MH Daily Bulletin: May 6

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- M. Holland recently hosted panelists from Business Publishing International, Jabil and LyondellBasell to discuss the ongoing pandemic, material shortages, the war in Europe, supply chain issues, high inflation and more. Read a recap of the broadcast here and access the recording here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose less than a percent Thursday, with WTI closing at its highest in over a month.

- In mid-morning trading today, WTI futures were up 1.7% at $110.00/bbl, Brent was up 1.6% at $112.70/bbl, and U.S. natural gas was down 4.6% at $8.38/MMBtu

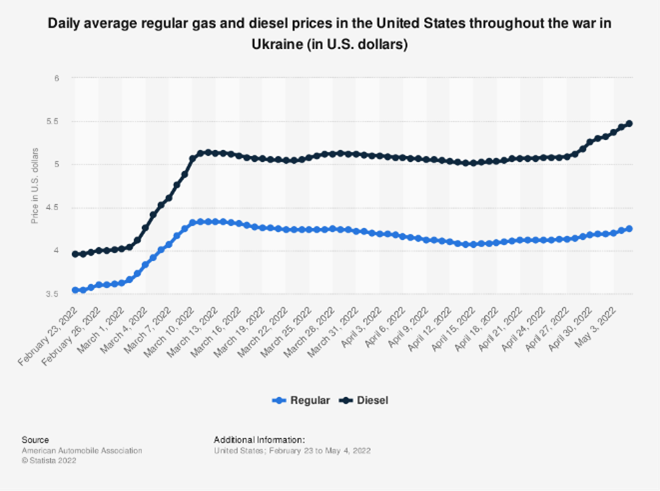

- U.S. gas prices are steadily rising again after a multi-week plateau:

- The U.S. government is looking for 60 million oil barrels to purchase this fall to help replenish emergency stockpiles.

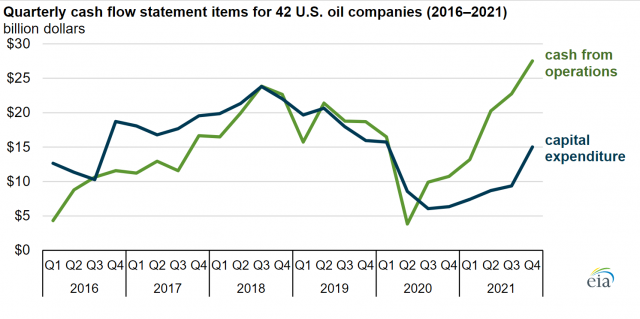

- Cash flows at U.S. oil producers already rose to an eight-year high before $100/bbl crude prices arrived in the first quarter, new data shows:

- A U.S. Senate panel advanced a bill that could expose OPEC+ to lawsuits for collusion on boosting oil prices, although similar bills have failed the past two decades.

- Britain’s government rejected calls for a “windfall” tax on BP and Shell and noted the majors are poised to contribute the most to the nation’s coffers in years.

- China suspended tariffs on coal imports for the next 11 months to ensure it has enough domestic supply.

- The U.S. committed $2.25 billion from 2020’s massive infrastructure package to build underground carbon-storage projects over the next five years.

- More oil news related to the war in Europe:

- Japan said it would face difficulties in following Europe’s plans to quickly cut off Russian oil imports.

- Slovakia says it would need at least three years to cut off Russian oil imports but otherwise supports a European embargo.

- The first of Germany’s four floating LNG hubs will come online at the end of this year as the nation seeks tools to further its goal of a Russian gas embargo by mid-2024. Construction on Germany’s first LNG import terminal also began.

- Germany is scrambling to fill western Europe’s biggest gas storage site that was abandoned by Russia’s Gazprom last month.

- A power plant in Ukraine’s southeast shut down due to a lack of coal supply.

- Russia is making efforts to use the halted Nord Stream 2 gas pipeline to Germany for domestic purposes.

Supply Chain

- The White House approved a disaster declaration for New Mexico as firefighters made progress against the 165,000-acre Calf Canyon blaze, the nation’s largest.

- Century-high temperatures continue to strain India’s power grid, prompting hours-long blackouts and widespread manufacturing stoppages in some regions.

- Schedule reliability for the 14 largest container carriers fell 10% in March from a year earlier, with only Maersk, Hamburg Süd and Evergreen showing improvement. Delays were most pronounced on ships between China and major U.S. and European ports.

- With export volumes from the Port of Shanghai down 30% since March, shipping groups worry an impending deluge of boxships will increase congestion at Western U.S. ports.

- A U.S. maritime advisory group is urging regulators to make rules that would place the burden of rising demurrage and detention fees on ocean carriers and railroads rather than shippers.

- Sanctioned Russian cargo is piling up and causing congestion at European logistics hubs, including the Port of Rotterdam.

- The Port of Vancouver faces worsening congestion over the summer months as dwell times remain stubbornly high and vessel queues pile up.

- South Korean shipbuilders are scrambling to find workers as orders for LNG tankers grow.

- German factory orders fell a larger-than-expected 4.7% in March as key manufacturers endured soaring costs and dwindling component availability.

- South African manufacturing activity hit a four-month low in April after severe flooding damaged infrastructure and disrupted one of Africa’s busiest ports.

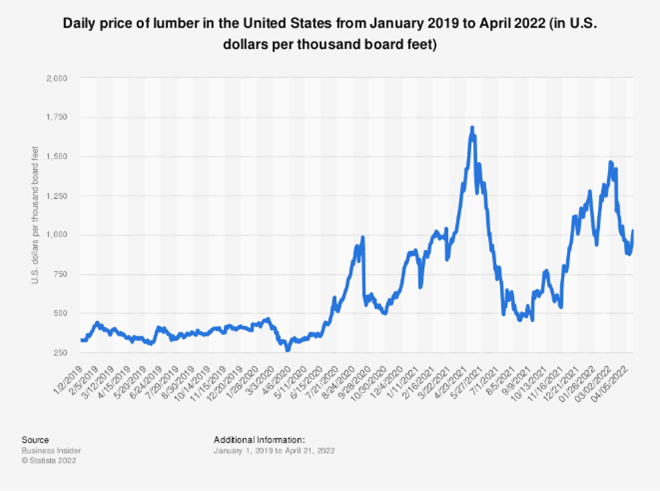

- Millennial homebuyers and the remote working trend will keep lumber demand robust despite surging inflation, according to a major Canadian producer.

- Class 8 truck orders fell to a seven-month low in April as supply constraints spurred manufacturers to hold off accepting bookings.

- Electric-vehicle maker Lucid said it would increase prices in June due to the same supply issues that prompted it to cut production forecasts in half to just 14,000 vehicles this year. The firm produced 700 vehicles and delivered 360 to customers in 2021.

- U.S. trucking regulators are again considering a plan to require certain heavy-duty trucks to use speed-limiting devices.

- Industrial robot sales in North America rose 28% last year to $2 billion, the strongest year on record.

- Sales of Switch, Nintendo’s popular gaming handheld device, could fall 10% this year due to China-based supply shortages.

- In the latest supply chain news from first-quarter earnings season:

- Maersk’s revenue grew 55% to a quarterly record $19.3 billion despite a 7% drop in cargo volumes, confirming preliminary earnings released last week.

- Stellantis’ revenue jumped 12% to $44 billion, as strong pricing helped offset chip shortages.

- Logistics firm ArcBest reported $69.57 million in net income, almost triple the same period last year.

- Trucker Forward Air reported record revenues and earnings aided by a resurgence in shipments to small- and medium-size businesses.

- Trucker Saia posted record revenue of $661.2 million and said it would build as many as 15 less-than-truckload terminals this year.

Domestic Markets

- The U.S. reported 73,713 new COVID-19 infections and 260 virus fatalities Thursday. Cases are rising in all but four states.

- The BA.2.12.1 subvariant of Omicron accounts for 36% of new U.S. infections, up from 16% two weeks ago, and more than 70% in New York state.

- New COVID-19 cases are at a two-month high in Iowa.

- A new study from the Harvard Medical School suggests Omicron might be as severe as previous COVID strains, contradicting early beliefs.

- The FDA limited the use of Johnson & Johnson’s COVID-19 vaccine after 60 cases of rare blood-clotting were reported among millions of people who got the shot.

- The stock market took its sharpest fall since the early days of the pandemic on Thursday as investors reassessed the Federal Reserve’s inflation comments from the day before. Losses were especially pronounced for the world’s largest tech companies whose supercharged pandemic earnings show signs of slowing.

- U.S. employers added a higher-than-expected 428,000 workers in April as unemployment remained at 3.6%.

- U.S. worker productivity fell 7.5% in the first quarter, the sharpest decline in almost 75 years as high labor costs clashed with economic contraction, according to the U.S. administration.

- Hiring and retaining employees remains the top challenge for small businesses, survey results show, while more U.S. workers are accepting job offers and quitting before they start, experts say.

- The U.S. has regained most of those who retired early during the pandemic, enticed by more flexible working conditions and waning COVID-19 risks.

- The average U.S. mortgage rate rose to 5.27% this week, the highest since 2009. Median home prices continue to rise by double-digit percentages from a year earlier.

- Property taxes rose surprisingly little in 2021 — just 1.6% — despite the surging cost of homes.

- Bank of America’s total debit and credit card spending was up 13% in April compared to a year ago thanks to sharp increases in travel and entertainment activity.

- The SEC is asking U.S. public companies for detailed information on how Russia’s invasion of Ukraine will impact their bottom lines.

- Boeing is moving its headquarters from Chicago to Arlington, Virginia, home of many of the largest U.S. military contractors.

- Five major U.S. manufacturers will commit to boosting reliance on small and medium-size American firms for their 3D printing requirements as part of a White House initiative.

- In the latest news from first-quarter earnings season:

- Online home seller Zillow beat revenue expectations but said unpredictable market trends could weigh on growth this year.

- Home-goods retailer Wayfair reported its third consecutive quarterly loss and a 14% decline in revenue as demand slowed.

- Food-deliverer DoorDash reported a 35% gain in revenue to $1.46 billion, signaling continued strength in pandemic-era demand for ordering online.

- “Dramatic improvement” in passenger volumes since mid-February was not enough to avoid first-quarter losses at budget carrier Spirit Airlines.

International Markets

- Beijing’s business district emptied yesterday as authorities called for people to return to work remotely. Meanwhile, national officials recommitted to their COVID-zero policy despite mounting economic tolls.

- Taiwan is lifting its zero-tolerance policy even as COVID-19 surges, with daily infections topping 30,000 for the first time yesterday.

- The true death toll from COVID-19 could be as high as 15 million, the World Health Organization said, accounting for roughly one in every 500 people. The agency’s estimate was backed by data showing about 15 million excess deaths across the world between 2019 and 2021.

- More news related to the war in Europe:

- Although the Chinese government opposes Western sanctions, more Chinese firms are quietly reconsidering ties to Russia and Ukraine over the risk of secondary sanctions.

- Britain ceased to recognize the Moscow Stock Exchange as legitimate.

- Russia’s efforts to reroute its commodity exports due to Western sanctions faces big infrastructure hurdles that could take years to overcome.

- China ordered government agencies and state-backed firms to replace foreign-branded personal computers with domestic alternatives within two years, one of the country’s most aggressive efforts to halt use of overseas tech.

- German airline Lufthansa and French airline Air France-KLM both reported strong first-quarter financials on a rebound in travel activity.

- Spain’s tourism industry is rebounding strongly with a near-eightfold jump in visitors in March.

- Australia’s Qantas ordered dozens of Airbus aircraft to expand capacity and replace aging Boeing jets.

- Stellantis’ CFO said the automaker would not follow the path of other firms by separating its growing electric-vehicle business from gas-engine operations.

- Volkswagen will invest over $10 billion to boost production of electric vehicles in Spain, $3 billion more than the automaker originally committed.

- Nissan pledged to spend $700 million upgrading its Aguascalientes facility in Mexico over the next three years.

- Battery-powered electric vehicles nearly doubled their share of the European market in the first quarter, accounting for 10% of total passenger car sales.

- Bosch, the world’s largest auto supplier, announced plans to invest $528 million to break into the component market for green hydrogen production.

Some sources linked are subscription services.