COVID-19 Bulletin: January 25

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell 2% Monday, moving in tandem with a broader selloff in Wall Street equities. Futures were higher in late morning trading, with WTI up 1.6% at $84.65/bbl and Brent up 1.4% at $87.48/bbl. U.S. natural gas was 1.6% lower at $3.96/MMBtu.

- European natural gas prices are on the decline following forecasts of milder weather and slightly boosted supplies from Russia.

- OPEC+ produced just 60% of its publicly stated target production last month.

- German power prices rose to their highest levels in a month Tuesday on a steep decline in wind output.

- Japan’s largest refiner is running its plants at high capacity after failing to meet sharply rising domestic demand in the final three months of 2021.

- Nigeria’s new 650,000-bpd Dangote refinery could be operational by the second half of this year, a key step toward the nation’s goal of ending gasoline imports.

- Indonesia’s short-lived ban on coal exports earlier this month sent prices for the fuel surging as other nations failed to boost supply, with global impacts expected to linger through February.

- While China is yet to lift an import ban on Australian coal, the bulk of stranded supply has now been cleared from Chinese ports, a boon last quarter to the nation’s power plants and steelmakers.

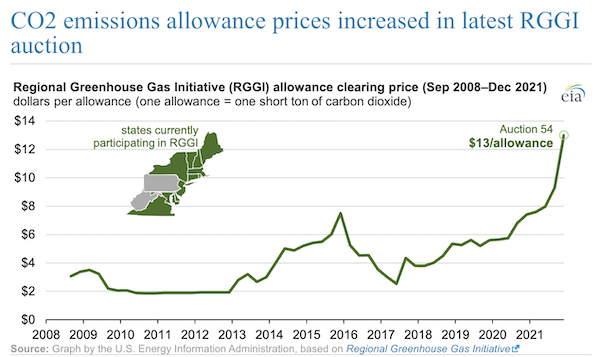

- The Regional Greenhouse Gas Initiative’s most recent auction saw a new record price for emissions allowances at $13 per short ton of CO2:

- Lowering excess methane emissions from a small portion of the U.S. Permian Basin could help the nation achieve broader emissions targets and save $26 million in escaped natural gas, a new report says.

- Honda and oil refiner Eneos Holdings are among a group of more than 35 Japanese firms attempting to develop microalgae farms to be used as biofuels in cars and planes.

Supply Chain

- An out-of-season wildfire in California’s central coastal region has forced hundreds to evacuate.

- Turkish and Greek roads and airports shut down for a second day following heavy snowfall over the past week.

- Thousands of trucks piled up at Vietnam’s northern border with China last week after Chinese officials tightened gate operations over fears of importing COVID-19.

- Canada’s Port of Vancouver delayed a plan to bar older trucks from serving the port after recent storms disrupted the region’s transit network.

- European airlines are flying thousands of empty or nearly empty flights to preserve takeoff and landing slots at airports.

- South Carolina’s Port of Charleston saw 1.29 million TEUs of loaded container imports last year, a 25% increase over 2020.

- Frankfurt Airport, Europe’s largest air cargo hub, saw an 18.7% rise in cargo tonnage last year and an 8.9% rise over 2019.

- The global fleet of seaborne crude and product tankers grew at a modest 2.7% pace last year, with the largest number of tankers leaving the market since 2018.

- HMM and Evergreen are among the 23 container shipping lines being fined more than $80 million for price-fixing over the last 15 years.

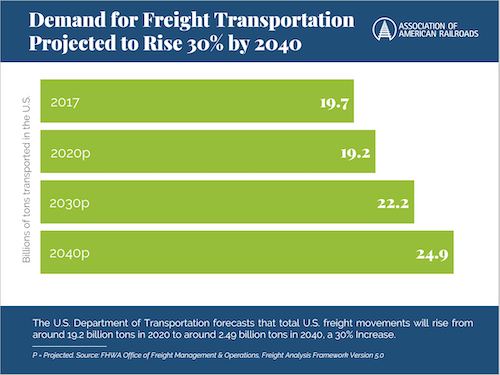

- Total U.S. freight movements will rise 30% to 2.49 billion tons per year by 2040, the Department of Transportation forecasts:

- American food processing giants are raising prices at a faster clip to offset higher transportation and labor costs.

- Canada, one of the world’s top barley exporters, made the rare move to import a cargo of the crop from Europe after drought decimated its harvest last year.

- Mexican production of tractor-trailers hit an all-time high in December on rising demand from the U.S. and Canada.

- An earthquake in southern Japan shut down one of Toshiba’s chip-making factories, with the company providing no timeline on a return to operations.

- Toyota is suspending more production in Japan as workers call out sick with COVID-19, while operations resumed at a COVID-shuttered factory in northern China after 11 days. Delivery times for the automaker’s popular Land Cruiser have increased to four years in Japan.

- The global semiconductor shortage cost automakers nearly 190,000 vehicles of production since Jan. 1.

- Amazon Air, a cargo line operating exclusively to transport Amazon packages, added a base at a Kansas airport to support higher volumes into Texas.

- A British LNG shipping venture has sold the world’s largest LNG bunker vessel in Shanghai.

- MSC and German airline Lufthansa are teaming up for a potential acquisition of a small state-owned airline in Italy.

- General Electric cited supply chain woes for a 3% drop in revenues in its latest quarter.

Sustainability: M. Holland’s 2022 Market Trends & Predictions

M. Holland’s Sustainability Market Manager, Debbie Prenatt, reflects on how recent sustainability efforts in the plastics industry will continue to evolve.

Domestic Markets

- The U.S. reported 1,010,754 new COVID-19 infections and 1,984 virus fatalities Monday.

- Millions of free federally supplied N95 masks started arriving at pharmacies across the U.S.

- The number of new COVID-19 cases is either leveling off or falling in 31 states, new data shows, suggesting the U.S. could be on the verge of a turning point in the Omicron wave.

- New COVID-19 cases in Florida are down 31% week over week, but the state yesterday registered its highest seven-day average death rate since November.

- New COVID-19 cases are trending down to one-month lows in New Jersey.

- The White House’s top medical adviser cautioned Americans not to drop their guard, warning that despite signs that the recent wave of Omicron COVID-19 infections is peaking, many parts of the nation, particularly on the West Coast, are still experiencing virus surges.

- COVID-19 hospitalizations in Seattle last week were up 460% from a month earlier, pushing hospitals to their breaking point.

- A Long Island judge struck down New York state’s indoor mask mandate yesterday.

- The White House said it will not enforce its COVID-19 vaccine mandate for federal employees until pending litigation is resolved.

- A three-dose regimen of Pfizer’s COVID-19 vaccine is highly protective against the Omicron variant, the company said, adding that boosters may be needed on an annual basis.

- The FDA restricted authorizations for COVID-19 antibody treatments made by Regeneron and Eli Lilly due to their limited effectiveness against the Omicron variant.

- The U.S. services and manufacturing sectors are reporting slower growth this month, a result of labor shortages and weak demand for activities requiring close personal proximity.

- Almost 90% of U.S. restaurants saw business fall off the last several weeks due to surging COVID-19 cases, survey results show.

- Portions of the U.S. South and Midwest are seeing the nation’s steepest rises in consumer prices.

- 40% of the largest U.S. pension plans were funded at 100% or more in 2021, the largest percentage in 15 years amid strong equity markets.

- High school graduation rates are down in at least 20 states after the nation’s first full year of school in the pandemic, a concerning trend that comes even as many districts loosened standards to help struggling students.

- Boeing will invest $450 million in a California startup making autonomous flying taxis, the plane maker announced.

International Markets

- Six in 10 Europeans are expected to get COVID-19 by March, the World Health Organization predicts.

- German officials agreed yesterday to maintain strict COVID-19 protocols after the country experienced more than 840 infections per 100,000 citizens over the past week, with the surge not expected to peak until mid-February.

- France’s COVID-19 vaccine pass kicked in Monday, effectively barring unvaccinated people from the nation’s restaurants, bars and most public entertainment venues.

- The Netherlands will allow restaurants and other public venues to re-open despite record new COVID-19 cases, with officials citing the reduced severity of the Omicron variant.

- Russia reported 65,109 new COVID-19 cases Monday, its fourth straight daily record.

- Britain logged 88,447 new COVID-19 cases Monday, a 5% increase over the prior week. The nation has ended testing requirements for fully vaccinated incoming travelers.

- Japan plans to more than double the number of prefectures that are under a quasi-state of emergency to at least 34 due to a rapid surge of the COVID-19 Omicron variant, which brought a record 54,000 new infections Sunday.

- South Korea registered over 8,000 new COVID-19 infections for the first time on Tuesday despite tough social distancing rules.

- A lockdown of more than 13 million people in the northwest Chinese city of Xi’an has been lifted, allowing normal work and production to resume. Beijing is making anyone who buys over-the-counter fever medicine to test for COVID-19 as a preventive measure against new outbreaks ahead of next week’s Winter Olympics.

- The U.S. added 15 more destinations to its highest-risk category for travel, including Costa Rica, Peru and the UAE.

- An Israeli medical panel recommended fourth COVID-19 shots for anyone over the age of 18.

- Hospital pressures are rising in low-income nations whose healthcare workers have been recruited to fight COVID-19 across the globe.

- Half of people who have been infected with COVID-19 could suffer permanent changes to their sense of smell, new research out of Sweden suggests.

- Consumer prices in Singapore rose at their fastest pace in eight years last month, leading the island’s central bank to tighten monetary policy in the first out-of-season move in seven years.

- South Korea’s economy expanded at its fastest pace in more than a decade last year on a jump in exports and construction activity.

- Specialty glass and materials producers are reaping the benefits of pandemic-induced demand for syringes and vials.

- Hong Kong’s Cathay Pacific Airways warned it may burn through more than $190 million per month after the government tightened crew quarantine restrictions, forcing the airline to cut cargo and passenger capacity.

- Europe’s largest airlines are calling on European lawmakers to revise climate-focused fuel and emissions targets that put them at a competitive disadvantage with foreign carriers.

- New legislation would require 25% of new cabs to be electric in Delhi, India’s second-largest city of nearly 19 million people.

- By 2023, Panasonic will start mass producing next-generation electric-vehicle batteries for Tesla with five times the storage capacity of existing models, the company said.

- Consumer goods firm Unilever is cutting thousands of jobs in a restructuring aimed at easing shareholders’ concerns after a failed takeover bid and reports of a large stake built by an activist investor.

- Dutch health tech giant Philips expects sales to recover strongly in the second half of this year.

At M. Holland

- M. Holland’s 2021 EcoVadis rating improved year over year, reflecting a continued commitment to sustainability and corporate social responsibility initiatives. See the press release.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.