MH Daily Bulletin: May 24

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending the Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm ET.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am ET.

- M. Holland will be closed Monday, May 30 for the Memorial Day holiday.

Supply

- Competing pressures held oil prices to a limited gain Monday. In mid-morning trading today, WTI futures were up 0.2% at $110.50/bbl, Brent was up 0.5% at $113.90/bbl, and U.S. natural gas was up 1.3% at $8.86/MMBtu.

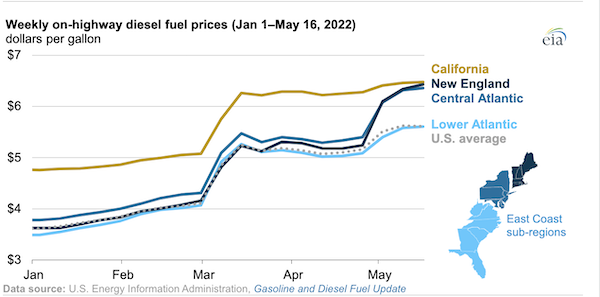

- The White House is weighing an emergency release of diesel from a rarely used stockpile to help blunt rising prices, officials said. The average diesel price hit $6.43 a gallon in New England yesterday, up 78% on the year.

- U.S. crude output remains below pre-pandemic levels even though crude prices have doubled since early 2020.

- Britain’s administration is considering a windfall tax on electricity generators and oil and gas producers to help subsidize soaring energy costs.

- Brazil’s president fired Petrobras’ new chief executive after a month on the job amid rising criticism of high gas prices.

- U.S.-based Sempra Energy signed a deal with TotalEnergies and Japan’s Mitsui and Mitsubishi to build a carbon-capture project in Louisiana.

- More oil news related to the war in Europe:

- Hungary continues to hold out against a European ban on Russian oil.

- Russia seaborne crude exports fell just 3% last week, showing minimal effect from Western sanctions.

- EU nations plan to start jointly buying gas before winter as the bloc seeks to cut reliance on Russian fuels.

- Poland will no longer receive Russian gas from the Yamal pipeline after rejecting Moscow’s demand for payment in rubles.

- Poland is in talks to receive more gas shipments from Portugal which it could distribute to western and southern neighbors.

- The IEA continues to warn investors not to fund new fossil fuel projects despite the supply crunch caused by Russia’s invasion.

Supply Chain

- Emergency crews are working to restore power to half a million people in Ontario and Quebec following severe weekend storms that left eight dead.

- California may impose mandatory water restrictions after one of the driest rain seasons in a century. The state’s current drought is linked to a longer “megadrought” which has persisted since 2000.

- Contract negotiations between 22,000 West Coast dockworkers and their employers could stretch one or two months past a July 1 deadline, officials indicated.

- Supply-chain managers quit their jobs last year at the highest pace since 2016, while openings for managerial positions have more than doubled during the pandemic.

- Jet engine maker CFM International is facing industrial delays of six to eight weeks due to supply-chain problems and French labor unrest.

- Tesla plans to restore production at its Shanghai plant to pre-lockdown levels today.

- Lockdowns in China are having a greater impact on DHL’s operations than the war in Ukraine, the firm said.

- Amazon is looking to sublease at least 10 million square feet of warehouse space after expanding too rapidly during the pandemic.

- Walmart GoLocal, the retail giant’s third-party delivery service, is now delivering from 1,600 retail and business locations in the U.S.

- Motorola is paying a premium for semiconductors on the secondary market and shifting from ocean to air as its primary means of freight as supply constraints hamper manufacturers.

- Samsung unveiled a $356 billion investment blueprint for the next five years aimed at making it the world’s frontrunner in semiconductor development.

- A German court banned sales and production of Ford vehicles with internet connectivity as part of a lawsuit over wireless technology patents.

- Mercedes plans to cut up to 20% of its dealerships in Germany and about 10% globally as part of a broad overhaul of its distribution network.

- BMW expects to meet its output targets for 2022 even as congestion at Chinese ports, closures in Ukraine and other supply disruptions continue to weigh on sales.

- U.S. egg prices are up 40% this year after a series of avian flu outbreaks forced the destruction of flocks, dropping output to a 17-year low.

- Malaysia will halt exports of 3.6 million chickens per month starting in June to ensure domestic supplies.

- U.S. regulators will issue an emergency declaration to waive hours-of-service requirements for commercial vehicle drivers transporting baby formula ingredients and packaging.

- Maersk extended contracts to provide two anchor-handling tugs cleaning floating plastic waste in the Great Pacific Garbage Patch.

Domestic Markets

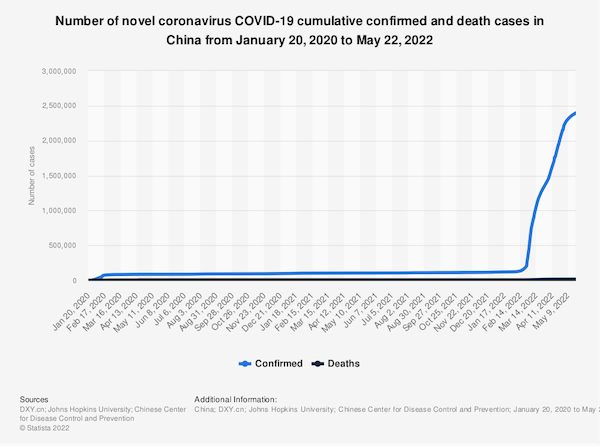

- The U.S. reported 18,309 new COVID-19 infections and 27 virus fatalities Sunday.

- Los Angeles County extended its order requiring masks on public transit due to a rise in COVID-19 cases.

- The U.S. reported 109,258 new COVID-19 infections and 204 virus fatalities Monday.

- About 18% of the population now lives in high-risk areas for COVID-19 transmission, according to the CDC.

- COVID-19 cases in California are up 63% the past week.

- New Jersey’s seven-day COVID-19 infection average is up 131% from a month ago.

- Average daily COVID-19 cases in Florida rose 53% last week, the largest jump in five months.

- The active COVID-19 case count in New York state dropped for the sixth straight day Monday, although the test positivity rate stood at a high 9.1%.

- The FDA will meet in mid-June to discuss emergency authorization for COVID-19 shots in children as young as six months old following positive clinical trial data released Monday.

- Merck and Johnson & Johnson are among the firms cutting sales expectations for pandemic products this year as stockpiles grow and many people are vaccinated.

- Arizona banned COVID-19 vaccine mandates for schools.

- The number of U.S. births rose by 1% in 2021, the first increase in seven years.

- Last fall, Americans reported the highest level of financial well-being than at any point the past decade, according to a new Fed survey.

- JPMorgan Chase says credit losses will remain low through 2023 as customers continue to possess cash balances that surged during the pandemic.

- First-quarter share repurchases reached $269 billion, up 58% from a year earlier and on track for a record $1 trillion by the end of the year.

- Marketing budgets surged to 9.5% of total company revenue in 2022, up from 6.4% last year but still slightly lower than pre-pandemic levels.

- Bank of America is increasing its minimum wage to $25 an hour by 2025.

- Best Buy reported lower sales and profits in the latest quarter and lowered projections for the year, citing “worsened” economic conditions over the past two months.

- Sales at Zoom Video Communications rose 12% in the latest quarter, the slowest rate in the firm’s history as more workers return to the office.

- Broadcom is expected to announce one of the biggest acquisitions so far this year, a $60-billion takeover of California cloud-computing firm VMware.

- As Microsoft’s acquisition of Activision goes through antitrust review, some Activision studio workers voted to unionize, a first for a major U.S. videogame maker and another example of new groups organizing amid a labor crunch.

- A New York City cab driver union is asking for higher fares and wages to deal with a surge in fuel prices.

- New York office occupancy remains below 40% of pre-pandemic levels.

- A global survey found just 29% of U.S. car buyers have plans to go electric for their next vehicle, well under the 50% rate for the rest of the world. Still, electric vehicle registrations in the U.S. soared 60% in the first quarter, despite a decline in total registrations.

- Auto supplier Piston Group will manufacture electric vehicle batteries for a startup based near Detroit.

- A British recycling firm plans to open a U.S. facility to retrieve metals such as copper, gold and silver from discarded personal electronics.

International Markets

- Shanghai remains on track to lift lockdowns on June 1 but said residents will need to scan mobile health apps to enter schools, parks, and office and residential buildings.

- Sweden recommended a fifth COVID-19 vaccine dose for people over 65 and pregnant women.

- Japan will double its cap on overseas arrivals to 20,000 per day starting in June, officials said.

- New research shows that organ damage, particularly in the lungs and kidneys, is common where COVID-19 infection requires hospitalization.

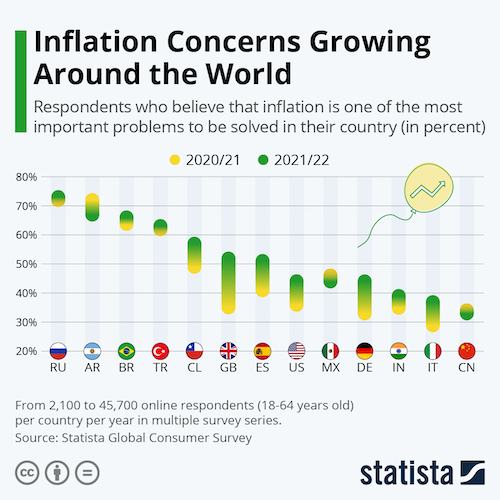

- Inflation and the risk of a global recession were among the top economic worries of diplomats at the annual Davos economic summit. IMF officials said they did not expect a recession for major economies but could not rule one out.

- The WTO’s latest report on global merchandise trade suggests growth continues to slow since Russia’s invasion of Ukraine and China’s lockdowns.

- The U.S. president concluded a tour of East Asia with commitments to form a loose commercial alliance with at least 12 nations, including Japan, South Korea and India.

- The EU’s central bank is likely to increase its key interest rate — currently negative — to zero by September and could continue raising rates after that, officials said.

- UBS and JPMorgan Chase downgraded growth forecasts for China’s economy after April activity was crushed by lockdowns. China said it will continue taking targeted steps, including broadening its tax credit rebates and rolling out new investment projects, to support lagging growth.

- At least 20 countries recently committed to new aid packages for Ukraine.

- All of Airbnb’s mainland China listings will be taken down by this summer as lockdowns and domestic competition lower demand.

- British home prices are 10% higher than the same time last year, new data shows.

- Almost 85% of British workers want to keep working in a hybrid setting once the pandemic eases, according to a new survey.

- Canada’s Bombardier launched a new long-range business jet, a bid to capitalize on elevated luxury consumption.

- BMW is exploring new investments in solar, geothermal and hydrogen energy to lower its dependence on natural gas, executives said.

- Siemens Energy, majority owner of Siemens Gamesa Renewable Energy, will take the struggling renewable energy company private, rescuing frustrated minority shareowners.

Some sources linked are subscription services.