COVID-19 Bulletin: February 22

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices spiked around 3% on Monday on heightened tensions in Eastern Europe and news that OPEC again failed to reach monthly output increases in January. Futures rose further this morning to close in on $100/bbl after Germany halted the process of certifying the Nord Stream 2 gas pipeline from Russia.

- In mid-morning trading, WTI futures were up 2.0% at $92.88/bbl, Brent was up 1.2% at $96.52/bbl, and natural gas was 3.3% higher at $4.58/MMBtu.

- A 578,000-bpd Marathon refinery in Garyville, Louisiana — one of the nation’s largest — exploded into flames for about 4.5 hours on Monday, adding to fears of higher gasoline prices. The blaze came at a time when 10% of Gulf Coast refining capacity is already idle for repairs and other maintenance work.

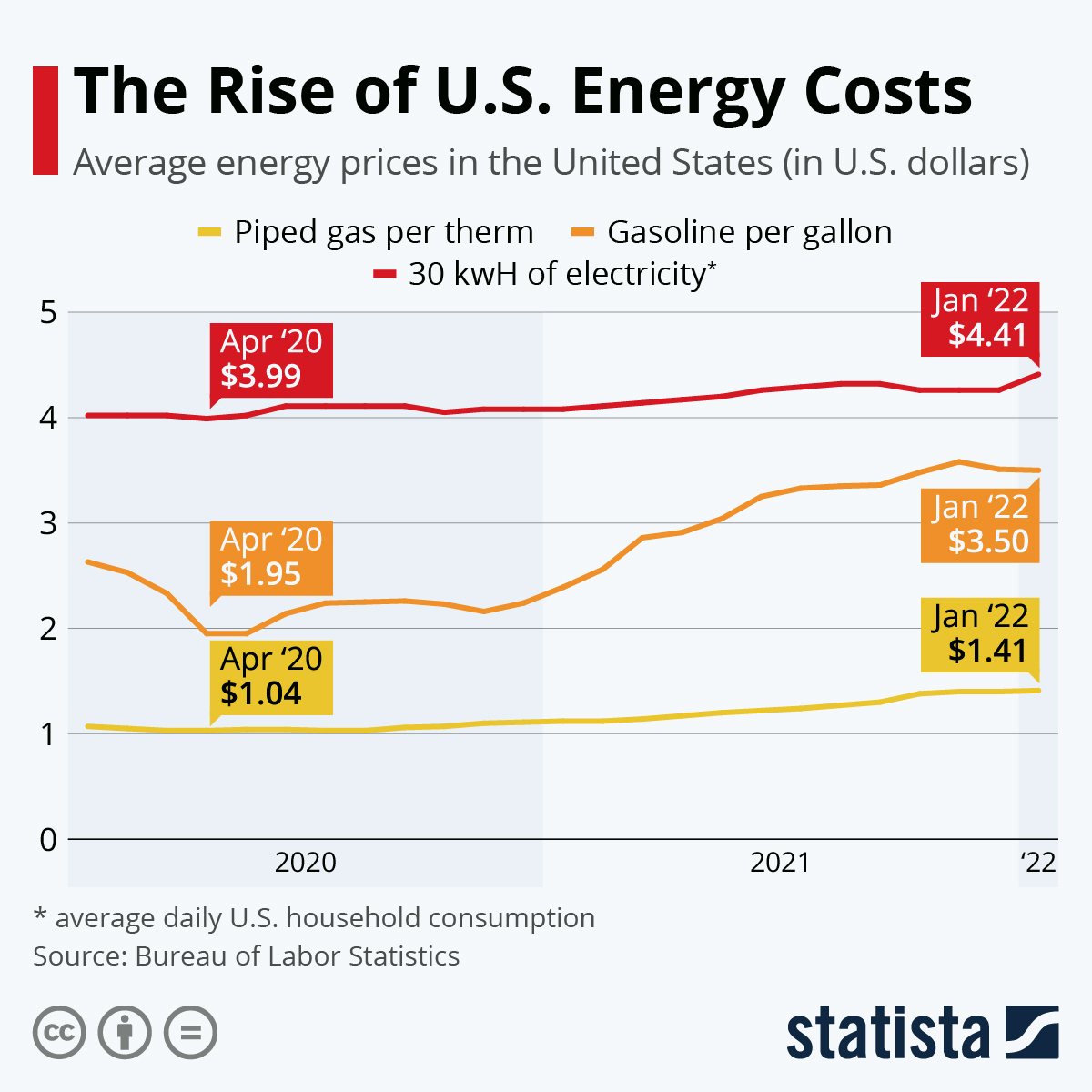

- Retail gasoline prices in the U.S. have climbed 7.5% this year, adding to 2021’s 46% advance, according to AAA. The last time prices were this high was the summer of 2014, when international oil prices were above $100/bbl.

- Shell estimates global LNG demand rose 6% last year and will continue rising this year as supplies remain tight. Demand could double by 2040, the producer said.

- Saudi Aramco is working on boosting its maximum sustained capacity to 13 million bpd by 2027 from around 12 million bpd currently.

- After a year when energy shortages sent prices skyrocketing, China has approved plans to build three new coal mines that could produce up to 19 million tons per year. Roughly 70% of their $3.8 billion cost would be covered by bank financing, a contrast to efforts by Western lenders to shift away from coal.

- European lawmakers are proposing legislation that would require nations to ensure minimum gas storage by Sept. 30 every year, an effort to prevent future shortages during periods of high demand.

- Chevron is looking to sell its stakes in three oil and gas fields in Equatorial Guinea for roughly $1 billion, as the producer focuses on its most profitable hubs in the U.S. Permian Basin and Kazakhstan.

- European wind power output is up 26% so far this year after three named storms battered the continent in the past week, providing some relief amid a shortage of gas.

- German wind power giant RWE is working with Tata Power, India’s largest integrated power company, to build more offshore projects in the nation.

- Japan’s largest railroad company will begin testing the nation’s first hydrogen-fueled train next month, with plans to use the technology to help replace its diesel fleet by 2030.

Supply Chain

- Nearly 25 million Americans from the northern Plains through the Great Lakes will see severe winter conditions for much of this week as a string of arctic blasts sweeps the nation.

- Fearing more disruption, Canadian lawmakers voted to extend for another 30 days the emergency powers that aided in breaking up trucker blockades of the nation’s capital and borders with the U.S.

- Rising fuel prices are starting to eat into sky-high profits for global shipping lines, exemplified by a 23% rise in the cost of Rotterdam marine fuel since Jan. 1.

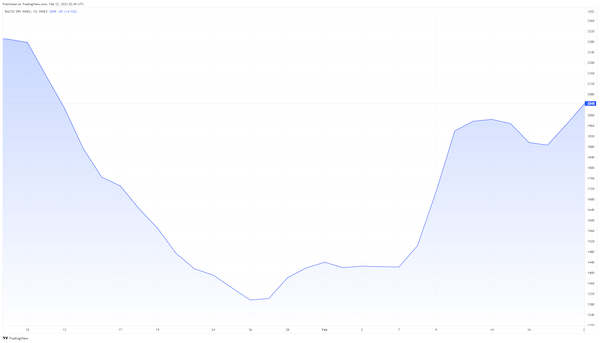

- The Baltic Exchange Dry Index, a bellwether for the general shipping market, rose 4.1% to 2,045 Monday, its highest level since Jan. 11.

- Container ship queue times are rising at maritime gateways in Singapore, disrupting imports of frozen goods from the U.S. and Europe.

- Maersk is bulking up inland U.S. distribution capabilities and aims to add at least another 12 warehouses this year to its portfolio of 150 sites across the nation.

- Trucking groups are urging the U.S. administration to build more parking places nationwide, with up to 98% of drivers reporting they spend an hour a day or longer searching for safe parking to meet hours-of-service regulations, cutting their compensation and exacerbating supply chain issues.

- Truckers in California are decrying the state’s new requirement that all semis have engines built since 2010 by the start of next year, arguing the rule will further back up supply chains and force many small operators to shut down.

- Several shippers and short lines have filed comments with the Surface Transportation Board to oppose Amtrak’s proposal to run passenger trains on a Gulf Coast track owned by CSX and Norfolk Southern Railway.

- Two-thirds of U.S. small businesses impacted by supply chain constraints said suppliers are favoring large businesses because of the volume of orders, while 84% said inflationary pressures had worsened since September, according to a Goldman Sachs survey.

- Manufacturing technology orders surged 55% last year to $5.9 billion, nearly tripling from 2020.

- Taiwan’s semiconductor industry was short a consistent 34,000 workers per month in the fourth quarter, the largest labor shortage in at least seven years.

- Matson, the leading U.S. shipping company in the Pacific trade, saw fourth-quarter income rise to $395 million and full-year profits rise to $927 million amid soaring freight rates and record imports.

- The cost of a key ingredient used in weedkiller is up about 250% the past year, spelling trouble not only for American farmers but also international food markets such as Africa, where food prices are the highest in a decade.

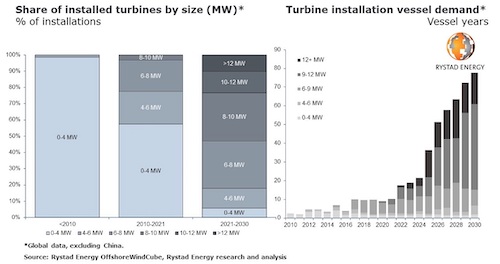

- Installing larger offshore wind turbines could become a challenge for operators as demand will outstrip the availability of suitable vessels by 2024, Rystad Energy predicts:

- The Maersk/MSC 2M alliance will drop its cooperation on Asia-to-U.S. transpacific routes with container carrier SM Lines by early May. The move follows a similar breakup on Asia-Mediterranean and Asia-Pacific Northwest routes with Israeli carrier Zim.

- Greek container ship owner Euroseas plans to spend its surging profits on expanding its fleet.

- Bad weather has delayed efforts to put out the flames engulfing a luxury car carrier near Portugal since last week. While the blaze died down Monday, loss estimates have surpassed $400 million for brands including Audi, Porsche, Bentley and Lamborghini.

- The U.S. monument industry is suffering from globally disrupted supplies of granite and tools required to work as demand spikes due to COVID-19 fatalities.

Domestic Markets

- The U.S. reported 49,965 new COVID-19 infections and 655 virus fatalities Monday.

- The seven-day average for U.S. COVID-19 hospitalizations is down to 80,185 after reaching more than 146,000 a month ago, while average daily fatalities dipped below 2,000 for the first time in a month.

- New COVID-19 cases in Florida dropped 65% over the past week, matching similar trends in New Jersey, Wisconsin, Kansas and Maine.

- The Supreme Court upheld Maine’s vaccine mandate for healthcare workers.

- New research suggests three doses of Pfizer or Moderna’s COVID-19 vaccine can ward off serious infection for several years.

- U.S. health officials are closely watching the BA.2 subvariant of Omicron, which quickly overtook Omicron cases in South Africa and even led to a second Omicron surge in Denmark.

- Federal Reserve officials are sending mixed signals on whether they will raise interest rates by a half percentage point or a quarter point when the central bank meets next month.

- U.S. for-sale home inventory is at an all-time low, with active listings for the week ended Feb. 13 down 49% from the same period in 2020, according to real estate broker Redfin.

- U.S. sales of electric vehicles doubled year-over-year in 2021 to 656,866 units, representing 4.4% of the passenger-vehicle market.

- GM’s Cruise unit is seeking U.S. regulatory approval to build and deploy self-driving vehicles without human controls like steering wheels and brake pedals.

- California will likely resume its spot as the nation’s major influencer for vehicle emissions standards pending an expected waiver from the EPA allowing it to impose stricter requirements than those of the federal government.

- Over 8.4 million travelers passed through airport security in the U.S. over the holiday weekend, double the level of a year ago but still below pre-pandemic levels.

- U.S. air-safety regulators plan to inspect and sign off on individual 787 Dreamliner jets versus allowing Boeing to perform those routine tasks, a similar action to that taken after the plane maker’s 737 MAX jets caused two crashes in 2018 and 2019.

International Markets

- Hong Kong ordered three rounds of mandatory COVID-19 testing for all its 7.5 million people next month as the island’s worst-ever COVID surge worsens. China is pressing for a full lockdown of Hong Kong.

- Japanese lawmakers are considering shortening quarantine periods as COVID-19 cases spread rapidly due to the shorter incubation period of the Omicron variant.

- Britain will start offering fourth COVID-19 vaccine doses to high-risk populations this spring, officials said. The nation has now dropped all pandemic restrictions, including free virus testing programs.

- Italy is recommending fourth COVID-19 vaccine doses to high-risk populations.

- The economies of Germany and France — Europe’s largest — picked up in February as the European Omicron wave peaked and manufacturing output showed signs of a rebound.

- Inflation rates are rising sharply in many Asian countries that recently seemed immune to cost pressures, including India, South Korea and Thailand. Notably absent from the list is China, where producer price inflation is easing unexpectedly amid the nation’s property market slowdown.

- Mercedes-Benz said it plans to have some factories only produce electric vehicles (EVs) by 2025 but will steer clear of building EV-only plants, instead keeping production lines flexible to respond to market demand.

- Toyota hopes emulating the manual transmission of gas-powered cars could draw more consumers to electric vehicles.

- British sportscar maker Lotus is looking to open a production plant in China and is reportedly targeting annual sales of 100,000 vehicles by the end of the decade.

- Thousands of Airbus employees at U.K. factories voted to authorize a strike in a dispute over pay.

At M. Holland

- M. Holland just published a 2022 Logistics Outlook examining continued trucking, ocean freight and rail challenges, plus key takeaways for plastics companies. Read it here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.