MH Daily Bulletin: April 21

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- In a rare day of market calm, oil prices settled nearly unchanged Wednesday.

- In mid-morning trading today, WTI futures were up 3.0% at $105.20/bbl, Brent was up 2.6% at $109.60/bbl, and U.S. natural gas was up 0.9% at $7.00/MMBtu.

- U.S. crude stockpiles fell by 8 million barrels last week on the highest export volumes in over two years. Domestic production rose to 11.9 million bpd, the highest since May 2020.

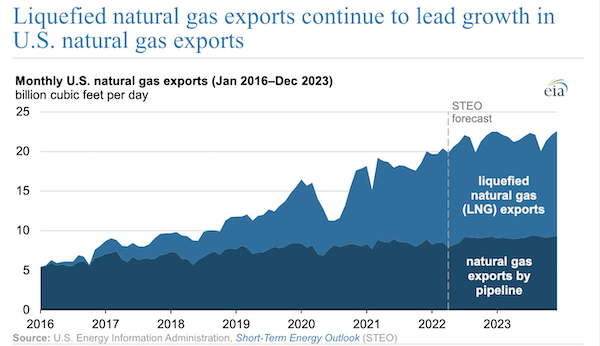

- The U.S. will likely surpass Australia and Qatar to become the world’s top LNG exporter this year, according to the Energy Information Administration:

- Libyan output losses now total 550,000 bpd, as a wave of political protests continues to block the nation’s oilfields and ports.

- Over $1.3 trillion must be invested in boosting global energy output to avoid a 2030 scenario where demand massively outstrips supply, JPMorgan Chase forecasts.

- More oil news related to the war in Europe:

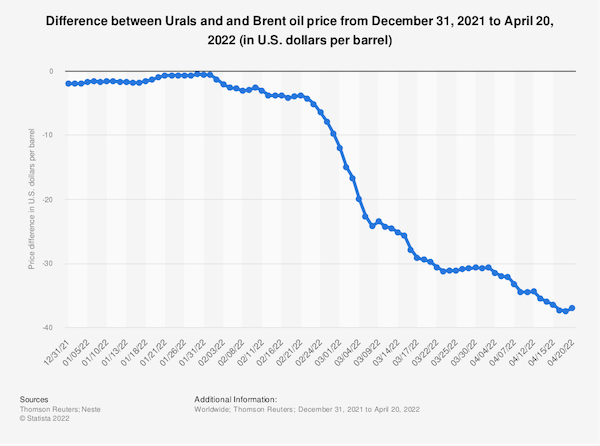

- Rosneft’s unusually large tender for May and June Urals crude suggests the state-owned producer is racing to get ahead of an expanded EU ban on Russian energy:

- Germany laid out a timeline to phase out Russian oil imports by the end of the year, with gas imports to follow. Officials also reaffirmed their stance against Moscow’s demand to pay for its gas in rubles.

- The U.S. received what was likely its final crude delivery from Russia ahead of an all-out ban beginning Friday.

- European lawmakers may boost the bloc’s 2030 renewable energy targets to help accelerate a shift from Russian imports. Officials are also working on an emergency deal to stock up on natural gas ahead of next winter.

- Italian lawmakers imposed a new set of cooling and heating limitations for public offices and buildings to use less electricity.

- Emerging economies, including Sri Lanka, Egypt, Tunisia and Peru, face rising blackouts as inflationary pressures slash into government budgets for energy.

- Exxon Mobil expects the carbon capture and storage market to reach $4 trillion by 2050, over half the $6.5 trillion market projected for oil and gas.

- The U.S. government permitted 10 solar and two geothermal projects on public lands last year, with total capacity under construction up 35% from 2020.

- Low-producing U.S. oil wells could be the source of the industry’s largest methane emissions, new research suggests.

- Japan’s JGC Holdings and Kawasaki Kisen plan to turn old LNG tankers into floating offshore LNG production bases.

- Danish lawmakers proposed a carbon tax on corporations to fund ambitious climate targets, including building the nation’s largest wind farm off the port of Thorsminde.

- One of Indonesia’s largest coal miners plans to use a fortune made on high commodity prices to invest in renewable projects, mostly solar farms.

- Amazon aims to purchase 3.5 GW of new green energy, mostly from solar farms, part of a plan to source all its power from renewables by 2025.

Supply Chain

- Cargo transport into Shanghai, one of the world’s busiest manufacturing hubs and ports, has ground to a near halt, with truckers particularly impacted by strict COVID-19 rules and their arbitrary enforcement.

- Arizona declared a state of emergency as the Tunnel wildfire near Flagstaff spread to nearly 20,000 acres, forcing the evacuation of 2,000 people on Tuesday.

- Chinese marine fuel exports fell 15% in March as shipping firms canceled calls at the nation’s ports and discouraged international vessels from refueling there.

- Rail congestion is forcing more intermodal cargo to transport by truck, according to J.B. Hunt, which experienced a 7% rise in intermodal volume last quarter.

- Passenger car registrations in Europe slumped 19% in March, an industry group said, marking the ninth consecutive monthly production decline amid supply disruption from Eastern Europe.

- More than half of U.S. building material suppliers said March inventories were back to pre-pandemic levels, suggesting the soaring cost of construction could soon ease.

- Cargo aircraft orders are growing on expectations that airfreight expansion will stay strong over the long term.

- Bed Bath & Beyond said supply chain delays cost the retailer $175 million in lost sales in the first quarter.

- Organic growth at Nestle reached 7.6% in the first quarter as shoppers shrugged off higher prices for consumer goods.

- The U.S. administration is making over $6 billion of last year’s infrastructure dollars available to local projects aimed at carbon reduction.

- European developers announced plans for a $1.08 billion complex to produce green hydrogen and ammonia in Sines, Portugal, home to the nation’s largest deep-water port.

- Shopify is holding talks for a $2 billion purchase of California-based Deliverr, a firm that relies on predictive analytics to position items in its warehousing network for fast delivery.

- McDonald’s is testing an electric Class 8 truck for deliveries to its outlets in the Montreal area.

Domestic Markets

- The U.S. reported 68,781 new COVID-19 infections and 877 virus fatalities Wednesday. The seven-day moving average hit 34,972, up 23.4% from a week earlier.

- The BA.2.12.1 subvariant of Omicron, an offspring of the recent BA.2 strain, is rapidly gaining ground in the U.S. and now accounts for 1 in every 5 cases, according to the CDC.

- New York’s COVID-19 positivity rate is back on the rise as officials find hope in an unusually large number of asymptomatic cases.

- Almost one-third of COVID-19 patients will suffer from long-term symptoms, new research from the University of California suggests.

- The U.S. Justice Department said it is following a CDC request and appealing a Florida judge’s ruling that threw out the federal government’s mask mandate for airlines and other public transit.

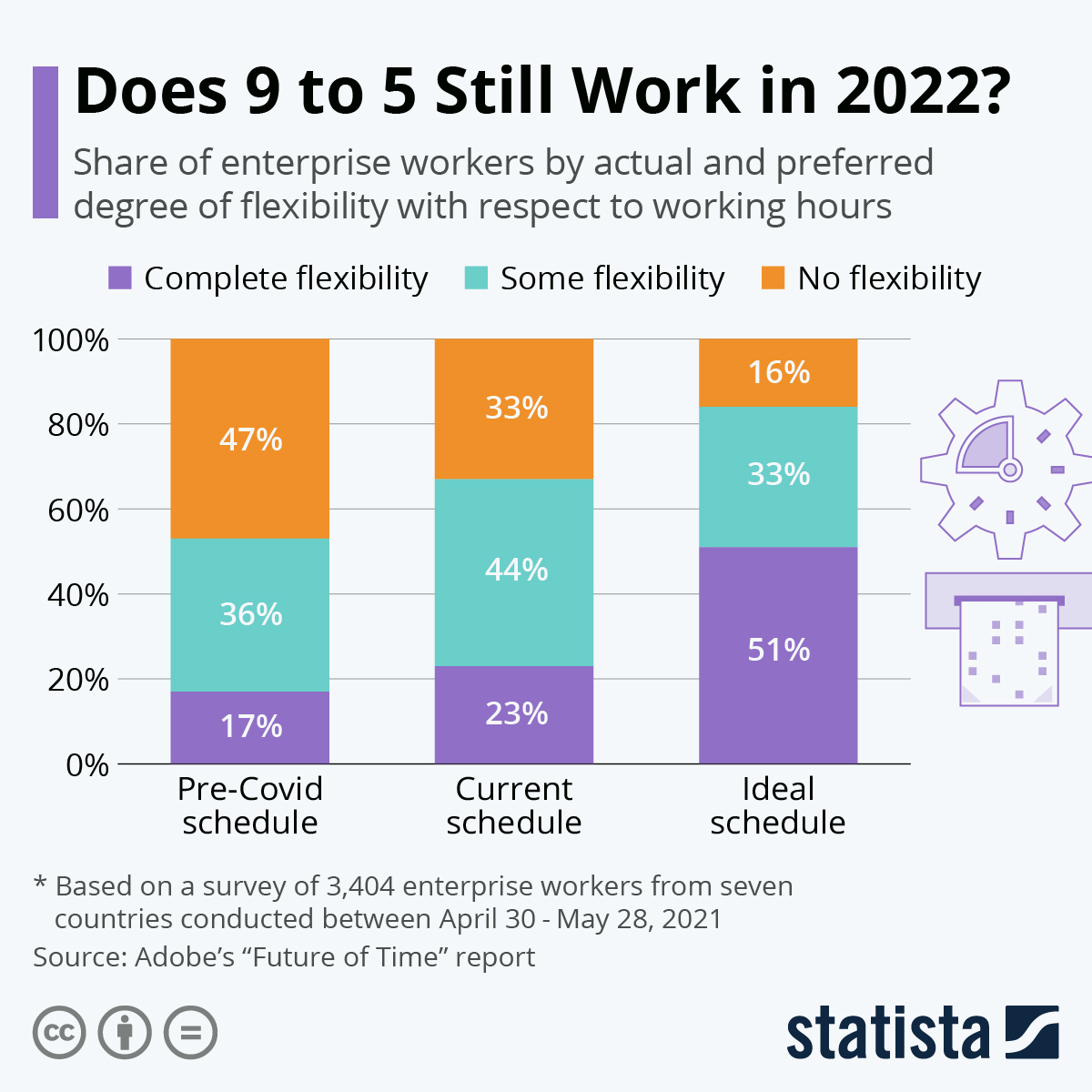

- The Fed’s Beige Book of anecdotal economic activity suggested inflation and worker shortages remain top priorities for U.S. firms, while bringing workers back to the office is also a common point of debate.

- First-time unemployment claims fell by 2,000 last week to 184,000. The number of Americans collecting unemployment fell to the lowest level in over half a century.

- U.S. employers posted 1.1 million tech jobs in the first quarter, up 43% from a year earlier as the pressure to attract talent spurs massive wage increases.

- The median U.S. home price hit a record $375,300 in March, up 15% from the same time last year. Rental prices, meanwhile, are surging by double-digit percentages in Portland, Austin and New York City.

- An index of U.S. homebuilder confidence is down 2 points so far in April, on track for the fourth straight month of decline.

- The average growth rate of U.S. auto loans hit 13% in the first quarter, roughly the same as the fourth quarter’s blistering pace and more than double the pace of overall loan growth across U.S. banks.

- Carvana posted its first ever decline in quarterly sales yesterday while inflationary headwinds prompted the online seller to scrap its financial guidance for the year.

- Bookings for domestic flights in peak summer travel months surpassed pre-pandemic levels by 1%, new data shows.

- United Airlines posted a surprise $1.38 billion loss in the first quarter but expects to return a full-year profit for the first time of the pandemic on surging bookings and rising revenue per seat.

- Tesla posted a sevenfold increase in first-quarter profit and said 2022 production would rise 60% from last year to more than 1.5 million vehicles.

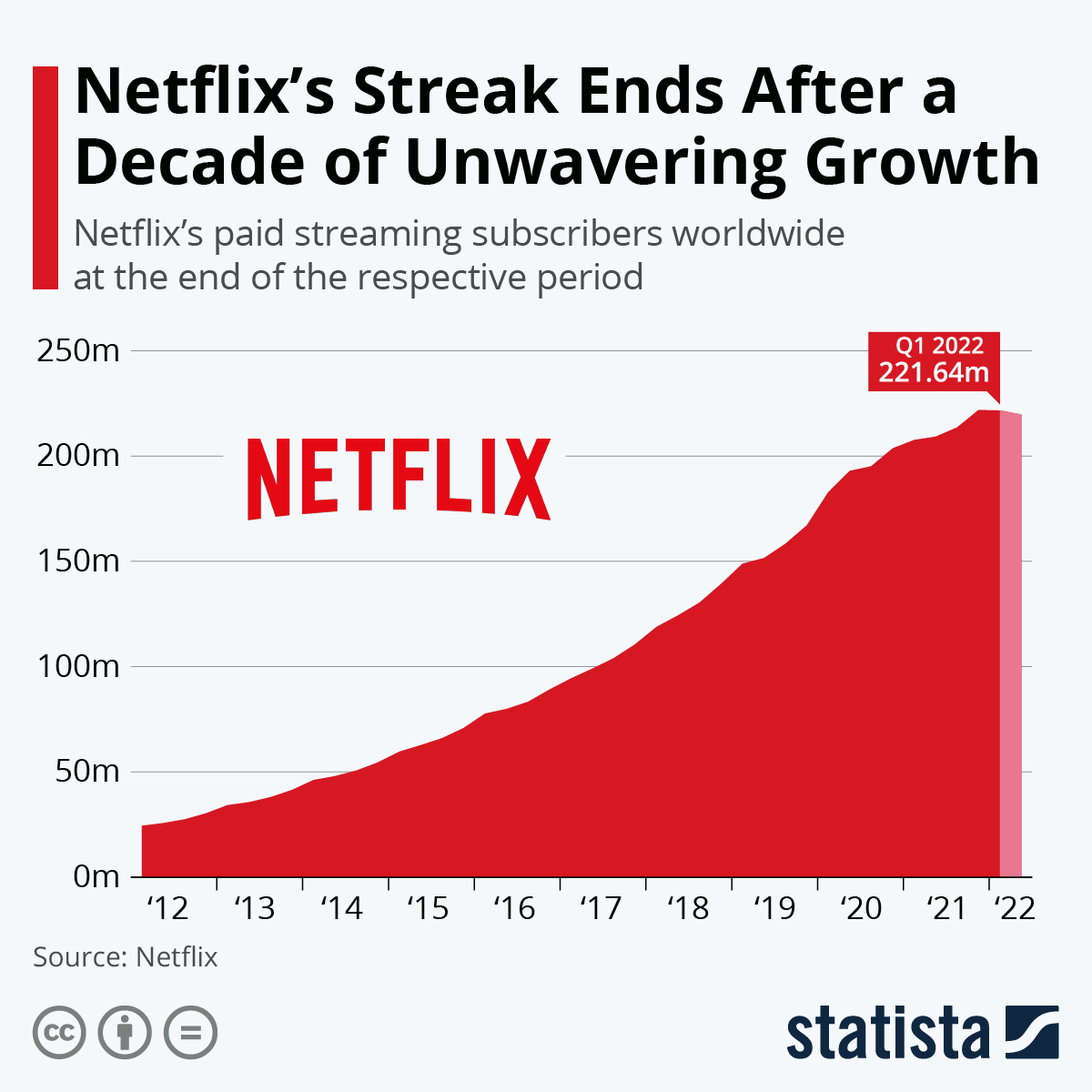

- Netflix stock tumbled an additional 35% Wednesday as the fallout from disappointing subscriber declines continues.

- Workers at an Apple store in Atlanta yesterday filed for a union election in a bid to become the tech giant’s first unionized retail employees.

International Markets

- Global COVID-19 cases fell 25% and fatalities fell 21% last week, according to the World Health Organization. In North America, cases were up 11.2%.

- Declining COVID-19 cases in Shanghai suggest the city’s recent wave is easing, despite a tripling in severely ill patients Wednesday. Authorities reaffirmed that strict lockdowns would remain in place even in districts which managed to cut viral transmissions to zero.

- South Africa reported 2,846 new COVID-19 cases Wednesday, the most in three months.

- Hong Kong further eased pandemic restrictions yesterday after COVID-19 cases fell to under 1,000 from more than 70,000 on March 3. Hong Kong Disney reopened after a three-month shutdown.

- Face coverings remain the norm in Asian nations from Japan to Thailand, a stark contrast with rapidly loosening restrictions in the West.

- Israel dropped its indoor mask mandate for businesses as COVID-19 cases continue falling.

- Spain dropped its indoor mask mandate for the first time in two years.

- More news related to the war in Europe:

- Signs of a Russian default are growing, with an industry body overseeing credit-default swaps rejecting the nation’s attempt to pay creditors in rubles yesterday.

- Russia’s inflation rate soared to 17.62% last week, a 20-year high.

- The U.K. announced plans to further tighten Russian sanctions by week’s end.

- Wimbledon banned Russian and Belarusian players from participating in this year’s tennis tournament.

- The IMF says countries should donate $5 billion monthly to keep Ukraine’s economy afloat through the war.

- The Ukrainian refugee count topped 5 million yesterday, the largest exodus on the continent since WWII. Counting domestic migration, one in every four Ukrainians has been displaced by war.

- Pittsburgh aluminum maker Alcoa expects to scrap 1.1 million tons of output this year due to fallout from Russia’s invasion, the firm said.

- Japan’s trade deficit in March soared fourfold over market forecasts to more than $3.2 billion, as shipments to China and car exports slowed.

- Volkswagen delivered 37.3% fewer vehicles in March from a year ago, the automaker said.

- Brazilian plane maker Embraer’s order backlog rose to over $17 billion at the end of March.

- BMW started taking orders for its first all-electric sedan this week, while Mercedes unveiled its second all-electric SUV.

- German auto supplier Schaeffler inked a first-of-its-kind deal to source rare earth metals from Europe for its budding electric vehicle business.

- Australian researchers are hoping to take a Tesla 9,400 miles on a single charge with the use of printed, foldout solar panels.

- A proposed British law would make insurance companies liable for autonomous-vehicle crashes, a measure meant to boost early deployment of the technology.

Some sources linked are subscription services.