MH Daily Bulletin: May 27

News relevant to the plastics industry:

At M. Holland

- M. Holland is exhibiting during the WAI Operations Summit & Wire Expo on June 7-8 in Dallas, Texas. This event focused on wire and cable manufacturing offers industry forecasts, technical presentations, networking and more. Join us at Booth #621 to learn more about our supply solutions for wire and cable.

- Nick Chodorow has joined M. Holland as Chief Innovation Officer. In this role, Nick will lead efforts to enhance the company’s technology platforms and accelerate its digital journey. Click here to read the full press release.

- M. Holland will be closed Monday, May 30 for the Memorial Day holiday.

Supply

- Oil prices jumped 3% Thursday to a two-month high. In mid-morning trading today, WTI futures were down 0.5% at $113.50/bbl, Brent was down 0.1% at $117.30/bbl, and U.S. natural gas was down 3.1% at $8.62/MMBtu.

- Demand for gasoline in mid-May fell to one of its lowest levels for this time of year in nearly a decade, new data shows. U.S. households are now spending the equivalent of $5,000 a year on the fuel, up from $2,800 a year ago.

- The White House is inquiring about restarting shuttered refineries to bring down record-high gasoline prices.

- Duke Energy is set for a battle with South Carolina regulators, who rejected the company’s plans to shut down six remaining coal-fired power plants a decade earlier than originally planned in its pursuit of zero net emissions.

- OPEC+ will likely stick to a 432,000-bpd output boost for July when the group meets next week, rebuffing Western calls for a faster increase to control prices.

- Britain announced a 25% windfall tax on oil and gas producer profits alongside an $18.9 billion support package to help households pay energy bills.

- Saudi Arabia pledged fiscal discipline and plans to funnel much of its windfall from high crude prices to its sovereign wealth fund to help diversify the economy.

- China’s imports of natural gas fell nearly 20% in April and LNG imports were off nearly 35%.

- The U.S. government confiscated an Iranian oil cargo held on a Russian-operated ship near Greece and will send the cargo to the U.S. aboard another vessel.

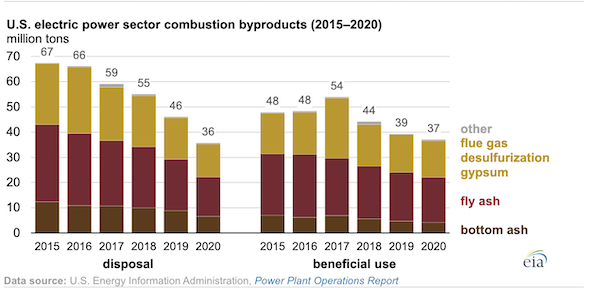

- The U.S. is now putting more combustion byproducts to beneficial use than it is discarding, the first time in data going back to 2008:

- More oil news related to the war in Europe:

- Hungary is pressing for about $800 million to upgrade its refineries and expand a pipeline from Croatia before it agrees to an EU embargo on Russian oil.

- Europe is hitting roadblocks in complex negotiations to replace Russian gas with supply from the Middle East and North Africa.

- Canada may quicken construction of a new LNG project that could start supplying Europe within three years.

- Buyers are using creative ways to maintain oil imports from Russia, including costly transfers of crude between tankers at sea.

- Western policymakers are discussing forming an international buyers’ cartel and using secondary sanctions to enforce a cap on the price of Russian oil.

- The White House released lease terms for offshore wind projects that would place hundreds of turbines and some 4.5 GW of capacity off California’s coast.

- On peak days, British wind farms produce enough electricity to cover half the nation’s demand.

- Germany’s economy minister said the G7 industrialized nations should put greater focus on phasing out coal-power generation.

- Rooftop solar installations are surging in Spain, increasing 102% last year by 1.2 GW.

Supply Chain

- California experienced its driest first three months of the year on record, a period when the state typically gets most of its annual precipitation.

- Daily operations at Shanghai’s port have rebounded to 95.3% of capacity, while the port’s cargo backlog remains high at 260,000 TEUs. The data aligns with other indications that seaborne cargo volumes from China to the U.S. ticked up this month.

- Maersk expects the ports of Los Angeles and Long Beach to finally impose long-delayed container dwell fees by the end of the month.

- Loaded container imports into the ports of Los Angeles and Long Beach in April were 41% higher than the same time in 2019.

- More than 752,000 international containers were moved in North American intermodal networks in April, a 10.4% decline from the same month last year.

- Loaded container imports into Georgia’s Port of Savannah increased 5% year over year in April and were up 40.1% from April 2019.

- Shortages of dockworkers and truck drivers are causing significant delays at Northern European ports, according to Alphaliner.

- Japan’s largest steel maker warned it would push even more price hikes onto customers after it boosted prices by 50% to record levels over the past year.

- Thousands of workers at an Apple supplier in Shanghai are demonstrating against strict COVID-19 protocols imposed by the government.

- Air Canada operated its final cargo-in-the-cabin flight of a passenger jet and will return its temporarily converted fleet of B777s and A330s to passenger service.

- Toyota announced its second global output cut in a week, lowering its planned annual output by 50,000 units to a total of 800,000.

- A majority of supply chain professionals expect disruptions in the third quarter to exceed last year’s turbulence, according to a recent survey.

- Shipping line Zim raised its earnings guidance after finalizing trans-Pacific contracts at sharply higher rates than expected.

- Intra-Asia carriers are posting record first-quarter profits as larger carriers shift capacity to major trade lanes.

- Notarc Management and Mediterranean Shipping Co. will take over the construction of a $1.4 billion container port at the Panama Canal.

- Rolls-Royce expects supply chain issues to prolong waiting lists that already stretch into the second half of 2023 for some models.

- A global shortage of Rolex watches is spreading to other luxury watch brands.

- Clorox is eliminating contract manufacturers it signed on early in the pandemic as COVID-19 shifts to an endemic phase with more predictable intensity.

- Dallas Fort Worth International Airport is testing an autonomous tug that will haul containers from freighter aircraft to the cargo terminal.

- The FDA commissioner proposed building a national stockpile of baby formula that authorities could tap to ease future shortages in as little as two months.

- The Netherlands will consider joining an alliance to help escort grain supplies stuck in Ukrainian ports.

Domestic Markets

- The U.S. reported 118,954 new COVID-19 infections and 338 virus fatalities Thursday. There were roughly 108,000 new daily infections over the last week, up 28% from two weeks ago, while fatalities hovered near the lowest levels of the pandemic at 300 per day.

- Hawaii has the highest per capita rate of COVID-19 in the nation.

- COVID-19 cases are rising in all of California’s 58 counties.

- The CDC will stop collecting hospital data on suspected COVID-19 cases that have not been confirmed by tests.

- The U.S. economy contracted by a 1.5% annual rate in the first quarter, new government figures show, while corporate profits fell for the first time in five quarters.

- U.S. consumers expect current high inflation to moderate and to be down to a 3% annual rate in five years, according to a new Fed survey. The U.S. inflation rate decelerated in April to 6.3% from 6.6% in March, while consumer spending jumped 0.9%.

- Initial U.S. jobless claims fell by 8,000 last week to 210,000, a bigger drop than expected and a signal of continued tightness in the labor market.

- The average U.S. mortgage rate fell to 5.1% this week, the lowest in a month.

- U.S. pending home sales slumped 3.9% in April, falling for the sixth month in a row.

- Home listings rose 9% last week as sellers worry that they may miss out on the booming market. Roughly 20% of sellers dropped list prices over the previous four weeks.

- Over half of Americans surveyed don’t believe they can afford a vacation this year due to surging inflation and fuel prices that are 50% higher than a year ago.

- The widespread adoption of remote work across the U.S. has local employers learning to compete with out-of-state firms offering higher salaries.

- Discount retailers Dollar General and Dollar Tree saw better-than-expected quarterly earnings, a reversal from disappointing results at big-box stores such as Target and Walmart.

- Macy’s stock jumped after the retailer raised its profit forecasts on healthy demand for high-end goods.

- Microsoft is slowing hiring for its Windows, Office and Teams software units, joining a growing list of tech companies reducing expenses amid the economic downturn.

- PayPal began laying off scores of workers across the country this week as growth in spending on its platform slows.

- Broadcom confirmed one of the biggest acquisitions so far this year, a $60-billion takeover of California cloud-computing firm VMware.

- Roughly 662,000 fewer students enrolled in undergraduate programs this spring, a 4.7% decline from a year earlier.

- Delta Air Lines is cutting about 100 flights per day this summer, becoming the latest carrier to scale back capacity in the hopes of avoiding significant travel disruptions.

- Joby Aviation received FAA certification for its five-seat air taxis, clearing a significant hurdle toward eventual commercialization.

- A Korean solar panel maker plans to build a $171 million plant in Dalton, Georgia.

International Markets

- Global COVID-19 infections and fatalities dropped a respective 3% and 11% the past week, according to the World Health Organization.

- Shanghai unveiled more post-lockdown plans it will implement on June 1, while Beijing began imposing harsher punishments on workplaces that flout pandemic rules.

- Japan yesterday reopened its borders to tourist groups but not individual travelers for the first time since early 2020 and doubled its cap on overseas arrivals to 20,000 per day.

- New research suggests asymptomatic carriers of COVID-19 are about 68% less likely to pass the virus on than those who get sick.

- Economists predict Africa’s GDP will rise just 4.1% this year compared to 6.9% in 2021.

- Canadian job openings hit a record-high of over 1 million in March.

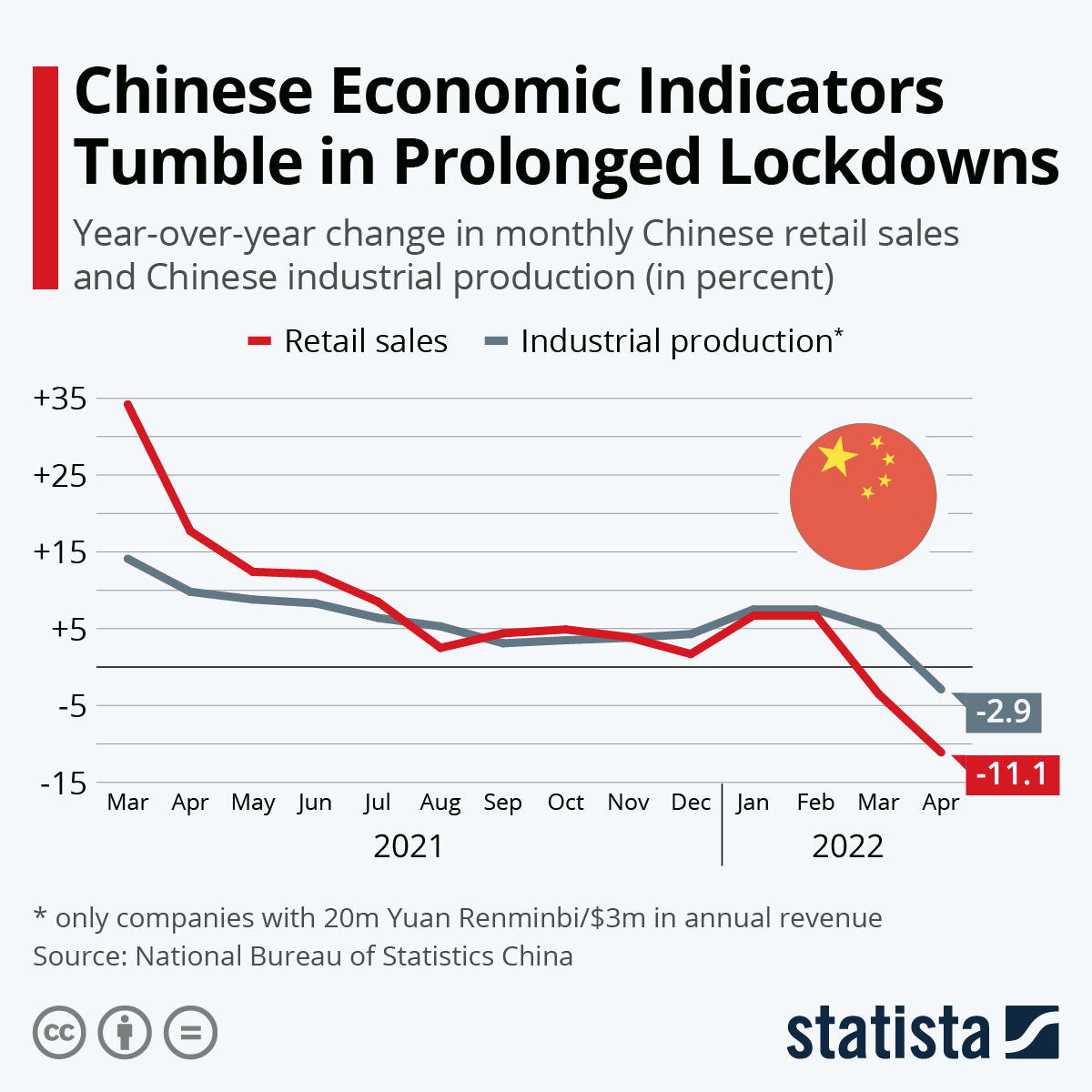

- Profits at China’s industrial firms fell 8.5% last month, the quickest decline in two years.

- Taiwan lowered its estimate for GDP growth this year to 3.9% from the 4.4% it forecast in February.

- China’s e-commerce giant Alibaba reported better-than-expected quarterly revenues and earnings but declined to give a forecast for the current fiscal year due to risks from COVID-19.

- Hungary will impose windfall taxes worth $2.19 billion on excess profits earned by banks, energy companies and other firms.

- The U.K. is rolling out sanctions aimed at preventing Russian airlines from selling their unused landing slots at British ports.

Some sources linked are subscription services.