MH Daily Bulletin: April 27

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices jumped nearly 3% in a choppy session Tuesday, reversing some of the previous day’s declines.

- In mid-morning trading today, WTI futures were down 0.6% at $101.20/bbl, Brent was off 0.4% at $104.50/bbl, and U.S. natural gas was up 4.8% at $7.18/MMBtu.

- NYMEX ultra-low-sulfur diesel jumped 9.2% yesterday to $4.47 a gallon, an all-time high.

- U.S. crude stocks rose a larger-than-expected 4.8 million barrels last week, according to the American Petroleum Institute. Government data will be released today.

- Valero Energy, the first U.S. refiner to report quarterly results, crushed market expectations on a doubling in refining margins from the same time last year.

- The Caspian Pipeline Consortium, which Kazakhstan uses to export most of its oil, began operating at full capacity, a month after key infrastructure was damaged by a storm.

- Global coal plant capacity rose 1% last year as a surge in new Chinese projects offset plant closures in the rest of the world.

- LNG inventories in Japan are sharply down compared to a year ago.

- More oil news related to the war in Europe:

- Russia said it would cut gas deliveries to Poland and Bulgaria today, with the news sending European gas prices up as much as 17% during yesterday’s trading.

- Russian export terminals loaded 25% more oil last week on higher demand from Asia, although more vessels continue to sail without a listed destination.

- Zero European customers participated in Rosneft’s most recent sale of 37 million barrels of oil.

- Commodities trader Trafigura Group said it will stop all purchases of crude from Rosneft by May 15.

- Four supertankers of oil traveled between the U.S. and Europe to start the year, up from just one a year ago, as the EU steps up its purchases of U.S. crude.

- Germany said it hopes to replace all deliveries of Russian oil within days. A new German law would permit the government to seize ownership of energy companies during supply emergencies, with lawmakers expected to vote on the measure next month.

- Russia’s invasion is causing the biggest supply shock to commodities in a half-century and will keep oil and other energy prices elevated for years, the World Bank says.

- Consulting firm McKinsey expects global oil demand to peak at about 102 million bpd within the next five years.

- Houston announced plans for the U.S.’s largest solar farm on a 240-acre former landfill with the capacity to power 5,000 homes by 2023.

- Exxon Mobil will create a new unit for biofuel and ethanol trading to lower its emissions over the next six years.

- Trade groups say a U.S. probe into China’s efforts to evade sanctions on solar equipment could cut installations by double-digit percentages this year and next.

Supply Chain

- Southern California’s water supplier declared an emergency and will require about 6 million people to cut outdoor watering to one day a week as drought continues to plague the state.

- New satellite images suggest port activity and construction have plummeted during China’s COVID-19 outbreak, while manufacturing inventories are piling up.

- Maersk container volumes declined 7% between January and March, the shipper said, while forecasts for global growth in container demand this year were lowered.

- Guyana is in talks with the UAE on building a new deep-water port to handle the largest commercial vessels along South America’s Caribbean coast.

- UPS’s U.S. volumes fell a larger-than-expected 3% last quarter while per-package revenue rose 9.4%.

- Kraft Heinz’s new partnership with Microsoft will see 34 new “digital twin” facilities that can model and test new supply chain processes before applying them to plant floors.

- A North Carolina battery startup is partnering with South Korea’s Lotte Chemical on a $200 million investment in battery-component manufacturing in the U.S.

- Volta Trucks, a Swedish maker of electric commercial vehicles, unveiled two new small models for urban transport to be produced by 2025.

- Chipotle says inflation for food, including avocados, tortillas and dairy items, will likely stretch into 2023.

- A projected 7% drop in Canada’s canola production this year will exacerbate global food shortages and further push up prices, officials warn.

Domestic Markets

- The U.S. reported 57,284 new COVID-19 infections and 331 virus fatalities Tuesday. Weekly infections were up 57% last week, with 42 states seeing a week-over-week rise.

- New antibody data suggests nearly 60% of Americans had a prior COVID-19 infection, with about half the total coming from the latest surge of Omicron.

- The FDA may wait to authorize a COVID-19 vaccine for children under age 5 until at least June, officials indicated.

- Pfizer requested authorization for its COVID-19 booster dose for children aged 5-11.

- U.S. consumer confidence fell slightly in April as concerns about inflation retreated from an all-time high but remained elevated, according to The Conference Board.

- Led by cars and computers, U.S. orders for durable goods rose 0.8% in March, the fifth increase over the past six months following a decline in February. Orders for capital goods rebounded unexpectedly by 1%, signaling healthy momentum.

- Deutsche Bank predicts the U.S. economy will fall into a “significant recession” next year as the Federal Reserve aggressively kicks up interest rates to fight inflation.

- A sharp increase in the number of Americans asking family and friends for loans is the latest sign that household budgets are coming under strain as prices surge.

- U.S. homebuilders will find it harder to raise prices in the coming months as rising mortgage rates and inflation cut into demand, according to industry consultants. New home sales fell 8.3% from February to March, new data shows.

- Rents in Manhattan are up more than 25% in most neighborhoods, one of the fastest rises in the country.

- Smaller U.S. communities remain the hottest housing markets as Americans look for affordability, more space and satisfying remote work locations.

- Higher inflation pushed down the average real starting salary for U.S. teachers last year by 4% to $41,770, a 10-year low for a profession suffering from labor shortages.

- Higher wages are keeping young businesspeople in the workforce and sending MBA enrollments down sharply, school officials say.

- Toy maker Mattel is in talks about a potential sale of the firm just months after executives declared its corporate turnaround complete.

- United Airlines announced its biggest trans-Atlantic expansion in history with 30 new or resumed flights by early June, a boost of 25% over pre-pandemic levels.

- In the latest news from first-quarter earnings season:

- Higher sales at Chipotle were offset by a 12% rise in the cost of food and materials.

- Skechers’ sales rose a surprise 27% on greater pricing power in its wholesale and direct-to-consumer business.

- Snack food maker Mondelez said profit rose 14% after it raised prices, with another round of price increases set for early May.

- Texas Instruments’ revenue rose 14% on growth in the industrial and automotive markets.

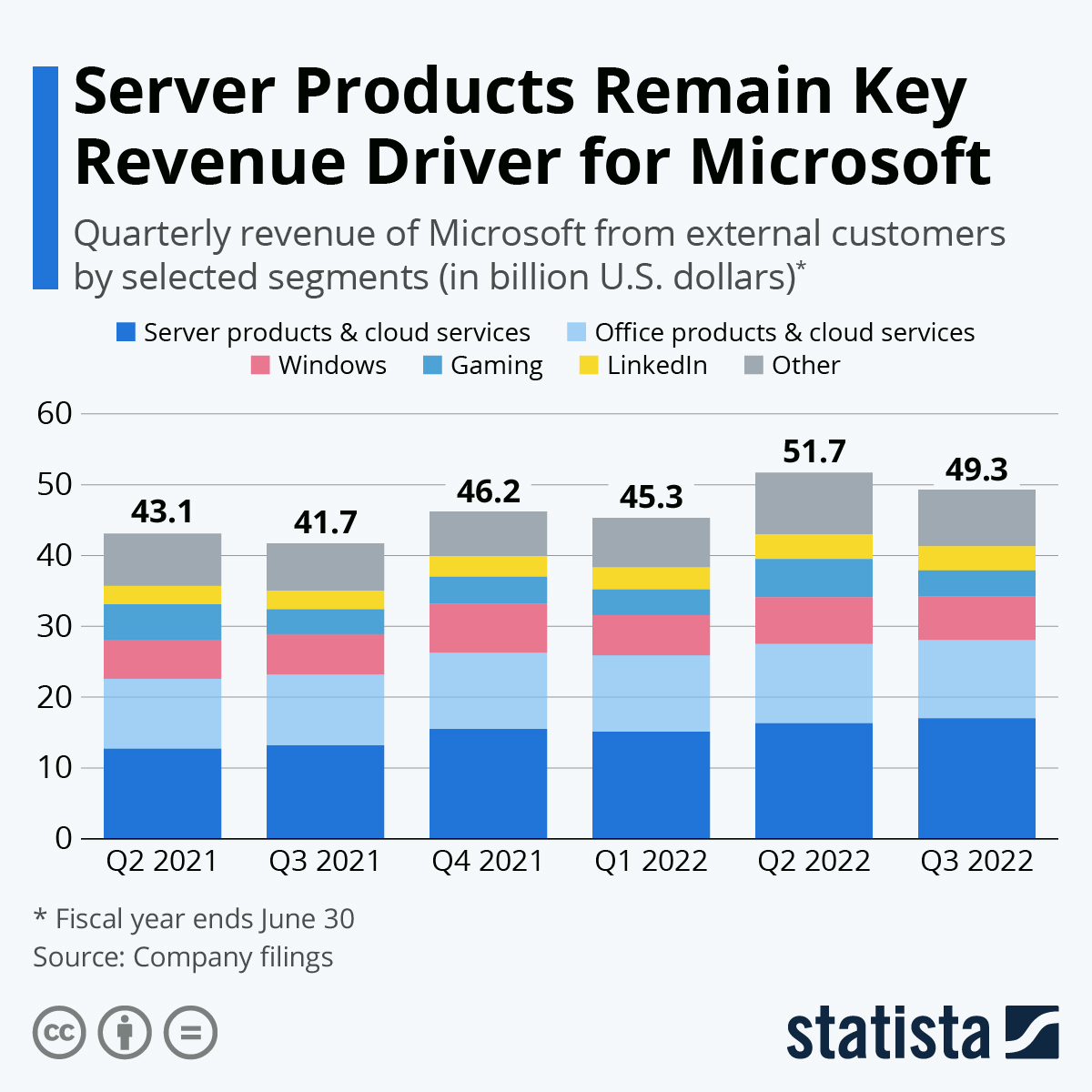

- Microsoft reported an 18% rise in revenue on continued strength in its cloud computing business.

- Google parent Alphabet posted lower-than-expected sales growth of 23% on lower advertising activity and high costs at its cloud computing unit.

- 3M posted a drop in sales and profits on lower demand for face masks and ripple effects from supply shortages in auto and electronics production.

- Specialty glass maker Corning saw sales rise 12% and expects rising production capacity to boost earnings from optical cable and fiber.

- Paint and coating maker Sherwin-Williams posted a 9.5% profit decline on a 7.4% increase in sales due to higher costs for raw materials.

- PepsiCo revenues rose following a 10% boost in prices and higher sales volume in most markets.

- Profits at GM slipped 3% from a year ago on higher commodity and logistics costs.

- Airline ticket prices have surpassed pre-pandemic levels by up to 80% on some of the most popular routes to Chicago and Las Vegas this summer.

- Ford launched production of its electric F-150 Lightning yesterday and hinted that another electric truck is in the works at its mega campus under construction in Stanton, Tennessee. The automaker upped production targets on the massively popular Lightning model from 40,000 to 150,000 per year.

- California electric vehicle startup Lucid received orders for tens of thousands of new vehicles from Saudi Arabia.

- Discarded composite wind turbine blades are being burned and repurposed to produce cement.

- The U.S. administration plans to block the sale of many incandescent light bulbs starting Jan. 1 of next year.

- Bumble Bee Seafood is the first seafood brand to replace its shrink-wrap packaging with 100% recycled paperboard.

International Markets

- Beijing expanded mass testing to much of the city’s 22 million people yesterday ahead of potential lockdowns. Officials in Shanghai ordered new mass testing to see if some neighborhoods can be given limited freedoms from lockdowns. Health experts are blaming the nation’s refusal to adopt Western mRNA vaccines as a major contributor to its recent virus wave.

- More news related to the war in Europe:

- Since the start of Russia’s invasion, 40% of countries have introduced new measures to help contain the effects of rising prices on vulnerable groups, ranging from tax and tariff reductions to price caps.

- EU officials will downgrade the continent’s 4% projected growth rate for 2022 later this month, primarily due to energy fallout from Russia’s invasion.

- BASF will wind down most of its business in Russia by July.

- U.S. aircraft lessor Air Lease Corporation plans to write off $802 million for 27 jets stuck in Russia.

- GE wrote down a quarter of its Russian assets yesterday for roughly $200 million.

- BMW and Volkswagen suspended rail shipments through Russia of the small share of vehicles they export to China from Europe.

- Chicago-based Mondelez said Russia’s invasion caused $145 million in direct costs, with two of the firm’s Ukrainian factories significantly damaged.

- A new Canadian law will send proceeds from seized Russian assets to war victims and foreign state-aid funds. The U.S. administration is considering a similar move.

- New British sanctions will cut off more key exports to Russia and strip tariffs from Ukrainian imports.

- Big banks are cutting profit estimates for Chinese companies by double-digit percentages due to lockdowns.

- In the latest news from the international first-quarter earnings season:

- Deutsche Bank posted better-than-expected profits but said a squeeze for talent was putting pressure on the bank’s payroll alongside rising economic uncertainty. Credit Suisse reported a loss largely due to rising legal costs.

- South Korean automakers Hyundai and Kia reported declining unit sales but higher revenues and operating profits on higher prices.

- Mercedes’ net profit fell nearly 20% due to higher production costs.

- In line with U.S. airlines, Air Canada reported a larger-than-expected loss but said rebounding demand will justify adding 41% more flight capacity over the coming months.

- Nissan is halting production of its low-cost Datsun models.

- Emirates airline is moving at least $1 billion planned for new aircraft purchases to refurbishing its existing fleet as production delays hamper deliveries from Boeing.

Some sources linked are subscription services.