MH Daily Bulletin: May 2

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- How can healthcare organizations improve the environmental impact of their healthcare packaging, increase the recyclability of products and reduce overall waste? Read the insight from our experts here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose about 3% Thursday on the likelihood that Germany would join a complete European ban on Russian oil.

- In late-morning trading today, WTI futures were up 1.3% at $106.70/bbl, Brent was up 2.0% at $109.70/bbl, and U.S. natural gas was up 2.7% at $7.08/MMBtu.

- Oil prices fell modestly Friday but notched their fifth straight month of gains, with WTI up 4.4% and Brent up 1.3% since April 1.

- In mid-morning trading today, WTI futures were down 2.8% at $101.80/bbl, Brent was down 2.6% at $104.40/bbl, and U.S. natural gas was up 2.2% at $7.33/bbl.

- The price of diesel fuel approached $5.30 per gallon yesterday, a record high, and was up 4.3% over the past week and nearly double the price a year ago.

- Active U.S. oil and gas rigs rose by three to 698 last week, the highest total since the beginning of the pandemic and the 21st consecutive monthly gain.

- To ease high gasoline costs, the EPA lifted summer restrictions on selling E15 gasoline containing 15% ethanol content, despite its higher emissions.

- U.S. refiner Phillips 66 said it would resume share buybacks after refining margins doubled in the first quarter and fuel and refined-products demand neared pre-pandemic levels.

- Saudi Arabia may cut crude prices for June delivery to Asia as demand wanes in locked-down China. Saudi Arabia’s GDP rose almost 10% in the first quarter on the boom in oil prices.

- More oil news related to the war in Europe:

- The EU is moving toward an all-out ban on Russian oil by the end of the year, with restrictions gradually increasing until then.

- A Russian diesel tanker was shunned by dockworkers in Sweden, then Rotterdam, then Amsterdam, as support grows for tightened sanctions on Russian energy.

- The Polish government is attempting to take over Russian gas pipelines that run through the nation to ensure domestic supplies.

- Italian oil major Eni said it would continue paying in euros and dollars for Russian gas.

- Russia’s Gazprom has yet to book any gas transit capacity on the Yamal-Europe pipeline, which spans Belarus, Poland and Germany, for the third quarter.

- Texas has recorded 59 earthquakes this year and is becoming the nation’s largest earthquake zone due to increased fracking in the Permian Basin.

- California’s attorney general is investigating whether oil and gas companies engaged in “a half-century campaign of deception” about the recyclability of plastics.

- Scientists claim to have uncovered a link regarding PFAS, better known as “forever chemicals,” and their connection to liver damage, as well as a possible connection to non-alcoholic fatty liver disease.

- Five counties in Wisconsin along with the entire state of Michigan signed a deal with a carbon development firm in Utah to create carbon offset projects on approximately 800,000 acres in the region.

Supply Chain

- Evacuations continue near Santa Fe, New Mexico, as windy and dry weather worsened the state’s multiple wildfires over the weekend.

- A historic drought along the U.S. West Coast and Rocky Mountains could strain power grids, cause blackouts, and force the region to rely more on fossil fuels rather than hydropower throughout the summer.

- Hours-long blackouts in India could extend for several more weeks as century-high temperatures strain the nation’s power grid.

- Spot rates for bulk shipping’s largest capesize vessels rose almost 50% last week as Chinese steel mills resumed operations and Brazil saw higher export activity.

- Air cargo capacity out of Shanghai is down to one-third of last year’s levels, according to the latest data. Trucking capacity remains the city’s biggest logjam as lockdowns continue to hamper logistics activity.

- Positive comments from U.S. West Coast dockworker labor leaders are raising hopes that a new contract agreement will be reached without disruptions this summer.

- With freight rates up 71% over the same time last year, Maersk upped its full-year earnings guidance by 25%.

- Container volumes at Belgium’s Port of Antwerp fell 11.6% in the first quarter.

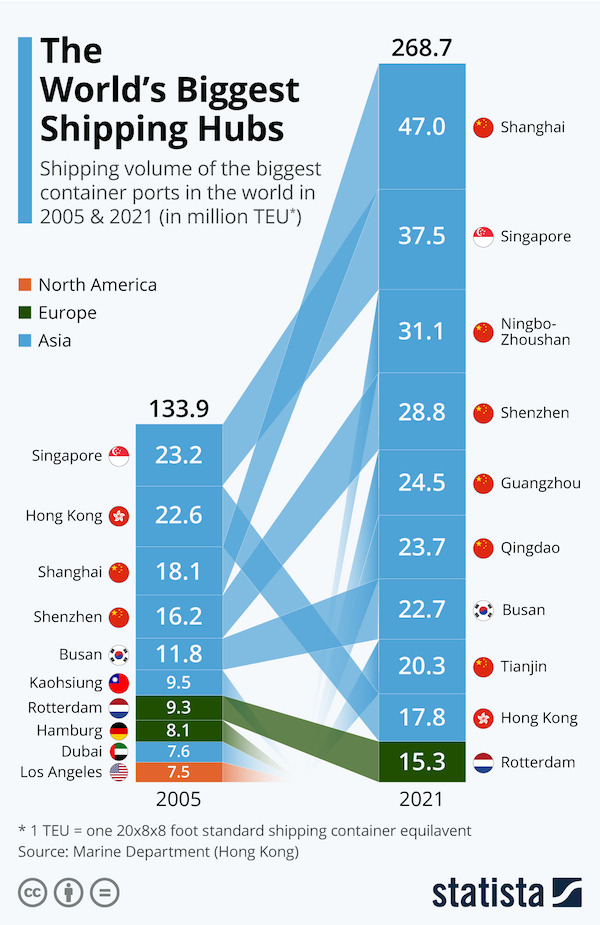

- Global container flows continue their steady ascent, with gains primarily coming from new port infrastructure in Asia:

- Alaska Airlines pilots will vote this month on whether to authorize a strike.

- CSX Transportation saw a 24% jump in per-unit revenue last quarter from the same time last year despite a 2% decline in volume.

- Union Pacific expects rising fuel costs to pressure operating earnings following a 22% gain in first-quarter net profit.

- Some U.S. ethanol suppliers have cut production due to a lack of rail cars for transport, according to the Renewable Fuels Association.

- Sales of used Class 8 trucks surged 23% from February to March, while prices were up 11%.

- Walmart says truck driver applications are up eightfold after the retailer announced a pay increase to more than $100,000 for some drivers.

- The U.S. imported 2.8 million metric tons of steel in March, up 32% from February and 33.8% from the same time last year.

- More solar developers are delaying projects set to come online over the next few years as a U.S. tariff probe takes aim at supplies from Asia.

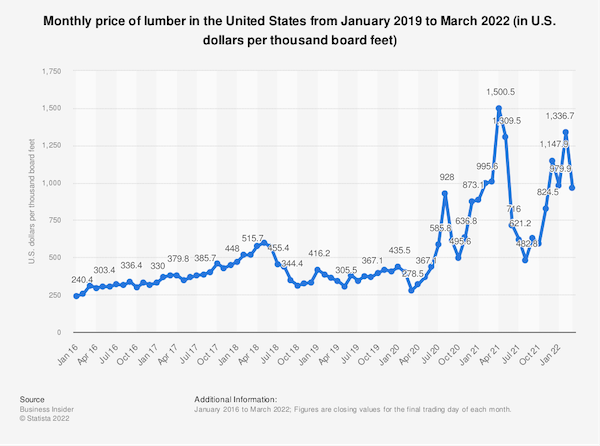

- Supply chain congestion is even impacting Amish furniture makers as lumber continues a decade-long march to becoming a majority-imported good.

- A quarter of cropland in Alberta, Canada, is in significant drought, threatening a further tightening of global grain supplies.

- Spurred by the invention of “tropical wheat” that can grow in hot and humid climates, Brazil’s wheat farmers could boost production by 40% this year, providing relief to strained global food supplies.

- Ukraine sent out its first grain shipment in more than two months last week.

- Trader Joe’s is cutting some of its proprietary branded products due to ingredient and material shortages, including plastic packaging from China.

Domestic Markets

- The U.S. reported 16,153 new COVID-19 infections and 21 virus fatalities Sunday. Fatalities are down 20% the past two weeks.

- Health officials are optimistic that gradually rising COVID-19 cases across the U.S. are not translating into a jump in hospitalizations, as might be expected. In Florida, where hospitalizations hit their highest level in a month, the number of ICU patients is down to an all-time low.

- Two new subvariants of Omicron sweeping through South Africa were discovered in the U.S., scientists say. Early research suggests they can evade antibodies from earlier COVID-19 infection and vaccination.

- The FDA could come out with a decision on COVID-19 vaccines for children under age 5 by this June, officials said.

- Pfizer’s Paxlovid COVID-19 therapeutic failed to prevent infection of the virus in tests.

- Economic worries sent U.S. stock markets to their lowest monthly close since early in the pandemic in April.

- U.S. consumer prices rose 6.6% in March from a year before, the fastest inflation rate in 40 years, according to a Fed-preferred measure of data released Friday. Survey results suggest more than 70% of consumers are switching to cheaper alternatives for food and essential items while more than 40% are delaying purchases of big-ticket items.

- The IRS raised the contribution limits for health savings accounts in response to high inflation.

- U.S. public debt declined to about 123% of GDP at the end of last year, down from 136% in the middle of 2020, on the value-adjusting effects of inflation.

- The Fed will announce this week a plan to start shrinking its $9 trillion portfolio of Treasury and mortgage securities that more than doubled in size during the pandemic.

- U.S. home prices were up 14.4% last week from the same time last year, as rising interest rates appear to have minimal effect on demand so far.

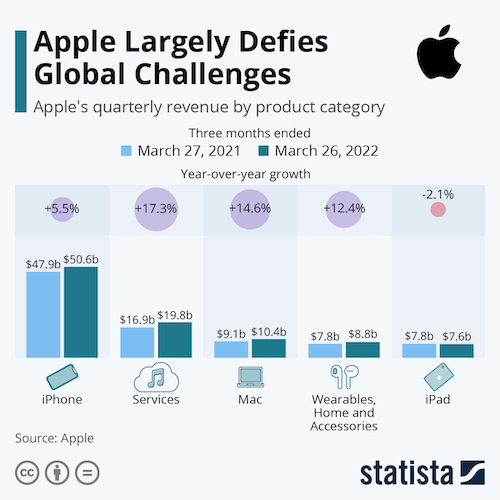

- Apple’s ambition to design its own microchips for smartphones is spurring growth for the tech firm’s hottest business segment.

International Markets

- Beijing saw a record 59 COVID-19 cases Saturday, prompting sweeping new restrictions on daily life that stopped just shy of lockdowns.

- Taiwan reported 15,149 new COVID-19 cases Saturday, an all-time high.

- Greece lifted COVID-19 restrictions for foreign and domestic flights Sunday, while Italy will no longer require visitors to fill out the EU passenger locator form upon arrival, as the two countries prepare for the peak summer travel season.

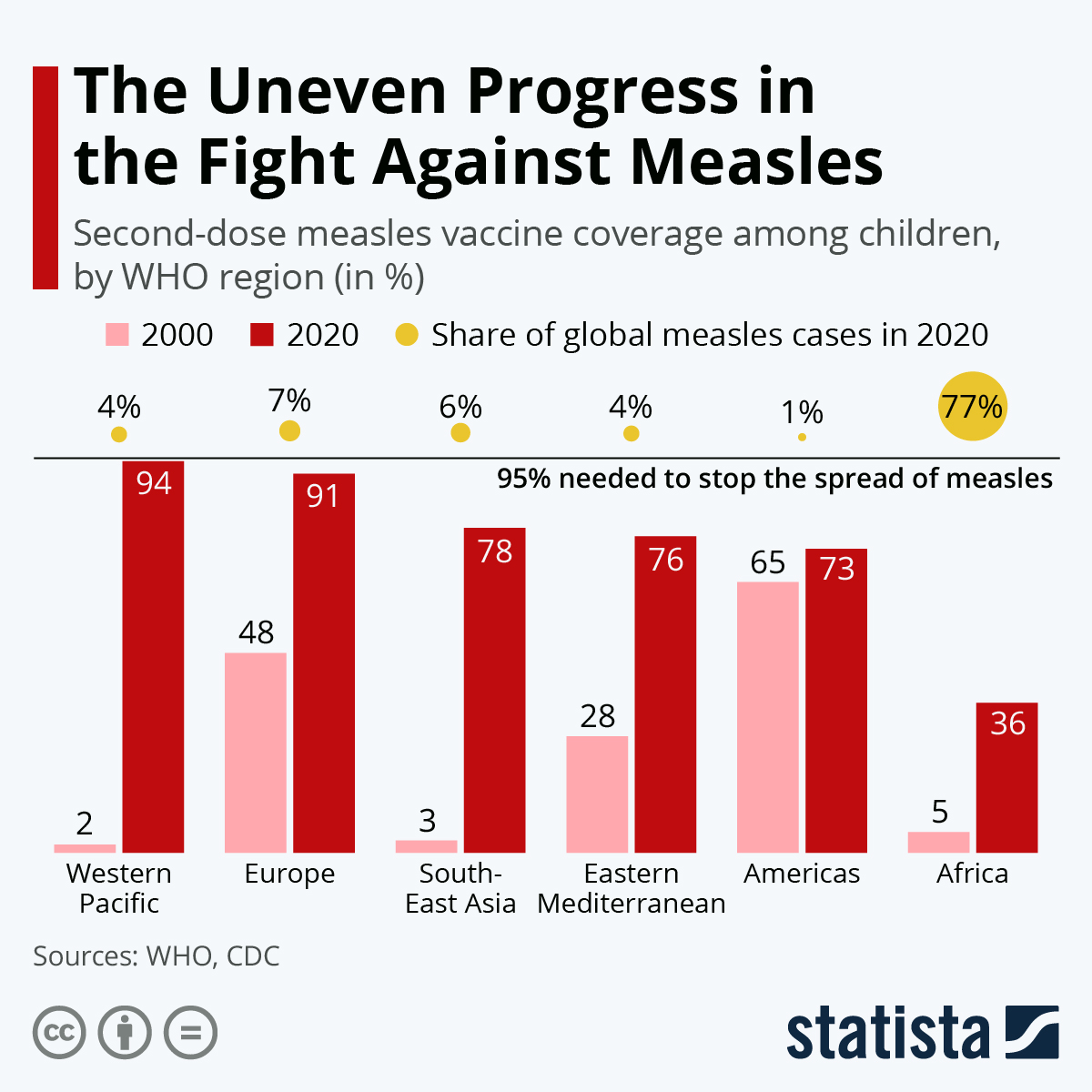

- Cases of measles are up 80% across the globe this year after the pandemic interrupted vaccination campaigns for non-COVID diseases.

- Euro-area inflation hit an all-time high 7.5% year over year in April, pressuring the EU’s central bank to reverse pandemic stimulus and raise interest rates. The bloc’s GDP rose 0.2% in the first quarter, an optimistic sign amid economic contraction in the U.S.

- A purchasing managers index of factory activity in China fell to 47.4 in April, a two-year low signaling larger-than-expected contraction due to lockdowns.

- South Korea registered a $2.66 billion trade deficit in April, as COVID-19 lockdowns in China shrank exports, and rising energy and raw materials prices pushed up imports.

- More news related to the war in Ukraine:

- Russia is estimating that its economy could contract by as much as 12.4% due to sanctions.

- Russia narrowly avoided default on its foreign debt after switching two recent attempts to pay interest in rubles to the U.S. dollar.

- Goldman Sachs cut its credit exposure to Russia from $650 million at the end of 2021 to $260 million in March amid the nation’s ongoing war with Ukraine.

- Chinese drone maker DJI will temporarily suspend its operations in Russia and Ukraine following claims that the company’s drones were being used by Russia’s military.

- Australia’s Qantas Airways will purchase 12 A350-1000 models from plane-maker Airbus as it resumes pandemic-stalled plans to offer direct flights between Australia’s east coast to New York and London, the longest direct flights in the world.

- Airbus is ramping up strategic commitments from suppliers to boost narrow body jet production from 45 to 65 per month by mid-2023.

- Volkswagen will partner with Qualcomm to develop automated driving technology under a contract that runs through 2031.

- Thailand will offer tax breaks and subsidies to make electric vehicles cheaper, as the nation inks deals with Toyota and other auto manufacturers to produce 725,000 electric vehicles a year by 2030.

Some sources linked are subscription services.