MH Daily Bulletin: April 11

News relevant to the plastics industry:

At M. Holland

- M. Holland will be closed on Friday, April 15, in observance of the Easter holiday. The MH Daily Bulletin will not be published that day.

- M. Holland has launched a new Healthcare Packaging line card to meet the product needs of medical device and pharmaceutical packaging manufacturers.

- M. Holland’s Color & Compounding experts shared insight on the current pigment shortage and how it’s impacting the industry.

- M. Holland will be exhibiting at MD&M West in Anaheim, California, from April 12-14. MD&M West is the largest medtech conference in the U.S. If you’re attending, please stop by Booth #4111 to meet our Healthcare experts!

- In case you missed it, watch M. Holland’s Plastics Reflections webinar about the current and future state of the North American plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose 2% Friday but ended the week about 1% lower, their second straight weekly decline. For several weeks, the benchmarks have been the most volatile since the beginning of the pandemic.

- In mid-morning trading today, WTI futures were down 3.9% at $67.40/bbl, Brent was down 4.0% at $98.64/bbl, and U.S. natural gas was up 4.5% at $6.56/MMBtu.

- U.S. producers added 13 oil rigs last week, the third straight week of gains, with the count 59% higher than the same time last year.

- U.S. crude reserves will fall to a four-decade low after the latest release of 120 million barrels is completed.

- U.S. gasoline prices were 20% higher in March than in February.

- Natural gas prices at the U.S.’s main trading hub are up 64% this year, the highest since 2008, with surging foreign demand likely to keep exports strong for years.

- Pennsylvania-based Talen Energy is expected to file for bankruptcy within weeks after struggling with added hedging costs from rising natural gas prices.

- The Mexican administration’s efforts to nationalize the nation’s energy industry got a significant boost from a court ruling last week.

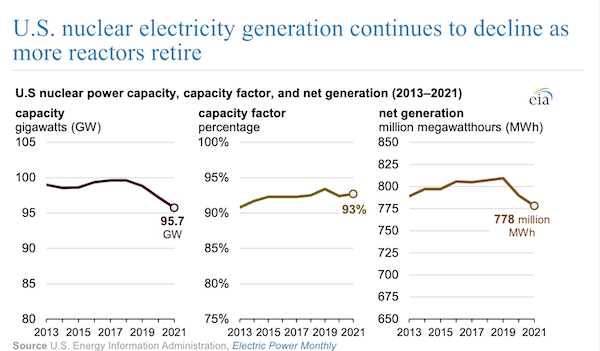

- U.S. nuclear electricity generation declined in 2021 for the second consecutive year as more reactors were retired:

- More oil news related to the war in Europe:

- The U.K. plans to build eight new nuclear plants to reduce its dependence on Russian oil and gas.

- EU officials do not plan to formally discuss a Russian oil embargo at their scheduled meeting today, although Germany, the continent’s largest economy, said it is on track to be free of Russian oil by the end of the year.

- Germany’s government may step in to secure more gas supplies by November if operators fail to fill their facilities, officials said Friday.

- The EU has launched a new platform for member nations to leverage their association and jointly buy gas and hydrogen imports.

- Spain will open a new LNG plant on its northern coast for sending fuel to other European nations looking to lessen their dependence on Russian energy.

Supply Chain

- Power was restored to more than 90% of Puerto Ricans on Saturday following a fire last week at a major power plant.

- More Chinese cities are requiring truck drivers to take daily COVID-19 tests or quarantine before crossing borders, limiting how quickly components can be moved among factories and from plants to ports.

- Congestion at China’s ports are growing exponentially amid the lockdowns in Shanghai, with 222 bulk cargo ships waiting off the city’s coast, and 477 vessels waiting throughout the country.

- Shipping lines continue to cancel sailings to Shanghai because of disruptions from COVID-19 lockdowns.

- Just 7% of sea shipments from Asia to North America and 6% from Asia to Europe arrived on time last month, according to eeSea data.

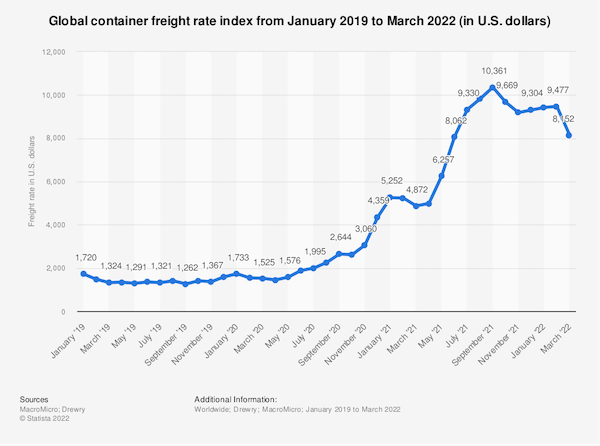

- Global container shipping rates have fallen to levels not seen since last summer:

- Bad weather, Easter demand and closed ferry routes have caused congestion at the U.K.’s busiest port at Dover, including delays of more than 24 hours to cross the English Channel.

- Canadian construction firm Aecon was awarded a $170 million contract to modernize cargo facilities in the Caribbean port of Saint Vincent and Grenadines.

- The latest Logistics Managers’ Index advanced for a third straight month to 76.2 in March, an all-time high, as U.S. supply chains face more pressure from scarce warehouse space and high inventory costs.

- Trucking contractors and ride-share drivers are looking for greater compensation to help offset surging fuel costs.

- The White House unveiled a range of programs last week intended to recruit more workers, including veterans and women, to the trucking industry.

- Over 10% of Americans in lower-paying jobs in warehouses, manufacturing and hospitality have switched to so-called “new collar” tech positions during the pandemic.

- Some Americans are pushing back against a warehouse boom they say disrupts communities with industrial traffic and pollution, as companies have added a record 1.6 billion square feet of new industrial space across the country since 2017.

- Despite the global chip shortage, sales of graphic processing units rose almost 30% in 2021 from a year ago.

- Auto sales in China fell by more than 10% in March to 1.58 million vehicles as the nation’s strict pandemic measures hampered both auto production and consumer purchases.

- Chinese electric-vehicle maker Nio suspended production and warned of delivery delays as local lockdowns take a toll on supply chains.

- With chip shortages still affecting output, British car sales fell 14% in March to the lowest level in two decades.

- Volvo is investing in Swiss materials startup Bcomp, a maker of natural fiber composites.

- Large logistics firms remain wary of placing big bets on autonomous trucks despite the urgency of an estimated 80,000-driver shortage.

- Hyundai’s hydrogen-fueled heavy truck is making inroads with European logistics operators.

- Google’s drone unit Wing launched its newest and largest delivery service in the Dallas-Fort Worth area last Thursday, which will transport everything from Walgreens medicines to local ice cream.

- U.S. egg prices are rising as an outbreak of Avian flu spreads to farms in 24 states.

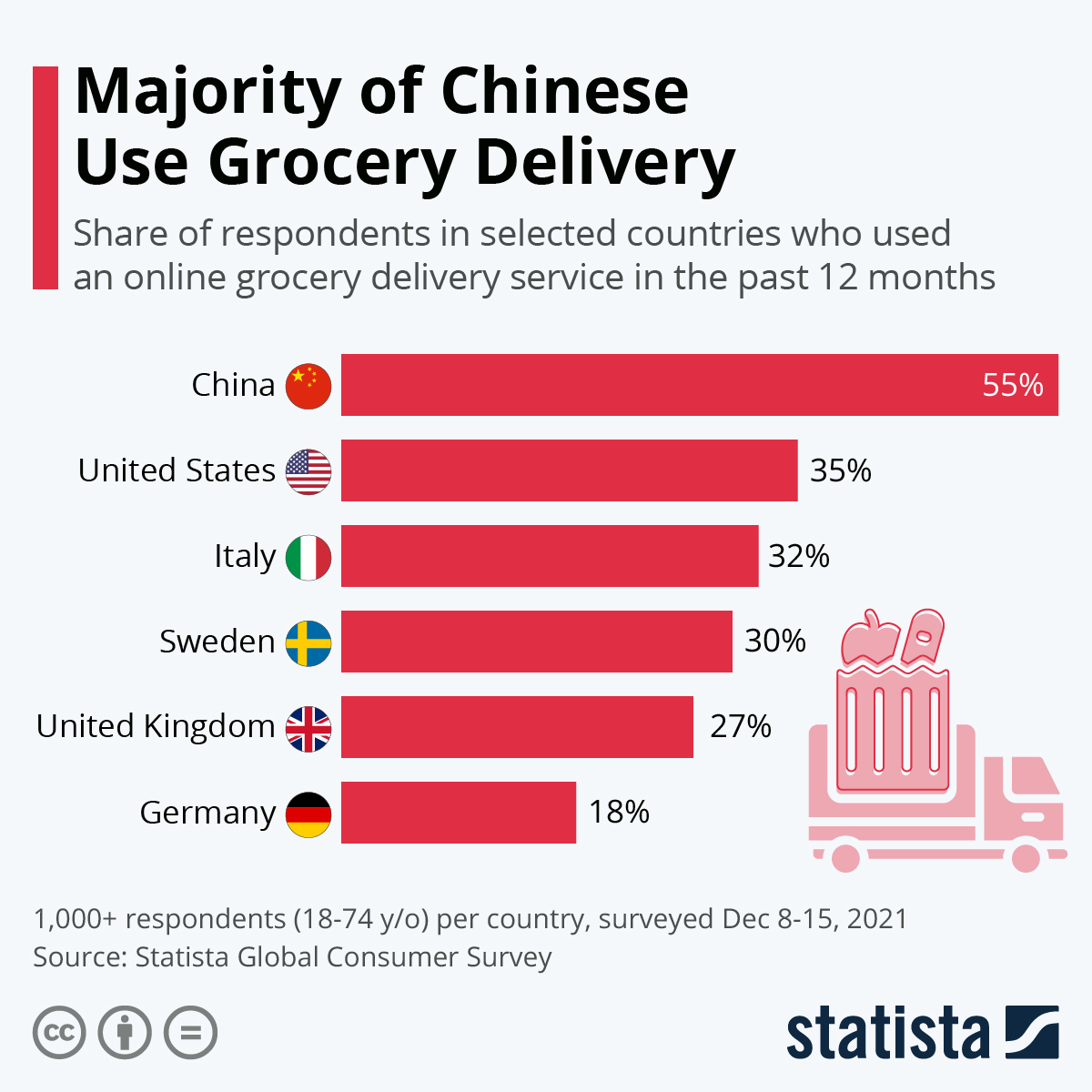

- U.S. online grocery sales are falling sharply from pandemic highs, with the ship-to-home segment seeing the largest drop of 30% in March from a year ago.

- More supply chain news related to the war in Europe:

- The EU’s latest round of sanctions will slash 10% of Russian imports, including coal, wood and chemicals, officials say.

- A United Nations gauge of global good prices rose 13% in March to a fresh record as the war in Ukraine chokes crop supplies. Acute hunger across the globe could spread to affect as many as 47 million more people if war is prolonged, officials say.

- Unlike many western companies that closed operations in Ukraine at the start of the war, German auto maker Leoni AG remains open with defiant employees continuing to show up for work between Russian attacks.

Domestic Markets

- The U.S. has averaged 28,169 daily new COVID-19 cases over the past seven days, along with 516 daily deaths from the virus.

- COVID-19 cases have doubled in Washington, D.C., and are up 60% in New York City since the last week of March. Incomplete data reporting could be masking an upward trend in many other regions such as North Dakota, which stopped reporting dozens of metrics last month.

- The surge in COVID-19 infections in Washington, D.C., has encompassed dozens of the city’s power brokers.

- After several weeks of continued decline, COVID-19 vaccinations in the U.S. trended upwards in the first eight days of April, with the average number of vaccinations administered more than doubling from 214,405 per day on March 30 to 485,505 per day April 8.

- The U.S. COVID-19 vaccine program has prevented 2.2 million deaths, 17 million hospitalizations and 66.1 additional infections, new estimates show.

- Over one-quarter of Americans surveyed said they quit their jobs during the pandemic due to mental health concerns.

- The U.S. Federal Reserve signaled it could raise the benchmark interest rate by another three percentage points by the end of the year.

- Economists surveyed by the Wall Street Journal put the probability of a U.S. recession sometime in the next year at 28%, up from 18% in January.

- After U.S. consumers stashed away more than $5 trillion in bank deposits during the pandemic, a 35% gain, banks could see their first decline in deposits since WWII as savers seek higher returns amid rising interest rates.

- Inflation is driving more retirees back to work, with 480,000 people over age 55 joining the workforce in the past six months, up from 180,000 in the six months prior to the pandemic.

- A shortage of pilots is forcing American Airlines to cut more flights, even as airlines more broadly attempt to staff up ahead of a packed summer schedule.

- United Airlines further delayed the return of some grounded Boeing 777 planes with Pratt & Whitney engines to May, as fallout lingers from a failed-engine incident last February.

- Safety experts are expressing concerns about the seismic shift of automakers building electric vehicles, saying that their increased size and power could lead to a rise in collisions and pedestrian fatalities.

International Markets

- The BA.2 subvariant of Omicron is now dominant in at least 68 countries, including the U.S.

- Shanghai continued lockdowns and imposed a fresh round of mass testing after health authorities recorded the eighth straight day of record COVID-19 cases on Saturday. Cases remained high on Sunday, as officials sought to assure residents that shortages of food and essentials would ease. Despite recording over 130,000 infections, the city has not reported any deaths from the virus in that time, and only one reported case of someone with severe disease.

- Global COVID-19 vaccine supply now outweighs demand by about 2 billion doses, according to COVAX.

- Mumbai claims to be the first city in the world to vaccinate 100% of its eligible population against COVID-19.

- More news related to the war in Europe:

- The Kremlin on Friday said Russia’s invasion of Ukraine could end in the “foreseeable future.”

- S&P Global moved Russia into default on its foreign-debt credit rating after the government attempted to make a dollar-bond payment in rubles on Saturday. The move makes it much more likely that Moscow will soon default on external loans for the first time in more than 100 years.

- By year’s end, Visa expects global sales growth to offset the 4% loss in revenue from its decision to pull business from Russia.

- Canada imposed new sanctions on Russia’s defense sector Monday and is reportedly examining additional measures it can take in response to the nation’s invasion of Ukraine.

- While encouraging war dissenters to leave the country, Russia is offering incentives to tech workers to stay after an estimated 300,000 young professionals fled the country since the start of the war. The brain drain follows the loss of 500,000 young professionals in 2021.

- Brazil’s monthly inflation jumped 1.62% from February to March, the fastest pace in almost 30 years.

- Canadian unemployment fell to its lowest level ever in March at 5.3%.

- New Zealand’s rental car inventory is 40% of pre-pandemic levels at best, a poignant example of the pandemic’s widespread effects on the auto industry.

- Almost a quarter of air traffic controllers in Warsaw, Poland, walked off the job last month over contract disputes.

- IKEA is investing $373 million into nine solar parks in Germany and Spain, part of a long-term plan to generate more renewable energy than it consumes.

- Issuance of sustainability focused bonds fell 19% in the first quarter from a year ago, mainly on inflation concerns and supply disruptions, new data shows.

- Investors are calling on Australian mining giant Rio Tinto to clarify its $7.5 billion plan to lower carbon emissions by the end of the decade.

Some sources linked are subscription services.