MH Daily Bulletin: May 3

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- How can healthcare organizations improve the environmental impact of their healthcare packaging, increase the recyclability of products and reduce overall waste? Read the insight from our experts here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose half a percent Monday on signs of higher demand for refined products. Diesel futures continued to rally, gaining 5% on low global supplies.

- In mid-morning trading today, WTI futures were down 0.5% at $104.70/bbl, Brent was down 0.4% at $107.20/bbl, and U.S. natural gas was up 8.4% at $8.11/MMBtu.

- U.S. shale producers Devon, Diamondback and Coterra reported three- and fourfold increases in first-quarter profit Monday but said they would hold output mostly steady to focus on shareholder returns.

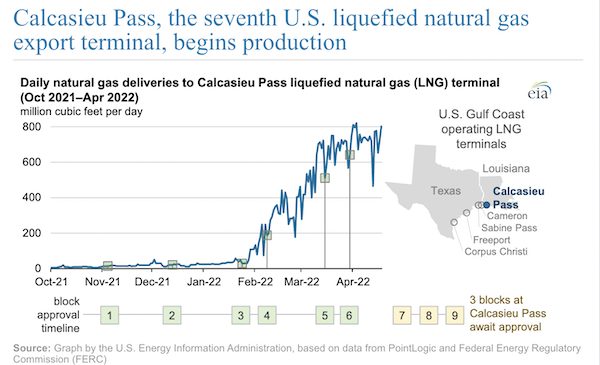

- Swelling orders for new LNG-carrying vessels are on pace to crush last year’s $16 billion orderbook as global demand for the fuel grows and more U.S. export projects come online:

- Chinese oil demand is down over 1 million bpd from the same time last year, analysts say.

- OPEC likely remained more than 250,000 bpd short of its planned output hike for April, the fourth shortfall in five months. The group meets Thursday and is expected to keep a gradual output increase for June.

- Pemex reported over $6 billion in first-quarter profit, the highest in 18 years as output stabilized with more onshore and shallow-water drilling.

- India’s power demand is up 13% from March as century-high temperatures rock the nation’s electricity grid.

- More oil news related to the war in Europe:

- The EU may spare Hungary and Slovakia from a Russian oil embargo as it prepares to finalize its next batch of sanctions today.

- German officials announced support for a potential immediate ban on Russian oil, gaining promised aid from Poland.

- Reports suggest Europe will look to African LNG shipments to help reduce dependence on Russian natural gas by up to two-thirds this year.

- Finland dropped its contract for a proposed nuclear power plant to be built by a Russian energy company.

- Mitsui & Co., one of Japan’s biggest traders, will stay involved with a massive LNG project in Russia’s Far East it says is vital for Japanese energy supply. The firm tripled its full-year profit to $7 billion on the recent rise in energy prices.

- BP took a $25.5 billion accounting charge related to its decision to exit Russian holdings, the biggest hit so far among firms pulling out of the nation.

- Supported by a tax on energy firms, Italy unveiled over $14 billion in new fiscal support to help households and businesses manage rising costs, particularly for energy.

- The British government is calling on North Sea producers to reinvest massive earnings into building more energy projects.

- Sri Lanka secured hundreds of millions of dollars to purchase fuel from India on credit, a much-needed relief amid the island’s worst financial crisis in decades.

- A global funding package is in the works to help low-income nations reduce dirty coal consumption after demand for the fuel surged during the pandemic.

- Construction began on the world’s largest offshore wind farm in the British North Sea, which could power up to 6 million homes by 2026.

- 3D printing is gaining traction in the oil and gas industry as a means of reducing cost, speeding part manufacturing and decreasing the overall carbon footprint.

Supply Chain

- New Mexico’s Calf Canyon wildfire, the U.S.’s largest blaze currently, spread to 120,000 acres Monday as 13,000 people prepared to evacuate in the state’s central-northern region. The fire is expected to spread further due to high winds, officials said.

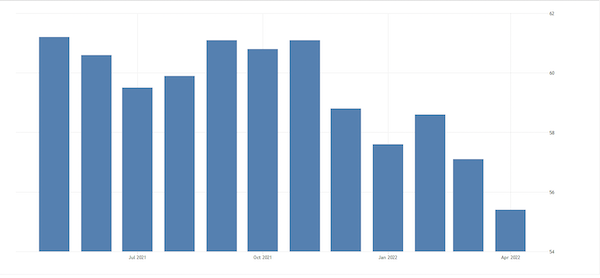

- The U.S. Purchasing Manager’s Index fell to 69.7 in April, a 16-month low, primarily on a drop in transportation capacity:

- The ports of Seattle and Tacoma saw a 28.1% decline in first-quarter loaded exports from the same time last year, while imports hit an all-time high.

- Export bookings at the Port of Shanghai are down more than 20% since mid-March. Cargo diversions are creating backlogs at the nearby Port of Ningbo-Zhoushan.

- The Suez Canal saw a record $629 million in ship fees in April, up 13.6% from the same time last year on a 6.3% gain in ship volumes.

- UPS will put RFID tags on packages at 100 facilities this year, eliminating millions of manual sorting scans each day.

- Canada’s Cargojet quadrupled its order for Boeing 777 passenger planes that it plans to convert into cargo carriers. Air Canada is buying two factory-built Boeing 767-300 freighters after cargo revenue rose 42% in the first quarter.

- Over 1,000 U.S. workers for CNH Industrial, a global supplier of agricultural and construction equipment, walked off the job for the first time in two decades yesterday over failed labor negotiations.

- Amazon workers voted against unionizing at a facility in Staten Island, New York, dealing a blow to labor organizers after last month’s victory in a separate Staten Island warehouse.

- Ford is temporarily shutting production at a Mustang plant in Michigan, citing chip shortages.

- Semiconductor supplier Wolfspeed opened a plant in New York state aimed at compressing chip supply chains for U.S. automakers.

- India could provide up to half the cost for global chipmakers to build new facilities as the government looks to expand high-tech manufacturing.

- A Dutch energy firm and a storage specialist are partnering to build out Northwest Europe’s infrastructure for hydrogen imports from sea.

- British retail giant Tesco will test the use of trucks powered by solar panels on trailer roofs.

- More supply chain news related to the war in Ukraine:

- Ukraine’s government formally shut down its seaports that have been closed since late February.

- The U.S. cut its outlook for global wheat trade by 3% this year as governments scramble to fill a void from the Black Sea region.

- Soba noodles, an iconic low-cost dish in Japan, will see prices rise for the first time in a decade on shortages of Russian buckwheat.

Domestic Markets

- The U.S. reported 81,644 new COVID-19 infections and 266 virus fatalities Monday. Cases are up in all but three states, with the daily average rising to 56,000 from just 25,000 in early April.

- COVID-19 cases in California are up 30% the past week. The state’s population fell 0.3% last year due in part to high COVID-19 fatalities and a falling birth rate.

- More than 1 in 10 people tested positive for COVID-19 in Florida, a two-month high.

- New York City entered a higher risk category for COVID-19 yesterday, as daily cases are up fourfold from early March.

- The share of fully vaccinated people dying from COVID-19 is growing as more infectious strains reach older and immunocompromised populations.

- COVID-19 was the leading cause of death for U.S. law enforcement last year and the third-leading cause of death across the nation.

- Moderna expects to have ample supplies of its Omicron-tailored COVID-19 vaccine dose by this fall.

- Airbnb will no longer allow travelers to cancel reservations for COVID-19-related reasons.

- At 59%, Austin, Texas, has the highest share of workers returning to the office of any major U.S. metro area.

- U.S. job openings increased from 11.3 million to 11.5 million in March, as 4.5 million people quit or changed jobs during the month.

- The U.S. Treasury will scale back long-term debt sales for a third straight quarter this month, one of the longest streaks since 2014.

- The ISM’s index of U.S. manufacturing activity fell to 55.4 in April, its lowest in two years, as sector employment declined sharply.

- U.S. construction spending grew at a smaller-than-expected rate of just 0.1% last month on a slowdown in commercial construction:

- Almost 90% of consumer-goods companies reporting quarterly earnings have logged profits above analyst estimates.

- Mortgage borrowers paid 31% more in fees used to lower contractual interest rates last month, one of several methods homebuyers are using to combat decade-high rates.

- California shelved plans to create a four-day workweek for hourly employees after the bill received little support from lawmakers.

- Spirit Airlines rejected a $3.6 billion cash takeover bid from JetBlue and will continue plans to acquire low-cost rival Frontier.

- Penske will buy back more shares after first-quarter profit more than doubled to $367.9 million, as industrywide vehicle shortages bolstered prices.

- Northrop Grumman reported a 9.6% decline in quarterly revenue for its aeronautics unit, citing labor and supply shortages.

- A Seattle-based startup is gaining traction with its pickup service for hard-to-recycle items, including batteries, #1 PET plastics and lightbulbs.

International Markets

- Beijing expanded mass testing and reopened a mass isolation center from 2003’s SARS outbreak as officials scramble to avoid Shanghai-like lockdowns.

- Civil unrest over indefinite COVID-19 lockdowns is growing in Shanghai as cases decline to under 10,000 per day.

- South African COVID-19 cases tripled last week, raising fears of a fifth virus wave.

- New Zealand dropped most of its remaining border restrictions and will allow incoming travelers from more than 50 countries for the first time in two years.

- New COVID-19 cases in Hong Kong fell below 300 for the first time since February.

- Many South Koreans are choosing to ignore the government’s lifting of an outdoor mask mandate, despite daily case counts declining from recent peaks.

- The U.S. removed Mexico from its high-risk COVID-19 assessment, a boon for the Mexican tourism industry.

- More news related to the war in Europe:

- Russia’s billions of dollars in fiscal support are unlikely to prevent the nation’s sanction-induced economic spiral, economists say.

- Russia pulled its involvement with the International Space Station.

- The Ukrainian refugee count hit 5.5 million and continues to grow, according to the United Nations.

- Mexican manufacturing activity remained in contraction territory for the 26th consecutive month, according to a purchasing manager’s index.

- GDP in Hong Kong fell 4% in the first quarter from the prior year due to COVID-19 disruptions and moderating global demand.

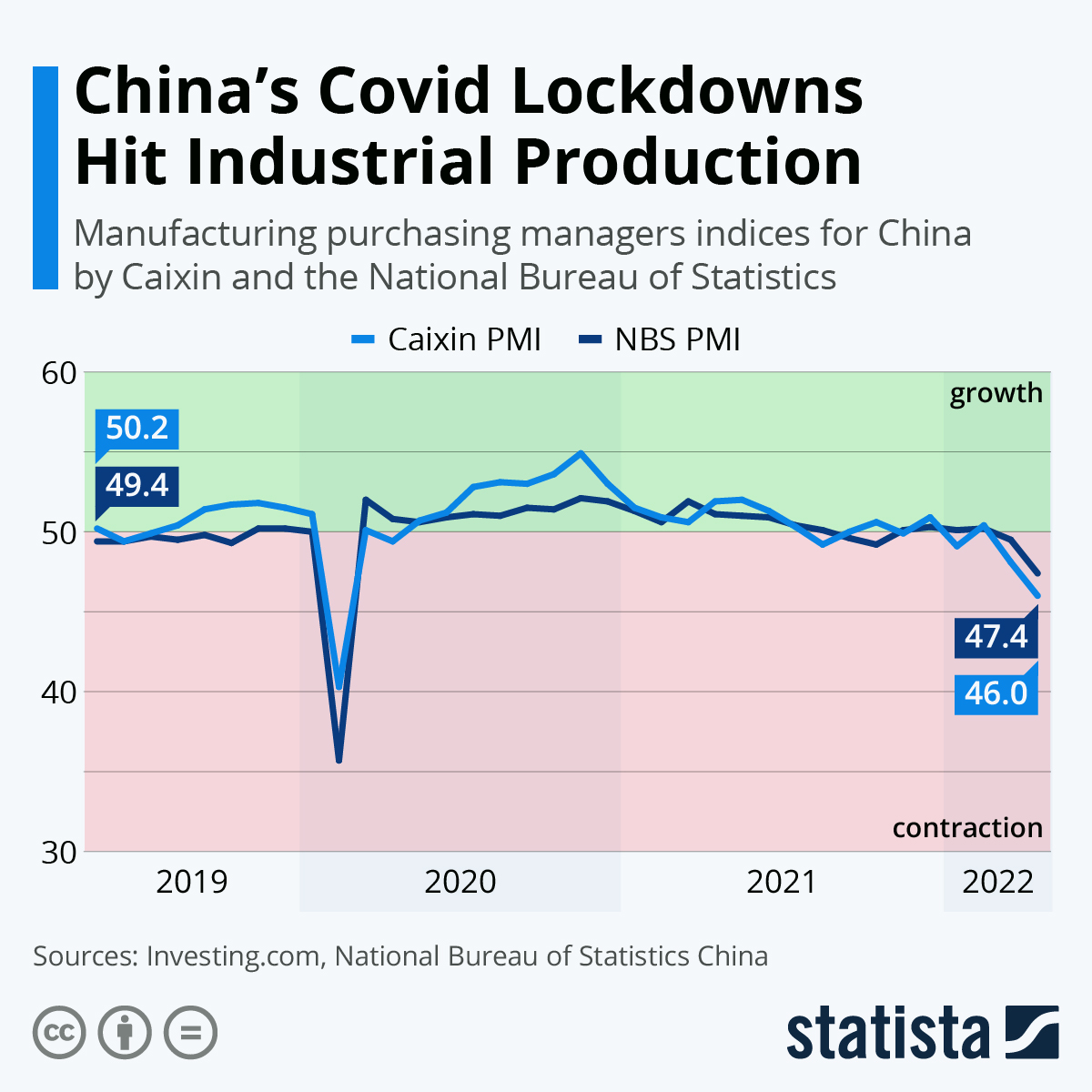

- Japanese manufacturing activity slowed last month as supply chain disruptions in China weighed on demand. China’s factory activity is contracting sharply:

- Stellantis is putting $2.8 million into reconfiguring two Ontario plants to make new-model electric vehicles.

- Used car prices in Germany jumped 17% in April as supply shortages hampered production of new vehicles at Mercedes and Volkswagen.

Some sources linked are subscription services.