MH Daily Bulletin: April 22

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose about 1.5% Thursday on more rumors of an impending EU embargo on Russian oil.

- In mid-morning trading today, WTI futures were down 1.9% at $101.80/bbl, Brent was down 1.9% at $106.20/bbl, and U.S. natural gas was down 4.0% at $6.68/MMBtu.

- 10-year LNG contracts are 75% higher than the same time last year as suppliers warn of long-term market tightness.

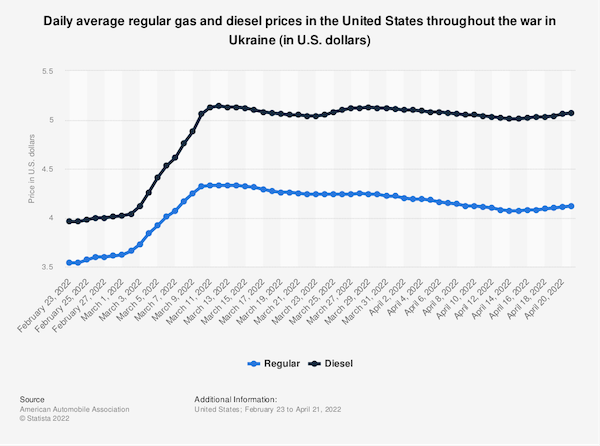

- High U.S. gasoline prices are having little effect on demand in California, the nation’s most populous state. The national average for a gallon of gas hit $4.12 yesterday, up from $2.88 last year.

- Liberty Oilfield Services reported its best quarterly sales in the four years since it went public, as domestic producers ramp up drilling and exploration activity.

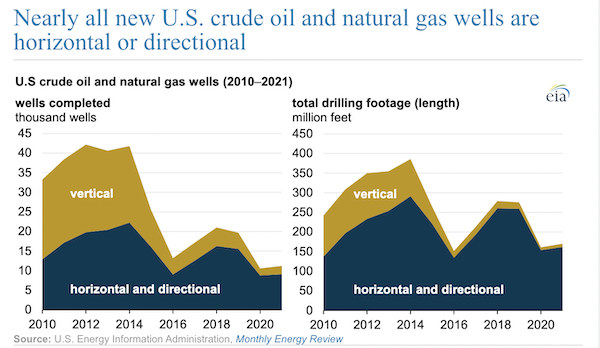

- U.S. crude production more than doubled since 2010 largely due to horizontal drilling, which made up 81% of completed wells last year:

- The U.S.’s largest oil industry trade group is working on a carbon tax proposal that would likely make consumers pay more for gasoline and other fuels, a sharp turnabout from a decade ago when the group helped kill a similar plan.

- More oil news related to the war in Europe:

- Oil prices saw downward pressure Thursday after the U.S. Treasury Secretary said the EU needs to be careful about the global economic impacts of a complete ban of Russian energy imports.

- New estimates suggest Russia’s oil production is down 10% since late February and will fall 1.5 million barrels this month.

- Millions of barrels of Russian oil are being loaded onto tankers marked “destination unknown,” up from none in late February, as the heavily sanctioned market becomes increasingly opaque.

- Ukraine is lobbying Western allies to transit more Russian gas on its own pipelines, potentially giving the nation leverage in its conflict with Moscow.

- European consumers should make everyday adjustments to cut back on energy use and help the continent use less Russian energy, the IEA said Thursday.

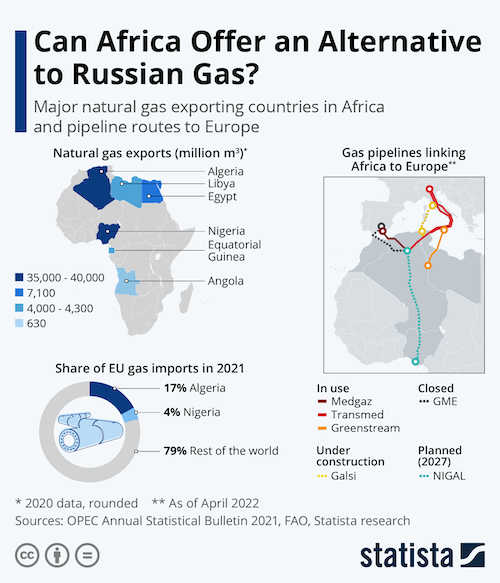

- Germany’s top power producer is looking to replace Russian supplies with greater LNG shipments from the U.S. and Qatar. Other European nations are turning toward Africa, with Algeria and Nigeria already making up 21% of the continent’s imports last year:

- Shell’s sale of its Russian gas export project will likely go to one of China’s several energy giants, reports suggest.

- Italy could become completely independent from Russian gas by the second half of 2023, officials said.

- Exxon Mobil, which already removed employees of U.S. citizenship from Russia, is considering a complete withdrawal from the country by late June.

- Japanese officials are building a legal framework around long-term plans for carbon capture and storage, a vital part of the nation’s 2050 emissions targets.

Supply Chain

- Officials warn of more evacuations in Arizona as wind gusts spread the state’s 20,000-acre Tunnel wildfire today.

- More supply chain news related to the war in Ukraine:

- The U.S. joined Canada and several European nations yesterday in banning all Russian ships from entering its ports.

- Empty containers are piling up at both east and west coast ports in the U.S. due to the war in Ukraine and lockdowns in China, forcing prices lower.

- One of Eastern Europe’s largest chemical-solvent plants in Russia was destroyed yesterday by a fire of unknown origin. It followed a similar suspicious fire that destroyed a defense facility in the nation earlier in the day.

- The commodity shortage caused by Russia’s invasion is inviting bribery and corruption among third-party sellers and agents, trade experts say.

- Maritime classification society Bureau Veritas will downsize its Russian ocean business.

- Officials in Shanghai said they would start to ease anti-virus controls on truck drivers that are hampering trade at the city’s port. National trade officials made similar promises at a Thursday meeting with global chambers of commerce.

- Three Indian states were forced to impose blackouts yesterday due to a shortage of coal, which fuels 70% of the nation’s electricity generation.

- Supply chain vulnerabilities exposed over the last two years will persist well after the pandemic ends, according to a new White House report.

- U.S. digital freight brokerage companies raised more than $1 billion in venture funding last year, up from $602 million in 2020.

- The U.S. administration is looking to invest a substantial chunk of $6.4 billion infrastructure dollars earmarked for sustainable transportation into expanding highway parking for trucks.

- California authorities are studying development of inland port hubs through public-private partnerships to relieve pressure on seaports.

- Some major U.S. airlines are cutting back on summer flight schedules as production shortfalls delay new jets from Boeing.

- General Mills said it is reformulating products around shortages of key ingredients and packaging.

- Panasonic announced plans to spend $4.8 billion to diversify its business away from Tesla and into areas including supply-chain software.

- Japan’s biggest steelmakers are raising prices and warning of additional hikes this year due to higher transport costs.

- Amazon’s latest expansion play will see its payment and speedy fulfillment platform embedded on third-party sites.

- Zipline, a U.S. drone delivery startup for medical supplies, is taking off in Japan.

- Japanese liner NYK received its third methanol-fueled tanker from South Korean builders yesterday.

- A natural-gas shortage in Bangladesh is disrupting production and deliveries at the country’s extensive garment factories.

- Peruvian staple crop production could fall 40% over the next several months, officials warn, due to a shortage of fertilizers. Across the globe, fertilizer costs have doubled over the past year, according to some measurements.

Domestic Markets

- The U.S. reported 49,200 new COVID-19 infections and 471 virus fatalities Thursday. New cases are up 35% the past two weeks, driven by rises in the Northeast, Mid-Atlantic and Pacific Northwest.

- Data analysis suggests one-quarter of all U.S. COVID-19 fatalities were preventable with vaccines.

- New COVID-19 cases in Florida rose 38% last week, the largest increase in a month.

- Officials in Boston are warning the public to wear masks as new wastewater analyses suggest an impending rise in COVID-19 cases.

- Philadelphia scrapped its indoor mask mandate just days after becoming the first major U.S. city to reimpose the measure.

- Los Angeles reimposed masking requirements on all public transit yesterday, including airports.

- California regulators extended the state’s generous benefits for workers infected or exposed to COVID-19 through the end of the year, citing a belief that the pandemic’s effects will remain significant through 2022.

- U.S. children under age 5 could get COVID-19 shots as early as June, health officials say.

- A CDC panel of independent vaccine experts signaled COVID-19 booster shots every four to six months is not a sustainable vision for the nation’s long-term pandemic response.

- As of last week, over half of Americans surveyed were in favor of keeping mask mandates for airports and other forms of public transit.

- A half-percentage-point rate hike at the Federal Reserve’s next meeting in early May is all but guaranteed, officials indicated.

- New U.S. business openings surged past 150,000 last quarter, according to Yelp, as entrepreneurs took advantage of reopened offices and eased pandemic restrictions.

- The average U.S. mortgage rate rose to 5.11% this week, up from 3.22% at the beginning of the year. Applications for new mortgages and mortgage refinancings are down by nearly half for the period.

- American Airlines posted a $1.64 billion loss in the first quarter yesterday, similar to the $1.4 billion loss reported Wednesday by United Airlines. Summer bookings are surging across the industry, including for corporate travel.

- United Airlines is refunding bookings for travelers who dropped plans after the federal government’s mask mandate was struck down.

- Stocks of large U.S. auto dealers fell Thursday despite better-than-expected quarterly results, as concerns rise over inflationary pressures on consumers.

- Ford’s luxury Lincoln brand announced plans for four new all-electric vehicle models by 2026.

- Japan’s Envision AESC will spend $2 billion to build a second electric-vehicle battery plant in the U.S.

- The U.S. administration released $420 million of new infrastructure dollars for dam rebuilds and flood prevention measures in 31 states. An additional $385 million, funded through a separate program, will go to states to help Americans with home energy costs.

- U.S. fast-food chains Burger King and McDonald’s are both facing multiple lawsuits from consumers over their use of PFAS, better known as “forever chemicals”, in their packaging.

International Markets

- New COVID-19 cases in Italy more than tripled yesterday from the day before to nearly 100,000.

- Some hospitals in Canada’s most populous provinces are canceling or postponing medical procedures in the face of another wave of COVID-19 patients.

- Shanghai authorities said they would step up enforcement of lockdowns after 11 COVID-19 deaths were reported Saturday, the most of its recent wave.

- The World Health Organization made calls Thursday for the global public to continue wearing masks even when not required, citing their high effectiveness at reducing viral transmission. The group also endorsed Pfizer’s COVID-19 antiviral pill as one of the most effective treatments for high-risk people.

- Portugal ended its mask mandate for most indoor public spaces yesterday, while New Delhi reimposed the requirement.

- More news related to the war in Europe:

- Purchasing manager surveys indicate the global economy is slowing in the face of the war in Ukraine and COVID-19 lockdowns in China.

- The U.S. added another $1.3 billion in aid for Ukraine yesterday, bringing its total to more than $3.7 billion.

- The U.S. is planning to crack down on Russian firms that use cryptocurrencies to evade Western sanctions.

- Carlsberg, the Western brewer with the largest exposure to the Russian market, expects a write down of nearly $1.4 billion upon its exit from the nation.

- AB InBev, the world’s largest brewer, will take a $1.1 billion impairment charge as it exits Russia, joining Heineken and Carlsberg in withdrawing from the country.

- South Korea’s exports jumped nearly 17% so far this month on a surge of shipments to the U.S. Overall, the nation’s economy likely slowed sharply last quarter during its worst COVID-19 wave of the pandemic, economists say.

- British consumer confidence fell for a fifth straight month in April to the lowest level since the 2008 financial crisis.

- Industrial conglomerate Toshiba put itself up for sale to private equity Thursday after shareholders rejected a plan to split the firm in two last month.

Some sources linked are subscription services.