MH Daily Bulletin: May 17

News relevant to the plastics industry:

At M. Holland

- Lindy Holland-Resnick, Market Manager for Packaging at M. Holland, is presenting during the upcoming Re|focus Sustainability & Recycling Summit in Cincinnati, Ohio. Her session on Developing a Sustainably Minded Staff will cover how to create a holistically sustainable company from top to bottom. If you’re attending Re|focus, don’t miss Lindy’s session on Tuesday, May 24 at 11:15 am ET.

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending the Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm ET.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am ET.

Supply

- Oil prices rose slightly Monday on signs that easing lockdowns in China would spur demand. China processed 11% less crude in April, a two-year low.

- In mid-morning trading today, WTI futures were flat at $114.20/bbl, Brent was up 0.1% at $114.40/bbl, and U.S. natural gas was up 3.5% at $8.24/MMBtu.

- U.S. gasoline prices hit a fresh record of $4.48 a gallon Monday, up 15 cents the past week. Despite the record prices, demand rose 3% the past week.

- U.S. grid operators are pushing to keep aging plants online as a last resort against rolling blackouts in vulnerable areas this summer. California is seeking federal funding to avoid the long-planned closure of its last nuclear power plant.

- Higher LNG prices are driving up costs for U.S. chemical manufacturers as executives urge producers to send less to Europe.

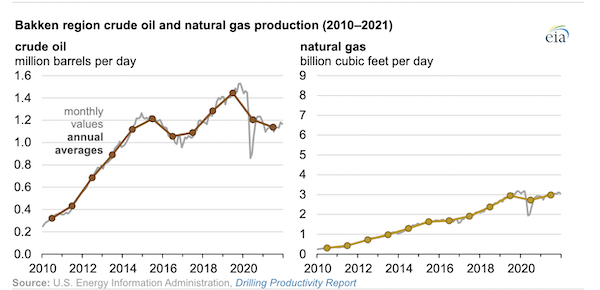

- Natural gas production in North Dakota’s Bakken region rose 9% in 2021, even as crude production declined 6%:

- South Africa’s largest utility expanded outages yesterday to prevent a grid collapse due to a lack of diesel and coal imports.

- Sri Lanka is down to one day’s supply of gasoline, officials said, as the cash-strapped island battles its worst economic crisis in decades.

- TotalEnergies is partnering with a French power company to buy a renewables electricity provider for over $1.5 billion.

- More oil news related to the war in Europe:

- Russian oil production was down 9% in April.

- The EU failed to persuade Hungary, the lone holdout, to agree to a full embargo on Russian oil yesterday. Officials remained optimistic that a deal could be reached this month, with Austria expecting agreement in the coming days.

- Protestors in Essex, England, forced a Russian diesel tanker to turn around on the Thames River yesterday.

- Gazprom’s year-to-date natural gas output is down 3.7% from 2021, while deliveries to nations outside the former Soviet Union are 26.5% lower.

- U.S. energy firm Sempra Energy signed a 20-year deal to provide Poland with 3 million tonnes of LNG per day.

Supply Chain

- New Mexico’s Calf Canyon wildfire spread to over 298,000 acres Monday, becoming the largest in state history.

- Costa Rica declared a state of emergency amid a month of crippling ransomware attacks on its government, which expanded to 27 agencies Monday.

- In the latest news related to Chinese lockdowns:

- At least 46 Chinese cities remain under lockdown, hitting shipping, factory output and energy usage.

- At least 180 global firms used terms including “China” and “lockdowns” in their first-quarter earnings reports, up from 50 firms the previous quarter.

- Zero cars were sold in Shanghai last month.

- Under Armour has been canceling orders due to production constraints and shipping delays.

- Most luxury brands ended the first quarter with sales down 30% to 40% in China, UBS estimates.

- CMA CGM aims to speed up cargo movement with a $300 payment for each container a shipper returns to select terminals within four days of pickup.

- XPO Logistics’ plan to become a pure less-than-truckload carrier by the fourth quarter is taking shape, with the firm’s freight forwarding unit entertaining offers up to $600 million.

- First-half orders were up 40% year over year at Milwaukee-based Rockwell Automation, a supplier of robotics software and other industrial technologies, as companies look to automation to mitigate supply chain challenges.

- Saudi Arabian airline Saudia will double its freight fleet by converting seven Boeing 777s from passenger to freight carriers.

- An Israeli maker of chassis for electric commercial vehicles is building a new plant in England to produce 10,000 units annually.

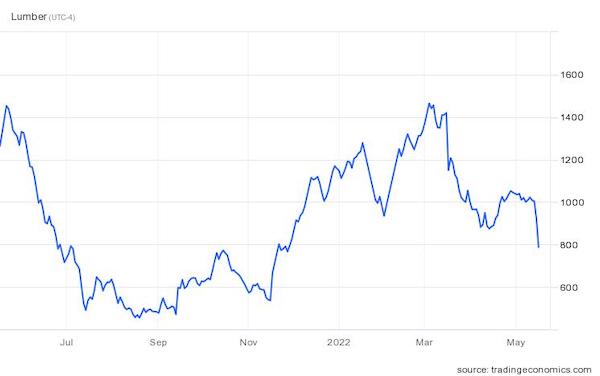

- With rising U.S. mortgage rates crimping housing demand, lumber futures hit a two-year low Monday and are down 50% from early March:

- The FDA eased rules to allow imports of baby formula from foreign manufacturers amid a nationwide shortage. Normally, the U.S. produces 98% of the formula it uses. Abbot is coming closer to restarting a crucial plant in Michigan, while Nestle began airfreighting product to the U.S. from Europe.

- Over 1.8 million tonnes of grain are trapped at Indian ports after the nation banned exports last week.

- U.S. automakers are speeding up a shift to using platinum for key parts instead of palladium, a response to supply concerns from top exporters in Eastern Europe. Platinum futures inched higher Monday.

Domestic Markets

- The U.S. reported 145,014 new COVID-19 infections and 240 virus fatalities Monday, with active cases at their highest level since November. Daily infections are up 90% the past two weeks to roughly 90,000 per day, with the largest rise in the Midwest.

- New York City’s rising COVID-19 positivity rate could trigger a renewed indoor mask mandate in the coming days, officials said.

- The federal government resumed offering free COVID-19 test kits by mail as infections in the nation rise.

- GM, Ford and Stellantis reinstated mask mandates at many factories in Detroit and the surrounding region.

- The prevalence of long-COVID symptoms have some medical professionals labeling the disease “chronic,” similar to congestive heart failure or diabetes.

- New research suggests vaccinated people who get infected with Omicron have a broad immunity to emerging virus variants.

- The FDA authorized the first nonprescription test that can detect COVID-19, influenza and RSV all-in-one.

- A union for hotel housekeepers is urging guests to request daily room cleaning as a way to secure their jobs after the pandemic ended pre-pandemic room maintenance routines.

- Retail sales jumped 0.9% in April, the fourth straight monthly gain, despite decades-high inflation.

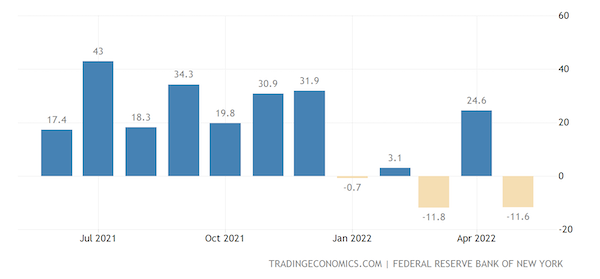

- Manufacturing activity in New York state fell unexpectedly this month for the second time in three months, reflecting plunging orders and shipments. General business conditions in the state were also down, according to a Fed index:

- Cash levels among investors is at a 20-year high, reflecting concerns about global economic growth and stagflation, according to Bank of America.

- Capital inflows to the U.S. hit a three-month low in March, new data shows.

- Big U.S. tech firms are cutting spending and staff in the face of economic headwinds.

- The U.S. administration is stepping up efforts to address a shortage of entry-level homes by offering more financing options and supporting new construction.

- Property values in Los Angeles County are projected to rise by a record $100 billion this year.

- The second-hand clothing market is expected to more than double from 2021 to 2025, driving up prices in a market usually less affected by inflation.

- United Airlines raised its revenue estimate for the current quarter despite a 40% jump in fuel costs, as booming travel demand is poised to give the firm its busiest summer of the pandemic.

- Boeing’s bid to resume 787 deliveries after a year of production setbacks is in doubt after the firm submitted incomplete documentation to U.S. regulators, reports suggest. Europe’s Ryanair criticized the plane-maker and said it may soon turn to the secondhand leasing market to support further growth.

- Ohio electric-truck maker Lordstown Motors expressed doubt about staying in business another year without more funding and a rise in its market value.

- Electric-truck maker Rivian warned of delivery delays due to a lawsuit alleging a supplier violated a contract by raising prices after a contract was signed.

- Ikea plans to sell home solar panels in the U.S. starting this fall.

- The SEC estimates its climate disclosure proposal would raise compliance costs for businesses from $3.9 billion to $10.2 billion.

International Markets

- Shanghai plans to broadly reopen on June 1, a city official said, after 15 of its 16 districts reported zero new COVID-19 cases outside quarantine areas. New infections hit a two-month low yesterday.

- Lockdowns were expanded to more areas in Beijing.

- South Africa is seeing a fifth wave of COVID-19 despite 91% of its population having virus antibodies from vaccination or previous infection.

- North Korea’s “fever cases” rose to 1.5 million in a month, the nation said.

- Canadian consumer confidence logged its sharpest weekly decline since the start of the pandemic last month, as the nation faces similar economic headwinds as the U.S.

- Mexico is waiving import duties for one year on a range of household staples, mostly foodstuffs, in a bid to curb inflation.

- Thailand’s economy grew 2.2% in the first quarter on a rise in tourism and exports following the lifting of COVID-19 restrictions.

- Israel’s economy contracted a surprise 1.6% in the first quarter.

- Venezuela is starting to sell 10% stakes in many of its largest state-owned firms, including petrochemical producers and telecom providers, after years of neglect and mismanagement.

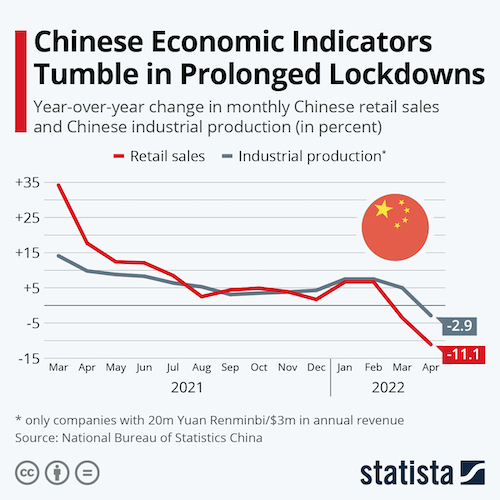

- Chinese consumer spending and factory output tumbled in April, new data shows, while the unemployment rate surged to a two-year high of 6.1%. Fiscal revenue fell 41% as the government returned more money to help taxpayers deal with lockdowns.

- The U.S. administration loosened some travel restrictions and expanded commercial opportunities with Cuba.

- A proposed $7 billion deal between Dublin firms SMBC Aviation Capital and rival Goshawk marks a continued streak of consolidation in the global aircraft leasing industry.

- Plug-in hybrids make up only 2% of all new-car sales in Australia, well below the global average of 13%, even as electric vehicle sales tripled last year.

- More news related to the war in Europe:

- The EU dropped its forecast for 2022 GDP growth from 4% to 2.7% and warned its economy could contract if Russia halts gas shipments.

- Restoring Ukraine could require long-term rebuilding efforts akin to the U.S. Marshall Plan for Europe after WWII, the U.S. Treasury Secretary said. The Senate is getting closer to approving another aid package of $40 billion.

- Reebok is selling its 100+ Russian storefronts.

- Japan would need over $1.2 trillion of investment the next decade to have a chance of meeting its 2050 climate goals, analysts say.

- New Zealand will set up a $2.83 billion fund dedicated to cutting pollution over the next four years.

- A French firm said it produced the world’s first carbon-neutral flat glass for use in building construction.

Some sources linked are subscription services.