COVID-19 Bulletin: February 21

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

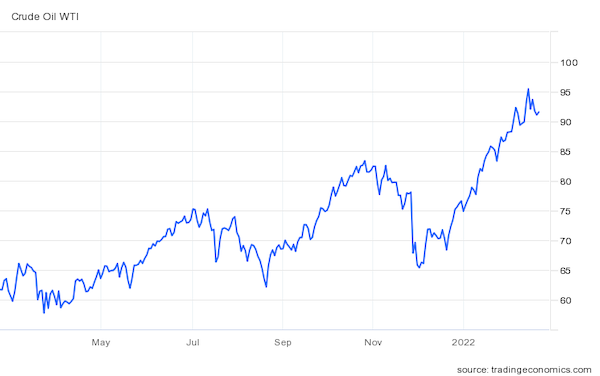

- U.S. benchmark WTI ended 2.2% lower last week after several days of volatile trading, the first weekly loss in two months.

- Futures were higher in mid-morning trading today, with WTI up 1.6% at $92.48/bbl and Brent up1.9% at $95.34/bbl. U.S. natural gas was 7.3% higher at $4.76/MMBtu.

- Ministers of Arab oil-producing countries recommitted to modest 400,000-bpd monthly output increases despite calls to pump more crude to ease pressure on prices.

- OPEC and its oil exporting allies are planning to integrate Iran into their oil supply accord if its nuclear deal with world powers is revived.

- Gas prices in California surged to another all-time high of $4.72/gallon last week.

- High oil prices are prompting shale producers to resume activity in high-cost, all but abandoned fields, such as the Anadarko Basin of Oklahoma and the DJ Basin in Colorado.

- Permits to drill for oil and gas on U.S. public land will be delayed after a federal judge ruled against the White House’s estimates of the social costs of greenhouse gas emissions, according to a court filing on Saturday.

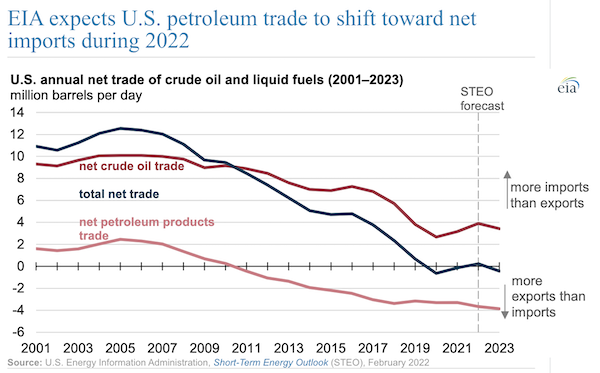

- The U.S. is expected to be a net importer of petroleum for the second consecutive year in 2022 following the nation’s historic shift in 2020 to become a net exporter.

- Western energy majors are poised to return a near-record $38 billion to shareholders through stock buybacks this year, almost double the amount from the last time oil traded above $100/bbl in 2014.

- Large, sustained power outages have occurred with increasing frequency in the U.S. over the past two decades, leading more American households and businesses to install backup generators.

- Consumption of oil and petroleum products fell 10% across Europe in 2020, the sharpest drop ever.

- As many as 35 major cyberattacks hit energy and oil infrastructure since 2017 — a third of all cyberattacks over the past five years — with the U.S. the most common target.

Supply Chain

- Parts of Pennsylvania, New York, Massachusetts and New Jersey were blanketed with severe snow squalls over the weekend, causing dangerous road conditions. Much of the country will experience another polar plunge this week.

- Winter storm Eunice pummeled the U.K.’s western coast over the weekend, bringing record wind speeds and interrupting power to over 150,000 homes.

- Most of Ottawa’s largest streets are now clear of trucker demonstrations following tighter police enforcement late last week, including 191 arrests.

- A series of truck convoys protesting COVID-19 restrictions are expected to arrive in Washington, D.C., around the time of the State of the Union address on March 1.

- U.S. lawmakers are looking to speed up the process for issuing commercial driver’s licenses amid an estimated 80,000-driver shortage across the nation.

- U.S. rail carloads were up 11.9% from a year ago for the week ending Feb. 12, but intermodal container and trailer cargos were down. In the first six weeks of 2022, container and trailer shipments by rail were down nearly 12% as shippers divert cargoes to trucks to avoid rail congestion.

- Cargo volumes through the Port of Los Angeles rose an annual 3.6% in January to 865,595 TEUs, the first annual increase since September of 2021. January volumes at the Port of Long Beach rose 4.8% to surpass 800,000 TEUs for the first time.

- Officials say a 30-vessel backlog of container ships at the Port of Charleston — up from 19 last month — will not be cleared until mid-April, as supply chain congestion extends to more U.S. gateways.

- Twelve vessels are waiting to anchor at the Port of Virginia after two snowstorms disrupted operations for four straight days in late January.

- The Port of Houston saw a 30% TEU increase in loaded container imports year over year in January, while exports were down 14%. Vessel calls were up 10%.

- Hong Kong cargo shipments plunged in January because of strict COVID-19 controls, with Cathay Pacific’s volumes falling over 50% from January 2019 and 31% from the same month last year.

- Cases of crew abandonment on shipping vessels, where operators leave crews stranded without pay, more than doubled to a new record last year and are set to exceed that level in 2022.

- Vietnam is keeping factories open despite record-high COVID-19 case counts, reversing a policy of sweeping lockdowns last year that cut off supplies to Western retailers.

- Growing numbers of startups are working on innovations aimed at managing warehouses and tracking inventory, as investment in supply chain tech firms hit $24.3 billion in the first nine months of 2021, 60% higher than in all of 2020.

- Intel will delay the launch of its standalone graphics chips for desktop computers to the second quarter. The firm also said it would sharply raise capital spending for expansion the next few years, putting free cash flow into negative territory in 2022.

- Many of the more than 1,200 computer chips in a modern automobile are unique to the application or brand, complicating the shortage affecting the global industry.

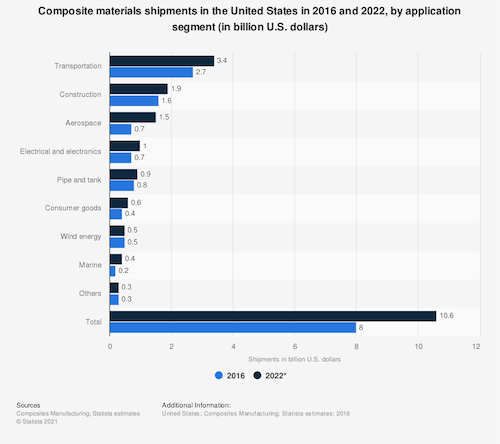

- The value of composite shipments for use in the transportation industry is expected to total roughly $3.4 billion in the U.S. this year:

- Google’s cloud unit partnered on a 10-year deal with analytics firm Dun & Bradstreet to develop software and services for supply chain risk management.

- The U.S. Department of Justice is stepping up scrutiny of logistics and transportation companies for possible anti-competitive behavior during the pandemic.

Domestic Markets

- The U.S. reported 22,053 new COVID-19 infections and 384 virus fatalities Sunday.

- New York delayed a mandate for healthcare workers to get a booster shot of the COVID-19 vaccine, joining similar moves by California and Connecticut.

- Hawaii is the only state that has not eased mask requirements amid falling COVID-19 cases across the nation.

- U.S. health regulators may approve a fourth COVID-19 booster dose by the fall, officials say.

- A growing number of Americans who contracted COVID-19 are booking international travel within 90 days of their recovery to avoid testing mandates when returning to the U.S., taking advantage of a “golden ticket” exemption to travel requirements.

- The U.S. is sending $250 million to help boost COVID-19 vaccination rates in 11 African nations.

- The White House on Friday signed a bipartisan bill to extend government funding for three weeks to give Congress more time to reach a budget for the remainder of this fiscal year.

- The U.S. Federal Reserve indicated it would likely raise interest rates by 0.25 percentage points in March, not the unusually large half-percentage-point that some analysts expected. JPMorgan predicts the central bank will raise rates at every one of its next nine meetings.

- An index gauging U.S. consumer satisfaction is down 5.2% since 2018, suggesting an inverse relationship between the quality of goods and the level of demand for those goods during the pandemic.

- Median rent for U.S. residential properties rose more than 19% between December 2020 and December 2021, with the biggest jump reported in Miami.

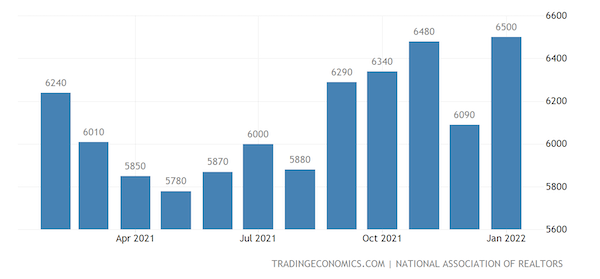

- U.S. existing home sales jumped 6.7% in January as buyers looked to snap up houses before higher interest rates kick in.

- Some retail employees at Apple are launching new efforts to unionize, following similar trends at other major U.S. firms including Amazon and Starbucks.

- Workers in finance, information and professional sectors saw wages rise by 4.4% in January, outpacing the 4.0% average gain made for all workers.

- A growing population of Generation Z employees have never worked in an office or met their co-workers in person, with many preferring working remotely.

- Roku, a maker of electronic devices for TV-streaming, posted disappointing fourth-quarter revenue on higher material and freight costs.

International Markets

- South Korea reported over 110,000 new COVID-19 cases Friday, the latest in a string of daily records. The nation has maintained its rigid pandemic controls, including six-person gathering limits.

- Hong Kong will introduce a health passport after suffering a daily record 7,533 new COVID-19 cases as ambulances queued at hospitals to deliver sick patients.

- China reported 195 new COVID-19 cases Saturday, up from 137 the day before.

- China will begin administering COVID-19 booster doses from different drug manufacturers, hoping to improve immunization from the virus amid concerns that Chinese vaccines are ineffective against the Omicron variant.

- Japanese officials decided to open the nation’s borders to more business travelers and students next month but will keep travel largely closed for tourists.

- Australia reopened its borders to tourists today after a two-year hiatus.

- Queen Elizabeth II tested positive for COVID-19 on Sunday and was reported to be suffering mild cold symptoms.

- New COVID-19 cases in the U.K., a bellwether for pandemic trends, dropped 27% the past week. Lawmakers scrapped mandatory self-isolation requirements for infected persons as the government makes plans to drop other COVID-19 restrictions in pursuit of a “living with COVID” strategy.

- Multiple U.K. trade unions are calling on the nation’s prime minister to commit to boosting sick pay and supporting individuals with weakened immune systems and “long COVID,” rather than scrapping the nation’s pandemic restrictions.

- Israel will begin allowing all foreign travelers to enter the country regardless of their vaccination status starting March 1.

- Six African nations — Egypt, Kenya, Nigeria, Senegal, South Africa and Tunisia — will receive the necessary technology to produce their own mRNA COVID-19 vaccines.

- New COVID-19 cases are down 40% in Mexico the past three weeks.

- Europe’s composite Purchasing Managers Index for February rose to 55.8, higher than expected, as prices in the region saw a record increase.

- Germany’s federal bank warned that the surge in Omicron COVID-19 infections may have pushed the nation into its second recession of the pandemic, projecting that economic output in the EU’s largest economy could drop considerably in the first quarter.

- The economy of Russia, boosted by rising oil prices, beat expectations and rose 4.7% last year, the quickest pace since 2008.

- Volkswagen is holding talks with China’s Huawei about potentially acquiring its autonomous driving unit.

- BMW will begin rolling out its new electric four-door i4 sports coupe in Japan, with deliveries planned for March.

At M. Holland

- M. Holland just published a 2022 Logistics Outlook examining continued trucking, ocean freight and rail challenges, plus key takeaways for plastics companies. Read it here.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.