COVID-19 Bulletin: March 9

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- More oil news related to the war in Europe:

- Oil prices rose 4% Tuesday after the White House announced a blanket ban on Russian oil and other energy imports. Almost 80% of surveyed Americans said they favored the ban, even if energy costs rise.

- The White House’s ban on Russian oil imports does not include uranium used to power nuclear plants, half of which is sourced from Russia and its neighbors.

- In mid-morning trading today, WTI futures were down 5.4% at $117.00/bbl, Brent was down 5.5% at $120.90/bbl, and U.S. natural gas up 0.5% at $4.55/MMBtu.

- The average U.S. gasoline price hit a record $4.17 a gallon yesterday, 55 cents higher than a week ago and 51% higher than a year ago. Households will spend an average of $850 more this year if prices remain above $4, leading several governors to call for suspending the federal gas tax.

- BP followed Shell in further paring back operations in Russia. The company had previously limited its moves to selling a 20% stake in Russian oil giant Rosneft.

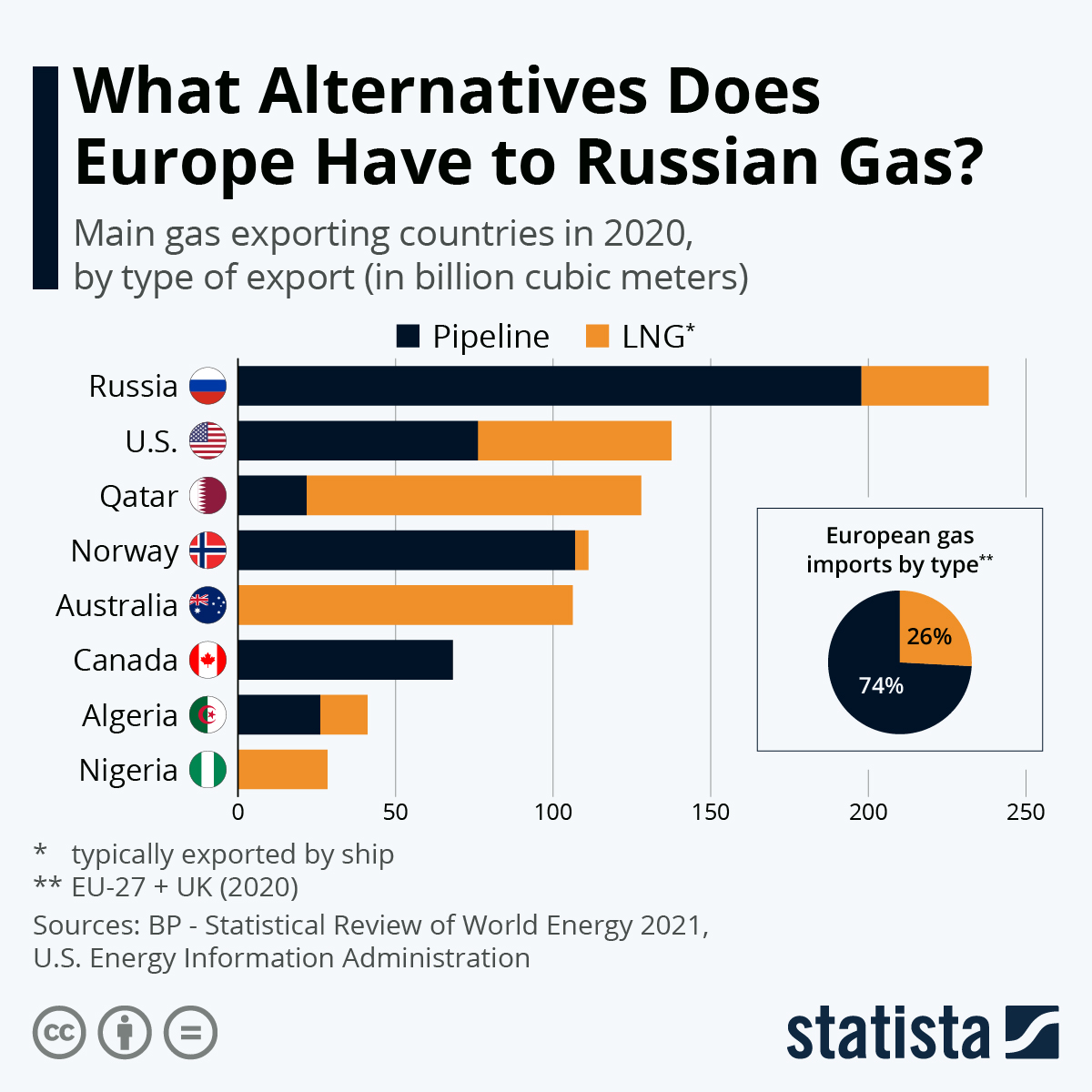

- The U.K. said it would end Russian oil imports — currently 8% of the nation’s demand — by the end of the year and is exploring a total ban on gas imports.

- EU lawmakers unveiled a plan to cut two-thirds of Russian gas imports by the end of this year through a mixture of changes in consumption, storage and use of renewables.

- The recent privatization of India’s coal industry will ramp up output and reduce imports, a boon for the world’s second largest coal consumer.

- Puerto Rico’s public power utility will remain in bankruptcy after the governor quit an $8.3 billion debt-restructuring agreement over fears of higher electricity rates.

Supply Chain

- More supply chain news related to the war in Europe:

- By week’s end, Russia will announce a list of commodities and raw materials banned from export, a retaliatory measure after the U.S. and allies tightened sanctions on oil yesterday.

- More ships are stranded around the globe than at any point since WWII, maritime historians say, with up to 200 stuck at besieged Ukrainian ports alone. The agriculture industry is expected to see the harshest ripple effects.

- Shipping traffic near Russian ports is down by one-third since Feb. 24, while the number of Russian-owned vessels seeking jobs this week rose threefold from last week.

- A 33% post-invasion rise in bunker fuel costs is adding millions of dollars to the cost of Asia-Europe container routes.

- Asia-to-West Coast and Asia-to-East Coast container rates are up a respective 204% (to $16,155 per FEU) and 218% (to $18,250 per FEU) from the same week last year, according to Freightos.

- High cargo rates are making it possible for some carriers to add the extra fuel and miles required to fly around Russian and Ukrainian airspace.

- The benchmark diesel price widely followed by the trucking industry is up 74.5 cents the past week to $4.849 a gallon, the highest ever.

- Russia’s AirBridgeCargo began offering its freighter fleet for ad hoc charters after numerous Western countries barred the carrier from their airspace.

- Russia may start nationalizing the factories of foreign companies that have halted operations in the nation.

- Ukrainian truck drivers in Europe are returning home to take up arms, exacerbating the driver shortage on the continent.

- Volkswagen stopped taking orders for several hybrid vehicle models as war-induced supply shortages curtail production.

- Trading losses at Chinese nickel giant Tsingshan Holding Group totaled $8 billion Monday — nearly half the firm’s annual revenue — before the London Metal Exchange shut off trading in the commodity due to extreme price volatility.

- China is holding talks to boost investments in Russian-owned energy and commodity firms at a war-induced discount.

- XPO Logistics will split its freight brokerage and North American trucking operations into two publicly traded companies and divest its European business and American intermodal unit, effectively dismantling the sprawling, multibillion-dollar freight and supply-chain heavyweight.

- There were 21,100 North American orders for new Class 8 heavy-duty trucks in February, down 2% from January and 53% from the same time last year, as freight haulers defer capacity expansions due to supply chain congestion.

- Canada further delayed to next year a mandate to install electronic logging devices on freight trucks.

- Target will open another 30 stores and 10 sortation centers this year as part of a $5 billion plan to further scale operations.

- Digital sales at Kroger have doubled in two years.

- Lockheed Martin is planning over $1 billion of strategic investments to manufacture products in Saudi Arabia, an executive said.

- The U.S. Senate overwhelmingly passed a bipartisan bill to send about $50 billion in financial relief to the U.S. Postal Service over the next decade, with the legislation now awaiting White House approval.

Domestic Markets

- The U.S. reported 29,805 new COVID-19 infections and 1,532 virus fatalities Tuesday.

- Hawaii will lift the U.S.’s only quarantine requirement for incoming travelers later this month.

- Chicago teachers are threatening legal action over the city’s plan to lift school mask mandates next week.

- The White House began rolling out a second round of free at-home COVID-19 test kits for any American household that requests one.

- Pfizer will soon submit new data on a fourth COVID-19 vaccine dose to U.S. regulators.

- The historically tight labor market continued in January, with 4.3 million workers quitting their jobs and a total of 11.3 million job openings.

- The Dow Jones index slipped into correction territory for the first time in two years this week. Intraday stock movements are hitting levels not seen since the first months of the pandemic as market volatility rises, Goldman Sachs said.

- American consumers will find a subtle form of inflationary effects in smaller sizes and portions offered for consumer goods, a phenomenon dubbed “shrinkflation.”

- Congressional leaders unveiled a $1.5 trillion spending bill to fund the federal government for the 2022 fiscal year, including tens of billions for humanitarian aid and continued pandemic assistance.

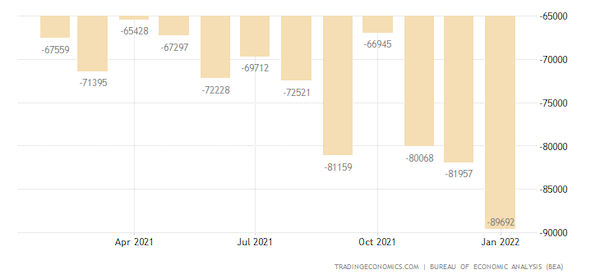

- The U.S. trade deficit widened to a record-high $89.7 billion in January, up from $82 billion the previous month as the cost of energy and commodity imports rose.

- Several U.S. airlines are trimming first-half flight schedules 5%-10% due to surging fuel costs.

- Visa and Mastercard will raise merchant transaction fees this April after delaying hikes the past two years.

- Almost 6,000 U.S. homes sold for more than $100,000 over asking price so far this year, a 62% increase from the same time last year.

- U.S. ride-hailing and third-party delivery firms are stepping up efforts to oppose a Congressional push to classify their workers as employees, which would allow them to form unions.

- Electric-vehicle startup Rivian is facing its first shareholder suit after the firm abruptly hiked prices 20% last week.

- GM is working with California utility PG&E to test the use of electric vehicles as backup power for homes.

International Markets

- More news related to the war in Europe:

- With 5,530 sanctions, Russia surpassed Iran to become the most sanctioned country in the world. Fitch Ratings expects the nation to imminently default on its debt.

- The U.S. Commerce Secretary warned that Chinese companies circumventing sanctions to do business with Russia will be cut off from crucial American equipment and software exports.

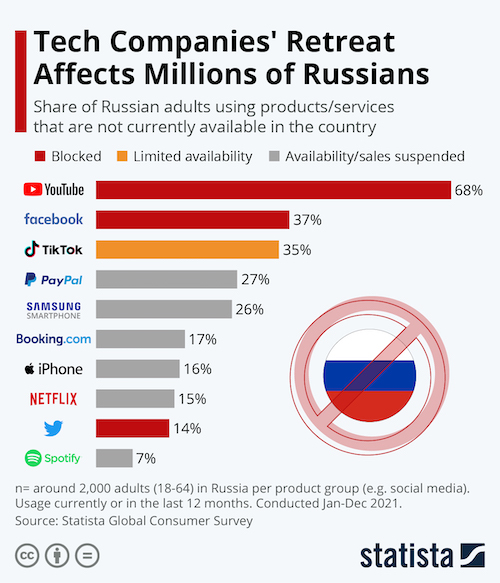

- The latest firms to shutter Russian operations include McDonald’s, Coca-Cola, Starbucks, the soda arm of PepsiCo, Unilever, Kraft-Heinz, Adidas, The New York Times, Netflix and a host of other tech companies:

- Amazon’s market-leading cloud-computing unit will no longer accept new customers based in Russia or Belarus, which currently represent about 1% of its annual revenue.

- Officials imposed yet another delay on reopening Russia’s stock market today.

- Russian car maker Lada was forced to cease production by sanctions-related parts shortages.

- Canada updated its foreign-investment rules to effectively halt all deals proposed by or involving Russian investors.

- The Organization for Economic Development and Cooperation banned Russia and Belarus.

- The hacking group Anonymous took credit for hacking Russian television programming to show footage of the war in Ukraine.

- Hong Kong indefinitely delayed a plan to mass-test its entire population for COVID-19 after a flood of residents fled the island in recent weeks.

- Belgium relaxed most remaining COVID-19 restrictions on Monday, weeks after many of its European counterparts.

- Romania will lift all remaining pandemic restrictions Wednesday.

- More countries are reducing or eliminating pandemic travel restrictions as passenger travel picks up sharply.

- The U.S. CDC recommends Americans refrain from traveling to New Zealand, Hong Kong and Thailand due to rising COVID-19 cases.

- China’s producer price inflation rose 8.8% in February, the slowest rise in eight months due to seasonal effects of Lunar New Year.

- Lego, the world’s largest toymaker, saw sales rise 27% last year to $8.11 billion, boosted by new stores in China.

- A new 3 GW offshore wind project could power over 3 million homes in Western Australia by 2028, executives say.

- Airbus is aiming to build a hydrogen-fueled aircraft for service by 2035.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.