COVID-19 Bulletin: March 11

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- More oil news related to the war in Europe:

- Oil prices settled 2% lower on Thursday, the second day of declines, after Russia said it would fulfill existing contracts and traders speculated that recent supply fears are overblown.

- Energy futures posted their largest high-to-low range on record this week. In mid-morning trading today, WTI futures were up 3.0% at $109.20/bbl, Brent was up 2.6% at $112.20/bbl and U.S. natural gas was up 2.3% at $4.74/MMBtu.

- Norwegian oil major Equinor is following BP, Shell and TotalEnergies in halting purchases of Russian oil as it winds down operations in the country. The producer said it would raise production in its normally slow summer maintenance season this year.

- The White House is facing rising pressure to suspend the 18-cent federal gas tax after the national average price jumped to $4.32 a gallon Thursday, up 7 cents from Wednesday’s record. San Francisco Bay has the highest average price at $5.75 a gallon.

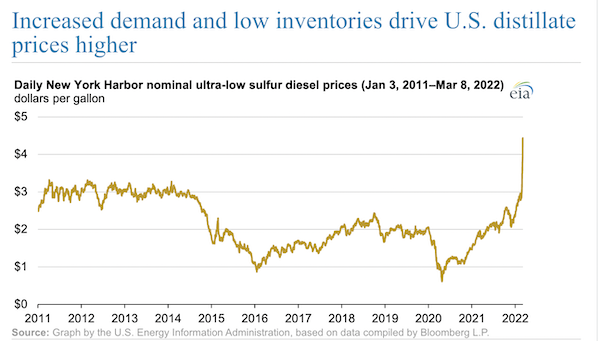

- Prices for U.S. distillates — including diesel fuel and heating oil — are at their highest level since 2014, boosted by high demand for trucking and rail freight transport:

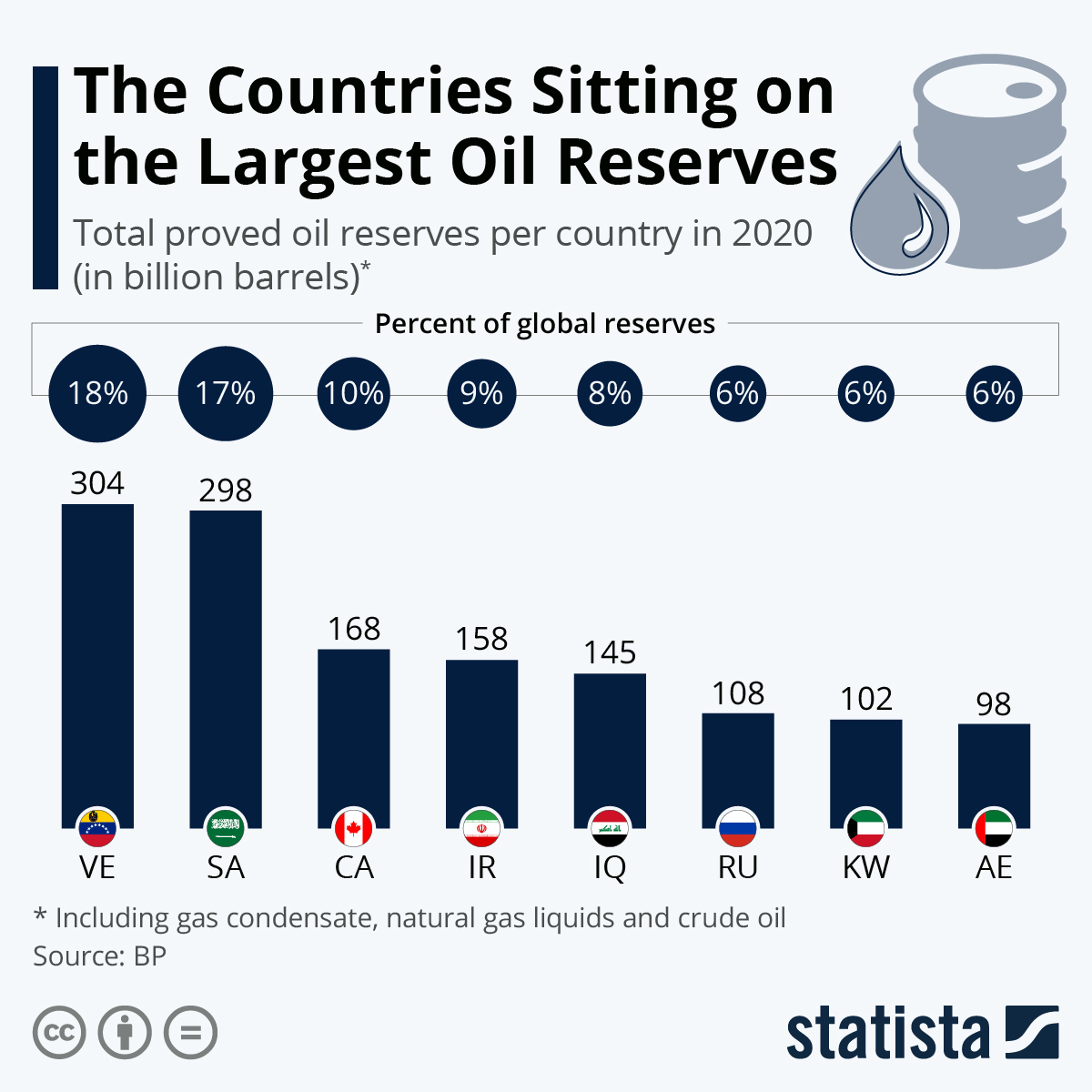

- U.S. attempts to recover lost Russian oil imports are rife with controversy as the nation reopens talks with oil-rich nations in the Middle East and other countries under strict U.S. sanctions, including Iran and Venezuela.

- Proposed mergers in the U.S. shale industry are falling through as firms worry about overpriced assets.

- German economists warn that cutting off Russian energy imports would cause a GDP contraction rivaling the worst waves of COVID-19.

- Power is back at Ukraine’s Chernobyl nuclear power plant, temporarily reducing fears of radiation leakage after Russian forces took over the site this week. Meanwhile, talks have stalled on an accord to prevent future fighting at regional nuclear sites.

- India is taking advantage of low energy prices from sanction-heavy Russia by importing a record amount of coal from the nation this month. Other Asian buyers have held off purchasing Russian fuel despite the discount.

- Shell and BP have reportedly held off spot diesel sales in Germany the past two weeks despite incentives to immediately sell at high prices.

- Brazil’s Petrobras will raise fuel product prices between 16%-25% today to match surging international prices.

- EU leaders are weighing emergency measures, including temporary ceilings on electricity prices, to soften the impact of energy market disruption.

- More top-ranking U.S. officials are endorsing natural gas as a potential benefit for the climate.

- Exxon Mobil is in the final round of interviewing bankers for a potential sale of up to $5 billion in mature North Dakota shale assets, the latest in a string of aggressive moves to cut costs and boost shareholder returns.

- The U.S. administration earmarked $36 million for research into advanced nuclear waste disposal for when the country’s next-generation reactors come online in the 2030s.

- Coal India, the world’s largest miner, is seeking net-zero emissions within the next four years.

- A Bay Area startup claims to have found a way to break up captured CO2 into atomic bits that can be re-formed into plastics and fuel products.

Supply Chain

- More supply chain news related to the war in Europe:

- The global shipping industry is calling for the safe passage of roughly 100 foreign-flagged vessels and hundreds more mariners stranded at Ukrainian ports by fighting. A growing number of shipowners are asking crews to abandon their vessels as at least five stranded ships have been hit by explosions.

- Airfreight rates from China to Europe jumped 80% the first week of Russia’s invasion, according to Freightos.

- Russia unveiled a list of banned exports in retaliation for Western sanctions, including products from telecommunications, medical, auto, agricultural, electrical, tech and forestry industries. The ban will last through the end of this year.

- The White House warned of even tighter economic sanctions against Russia if the nation goes forward with a plan to seize the factories of fleeing Western companies.

- Several U.S. logistics firms are donating money and resources to help coordinate movement of humanitarian aid for Ukrainian refugees in hot spots.

- Spanish steelmakers are cutting output due to soaring electricity prices used to power their mills.

- The queue of container ships waiting to unload at Southern California ports fell to 48 vessels last weekend, less than half January’s record of 109 and the smallest since last September. Analysts peg the breather on a Lunar New Year lull and a sharp decline in workers calling in sick with COVID-19.

- Analysts say the causes of last year’s historic shipping backlogs — including labor constraints, high demand and low capacity — will continue throughout 2022.

- CMA CGM says it is stepping up its fuel hedging after energy costs rose almost 40% last year.

- Israeli shipper ZIM is starting a new biweekly route connecting China and Vietnam to the Port of Boston via the Suez Canal, a result of more than $850 million recently spent on expanding capacity at the Massachusetts gateway.

- The union representing 3,000 Canadian engineers, conductors, crew members and yard workers approved a possible strike against Canadian Pacific Railway starting next Wednesday, March 16.

- Gap Inc. will boost sourcing from Mexico and Central America this year in a bid to cut down high lead times caused by shipping backlogs and factory closures in Vietnam.

- Google pledged to spend $2.5 billion with diverse suppliers this year, a $1 billion increase over last year’s record spend.

- Tesla imposed another price increase on some U.S. and Chinese vehicles due to surging raw material costs, with stickers on some models up by double-digit percentages this year.

- Renault is partnering with logistics operator GEODIS to develop an electric freight truck for urban transport.

- U.S. electric truck startup Rivian lowered production estimates to just 25,000 vehicles this year, roughly half of market expectations, due to supply chain constraints and higher component costs.

- The U.S. Coast Guard issued a fresh warning about transporting discarded lithium after an illegally loaded container caught fire and melted while in transit to the Port of Virginia yesterday.

Domestic Markets

- The U.S. reported 48,318 new COVID-19 infections and 1,645 virus fatalities Thursday.

- Roughly 98% of Americans can ditch face masks, according to the CDC’s new guidance.

- One in four Californians has had COVID-19, new data shows, even as case counts are down over 60% from two weeks ago.

- The U.S. administration extended mask mandates for travel on planes, trains and other public transit by another month to April 18.

- Ride-hailing companies are facing pushback for strict masking policies in the face of a growing number of cities that have dropped the requirement.

- Public schools with masking requirements saw 23% fewer COVID-19 infections among students and staff, according to one CDC study.

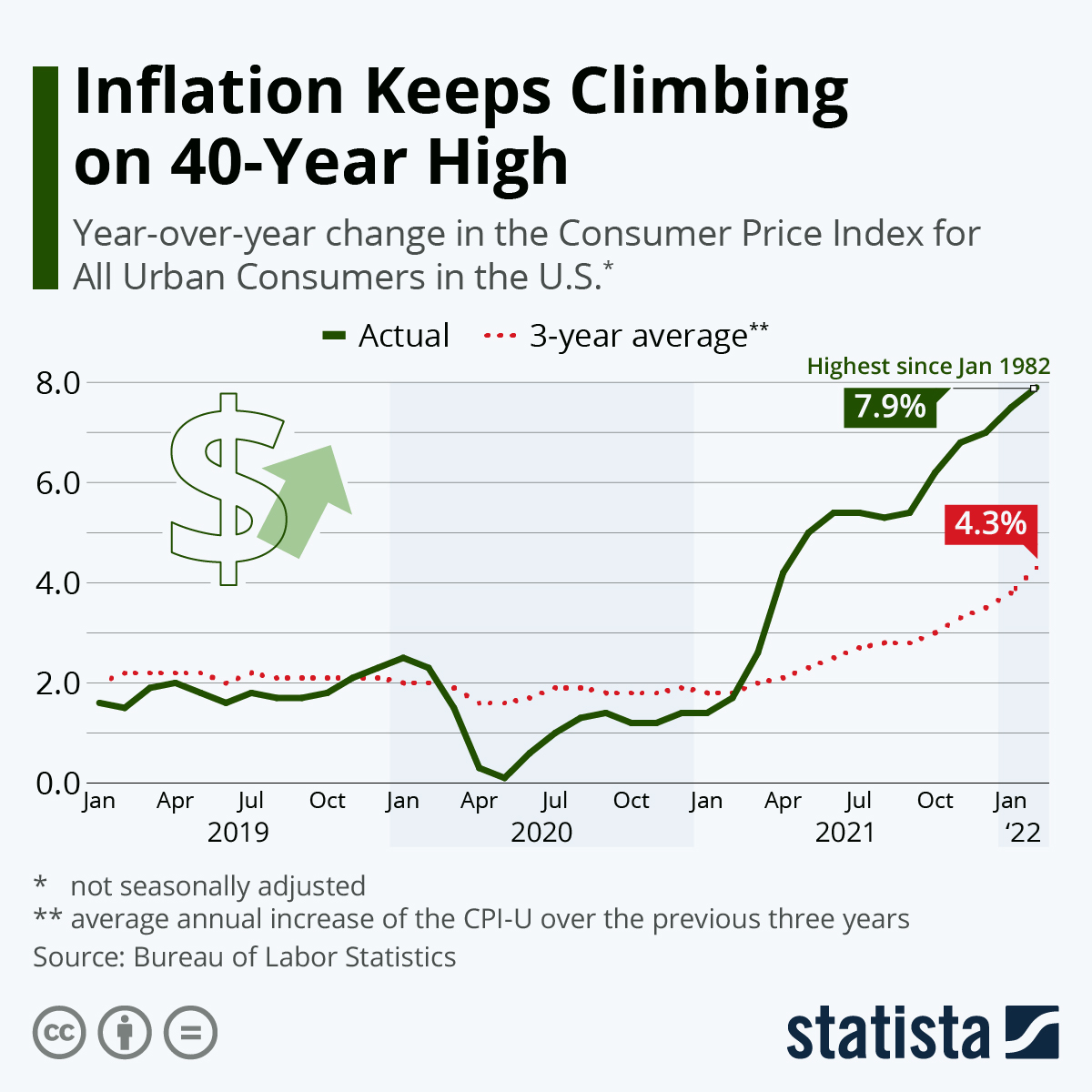

- U.S. inflation-adjusted weekly earnings dropped 2.3% last month from a year ago.

- Consumer prices in New York City rose just 5.1% last month compared to the record 7.9% rate nationwide.

- The U.S. Senate passed a $1.5 trillion package to fund the federal government for the current fiscal year, with the measure now heading to the White House for approval.

- Lower pandemic spending pushed the U.S. budget deficit down by more than half during the first five months of the latest fiscal year to $475.6 billion, the lowest since 2018.

- Entry-level salaries at some of the top U.S. banking firms are surging on the perfect storm of an economic rebound and a historically tight labor market.

- U.S. household net worth jumped 3.7% in the fourth quarter to an all-time high $150 trillion, fueled by rising stock prices and higher home values.

- The average U.S. 30-year mortgage rate hit 3.85% this week, its first increase in three weeks.

- An index of U.S. rent prices rose 0.6% in February, the fastest rise in three decades. In Manhattan alone, prices are up nearly 30% year over year.

- The U.S. population rose 5% the past decade to 323.2 million, higher than the official census count due to the millions of uncounted people during the first few months of the pandemic.

- The SEC will vote March 21 on a landmark measure that would require U.S.-listed companies to provide detailed climate-risk disclosures to investors.

International Markets

- More news related to the war in Europe:

- The U.S. plans to ban imports of Russian vodka, seafood and diamonds as it steps up economic pressure on the country.

- Goldman Sachs became the first major Wall Street bank to shutter operations in Russia. The move was quickly followed by a similar announcement from JPMorgan Chase.

- The latest firms to curtain business in Russia include Stellantis, Disney, payment giant Western Union, the world’s largest advertising company, one of the world’s largest New York-based insurance brokers, some of the U.S.’s and UK’s largest law firms, and a host of Japanese retailers, who previously said they would retain operations in the country.

- Russia again pushed back the reopening of its stock market today, marking a two-week stretch of halted trading.

- Both the U.S. and EU indicated further Russian sanctions are in the pipeline, including a revocation of normal trade relations.

- Russia was suspended from the Swiss-based central bank for central banks.

- The number of firms exiting Russian operations are leading to enormous job losses:

- Russians lined up to stock up on McDonald’s meals before the closure of its 850 restaurants in the country, a move that will cost the company $50 million a month. McDonald’s said it will continue to pay its 62,000 workers there.

- Over 2.5 million people, including half the population of Kyiv, have fled Ukraine in just two weeks of Russian aggression. The economic fallout of the war surpassed $100 billion.

- Today marks the second anniversary since the World Health Organization declared COVID-19 a pandemic.

- According to a new study, global deaths in 2020 and 2021 were 18 million higher than normal, suggesting that the official death count from COVID-19 of 6 million is greatly under reported.

- Just eight days before Germany’s pandemic restrictions are set to expire, COVID-19 cases in the nation are rising again, recently surpassing 250,000 in a single day.

- China is experiencing its worst COVID-19 wave since early in the pandemic, with over 1,000 domestic infections Friday. A lockdown was imposed on the 9 million residents of Changchun due to a COVID-19 outbreak in the city and schools were closed in Shanghai.

- Cases of the COVID-19 Omicron variant are starting to pick up in East and Southeast Asia, including Japan, South Korea and Vietnam.

- The World Health Organization is warning that reduced COVID-19 testing could falsely represent the state of the global pandemic.

- The European Central Bank announced that it will end its pandemic bond-buying program earlier than expected this year, paving the way for a quicker interest rate hike.

- BMW saw earnings more than double from pre-pandemic levels to $17.67 billion last year on a wave of luxury car demand.

- Tesla secured long-awaited approval to start production at a massive factory outside Berlin.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.