MH Daily Bulletin: May 23

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending the Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm ET.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am ET.

Supply

- Oil prices rose modestly Friday as WTI notched its fourth straight week of gains. U.S. natural gas prices fell almost 3% on signs of cooler weather in the coming weeks.

- In mid-morning trading today, WTI futures were up 0.1% at $110.40/bbl, Brent was up 0.4% at $113.00/bbl, and U.S. natural gas was up 4.3% at $8.43/MMBtu.

- Active U.S. oil and gas rigs rose for the ninth week in a row, as smaller producers respond to higher prices and governmental pressure to ramp up output.

- The average U.S. gasoline price ended last week at a record $4.59 a gallon. Despite the increase, Americans surpassed pre-pandemic levels of driving in April and will hit pre-pandemic travel volumes this Memorial Day weekend.

- Norwegian crude output in April missed forecasts by over 10%, while the country’s gas production was in line with expectations.

- More oil news related to the war in Europe:

- Germany and Italy are allowing companies to open rubles accounts to purchase Russian gas without breaching EU sanctions.

- Big German businesses are creating an auction system to help ration supplies in the event Russia cuts off the nation’s gas. Gas supplies to Finland were cut off Saturday.

- Germany’s plan to boost gas imports from Qatar could take several years as Qatar works to build new plants.

- China is quietly ramping up purchases of Russian oil at bargain prices, according to shipping data.

- India’s crude imports in April were the highest in 3.5 years on more purchases of discounted Russian fuel. The nation also reduced fuel taxes to fight inflation.

- A group of 20 states, including Texas and Ohio, are challenging the EPA’s decision to let California restore strict vehicle emissions standards.

- More than two dozen banks and financial firms declared themselves non-hostile to the Texas energy industry following a demand from the state’s administration.

- EU lawmakers will attempt to block labeling gas and nuclear energy as “sustainable” investments, a plan proposed by the EU administration earlier this year.

- The S&P removed Tesla from its ESG 500 index after a University of Massachusetts study concluded the company is a bigger polluter than Exxon Mobil.

Supply Chain

- A major heatwave broke decades-old temperature records across the East Coast over the weekend.

- The U.S. Forest Service will halt controlled burns after accidentally helping start New Mexico’s Calf Canyon blaze, now consuming over 300,000 acres and displacing tens of thousands of people. The state closed two of its national forests.

- Only 11% of shipments from Asia arrived on time in North America this month, down from 18% last year and 59% in 2020.

- Container lines removed about 25% of capacity from Asia-West Coast routes in late April and early May.

- Prices for dry bulk’s largest capesize vessels surged to a five-month high this month.

- Current orders for new container ships are equivalent to about 30% of the capacity of the existing global fleet.

- South Korean shipper HMM’s first-quarter profit rose nearly 20-fold to $2.4 billion.

- Tesla plans to keep its Shanghai employees working in a closed-loop system until mid-June, despite the city’s move to ease wider lockdown restrictions.

- Reports suggest Apple is looking to boost production outside China as the nation’s zero-COVID stance slows production and demand.

- The U.S. president was in East Asia last week promoting semiconductor development in South Korea and other nations.

- Top Chinese chipmaker SMIC says demand for mobile phones, personal computers and home appliances “dropped like a rock” this month.

- Yellow will drop 28% of its terminals as it consolidates its less-than-truckload operations.

- Truckload carrier Werner Enterprises is scaling back its sales of used trucks and trailers due to backlogs for new replacements at manufacturers.

- The world’s largest carmakers are warning that supply-chain disruptions and higher raw material prices threaten the rollout of electric vehicles.

- DHL ordered 44 Volvo electric trucks for European operations as part of a plan to scale up the use of electric power.

- Road freight costs in greater London are rising at twice the speed of the rest of Britain.

- A British startup is exploring options for cargo drone deliveries from Singapore’s only multi-purpose cargo port at Jurong.

- About 48% of companies surveyed by Modern Materials Handling said they have no plans to add robotics to their warehouse operations.

- Saudi Arabia is relaunching efforts to privatize its airports as it seeks to diversify its oil-dependent economy.

- France’s Danone, the world’s second biggest maker of baby formula, has tripled its ocean shipments to North America to help make up for shortages. Aided by the U.S. military, Nestle is also boosting shipments.

- The U.S. received its first 70,000-pound shipment of baby formula from Europe to help alleviate a critical supply shortage. Many low-income parents dependent on subsidies from the federal Women, Infants and Children (WIC) program have been forced to pay for formula outside the platform, prompting calls for changes.

- Substantial rain will be needed by early June to avert crop losses in France, Europe’s biggest grain producer.

- Russia is blocking the export of over 22 million tons of food from Ukrainian ports. The U.S. administration accused Russia of using food as a weapon in its invasion.

Domestic Markets

- The U.S. reported 18,309 new COVID-19 infections and 27 virus fatalities Sunday.

- Los Angeles County extended its order requiring masks on public transit due to a rise in COVID-19 cases.

- Almost 90% of New York counties are at the CDC’s highest level of risk for COVID-19 transmission. Last Wednesday, the state recorded 130 COVID-19 deaths, the highest number since vaccinations began.

- Alabama’s COVID-19 positivity rate hit almost 10% last week, the highest in three months.

- Boston’s COVID-19 positivity rate is up to 9.35% from just 1.6% two months ago.

- Philadelphia reinstated its mask mandate in schools amid surging infections in the city.

- An analysis of U.S. wastewater suggests that COVID-19 is spreading more widely than official new case tallies are indicating.

- The CDC now recommends that all people 50 or older get a second COVID-19 booster dose four months after the first.

- The U.S. warned it may ration supplies of vaccines and treatments this fall if Congress does not approve more money for fighting COVID-19.

- New research throws doubt on early conclusions that the Omicron strain of COVID-19 was less deadly than the Delta strain.

- With COVID-19 having spread to some 20 other animal species, scientists are researching whether animals could spawn new variants that might affect humans.

- A clinical trial of Pfizer/BioNTech’s COVID-19 vaccine showed that three doses of the treatment provided a strong immune response in children aged six months to four-years-old.

- Federal regulators will soon approve a revamped COVID-19 vaccine design which would allow manufacturers to produce new shots for this fall and winter.

- A new survey shows that roughly one-third of employers have yet to decide on their return to office plans, as new COVID-19 surges continue to disrupt plans and provide fresh obstacles for companies looking to instate hybrid work models.

- This year’s economic headwinds have shaved over $5 trillion from the $38.5 trillion in U.S. household wealth built up during the pandemic, according to JPMorgan.

- Roughly 57% of U.S. small business owners expect economic conditions to worsen in the next year, up from 42% in April.

- Many prominent tech and e-commerce companies are freezing hiring or imposing staff cuts in response to a “seismic shift” in markets.

- Macy’s, Dollar General and Costco are set to report quarterly earnings this week, providing more clues on the strength of U.S. consumer spending.

- Employers are placing a new focus on access to housing in an attempt to attract and retain talent.

- Supply chain challenges are prompting more Americans to keep their vehicles longer, with the average age of light vehicles in operation jumping to 12.2 years in 2022, a near two months increase from 2021.

- Deere reported a 20% decline in quarterly profit but raised its outlook for the full year as rising crop prices keep demand for machinery high.

- Hyundai pledged to invest another $5 billion in the U.S. by 2025, just days after confirming plans for a $5.5 billion electric-vehicle plant in Georgia.

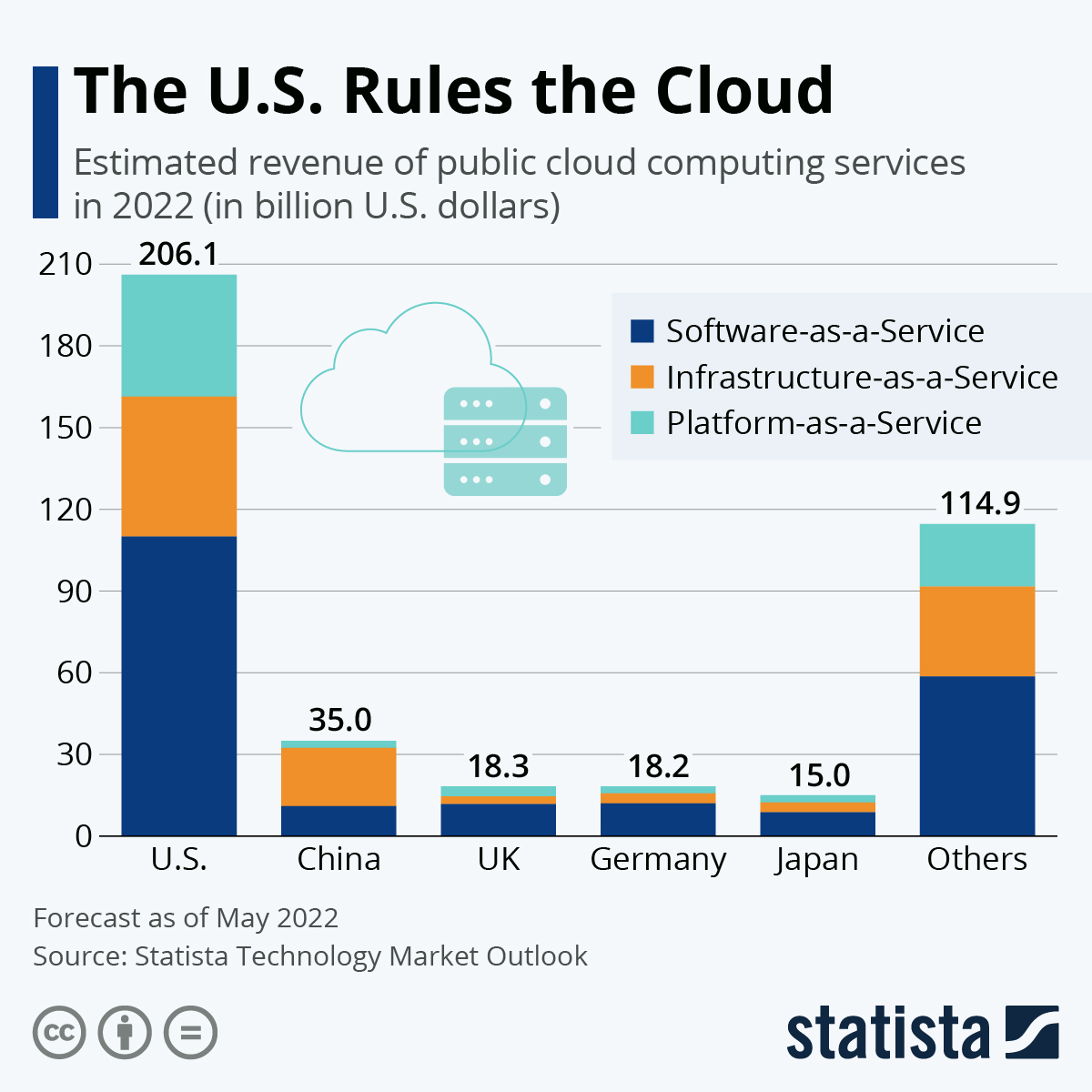

- U.S. revenues from cloud computing services will surpass $200 billion this year, roughly six times the size of the next largest market in China:

- Cleaning supply manufacturer SC Johnson is reviving its concentrated Windex product, first introduced over a decade ago, which uses 90% less plastic compared to its prior incarnation.

International Markets

- COVID-19 infections are increasing in almost 70 countries across the world, the World Health Organization said.

- Authorities in Shanghai say they are on track to completely lift lockdowns next week. Part of the city’s subway system opened Sunday for the first time in two months.

- Beijing closed public transit in a central district over the weekend and put thousands of people into forced quarantine as the city guards against persistent, though small, COVID-19 outbreaks. Today, the city extended work-from-home orders and expanded testing after an uptick in virus cases.

- The World Health Organization has granted emergency use authorization to China’s CanSino Biologics COVID-19 vaccine, the 11th vaccine to get clearance from the global health agency.

- Two types of the COVID-19 Omicron variant — BA.4 and BA.5 — were labeled variants of concern in the U.K. after fueling a new wave in South Africa.

- More news related to the war in Europe:

- Russia’s invasion of Ukraine is now in its fourth month.

- The White House approved $40 billion more in Ukrainian aid on Saturday.

- Russia narrowly avoided default late last week with a $100 million payment on two foreign debt obligations. Tightened U.S. sanctions will curtail Moscow’s ability to pay interest starting this week.

- Starbucks is closing its 130 stores in Russia and will exit the country after 15 years.

- After falling 7% against the U.S. dollar this year, the Euro and dollar are approaching parity.

- Turkey raised its key interest rate by 75 basis points Thursday, its first hike in three years, as the nation’s economy takes a hit from the war in Ukraine and surging inflation.

- Sri Lanka continues to face dire shortages of food, fuel and medicines amid its worst financial crisis in decades.

- British retail sales rose 1.4% in April, beating analyst forecasts for a decline.

- China spent at least 1.73% of its 2019 GDP on subsidizing favored industries, compared to just 0.39% in the U.S.

- April marked the third straight month of substantial foreign outflows in China’s bond markets, signaling a vicious cycle starting to devalue the nation’s currency.

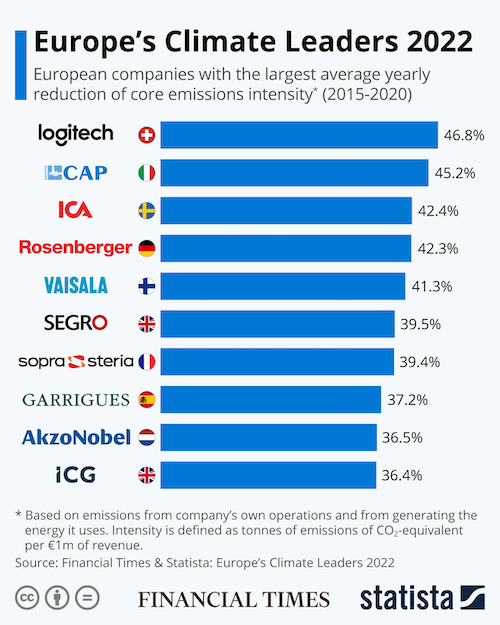

- Logitech ranks at the top of the list for emissions reductions among European firms this year:

- Indian auto manufacturer Mahindra is looking to source more electric vehicle components from other companies rather than boosting them in-house, hoping to accelerate its growth in the segment.

- Mitsubishi and Nissan unveiled their first jointly developed electric vehicle (EV) to cater to a Japanese market that has been slow to adopt EVs.

Some sources linked are subscription services.