MH Daily Bulletin: April 6

News relevant to the plastics industry:

At M. Holland

- M. Holland has launched a new Healthcare Packaging line card to meet the product needs of medical device and pharmaceutical packaging manufacturers.

- M. Holland’s Color & Compounding experts shared insight on the current pigment shortage and how it’s impacting the industry.

- M. Holland will be exhibiting at MD&M West in Anaheim, California, from April 12-14. MD&M West is the largest medtech conference in the U.S. If you’re attending, please stop by Booth #4111 to meet our Healthcare experts!

- In case you missed it, watch M. Holland’s Plastics Reflections webinar about the current and future state of the North American plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell about 1% Tuesday on growing worries of demand slowdowns caused by rising COVID-19 cases.

- In mid-morning trading today, WTI futures were down 0.2% at $101.80/bbl, Brent was off 0.2% at $106.40/bbl, and U.S. natural gas was up 4.3% at $6.29/MMBtu.

- The American Petroleum Institute estimates U.S. crude inventories unexpectedly rose by 1.08 million barrels last week.

- The U.S. administration is exploring ways to boost oil imports from Canada by rail and expanded pipeline capacity without resurrecting the Keystone XL project nixed in 2020.

- Member states of the International Energy Agency are still discussing how much oil they will jointly release from storage to cool markets, with an announcement expected this week.

- Chevron reported a profit of $15.6 billion in 2021, its highest since 2014 and a reversal from a loss of $5.5 billion in 2020. The firm plans to increase output by at least 3% yearly through 2025.

- More oil news related to the war in Europe:

- The EU’s proposed ban on Russian coal, which will require approval from all 27 member states, marks the first time the bloc has agreed to suspend imports of one of Russia’s main energy supplies.

- Daily Russian oil and gas condensate production is down 4% from March to early April, according to the Interfax news agency.

- Russia says it will earn $9.6 billion more in revenue from energy sales this month due to high oil prices.

- Greece will restart several gas exploration projects it abandoned years ago in a bid to weather supply disruptions from Russia.

- Nigeria, the leading crude producer in Africa, is accusing several oil majors of hamstringing efforts to boost LNG exports to Europe.

- Exxon Mobil could write down up to $4 billion in the wake of its exit from the Sakhalin-1 oil development in Russia’s Far East, which supplies 3% of the firm’s overall production.

- Spanish energy firm Repsol is partnering with Denmark’s Orsted to build up to 3 GW of offshore wind power in Spain by the end of the decade.

- India’s top refiner signed on to a joint effort that could eventually produce 5 million tonnes of green hydrogen by the end of the decade.

- Wall Street lending for oil and gas development is rising as the U.S. looks to boost output, reversing a trend that recently saw more investment given to clean-energy projects and uses.

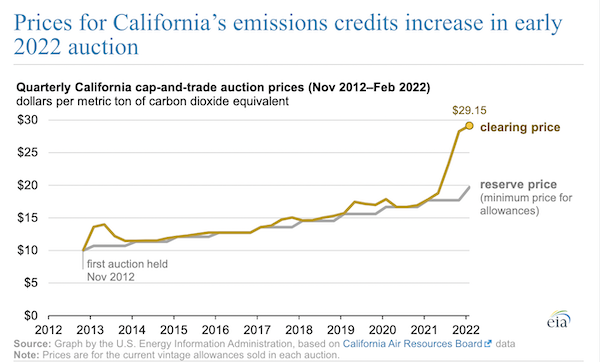

- Prices for emissions credits in California’s cap-and-trade program are rising sharply as demand grows:

Supply Chain

- Severe storms and tornadoes blanketed the area from North Texas to coastal South Carolina yesterday, killing at least two people.

- A growing number of shipping operators are refusing to transport used electric vehicles due to the potential for battery fires.

- Salvors have turned to unloading cargo from a container ship stuck for weeks in the Chesapeake Bay after several attempts to refloat the vessel last week failed.

- Warehouse rents in the U.S. could rise more than 8% this year, according to real estate firm JLL.

- Rates for car carriers have hit record highs as automakers push for faster deliveries.

- Nissan’s half-year delay in rolling out its second electric vehicle-only model has been further pushed back due to supply shortages.

- Sales of used Class 8 trucks in the U.S. jumped 16% from January to February as prices rose 7%, new data shows.

- A spate of production mishaps at Boeing has spread to the plane maker’s Air Force One project.

- Online pet-products retailer Chewy registered its third straight quarterly loss as supply-chain constraints and inflation outweighed record sales.

- Companies are boosting efforts to reduce packaging to fit more goods into shipping containers to offset high freight costs.

- Mediterranean Shipping Co. is expanding its orders for new LNG dual-fueled container ships to 28 vessels.

- A strike by tens of thousands of central and southern California grocery workers was averted after contract deals were reached with several major supermarkets.

- Drone delivery services are rising in popularity among the largest U.S. tech firms, with Google-parent Alphabet recently unveiling a service for tens of thousands of households in Dallas-Fort Worth.

- Chipotle will begin using RFID technology at its Chicago distribution center and 200 restaurants to track inventory and respond to food safety concerns more accurately.

- Macy’s will open a 1.4 million-square-foot fulfillment center in North Carolina in 2024 to serve its growing omnichannel business.

- Robot-dog maker Boston Dynamics commenced sales of Stretch, a logistics robot garnering rising attention from firms like DHL, Gap and H&M.

- More supply chain news related to the war in Europe:

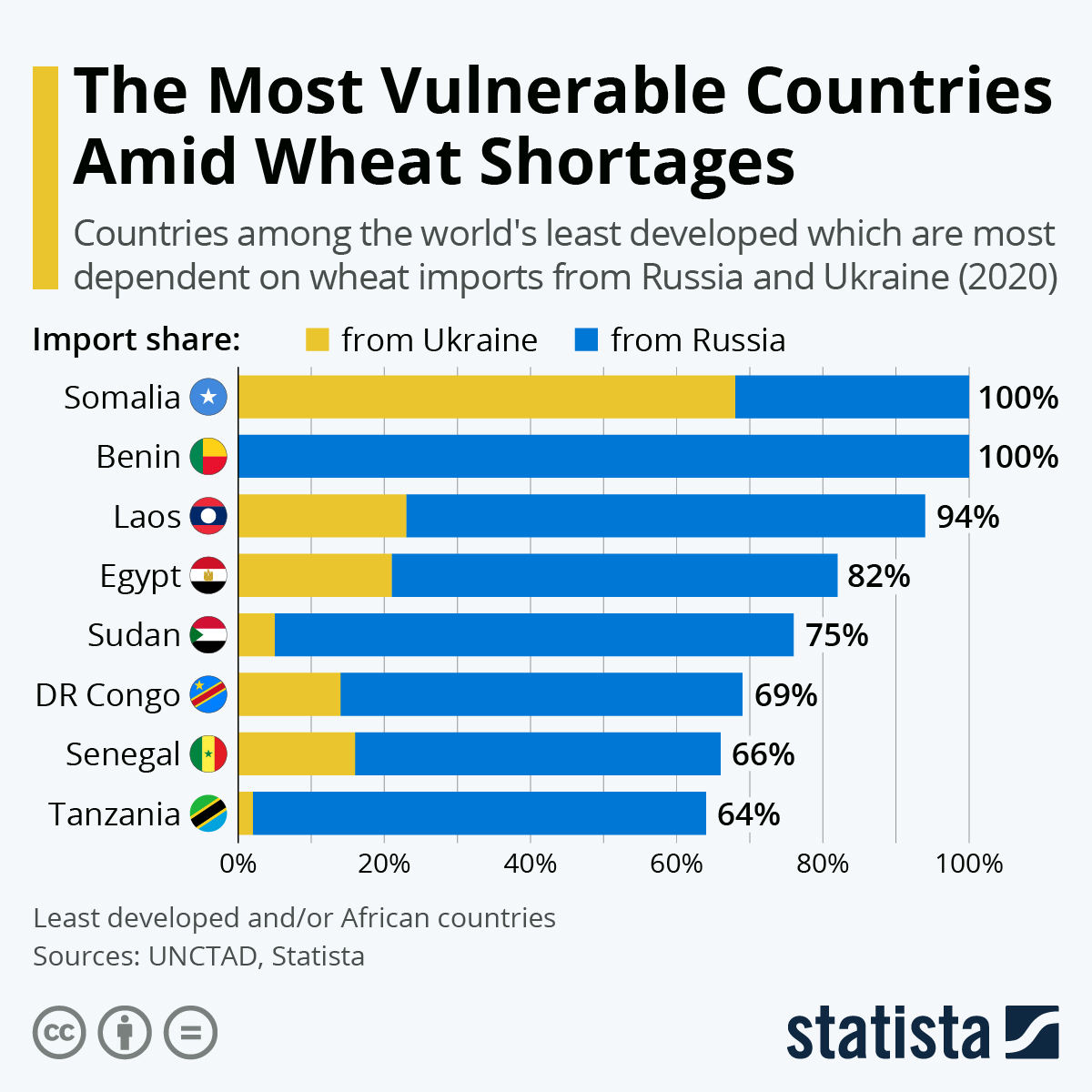

- Ukraine is sitting on 15 million tons of corn that it cannot export, while a large chunk of the nation’s sunflower seed output has been destroyed by Russian forces. The developments could further shrink global food supply, especially in places like Africa, where more than a quarter of the population now faces food insecurity.

- Canadian miner Kinross Gold agreed to sell its giant Arctic Russian mine to a unit of Fortiana Holdings for $680 million, the first public sale of an asset a large Western company is exiting in Russia.

- A Dominican-flagged merchant ship sank in the port of Mariupol after being hit by Russian forces.

- Indian wheat exports will hit a record this fiscal year as a rally in global prices gives the world’s second biggest producer an opportunity to gain market share.

- Russian cyberattacks on Ukrainian critical infrastructure are picking up in pace.

Domestic Markets

- The U.S. reported 29,521 new COVID-19 infections and 477 virus fatalities Tuesday.

- Daily COVID-19 cases in New York City are up 30% the past month, led by surging infections with the BA.2 subvariant of Omicron. The data is consistent with signs that rising cases are more prevalent in parts of the U.S. Northeast.

- The U.S. will invest $20 million next year to develop best practices for treating long-term COVID, a condition estimated to affect nearly 7% of all U.S. adults.

- Nearly 60 million Americans on Medicare will be able to order up to eight free at-home COVID-19 tests per month under a new White House program.

- The CDC lowered pandemic travel warnings for Canada and two dozen other destinations Tuesday.

- An immigration dispute in the Senate blocked debate on a $10 billion pandemic relief bill.

- The Federal Reserve will begin rapidly reducing its balance sheet this May for the first time since 2017, officials said yesterday, a further tightening in monetary policy on top of rising interest rates.

- Deutsche Bank forecasts the U.S. will fall into a recession next year as the Federal Reserve raises interest rates more aggressively to combat inflation, making it among the first major banks to predict recession. Some officials at the Federal Reserve have significantly more optimism.

- At $89.19 billion, the U.S. trade deficit narrowed by a modest 0.1% in February while remaining close to the previous month’s record, as fallout from rising commodity prices continued.

- U.S. services activity picked up in March, with the Institute for Supply Management’s index rising to 58.3 for the month, up from a one-year low of 56.5 in February.

- Some 22.4 million fewer immigrants than normal entered the U.S. during the pandemic, adding even more pressure to the tightest labor market in decades.

- The White House will likely extend through August a pause on roughly $1.6 billion in student loan repayments, a measure first imposed at the start of the pandemic.

- Fast food chains and airlines are among several new types of companies testing subscription programs to lock in consistent revenue streams.

- JetBlue Airways offered to buy ultralow-cost rival Spirit Airlines for $3.6 billion, a deal that would create one of the largest airlines in America.

- Amazon is positioning itself as a major competitor to SpaceX’s satellite broadband ambitions, with the e-commerce giant yesterday investing billions of dollars in launch slots for its technology over the next five years.

- The U.S. government will eventually need up to 100,000 electric-vehicle charging stations — up from just 1,100 currently — to support electrified federal fleets.

- Albuquerque’s City Council decisively reversed a ban on single-use plastic bags in grocery stores and other retail shops.

International Markets

- New COVID-19 infections globally fell 16% last week from the prior week.

- Locked-down Shanghai detected a record 17,077 new COVID-19 cases yesterday, nearly 90% of the national total and up by some 4,000 from a day earlier.

- Hong Kong is running short on wooden coffins to accommodate surging COVID-19 fatalities.

- The rate of COVID-19 in Brits over age 55 is currently 20 times higher than at any time during the pandemic, researchers say. The nation expanded its official registry of COVID-19 symptoms by nine to include sore throat and fatigue, among other symptoms.

- Germany’s government backed off a plan to end mandatory isolation periods for people infected with COVID-19.

- Canada may be facing a new wave of COVID-19, prompting Ontario, which experienced a 38% increase in COVID-19 hospitalizations yesterday compared with the prior week, to deploy fourth vaccine doses for some residents.

- A third COVID-19 vaccine dose retained strong protection against severe symptoms at least four months after inoculation, new research from Denmark shows.

- The African Union declined options to acquire hundreds of millions more COVID-19 vaccines due to weak demand.

- Countries across the globe should provide $15 billion in grants this year and $10 billion a year thereafter to manage long-term COVID-19 risks, the International Monetary Fund says.

- More news related to the war in Europe:

- The U.S. will announce a new package of sanctions against Russia today that will include a ban on all new investment in the nation as well as more penalties against its largest financial institutions and state-owned enterprises. The EU and members of the G7 are also proposing sweeping new sanctions, while Britain will advocate for NATO nations to ban Russian ships from their ports and set a timeline for phasing out oil and gas imports.

- U.S. lawmakers want to remove Russia from the United Nations Human Rights Council, Interpol systems and the G-20 group of industrialized nations.

- The probability of Russia defaulting on its debt within the next five years is almost 90%, economists say. An index of the nation’s services economy dropped from 52.1 in February to just 38.1 in March, indicating severe contraction.

- Australia has haltted all shipments of luxury goods to Russia.

- Russia’s administration indicated it may limit food exports to “friendly” countries only.

- The effects of Russia’s invasion are yet to be reflected in foreign trade figures, with Germany recently posting a surprise jump in both exports (+6.4%) and imports (+4.5%) in February.

- Chanel expanded its sanctions compliance to halt sales to all Russian residents from anywhere on the globe.

- Canada’s exports rose 2.8% in February to a record-high, driven mostly by energy products. The nation’s Central Bank will likely impose a half-percentage-point interest-rate hike when it meets next week.

- Saudi Arabia’s non-oil private sector expanded at the fastest rate in more than four years in March.

- Volkswagen announced plans to release a fully autonomous, electric van that could be used for passenger shuttling and light commercial activities.

- A German maker of partly solar-powered cars aims to produce its first vehicles in Finland next year.

Some sources linked are subscription services.