MH Daily Bulletin: April 20

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell 5% Tuesday after the IMF cut its forecast for global economic growth by nearly a percent on inflation worries.

- In mid-morning trading today, WTI futures were down 0.3% at $102.30/bbl, Brent was down 0.4% at $106.90/bbl, and U.S. natural gas was off 3.2% at $6.95/bbl.

- U.S. natural gas prices dipped as much as 11.1% yesterday, nearly reversing Monday’s surge to a 13-year high.

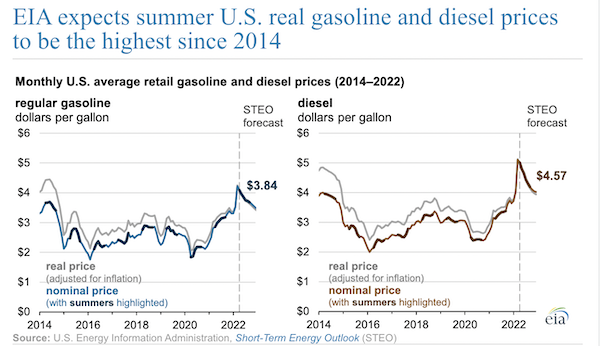

- The U.S. government expects summer gasoline prices to hit an eight-year high of $3.84 a gallon, up from $3.06 last year. Diesel prices will hit similar highs:

- Halliburton, the world’s second-largest oilfield-services company, expects North American drillers to boost spending on production by 35% this year.

- The U.S. government will hold oil and gas lease sales in at least eight states in June, the first announced after a federal court overturned the White House’s moratorium on drilling on federal lands.

- The U.S. government opened bidding yesterday for $6 billion in rescue dollars for the nation’s aging nuclear facilities.

- The attorneys general of 16 states wrote to the White House urging a renewal of permits for construction of the Keystone XL pipeline, which was effectively shut down in 2020.

- Libya’s oil production is down 500,000 bpd since last Friday, as political protests continue shutting oilfields and ports.

- Fuel demand in China, the world’s largest oil importer, could pick up as manufacturing plants prepare to reopen in Shanghai.

- The IMF raised its growth forecast for Saudi Arabia by three percentage points this year to 7.6%, boosted by higher oil prices.

- More oil news related to the war in Europe:

- France’s finance minister said Tuesday that an EU-level embargo on Russian oil is in the works. JPMorgan analysts predict a four-month phase-in of the embargo would prevent significant price disruption.

- Russian crude exports shrank 25% last week to the lowest in two months, as deliveries to Asia tumbled.

- Greece impounded a Russian oil tanker off the island of Evia Tuesday in accordance with Western sanctions on Moscow.

- Shell began to withdraw staff from joint ventures with Gazprom this week as the firm ratchets up its operational exit from Russia.

- Halliburton posted a pre-tax charge of $22 million in the first quarter due to its suspension of Russian operations.

Supply Chain

- Hundreds of thousands in the U.S. Northeast lost power Tuesday after an April nor’easter brought heavy snow and gusty winds to the region.

- Over 16,000 containers were waiting to be loaded onto trains at the Port of Los Angeles last week, more than twice the number at the height of last year’s congestion.

- U.S. regulators approved plans for a $1.5 billion on-dock rail facility at the Port of Long Beach, with Phase I to be completed by 2025.

- Officials at the U.S.’s busiest southeastern ports believe import volumes will rise through the summer while vessel backups expand.

- South Africa’s port of Durban, the largest in sub-Saharan Africa, expects to clear a backlog of thousands of containers within six days after severe flooding shut down the port last week.

- Used Class 8 truck prices with low mileage are up 72.9% since the same time last year and continue to set records at auction.

- J.B. Hunt’s revenue per loaded mile rose 33% in the first quarter on a 6% gain in total loads.

- Red Dog Equity, an Atlanta holding company, snatched up regional parcel carriers Capital Express and ADL Delivery as it builds a nationwide last-mile network.

- About 8,000 employees are back at work at Tesla’s factory in Shanghai, closed for the last three weeks due to lockdowns. Credit Suisse expects a 90,000-vehicle production loss for the automaker this quarter.

- Toyota plans to cut global vehicle production by 10% to around 700,000 units in May due to supply chain disruptions.

- ASML Holding, the world’s largest semiconductor equipment maker by market value, raised long-term forecasts on signs that demand for its machines continues to outstrip supply.

- Mineral-rich Australia is expected to export a record $425 billion of resources and energy commodities in the financial year ending in June, a boon to the dry bulk market.

- More supply chain news related to the war in Europe:

- About 80 to 100 ships, mostly bulk carriers, have been unable to leave Ukrainian waters for almost two months due to underwater mines and military blockades.

- Russia fired on and detained a Turkish-managed cargo ship that it claims was attempting to perform a rescue mission last week.

- One-fifth of planted areas in Ukraine will not be harvested in July, while the spring planting area will be about a third smaller than usual, agriculture officials say.

- Almost 10,000 Walmart lift trucks will soon be powered by green hydrogen produced by New York-based Plug Power.

- Container ship owner Danaos ordered four 7,200-TEU midsize vessels with methanol fuel capability to be built in South Korea and put into service by 2024.

Domestic Markets

- The U.S. reported 46,621 new COVID-19 infections and 432 virus fatalities Tuesday.

- Multiple counties in New York are at high risk of COVID-19 impacts, the CDC says. Infection rates are rising in metro areas of Illinois and Vermont as well.

- New data shows that almost 90% of children hospitalized for COVID-19 during the Omicron wave were unvaccinated, with child hospitalization rates higher than at any time during Delta.

- The Justice Department will not appeal a court ruling overturning the federal mask mandate on public transportation unless the CDC determines it is necessary. In the fallout from that decision, Uber and Lyft dropped their mask requirements, while state and city transportation departments as well as airports are split on whether to keep local mandates in place.

- The CDC launched a new center likened to a “National Weather Service” for infectious diseases yesterday, which aims to provide early warnings for outbreaks of COVID-19 and other illnesses.

- Moderna’s updated version of its COVID-19 vaccine provided better protection against Omicron and Delta strains in clinical trials, the firm said.

- Corporate executives are returning to the office at a much slower pace than non-executive employees, new data shows.

- Chicago Federal Reserve officials predict a round of interest rate hikes this year that would include two 50-basis-point increases.

- First-quarter earnings per share for S&P 500 companies are running 8.7% higher than expected on average, according to Credit Suisse. Stocks saw broad-based gains on the news Tuesday.

- Amsterdam-based Just Eats, parent of Grubhub, said it may divest the U.S. subsidiary after suffering a 5% decline in North American orders as consumers return to eating out.

- U.S.-sponsored mortgager Fannie Mae expects the U.S. to fall into a modest recession next year due to rising inflation, among other factors.

- U.S. companies borrowed a record $1.8 trillion in junk-rated loans in 2021, raising fears about what will happen when inflation kicks in higher rates on the instruments.

- U.S. employers are poised to hire at least 30% more new graduates this year than in 2021, while starting salaries hit new highs in tech, finance and consulting.

- A new plan from the White House would give around 3.6 million student-loan borrowers — some 10% of the total — three years of credit toward eventual debt forgiveness.

- New U.S. home construction unexpectedly rose 0.3% in March to the highest level since 2006, fueled by multifamily projects from large builders looking to replenish inventory.

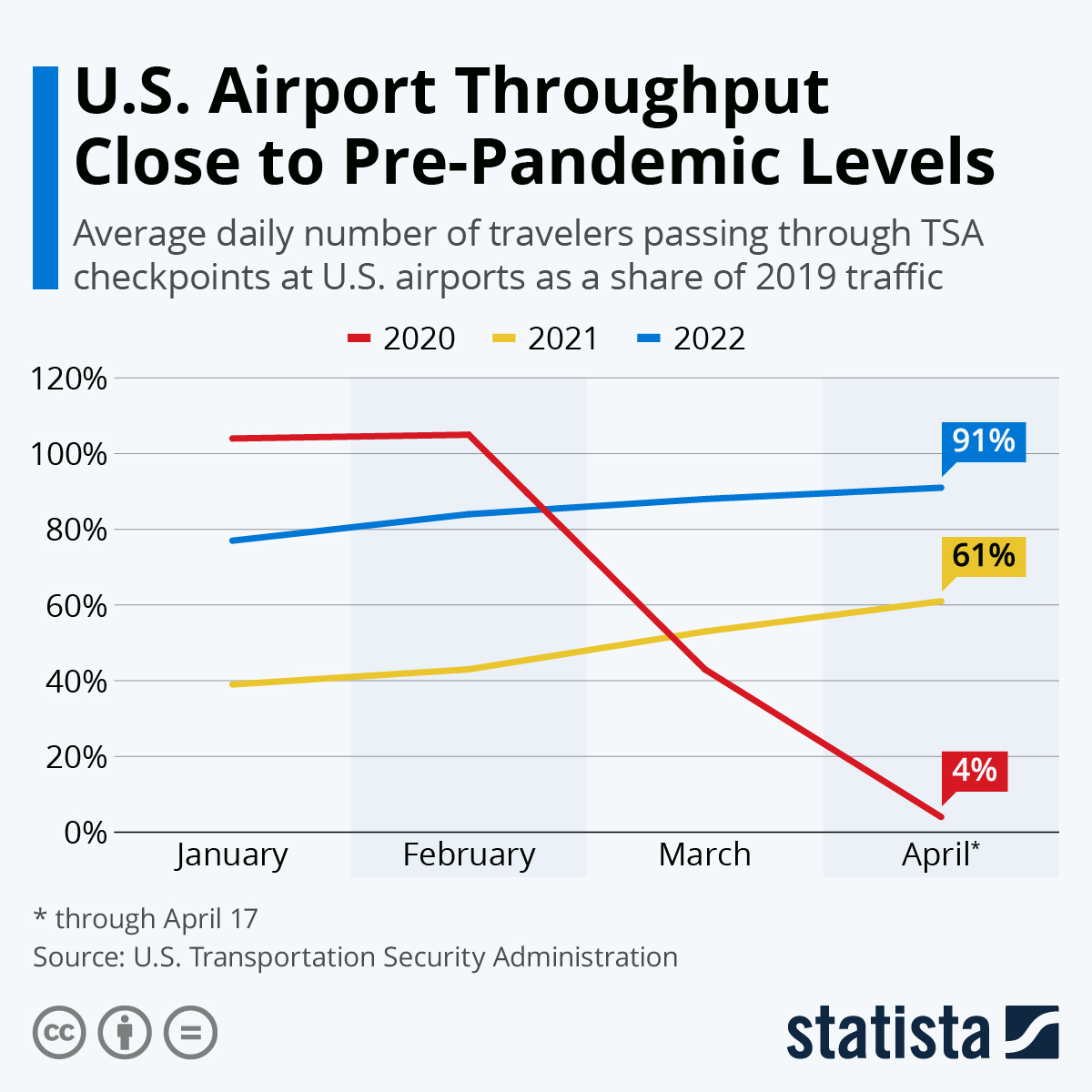

- U.S. budget carrier Spirit Airlines is the latest in a string of airlines to throttle back its summer schedule amid continued staff shortages, weather disruption and surging demand.

- Over 100 Delta pilots began picketing in Seattle yesterday over the disruption and fatigue caused by staffing and scheduling issues.

- Regional U.S. airline Sun Country ended service to Hawaii over staffing shortages.

- Boeing’s commercial deliveries rose 23.4% in the first quarter to 95, excluding its 787 Dreamliner jets whose production has been hampered by supply issues.

- The White House reimposed stricter environmental standards for approving new pipelines, highways, power plants and other construction projects that were dropped under the previous administration.

- Toyota announced over $380 million of investments in several southern states to build hybrid vehicles.

International Markets

- Shanghai began its first easing of stay-at-home orders for 4 million residents Wednesday, even as new virus cases remained in the tens of thousands. Officials are urging increasingly skeptical residents to comply with a new round of mass testing.

- One in 10 people tested for COVID-19 in South Africa are coming back positive, the highest rate in over a year.

- The Canadian government says it has no plans to stop requiring masks on planes and other transit after the U.S. government said it would stop enforcing mask mandates yesterday.

- Australia’s two most populous states are scrapping longstanding pandemic rules this week, including isolation requirements and proof-of-vaccination screening for indoor businesses.

- More news related to the war in Europe:

- The IMF reduced its forecast for global economic growth this year from 4.4% to 3.6%, citing Russia’s invasion.

- The U.K. stripped Moscow’s stock exchange of its legitimacy as a trading platform, while Russia will require all Russian firms to remove their listings from overseas exchanges.

- Two major European firms, automaker Stellantis and consumer-goods maker Henkel said Tuesday they would halt operations in Russia.

- Firms pulling out of Russia are seeing losses in the hundreds of millions this quarter, including IBM, Hasbro and Credit Suisse.

- The U.S. administration is considering another $800 million in military aid for Ukraine, on top of the $800 million announced last week.

- The IMF lowered its 2022 economic growth forecast for Mexico to 2.0% from 2.8%.

- Global sales of hotels reached a six-year high in the first quarter as investors seek to capitalize on rebounding travel demand.

- Britain will likely see the worst inflation shock of any advanced economy over the next two years, the IMF warned.

- Surging home sales in Canada cooled in March, down 16% from a year ago amid rising borrowing costs.

- Sales at L’Oréal climbed 13.5% in the first quarter to almost $10 billion amid strong U.S., European and Chinese demand for luxury body care products.

- Corporate spending on cloud computing is rising at double-digit rates, with global sales expected to reach nearly $500 billion this year, up 20% from last year.

- Volkswagen’s electric-vehicle deliveries surged 65% in the first quarter from the same time a year ago, the automaker said.

- Canadian auto supplier Magna International broke ground Tuesday on a joint venture with LG Electronics for a new factory in Mexico that will produce electric vehicle parts for GM.

Some sources linked are subscription services.