MH Daily Bulletin: April 13

News relevant to the plastics industry:

At M. Holland

- M. Holland will be closed on Friday, April 15, in observance of the Easter holiday.

- M. Holland is exhibiting at MD&M West in Anaheim, California, this week. MD&M West is the largest medtech conference in the U.S. If you’re attending, please stop by Booth #4111 to meet our Healthcare experts!

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices jumped over 6% Tuesday as lockdowns eased in Shanghai and new data showed Russian production fell to an almost two-year low to start the week.

- In mid-day trading today, WTI futures were up 3.3% at $103.90/bbl, Brent was up 3.7% at $108.50/bbl, and U.S. natural gas was up 4.3% at $6.97/MMBtu.

- In its most recent report, OPEC shaved 480,000 bpd off its forecast for growth in global oil demand this year while still expecting consumption to surpass 100 million bpd for the first time of the pandemic. The report also shows the cartel’s output rose by just 57,000 bpd in March, well below a 253,000-bpd target.

- U.S. natural gas prices are up 79% so far this year, reversing the usual spring declines as commodities fluctuate wildly across the board.

- The American Petroleum Institute reported a larger-than-expected build this week of 7.7 million crude barrels, as traders await government data to be released today.

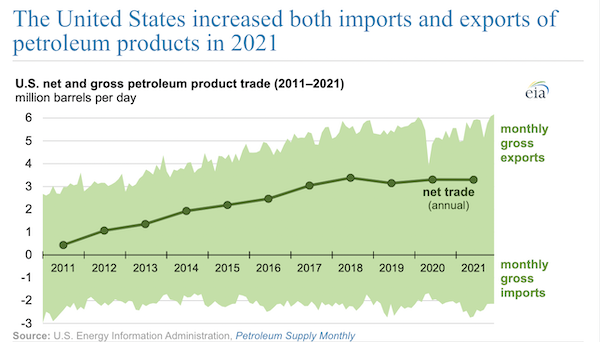

- U.S. shale could see a production boost of over 200,000 bpd in 2022, OPEC predicts, even as drillers continue to focus on capital discipline. The move corresponds with steadily rising foreign demand for the nation’s petroleum products:

- The latest forecasts from the U.S. government show both natural gas production and power consumption rising steadily to new highs for at least the next two years.

- Sasol, South Africa’s biggest fuel producer, dropped plans to invest in a large new pipeline over fears of getting stuck with obsolete infrastructure as the world shifts from fossil fuels, according to executives.

- Canada’s proposed budget contains the nation’s largest ever tax credit for carbon-capture projects, up to 60% in some cases.

- More oil news related to the war in Europe:

- Russia’s average oil output fell more than 6% — or 700,000 bpd — to 10.32 million bpd during the first 10 days of April, as Western sanctions dent foreign demand and cause the nation’s domestic storage to push capacity limits.

- Indian Oil Corp., which bought Russian Urals crude in previous tenders, has removed the grade from its latest crude tender after the U.S. warned that buying Russian energy was not in India’s best interests.

- Tanker charters from Russia’s Baltic ports to northwest Europe have surged to over $345,000 per day, the highest in at least 14 years.

- Greece plans to begin its first oil drilling in more than two decades by 2023, an effort to reduce reliance on Russian energy.

- A Paris trade group whose members count for more than 90% of global LNG trade has issued its first ever public plea for governments to promote new LNG developments and help ensure global supplies.

- Wholesale electricity prices in France surged well beyond levels that trigger renewable developers to repay government subsidies, creating a 5.9 billion euro windfall for state coffers.

Supply Chain

- Winter Storm Silas may smash snowstorm records in eastern Montana and North Dakota through Thursday after dumping heavy snow in parts of the West.

- A devastating tropical storm struck the central Philippines yesterday, prompting flooding and landslides that killed more than 20 people.

- Two major international bridges — Pharr-Reynosa on Texas’ southern tip and Ysleta Bridge in El Paso — were effectively shut down Tuesday after Mexican truckers blocked lanes to protest a new decree from the Texas administration that forced them to wait hours or days to bring products into the U.S. The shutdowns threaten billions of dollars in trade and are causing backups at smaller crossings where cargoes are diverted.

- Chinese year-over-year imports declined last month for the first time since early in the pandemic.

- More Shanghai factories, including two of key Apple assembler Pegatron, are halting production as lockdowns hamper transport services.

- First-quarter volumes at the Port of Los Angeles climbed 3.5% to an all-time high of 2.68 million TEUs, with greater staffing helping reduce vessel backups.

- Union Pacific plans to limit customer-owned railcars on its network beginning next week as part of a broader initiative to ease traffic jams.

- Inflation is slowing do-it-yourself construction activity in the U.S., creating an inventory glut at mills and a 30% decline in the price of lumber since the start of the year.

- European regulators are dropping the pandemic-era exception allowing aircraft to carry some cargo in passenger cabins.

- United Airlines’ recent decision to further delay flights of Boeing 777s with Pratt & Whitney engines will hinder the firm’s budding cargo division, analysts say.

- Big U.S. retailers are being forced to ration baby formula after a spate of recent recalls limited supply.

- Kroger launched a new unit in Dallas to provide next-day delivery to small and independent restaurants.

- Chewy’s in-house freight unit for middle-mile transport will expand outside its origin in Phoenix this year, the firm said.

- More warehouses are turning to contractable, intelligent robots to handle spikes in parcel delivery volumes amid a lack of manual labor to handle throughput.

- Global electric vehicle (EV) charging infrastructure is expanding at a notably slower pace than EV sales, suggesting continued low returns for investors in the emerging technology. Over 20 million plug-in EVs are expected to be on roads this June, up from just 1 million in 2016.

- GM said Tuesday it would buy cobalt from Swiss miner Glencore to use in its electric vehicles, as automakers around the world scramble to stock up on the material amid supply chain disruptions.

- Walmart executives say a campaign to get suppliers to decarbonize has pushed the firm past the halfway point in lowering emissions by 1 billion metric tons, as over 70% of suppliers have started reporting emissions.

- CMA CGM will no longer transport plastic waste onboard its vessels starting April 15.

- More supply chain news related to the war in Europe:

- U.S. steelmakers have lost the bulk of some 6 million metric tons of pig iron imported yearly from Russia and Ukraine, pushing up demand for scrap metal and raising prices for finished steel.

- ArcelorMittal, the world’s biggest steelmaker outside China, will partially restart operations at a large factory in Ukraine following a month-long shutdown. Ukrainian steel maker Metinvest is also resuming some output.

- Airbus is lobbying against a European ban on Russian titanium over production concerns.

- Boeing lost about 2% of its overall backlog of 4,200 commercial jet orders due to fallout from Western sanctions on Russia, the firm said.

- State-owned Russian Railways defaulted on a bond obligation due Monday, setting the stage for insurance payouts on a Russian corporate borrower for the first time since the invasion.

- Egypt, the world’s biggest buyer of wheat, is down to 2.5 months of supply after canceling several orders from Russia.

Domestic Markets

- The U.S. reported 27,853 new COVID-19 infections and 561 virus fatalities Tuesday.

- COVID-19 cases are trending higher again in the U.S., with half of states reporting upticks.

- The BA.2 subvariant of Omicron now accounts for over 90% of infections in the U.S. Northeast, putting health experts on edge about a larger potential virus surge.

- Philadelphia reimposed an indoor mask mandate, the first large U.S city to do so, after COVID-19 cases jumped 50% over the past 10 days.

- New COVID-19 cases in New York City have tripled since March 1 to an average of 1,600 per day. Four of the U.S.’s top five metro areas with rising COVID-19 cases are in New York state.

- New wastewater analyses suggest COVID-19 cases are back on the rise in Florida following a month of steady declines.

- Federal masking requirements for planes and public transport are set to expire April 18, as the White House stays silent on whether it will extend the measure.

- One or two days per week in the office is the “sweet spot” of permanent hybrid working arrangements, according to research from Harvard.

- Leases for 11% of U.S. office space are set to expire this year, as economists worry over property owners stuck with troubled loans. Some firms are taking advantage of market conditions, with Google recently saying it would invest almost $10 billion in new workspace across the U.S. this year.

- U.S. inflation spiked to a four-decade high in March:

- At an annual rate of 8.5%, U.S. inflation is the highest of any industrialized nation in the G7, and only outmatched by a small list of nations, such as Brazil, Argentina and Turkey.

- Inflation jumped the most in energy and food, while the cost of restaurant meals and used cars eased.

- In positive news, so-called “core” prices — a key Fed barometer for setting monetary policy — rose a lower-than-expected 0.3% in March, the smallest gain in six months.

- The Fed is almost certain to raise rates by a half-percentage point at its next meeting on May 3-4, analysts say.

- Over 80% of Americans say they will cut back on spending due to rising prices.

- The U.S. budget deficit narrowed sharply to $192.7 billion in March, new data shows, down from nearly $660 billion during stimulus payouts a year ago.

- Soaring prices for used cars sent CarMax’s fourth-quarter sales down a larger-than-expected 6.5%, while more buyers sought vehicle loans longer than 72 months.

- Rising food prices are boosting sales and profits for several supermarket operators including Albertsons and Kroger.

- Intel unveiled a $3 billion expansion of its chip factory in Hillsboro, Oregon.

- Digital ad revenue jumped 35% in the U.S. last year, the biggest gain since 2006, with almost 80% of advertising taking place on just 10 digital platforms including Google, Facebook and Amazon.

- San Francisco-based Brightmark and Georgia’s Macon-Bibb County have terminated their plans to build a $680 million chemical recycling facility first announced last year.

International Markets

- The Omicron variant of COVID-19 accounted for 99.2% of new cases globally over the past week. Reported cases and deaths fell for the third consecutive week, but World Health Organization officials warned that much of the decline may relate to the dismantling of tracking and monitoring programs.

- Panic-buying is spreading across China as more regions, including Beijing and the industrial hub of Suzhou, report COVID-19 cases and brace for Shanghai-like lockdowns. In Shanghai, officials threatened strict punishment for people who violate pandemic restrictions.

- Britain’s government rejected the idea of new pandemic curbs to fight rising COVID-19 cases yesterday.

- More news related to the war in Europe:

- Nokia is fully exiting the Russian market and will book a $109 million provision in the first quarter of 2022.

- The World Bank is preparing a nearly $1.5 billion aid package to support essential services in Ukraine, raising the bank’s total support to over $2.4 billion.

- A former Russian finance minister says the nation’s GDP could fall up to 10% this year, the biggest contraction in almost three decades.

- Singapore’s BOC Aviation plans to buy 80 Airbus A320 jets in what is the aircraft-leasing firm’s largest order to date.

- French luxury retailer LVMH saw first-quarter sales jump 23% to $19.5 billion, with executives predicting an upcoming slowdown caused by lockdowns in China.

- 2021 profits at the U.K.’s largest supermarket chain more than tripled last year.

- Mazda indicated its newest line of internal combustion engines could be its last.

Some sources linked are subscription services.