150/bbl if Russian crude exports suddenly contract.

- Gazprom plans to shut off gas supplies to the Netherlands tomorrow after the nation refused to pay for Russian gas in rubles. Denmark could also see Russian gas supplies halted soon.

- Australia’s plans for five gas import terminals in the populous southeast are in jeopardy amid rising competition from Europe for storage and transport equipment.

- Georgia’s extended to mid-July its suspension of fuel taxes, which was slated to end today.

- Droughts in California could lower hydropower’s share of the state’s electricity generation to 8% this year from the typical 15%.

- Saudi Arabia is expected to raise July selling prices for all crude grades to Asia in response to surging refinery margins.

- Greece is warning vessels and oil tankers to avoid sea waters near Iran following the seizure of two Greek-flagged oil tankers by Iranian forces last week.

- Mexico spends twice as much on domestic fuel subsidies than it receives from oil exports to mitigate inflation.

- The cost to charge an electric vehicle in Britain is 21% higher than it was in September due to soaring energy prices.

- South Africa would need $250 billion of investment over the next three decades to shift its coal-dominated economy onto greener footing, economists say.

- Schlumberger, Baker Hughes and Honeywell stand to gain from proposed EPA rules requiring firms to spend on specialized equipment to contain methane emissions.

Supply Chain

- Roughly 76% of land in the western U.S. is under severe drought conditions or worse, up from 72% at the start of last year’s historic drought and wildfire season.

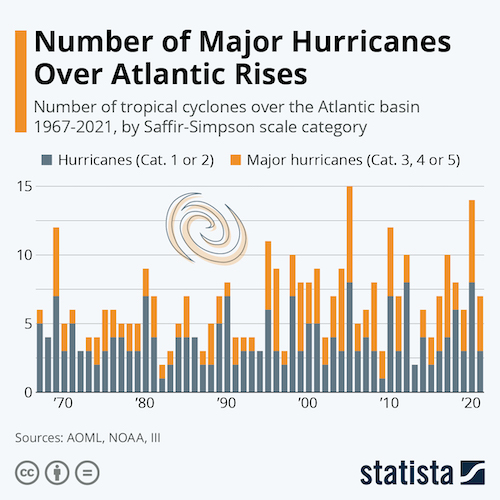

- Hurricane Agatha struck Mexico’s Oaxaca state Monday afternoon as a Category 2 storm with winds above 105 mph, the strongest May hurricane to make landfall in the Eastern Pacific from data going back to 1949.

- The U.S. government is predicting an above-normal Atlantic hurricane season for the seventh year in a row:

- A sharp boost in global container capacity has done little to alleviate supply chain snarls, as backups at ports and inland networks continue to restrain the movement of cargo. Analysts say about 12% of the world’s boxships are stuck outside congested ports for weeks longer than normal.

- Smaller U.S. parcel carriers nearly doubled both package volume and revenue in 2021, according to Pitney Bowes.

- Sony projects demand for its PlayStation 5 gaming console to outpace supply this fiscal year, primarily due to component shortages out of China.

- Tesla has restored weekly output at its Shanghai plant to nearly 70% of pre-lockdown levels.

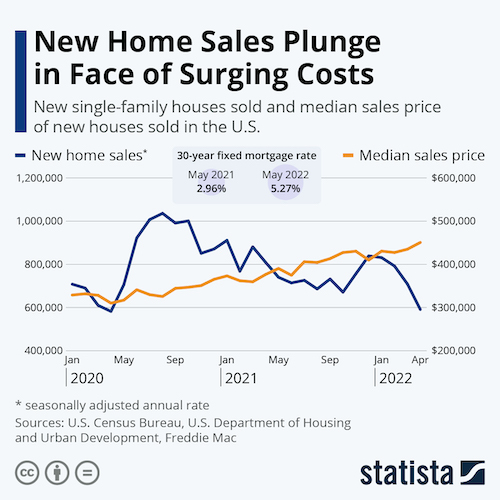

- Lumber prices are down 52% from an early-March high, as rising interest rates cool the U.S. housing market.

- Toyota produced just 692,259 vehicles last month, a 9.1% drop from last year and short of a 750,000-vehicle target.

- Singapore has 605 robots installed per 10,000 manufacturing employees, second only to South Korea’s 932.

- More supply chain news related to the war in Europe:

- Global commercial insurance premiums rose 11% on average in the first quarter, with gains concentrated on aviation and shipping firms.

- A shortage of automobile wire harnesses from top producing country Ukraine may be quickening automakers’ efforts to produce more electric vehicles.

- Less than half of Ukraine’s corn, wheat and sunflower oil will be able to pass through the nation’s war-torn infrastructure this summer, removing over 8% of all cereal exports worldwide.

- France’s Danone will fly the equivalent of 5 million bottles of specialist infant formula to the U.S. as part of a broader push to alleviate shortages faced by babies with allergies.

- Efforts to rush baby formula to the U.S. have firms building up supply-chain protections against theft, similar to measures used for pharmaceuticals and electronics.

Domestic Markets

- The U.S. reported 28,017 new COVID-19 infections and 27 virus fatalities Monday.

- COVID-19 cases are rising across North Carolina, with the state reporting over 29,000 new cases last week, a 151% increase from the same time last month.

- California’s Bay Area now has the highest COVID-19 infection rate in the state, with three of its counties each reporting more than 200,000 known cases of the virus.

- The U.S.’s first “test-to-treat” site opened in Rhode Island, where people who test positive for COVID-19 can immediately start receiving antivirals.

- Health officials are planning stepped up testing for monkeypox as the global case count hit 257 and 12 cases were confirmed in eight U.S. states.

- Consumer sentiment fell to a 10-year low in May, primarily on fears of inflation, according to a University of Michigan index.

- Americans’ personal savings rate fell to 4.4% in April, the lowest since 2008 after topping above 33% in the first year of the pandemic.

- The U.S. trade deficit in goods shrank 15.9% to $105.9 billion in April, the steepest decline in 13 years as Chinese lockdowns weighed on imports and exports hit a new record.

- Twenty percent of CFOs are planning to cut costs during the next three months in response to inflation, according to surveyor Gartner.

- Less than half of Phoenix’s public pools are opening this summer due to a shortage of lifeguards, exemplifying the nation’s continued labor shortage that will hit businesses particularly hard during peak summer months.

- The unemployment rate in 17 states in the Midwest, South and Mountain West reached a record low in April.

- Single-family home sales fell sharply by 16.6% in April, the slowest rate of sales in two years.

- More than 2,500 U.S. flights were canceled over the Memorial Day weekend holiday, mostly due to inclement weather in the U.S. Northeast and mid-Atlantic regions.

- Gap slashed its annual forecast on weak demand and high transport costs, echoing recent results from peers American Eagle Outfitters and Abercrombie & Fitch.

- Dell’s revenue rose a larger-than-expected 17% in the first quarter as more enterprises bought its computers to support hybrid work.

- Norwegian Air agreed to buy 50 Boeing 737 MAX 8 aircraft and possibly another 30, ending a contract dispute that almost saw the airline switch to Airbus.

- Efforts to build a network of public chargers to service millions of electric vehicles are faltering as states drag their feet on disbursing financial support.

- Chattanooga saw a surge of new residents during the pandemic, spurred by remote working opportunities in one of the nation’s first municipalities to install a citywide fiber-optic gigabit internet cable.

- “Top Gun: Maverick,” originally scheduled for release in 2019, brought in $156 million at the box office last weekend, a Memorial Day record and encouraging sign for beleaguered theaters.

International Markets

- Shanghai will end its two-month lockdown tomorrow, allowing the vast majority of people to leave their homes and some to return to in-person work. Meanwhile, Beijing is allowing residents from two districts to return to in-person work, as mainland China reported under 100 new COVID-19 cases Tuesday, its lowest daily total since early March.

- Taiwan is sticking to its plan of gradually easing restrictions despite record daily COVID-19 infections, including 94,800 last Friday. The island nation also announced it would shorten the mandatory quarantine time for travelers arriving from overseas.

- India will provide scholarships, counseling and health insurance to children orphaned by COVID-19.

- Russia’s latest attempt to pay roughly $100 million in interest to foreign investors has yet to clear, triggering a 30-day countdown to default. The news comes as Moscow scrambles to bypass tightened U.S. sanctions that block payment of foreign debt.

- Spain’s central bank expects that the EU could take as much as a 4.2% hit to its economy following a ban on Russian gas and oil imports.

- Eurozone inflation hit 8.1% in May, up from 7.4% the prior two months.

- China’s factory activity contracted at a slower pace for the month, as some virus curbs were lifted in key manufacturing hubs, with its official manufacturing purchasing managers index falling to 47.4 in April from 49.5 in March.

- German import prices surged 31.7% in April, the fastest pace since 1974.

- China’s effort to build a sweeping trade and security pact with 10 neighboring island nations has stalled. A renewal of the nation’s free trade agreement with Switzerland has also stalled.

- Britain will offer work visas to graduates from the world’s top universities in a bid to combat labor shortages.

- British supermarket Sainsbury’s will spend $631.4 million over the next two years to control the cost of core goods as food inflation in the country hit a 13-year high of 7% this month.

- South Korean conglomerate SK Group will invest $195 billion over the next five years to expand its semiconductor, battery and biopharmaceutical units.

- Rogers Communications and Shaw Communications agreed to delay their $15.8 billion merger until antitrust problems are resolved with Canadian regulators.

- Mexico’s Cemex, one of the world’s largest concrete producers, will fully operate a cement plant in the U.K. on alternative fuel, greatly reducing its carbon emissions.

- South Korea’s POSCO Chemical is partnering with GM to build a $633 million battery cathode plant in Canada.

- Stellantis will expand its partnership with Toyota’s European unit by producing a new large commercial van, including an electric version.

- Indian automaker Tata Motors is poised to buy a Ford manufacturing site in the western state of Gujarat as it looks to ramp up production of electric vehicles.

Some sources linked are subscription services.