MH Daily Bulletin: May 18

News relevant to the plastics industry:

At M. Holland

- Lindy Holland-Resnick, Market Manager for Packaging at M. Holland, is presenting during the upcoming Re|focus Sustainability & Recycling Summit in Cincinnati, Ohio. Her session on Developing a Sustainably Minded Staff will cover how to create a holistically sustainable company from top to bottom. If you’re attending Re|focus, don’t miss Lindy’s session on Tuesday, May 24 at 11:15 am ET.

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending the Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm ET.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am ET.

Supply

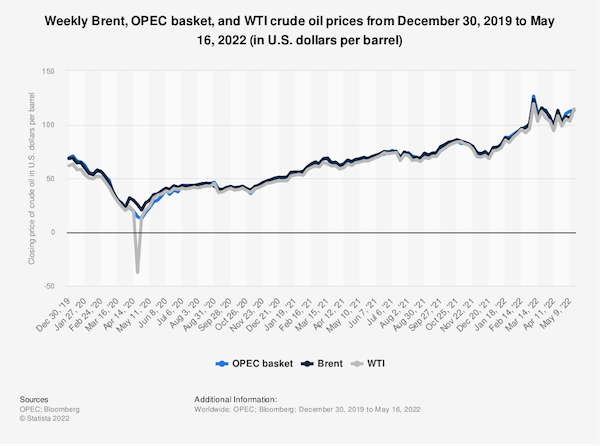

- Oil prices fell 2% Tuesday after the U.S. said Chevron could negotiate with Venezuela — holder of the world’s largest crude reserves — about possibly restarting production there.

- In yesterday’s trading, WTI settled higher than Brent for the first time in two years as U.S. reserves continue falling, according to the American Petroleum Institute.

- In mid-morning trading today, WTI futures were down 1.6% at $110.60/bbl, Brent was down 1.6% at $110.11/bbl, and U.S. natural gas was up 0.2% at $8.32/MMBtu.

- U.S. gasoline prices surpassed $4 a gallon in every state for the first time Tuesday, with the national average rising to $4.567 this morning, another record.

- Over 600,000 bpd of Libyan oil production remains shut-in as political tensions escalate.

- More oil news related to the war in Europe:

- European diplomats are pointing to a May 30-31 summit as the moment for agreement on a phased ban of Russian oil. U.S. officials now suggest tariffs may be quicker and less costly than an all-out ban.

- Germany plans to stop importing Russian crude this year even if a broader EU agreement fails. Hungary, the lone holdout, says it will cost $810 million to accommodate the embargo.

- The EU’s unclear guidance has some European importers setting up accounts to pay for Russian gas in rubles, while others consider the move a breach of sanctions.

- While Russian crude production fell 9% in April, seaborne deliveries to India and China remain high at more than 1 million bpd.

- Russia’s oil pipeline monopoly is withholding important port loading data as tensions mount with the West.

- Non-Russian crude deliveries into northern Poland were the highest in at least seven years this month.

- TotalEnergies is selling its interest in 13 onshore fields and three shallow-water fields in Nigeria because of unstable conditions in the country.

- BP is spearheading the U.S. Gulf Coast’s third major effort to capture and store industrial carbon emissions underground.

- Chevron’s $2 billion carbon capture facility in Australia has buried only half the emissions expected three years after startup.

- A German hydrogen firm plans to spend $2.8 billion to build 4 GW of green hydrogen capacity by 2030.

- Germany opposes putting a “green” label on nuclear energy but supports the label for natural gas, which it sees as essential in the transition to renewables.

Supply Chain

- New Mexico’s Calf Canyon wildfire, now the largest in state history, surpassed 300,000 acres Tuesday with just 26% containment.

- Temperatures in the mid-90s across the Southern Plains could break records in Florida and North Carolina later this week. The heatwave is testing Texas’ power grid and breaking multiple demand records for the month of May.

- Air conditioner sales in India will surge past their previous record this year amid century-high spring temperatures.

- Southern California port officials say the months-long threat of dwell fees is a major reason “aging cargo” has declined about 50% since last fall.

- The Port of Savannah handled 495,782 TEUs last month, its busiest April on record. Overall volumes are 8% higher this fiscal year.

- The Baltic Dry Index, a broad measure of strength in the dry bulk spot market, has declined slightly after hitting 2022 highs last week.

- The U.S. administration more than doubled funding for port infrastructure projects to $684.3 million this year, an all-time high.

- Non-mainland Chinese carriers, including Maersk and OOCL, were granted access to serve Chinese coastal shipping lanes between four key ports last week.

- U.S. maritime regulators are seeking comments on six rule changes aimed at increasing the transparency of shipping transactions.

- Daimler Truck reported a 17% gain in first-quarter revenue and said it would continue passing high costs to customers this quarter amid record demand.

- J&J Snack Foods lost $20 million in quarterly revenue due to operational and supply chain problems associated with the implementation of a new ERP system.

- Amazon is recruiting rural mom-and-pop shops to test package deliveries through their stores.

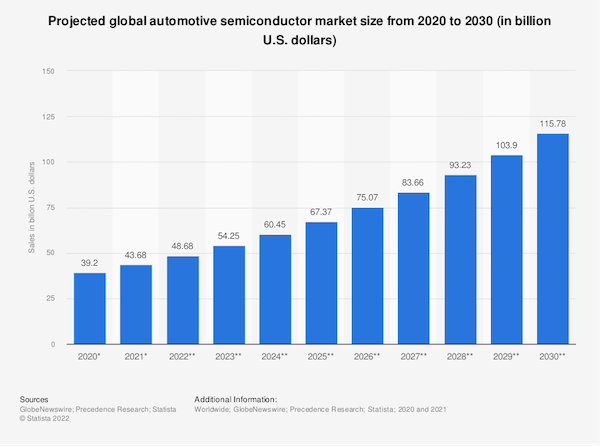

- The global auto semiconductor market is projected to grow rapidly to $115 billion by 2030:

- Perrigo, maker of Walmart- and Amazon-brand baby formula, expects U.S. shortages to last throughout the year. The U.S. House of Representatives will vote today on giving regulators emergency authority to relax some non-safety-related rules to boost supply.

- Hershey is beefing up production and distribution capacity ahead of Halloween after failing to meet strong demand at Easter due to supply chain and production constraints.

- Tootsie Roll said it may be forced to halt some production lines due to ingredient and packaging shortages.

- Uber launched pilot programs this week to test a sidewalk delivery robot and a self-driving delivery vehicle in Los Angeles. Los Angeles residents will also be able to hail robotic ice cream trucks this summer being piloted by a partnership between Robomart and Unilever (parent of Ben & Jerry’s), Breyers, Good Humor and other brands.

Domestic Markets

- The U.S. reported 112,487 new COVID-19 infections and 347 virus fatalities Tuesday. The total confirmed death toll surpassed 1 million Americans.

- Los Angeles County averaged 2,800 new COVID-19 cases per day last week, up 18% from the prior week, while infections also are spiking in the Bay Area. Rising infections prompted Apple to delay its return-to-office plans.

- New York City went into COVID-19 “high alert” Tuesday, triggering an official recommendation to wear masks indoors.

- Key COVID-19 antiviral drugs will be in short supply this summer and may run out without more funding from Congress, the White House warned.

- The FDA authorized booster doses of Pfizer’s COVID-19 vaccine for children aged 5 to 11.

- The Federal Reserve Chairman warned the U.S. economy could suffer from its more hawkish stance but vowed to keep tightening monetary policy until it is clear that inflation is declining.

- Alongside the 0.9% rise in retail spending in April, the Commerce Department raised its March reading from 0.5% to 1.4%, an additional positive signal.

- U.S. factory production rose at a better-than-expected 0.8% in April, a third consecutive month of solid growth, with gains recorded for metals, machinery, vehicles and food.

- Airfares surged 18.6% in April from a month earlier and will likely remain high for the foreseeable future, according to Frontier.

- Shares of Walmart fell by double digits Tuesday after the retailer’s first-quarter results showed a 25% drop in income and 30% higher labor costs.

- Target shares were down 25% in mid-day trading today after the company announced a more than 50% drop in net income due to cost inflation and shifting consumer buying patterns.

- Home Depot posted a better-than-expected rise in Q1 same-store sales and raised full-year profit guidance as demand remains steady for pricier tools and building materials, while competitor Lowe’s blamed unseasonably cold weather for a drop in first-quarter revenues.

- Netflix is cutting 150 employees in a new round of layoffs as the streaming firm grapples with slowing revenue growth and fewer subscribers.

- Online furniture seller Wayfair, a pandemic darling, is freezing corporate hiring for 90 days.

- Companies are expected to have 22.6% more interns this academic year compared to last, with the largest gains in tech and finance.

- United Airlines’ fleet of Boeing 777s powered with Pratt & Whitney engines has been cleared to fly again by the FAA. The planes were grounded after an engine failure showered plane parts over Colorado in February 2021.

- Tesla restricted reservations for its Cybertruck to North America ahead of a delayed launch in 2023, four years after it was introduced.

- The CEO of Stellantis said the U.S. must produce more electric vehicle batteries to keep pace with demand.

International Markets

- Shanghai reported a third straight day of zero COVID-19 cases outside quarantine zones, a key milestone to start easing lockdowns. Social media suggest restrictions are still widely in effect.

- Beijing reported 69 new COVID-19 cases yesterday, up from 52 the day before, as lockdowns grow. Three rounds of mass testing were ordered for several districts.

- Rapidly spreading COVID-19 cases in unvaccinated North Korea pose a risk of new virus mutations that could spread globally, health experts warn.

- Japan’s next phase of relaxed travel restrictions will allow boosted travelers from the U.S., Australia, Thailand and Singapore to take limited group tours in the nation.

- Indonesia lifted its outdoor mask mandate amid declining infections.

- More news related to the war in Europe:

- Russia and Ukraine indefinitely suspended peace talks.

- Finland and Sweden formally applied for NATO membership yesterday.

- The White House is poised to fully block Russia’s ability to pay U.S. bondholders after a deadline expires next week, bringing Moscow closer to default.

- Russia took over the Moscow factory that Renault exited this week and will begin making Moskvich cars — a Soviet-era brand last produced 20 years ago — to deal with a nationwide vehicle shortage.

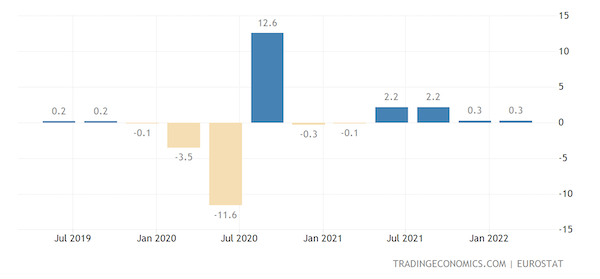

- The euro-area economy grew 0.3% in the first quarter, topping estimates.

- Britain’s jobless rate hit a 48-year-low of 3.7% in the first quarter, while pay levels rose a larger-than-expected 7%. The annualized inflation rate in the country jumped to 9% in April, a four-decade high.

- Japan’s economy contracted 0.2% in the first quarter as resurgent COVID-19 held back consumer spending. Unlike the U.S., China and Europe, the Japanese economy has yet to recover to pre-pandemic strength.

- A measure of new home prices in China fell for the first time in six years after Beijing began cracking down last year on housing speculation, pushing several prominent developers to the edge of collapse.

- International air travel is making a strong recovery this year with the exception of the Asia-Pacific region, where passenger volumes are only about 13% of pre-pandemic levels.

- New U.K. legislation could unilaterally override key parts of the Brexit deal related to Northern Ireland, raising the possibility of a trade war with Europe.

- British retailer Marks & Spencer expects the nation’s food prices to rise 10% this year.

- Hyundai says it will invest $16.54 billion by 2030 to expand its electric-vehicle business in South Korea.

- Coca-Cola’s British unit will introduce packaging that keeps plastic lids tethered to bottles when opened, making it easier for consumers to recycle drinks in their entirety.

- Nine million global deaths could be linked to industrial pollution in 2019, new research suggests.

- Carbon emissions from the global steel industry could drop 30% by 2050 as more mills switch to less-polluting furnaces, analysts say.

Some sources linked are subscription services.