MH Daily Bulletin: May 11

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm ET.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am ET.

Supply

- Oil prices were down for a second straight day on Tuesday, falling over 3% as WTI closed under $100/bbl.

- In mid-morning trading today, WTI futures were up 4.8% at $104.50/bbl, Brent was up 4.2% at $106.80/bbl, and U.S. natural gas was up 3.6% at $7.65/MMBtu.

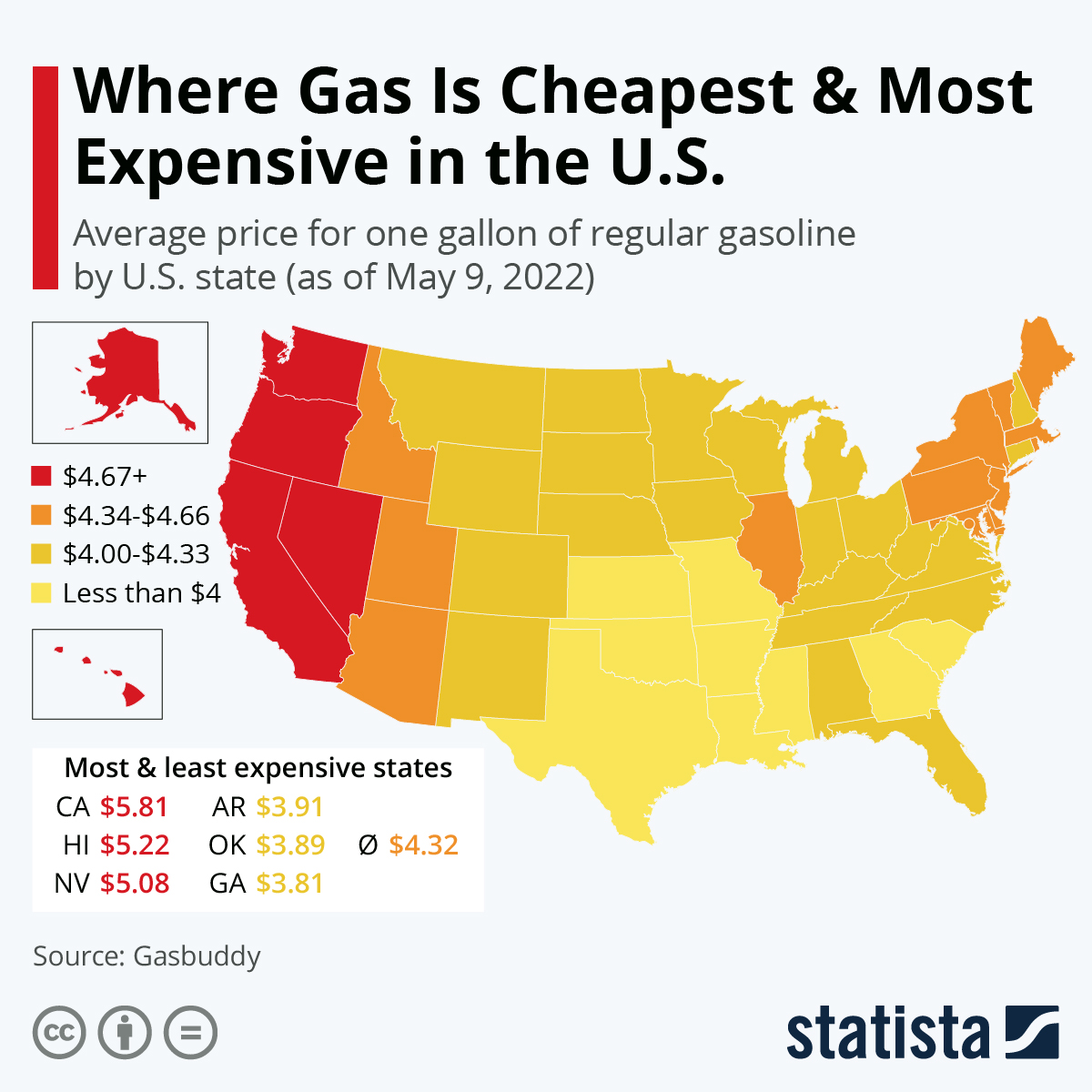

- U.S. prices for gasoline ($4.374 a gallon) and diesel ($5.55 a gallon) rose to all-time highs yesterday as refiners struggle to meet demand.

- U.S. crude oil production will grow by 720,000 bpd to 11.91 million bpd this year and by 940,000 bpd to 12.85 million bpd next year.

- The oil ministers of Saudi Arabia and the UAE warned that spare production capacity is decreasing in all energy sectors, setting up a challenge to meet demand for years to come.

- Household energy prices in the eurozone were almost 40% higher in April than a year earlier, new data shows.

- Venture Global LNG is becoming a force in U.S. LNG production, just entering a deal to sell 2 million tonnes per year to Exxon Mobil from two planned Gulf Coast facilities for export to Asia. The U.S. is expected to surpass Australia and Qatar next year to become the world’s largest LNG producer.

- Europe’s port of Rotterdam tripled its estimate for hydrogen-fuel delivery capacity by 2030.

- More energy news related to the war in Europe:

- Ukraine said it would block natural gas flowing from Russia to Europe through a pipeline transit point in its territory, potentially affecting a third of Russian exports and sending gas prices higher in Europe.

- While a French minister said EU members could reach a deal to ban Russian oil this week, Hungary dug in its heels in opposition.

- Russia’s occupation is limiting Ukraine’s ability to send Russian gas to Europe, putting upward pressure on European prices.

- Emerging economies in Europe, Central Asia and North Africa could slide back to pre-pandemic levels if Russia cuts off gas supplies, according to the European Bank for Reconstruction and Development.

- Germany will fast-track approvals for new LNG import terminals to reduce reliance on Russian oil and gas.

- Botswana says it is inundated with requests to supply more coal to Europe with prices for the fuel more than doubling since Jan. 1.

- Ukraine has nearly run out of gasoline for civilian use, officials say.

- The United Nations is seeking $144 million to offload a million barrels of crude from a tanker stranded for years off the coast of war-torn Yemen, posing a major environmental risk.

- A new EU proposal would require member nations to limit permit times for rooftop solar installations and push for solar energy in all suitable public buildings by 2025.

Supply Chain

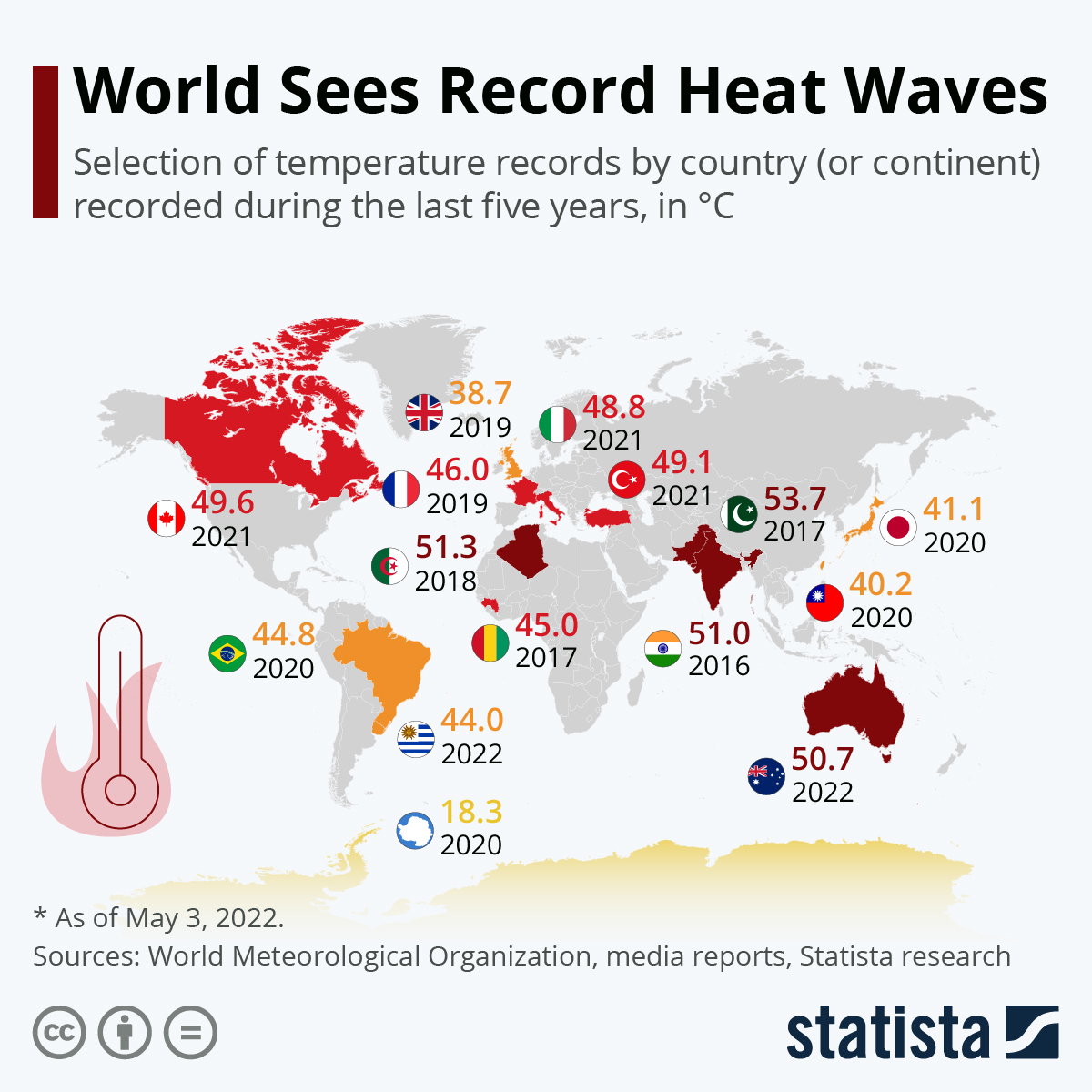

- Texas’ grid operator says it can handle record demand levels for the month of May amid unseasonably hot weather.

- Peak seasonal temperatures are testing power grids in India and Pakistan, among other nations:

- The Port of Los Angeles has seen “no dramatic change” in incoming vessels from China despite the nation’s lockdowns, its executive director said.

- The West Coast lost 4.6% of inbound container market share to the Eastern Seaboard and Gulf Coast this year, as more importers rerouted goods from heavily congested Los Angeles and Long Beach.

- The Baltic Exchange’s main sea freight index rose 3.8% to a five-month high Tuesday as rates rose for all vessel segments.

- Major ocean carriers could cut up to one-third of sailings from Asia in the coming weeks in response to falling export freight volumes, according to industry analysts.

- Prologis, the world’s largest owner of warehouse space, could expand its U.S. logistics presence by 160 million square feet if Duke Realty accepts its $24 billion acquisition bid.

- IBM says a quantum computer it hopes to release for commercial use by 2025 could drastically improve logistics operations and financial-risk modeling.

- Sony and Nintendo expect popular video game machines to be in short supply all year due to component shortages, leading to reduced sales forecasts.

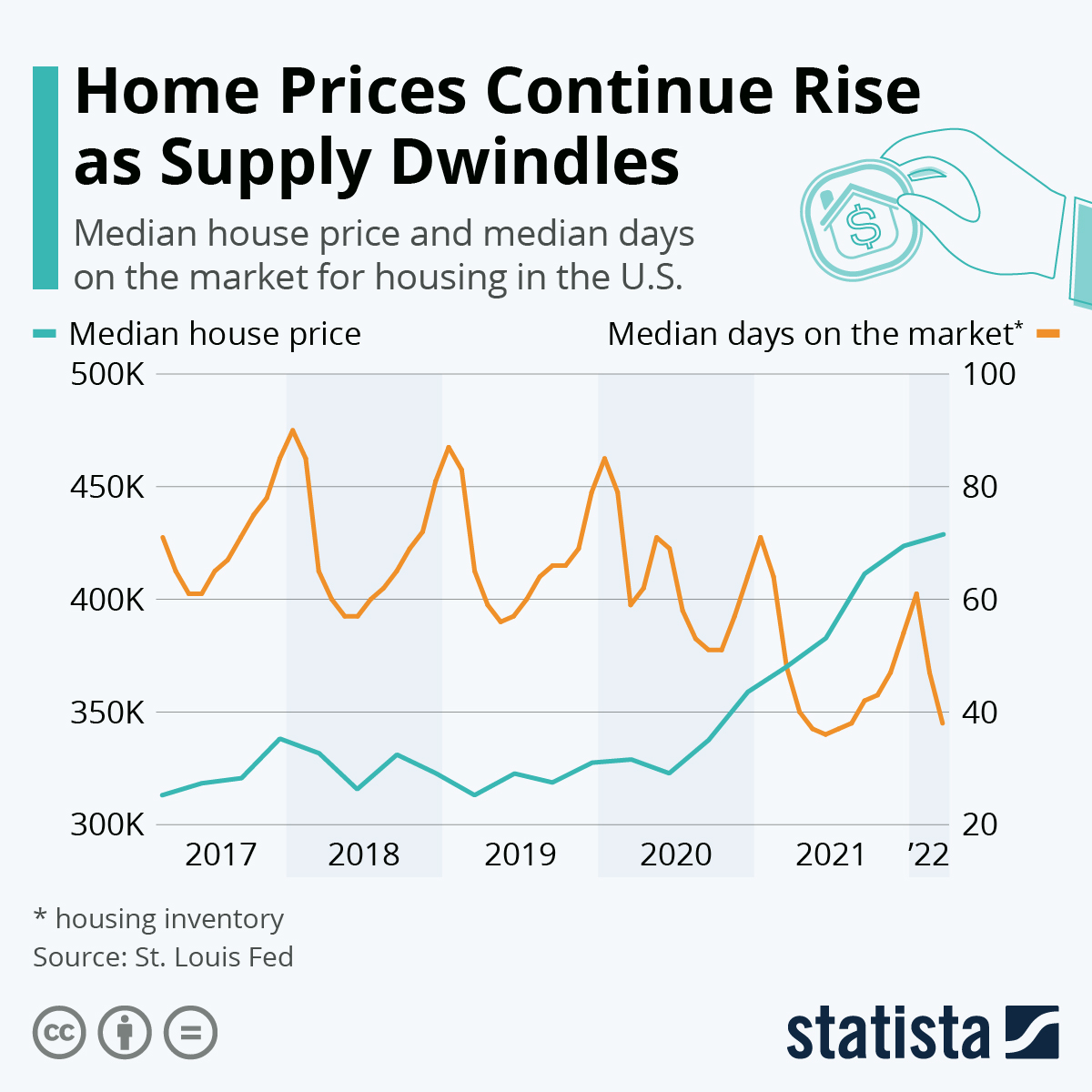

- Lumber prices sank to their lowest of the year Monday as rising mortgage rates threaten the boom in housing markets:

- Big U.S. retailers are renewing purchase limits on baby formula due to supply shortages.

- GE’s healthcare unit is boosting dye output in Ireland and shipping more products by air after lockdowns shut its factory in Shanghai.

- Caterpillar hopes a tighter focus on repurposing old engines will meet growing demand for more environmentally friendly products and enable it to underprice competitors.

- Boeing made 35 deliveries in April, down from 41 in March but more than double the 17 planes it delivered a year ago.

- Chinese vehicle production fell 41% in April, led by a 94% decrease at Tesla. Tesla’s Shanghai plant remained mostly closed Tuesday.

- Tesla recalled 130,000 electric vehicles due to risks of computer malfunctions from fast-charging technology.

- Toyota will suspend operations on 14 more production lines this month as lockdowns in China continue to hamper operations at home and abroad, likely to affect 40,000 vehicles.

- Stellantis’ chief executive says the auto industry will face greater shortages of batteries and raw materials as the shift to electric vehicles speeds up over the next several years.

- IKEA plans to spend $3.2 billion in an overhaul of its retail stores to double them as e-commerce distribution centers.

- The EU is finalizing a plan to speed land transit of Ukrainian food exports that would normally be shipped by sea. The nation’s farmers are resilient in the face of Russian aggression, planting a better-than-expected 75% of crops so far this year.

- The Malaysian government proposed cutting the export tax on palm oil by as much as half to help fill a global edible oil shortage.

Domestic Markets

- The U.S. reported 86,178 new COVID-19 infections and 308 virus fatalities Tuesday.

- Lower testing levels suggest the U.S.’s recent rise in COVID-19 cases could be bigger than statistics suggest. The CDC predicts virus hospital admissions will rise over the next four weeks.

- A more-transmissible subvariant of Omicron — dubbed BA.2.12.1 — now makes up nearly 75% of all new infections in New York state.

- Baltimore officials are recommending people wear masks indoors again but stopped short of a mandate.

- A growing number of COVID-19 fatalities are coming from breakthrough infections.

- California is set to surpass 90,000 COVID-19 fatalities since the start of the pandemic, the highest of any state.

- Inflation last month eased from 8.5% to 8.3%, but remained near a four-decade high.

- A recent uptick in companies putting their office space on the sublease market is a delayed response to the Omicron outbreak of late 2021, which led more firms to settle on hybrid work and cut space, analysts say.

- Just 8% of Manhattan office workers are back in the office five days a week, while 28% are still fully remote.

- U.S. consumers project inflation will soften a year from now on declining gas prices, a new Federal Reserve survey shows.

- U.S. household borrowing climbed 1.7% in the first quarter to a record $15.84 trillion, propelled by a 10% gain in mortgage debt.

- Municipal retirement funds returned a negative 4.01% in the first quarter on a broad selloff in stocks, new data suggests.

- U.S. small business confidence held steady in April after three straight monthly declines, but owners remained worried about high inflation and worker shortages, according to a new survey.

- Apple’s groundbreaking iPod line has been discontinued after 20 years.

- Carvana plans to lay off 12% of its workforce as expenses soar and demand for pricey used vehicles slips.

- U.S. electric vehicle (EV) registrations surged 60% in the first quarter to 158,689, with EVs now accounting for almost 5% of all light passenger vehicles.

- LiveWire, Harley-Davidson’s electric motorcycle spinoff, plans to unveil a new model costing less than half the current offering by next spring.

- Volkswagen intends to revive its iconic Scout off-road vehicle brand as an electric vehicle for the U.S. market.

- Demand for Mercedes-Benz electric vehicles is fast outpacing its ability to produce, the automaker said.

- March inflation hit U.S. travel firms particularly hard, with prices rising 30% at hotels, 24% at airlines and 14% at car rental firms.

- U.S. cruise operator Norwegian Cruise Line expects positive cash flow this quarter on “explosive” bookings and on-board spending from consumers, despite rising prices.

- Marin County in the northwestern part of the San Francisco Bay Area imposed a ban on single-use plastic utensils and takeout containers.

- In the latest news from quarterly earnings season:

- Shares of Peloton dipped almost 9% Tuesday after the fitness company said demand is softening and could mire the firm in losses for years.

- Bayer’s adjusted earnings rose 27.5% from a year ago on strong sales at its seeds and pesticides business.

- Tire maker Pirelli said operating profit grew 35% despite the loss of 11% of total capacity from its two plants in Russia.

- U.S. vaccine maker Novavax made just 42 million deliveries of its COVID-19 vaccine in the first quarter, a fraction of the planned 2 billion.

- Sony’s quarterly profit more than doubled on surging demand for games and its flagship PlayStation 5.

- Mitsubishi’s global sales rose 8.7% in the first quarter as operating profit jumped to over $250 million.

- New York-based chipmaker GlobalFoundries posted a 37% rise in first-quarter revenue for a record net income of $178 million.

International Markets

- China’s COVID-zero agenda is unsustainable and could lead to devastating economic consequences, the World Health Organization said.

- South Korean COVID-19 cases were up for the first time in two months last week.

- Taiwan, an island of just 24 million people, reported over 50,000 new COVID-19 cases yesterday, a record.

- A new British study throws support behind stronger immunity offered by a fourth COVID-19 vaccine jab.

- London’s Heathrow Airport upped its 2022 passenger forecast by 16% on strong signs of rebounding passenger demand.

- Mexico City International Airport is cutting flights by 25% after two aircraft nearly crashed on a runway amid heavy congestion.

- U.S. electric vehicle maker Lucid plans to launch its luxury sedans in Germany, the Netherlands, Switzerland and Norway later this year.

- Renault hopes more investment in services for ride-hailing, car-sharing, subscriptions and leasing will help turn around its ailing finances.

- More news related to the war in Europe:

- The U.S. House of Representatives passed legislation to send $40 billion in emergency aid to Ukraine, although the measure could get held up in the Senate.

- Moscow would likely be forced into default if the U.S. Treasury lets expire an exemption allowing the nation to pay interest on foreign debt.

- Ukraine’s economy is expected to contract 30% or more this year, economists predict.

- The U.S. Commerce Department is prepping more sanctions and export controls on Russia and companies doing business with the nation, officials said.

- Aircraft lessors have written down hundreds of millions in losses as some 400 planes worth almost $10 billion remain stuck in Russia.

- Sustainability topped the list of challenges facing international firms for 51% of companies surveyed, up from 32% last year.

Some sources linked are subscription services.