COVID-19 Bulletin: January 21

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices dipped from seven-year highs Thursday following news of a rise in U.S. crude and gasoline stocks to their highest levels in a year. Crude futures extended losses in late morning trading, with WTI down 0.5% at $85.09/bbl and Brent down 0.7% at $87.74/bbl. U.S. natural gas was 2.8% higher at $3.91/MMBtu.

- China surpassed Japan as the world’s largest LNG importer on an 18% rise in deliveries last year.

- China’s Sinopec is taking the rare step of selling up to 45 cargoes of LNG by October to take advantage of high Asian spot prices.

- Oil majors are withdrawing operations from Myanmar over growing concerns of a human-rights crisis.

- Turkey warned it would cut energy supplies for factories after a main Middle Eastern supplier suspended natural-gas flows for 10 days due to a technical problem.

- Oklahoma-based Unit Corp., which filed for bankruptcy in May of 2020 at the trough of the slump in oil prices, hired an investment bank to sell $1 billion of oil assets in the U.S. Anadarko and Gulf Coast basins.

- Chesapeake Energy, which only emerged from bankruptcy last year, is in advanced talks to purchase Chief Oil & Gas for $2.4 billion, underscoring the energy industry’s recovery as natural resource prices surge to multi-year highs.

- Saudi Basic Industries began commercial operations at its 1.18-million-tonne ethylene production unit developed with Exxon Mobil on the U.S. Gulf Coast.

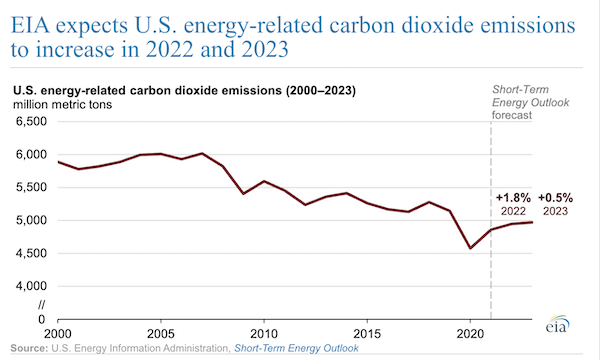

- U.S. energy related emissions dipped over 10% at the onset of the pandemic but are expected to rise again the next two years:

- Stormy weather in Scandinavia produced a combined 21.3 GW of wind power Wednesday, a single-day record.

- Phillips 66 is partnering with Novonix to commercialize next-generation lithium-ion batteries for energy storage.

Supply Chain

- More than 30 million Americans were under winter storm warnings yesterday as the second major weather system of the past week crept up the U.S. South and East Coast. Dangerous road conditions are expected to stretch from coastal parts of Virginia through the Carolinas.

- Congestion at Western ports is rippling back to Asia, with ships arriving at China’s Yantian port delayed by an average of seven days alongside a 40% drop in ship volumes from the U.S. and Europe the past two weeks.

- Union Pacific said COVID-19 infections among staff will continue to hurt freight volumes this quarter although not as severely as the 4% volume slump in the final three months of 2021.

- Saw timber prices rose to $26.44/ton last quarter, fueled by increased demand for cardboard boxes as well as wet weather that put a premium on trees sourced from dry areas.

- Shipping congestion is slowing the rollout of free COVID-19 tests to residents of Ohio and Maryland.

- Toyota will slow production at up to 11 Japanese plants due to rising COVID-19 infections among workers and suppliers.

- Intel, the world’s largest semiconductor manufacturer, announced plans to build a new $20 billion factory outside Columbus, Ohio, a major boost amid the decades-long slowdown in U.S. chip production.

- European lawmakers are working on a framework that would move 20% of global semiconductor production to the continent by 2030, up from the current 10%. The continent is competing with India, which just released $10 billion in incentives to lure chip makers, and Shanghai, which is offering to subsidize new investment.

- Federal regulators announced a key approval for a planned $10 billion train tunnel under the Hudson River, a milestone for the long-delayed project that promises to transform rail activity in the U.S. Northeast.

- Nearly $500 million of new U.S. infrastructure dollars will be used to expand a lock complex at Sault Ste. Marie, Michigan, enabling vessels to haul bulk cargo between Lake Superior and the other Great Lakes.

- Supply chain disruptions have reversed a decade-long decline in the cost of building clean energy infrastructure, with prices for solar panels surging more than 50% last year alongside double-digit price gains for wind turbines and batteries.

- Electric vehicle (EV) charging infrastructure is expanding more rapidly as automakers compete to win over an ever-growing number of consumers entering the EV market.

- A Florida-based aerospace firm received approval to start converting Boeing passenger aircraft to cargo jets in Canada.

- China Merchants Heavy Industry will supply Norway’s Höegh Autoliners with a dozen new car carriers with multi-fuel and zero-carbon capability.

- The world’s first liquid hydrogen carrier completed its maiden voyage from Australia to Japan yesterday, following a nearly year-long delay caused by the pandemic.

- France’s Port of Marseille is investing more than $850 million into an on-site green hydrogen project with 600MW of production capacity.

- Stock in wind-power company Siemens Gamesa Renewable Energy fell nearly 15% Thursday after it posted an operating loss and lowered its guidance, citing supply chain constraints.

- A recent study suggests that supply chains would benefit from more female participation, with all-women supply chain teams achieving greater efficiency than all-male and mixed-gender teams.

M. Holland’s 2022 Plastics Industry Trends & Predictions

M. Holland’s market experts weigh in on what we can expect for the plastics industry in 2022. View the infographic and read more on current trends and predictions.

Domestic Markets

- Yesterday marked the two-year anniversary of the U.S.’s first recorded COVID-19 case. The nation reported 644,814 new infections and 2,479 virus fatalities. Fatalities have surged 42% over the past two weeks to an average of roughly 1,900 per day, while hospitalizations reached an all-time high for the second day in a row at more than 160,000.

- Almost 1 million U.S. children were infected with COVID-19 in the past week, four times the rate of last winter’s peak surge. Pfizer’s vaccine could be approved for children under 5 within a month, health officials say.

- Almost 9 million American workers were out sick with COVID-19 the first ten days of 2022, a record. Millions more are estimated to have gone to work despite being exposed or infected.

- More hospitals across the country are suspending elective surgeries amid COVID-induced staff shortages, even as hospitals in some urban areas with declining case rates report easing strains.

- Top healthcare officials in Georgia, one of the least-vaccinated states, are pleading with residents to get their COVID-19 shots to reduce strain on hospitals.

- Teens as young as age 12 in California may soon be able to get vaccinated against COVID-19 without their parents’ knowledge or consent.

- Recent breakthrough infections with COVID-19 are down 50% in New York state.

- Florida’s seven-day average for new COVID-19 infections dropped to its lowest in three weeks.

- New COVID-19 cases are down 30% over the past 10 days in Massachusetts, suggesting the Omicron wave has peaked.

- The U.S. will require essential travelers crossing into the country by land or ferry to be fully vaccinated against COVID-19, a tightened restriction first announced last November.

- More than 300 U.S. testing sites affiliated with Chicago-based Center for COVID Control will shut down indefinitely over allegations of operating without state approvals.

- Price-gouging of COVID-19 tests is a rising concern among lawmakers.

- The White House is sending more than $100 million to hospitals to help improve workers’ mental health.

- The COVID-19 Omicron variant was likely already in the U.S. before its first reported appearance in South Africa.

- Pfizer’s antiviral pill is better at fighting the COVID-19 Omicron variant than treatments made by Eli Lilly and Regeneron, new research suggests.

- States are using record cash reserves built up during the pandemic for tax rebates and bonuses, paying down debts and pension obligations and investing in short-term infrastructure projects.

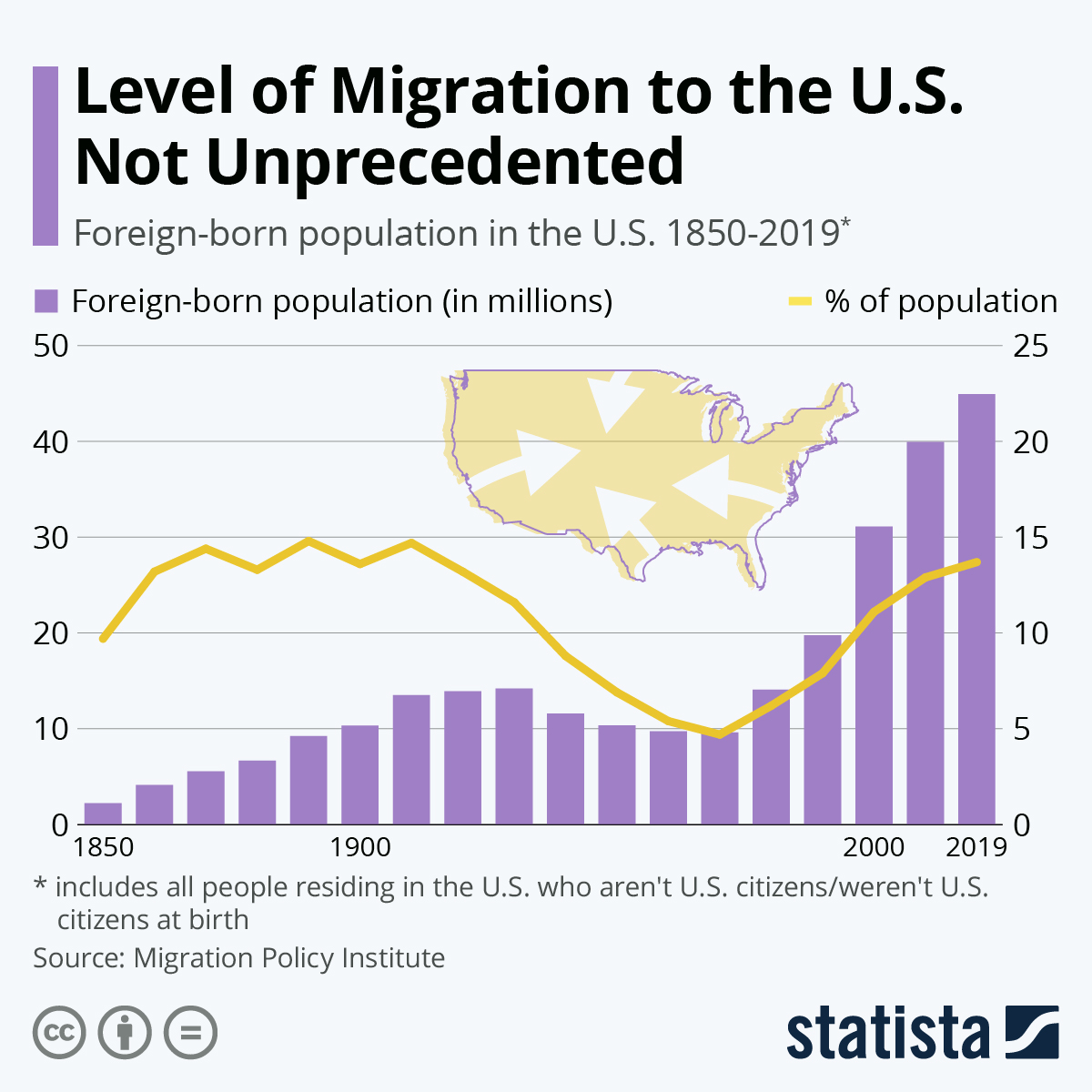

- U.S. immigration courts have hit historic pandemic-induced backlogs, sparking years-long delays for immigrants seeking asylum:

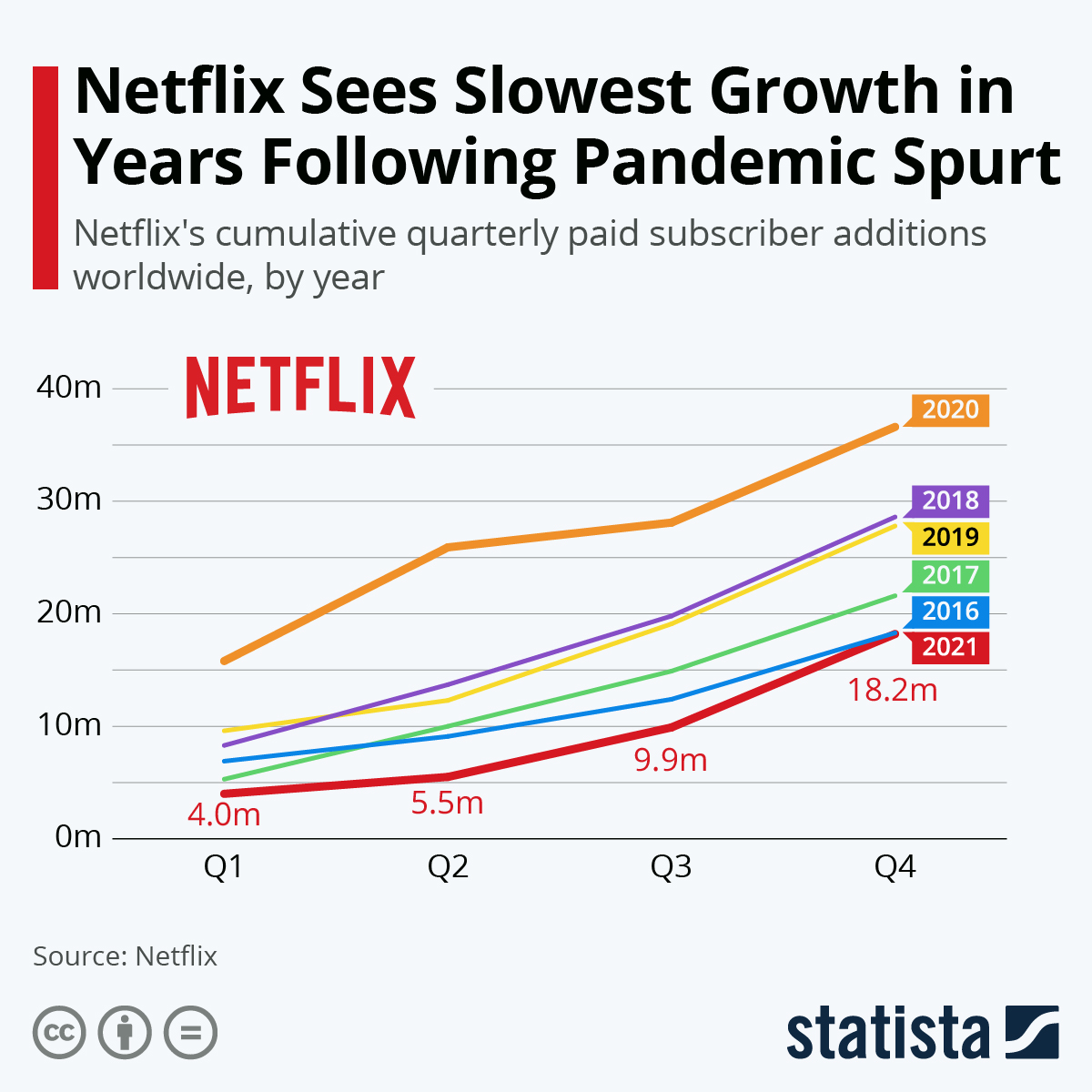

- Shares of Netflix fell sharply Thursday on forecasts of declining subscriber growth.

International Markets

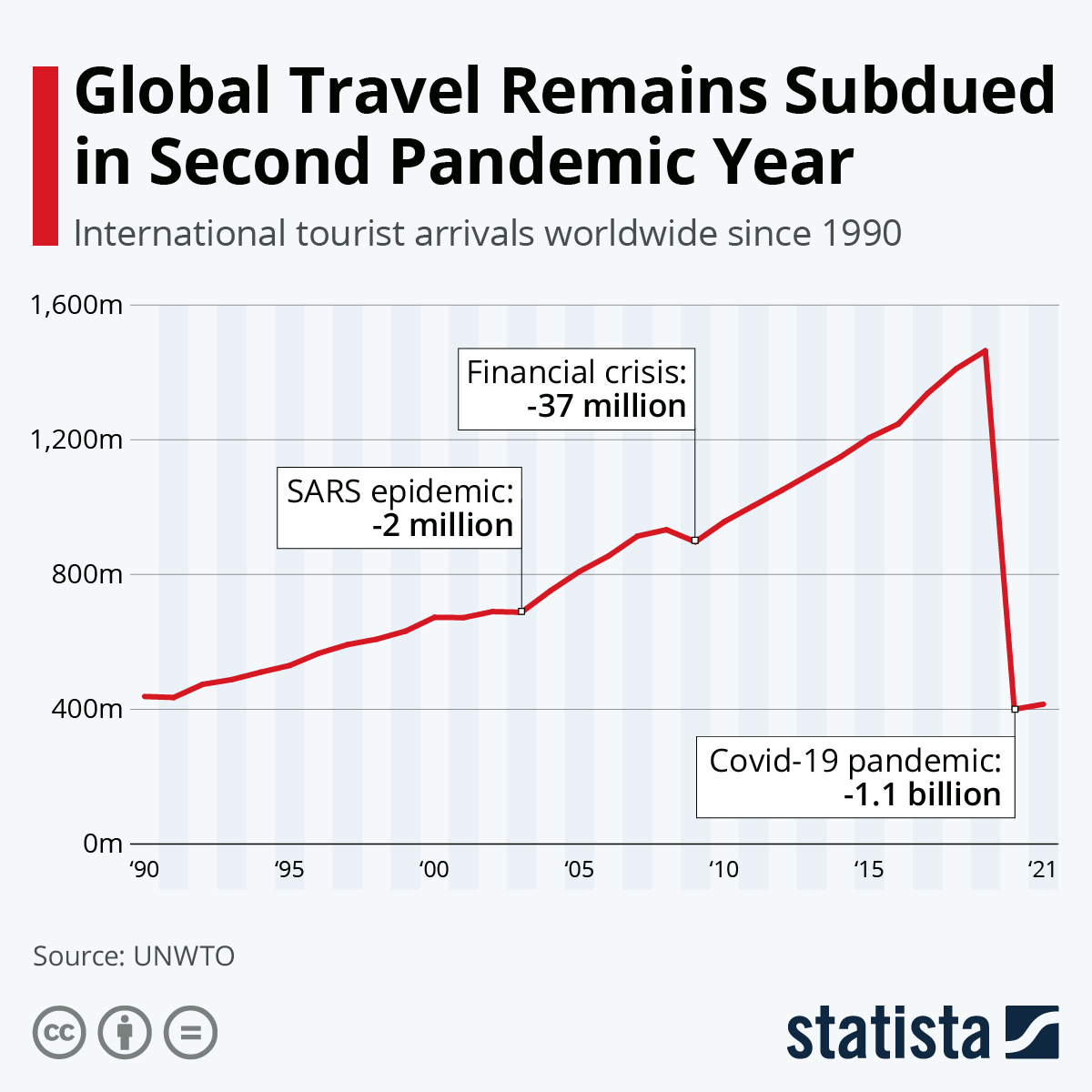

- The economic impacts of travel bans outweigh the limited protection they provide to most nations, the World Health Organization said. An extreme example is Hong Kong, where 44% of bankers surveyed said they are likely to leave the island due to its strict travel curbs.

- Several European nations have begun dropping pandemic restrictions in apparent recognition that the measures have been largely futile against the COVID-19 Omicron variant.

- France announced tighter COVID-19 rules yesterday with hopes of easing some restrictions next month.

- Austria is the first European nation to mandate COVID-19 vaccines for everyone over the age of 18.

- Sweden eased isolation rules after reporting a record 40,000 new COVID-19 cases Thursday.

- With 618 COVID-19 deaths per 100,000 people, Peru has the highest fatality rate in the world.

- New COVID-19 cases and fatalities dropped last week in Africa for the first time since the Omicron variant emerged last November.

- Thailand will restart quarantine-free tourism starting Feb. 1, citing economic concerns.

- Over two dozen generic drug makers are planning to make versions of Merck’s COVID-19 antiviral pill for distribution to low-income nations.

- Australia granted approval to the U.S.-made Novavax COVID-19 vaccine.

- Unemployment in Australia dropped to 4.2% in December, a 13-year low, possibly foreshadowing a quicker hike in interest rates than expected.

- German lawmakers are calling for a rapid escalation of the nation’s planned emission cuts by 2045.

- Mercedes-Benz has partnered with sensor maker Luminar Technologies to develop fully automated highway driving in its next line of vehicles.

- California startup TuSimple is holding talks to install its autonomous driving software in vehicles made by China state-owned automaker Beiqi.

- China’s government is ramping up pressure on consumers to purchase light, small-sized and low-emission gas passenger vehicles or electric vehicles.

- U.S. engine maker Cummins will produce battery-electric powertrains for some Isuzu commercial trucks.

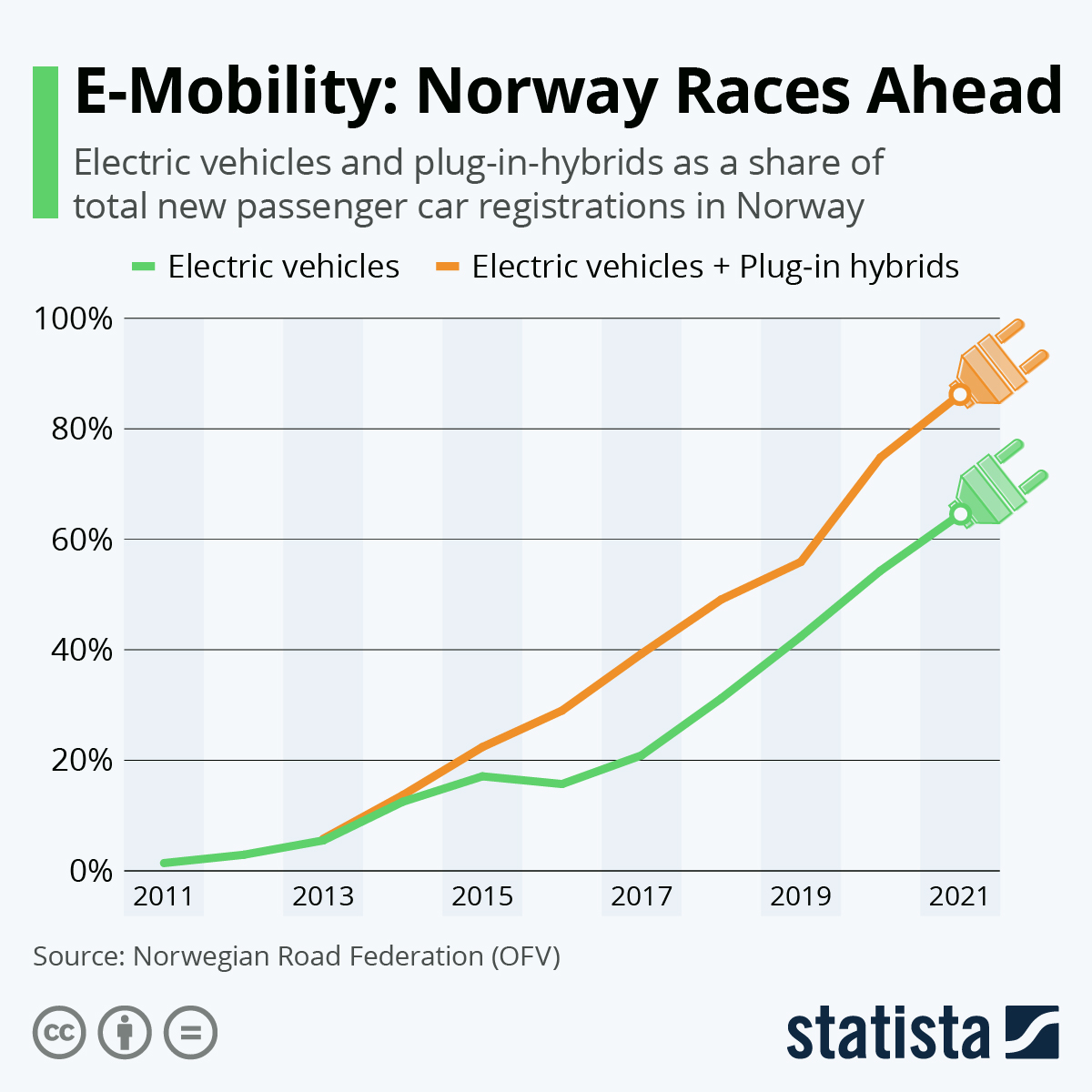

- Hybrids and fully electric vehicles accounted for a global high 86% of new passenger car registrations in Norway last year:

At M. Holland

- M. Holland’s 2021 EcoVadis rating improved year over year, reflecting a continued commitment to sustainability and corporate social responsibility initiatives. See the press release.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.