COVID-19 Bulletin: January 13

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. benchmark WTI rose 1.7% to a two-month high Wednesday after government data revealed the nation’s crude stockpiles are at their lowest levels since late 2018. Futures were lower in late morning trading, with WTI down 0.6% at $82.12/bbl and Brent down 0.5% at $84.26/bbl. U.S. natural gas was 9.8% lower at $4.38/MMBtu.

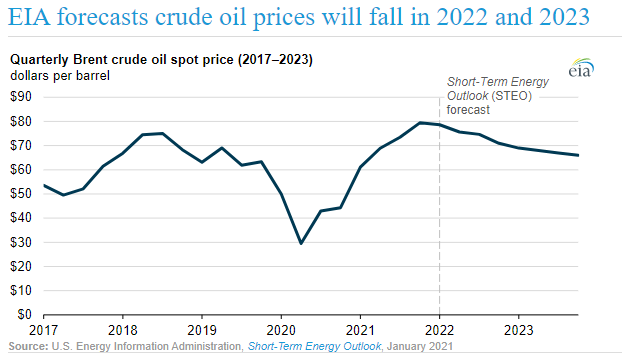

- The U.S. Energy Information Administration forecasts Brent crude will average $75/bbl this year, down $4/bbl from last year’s average, on a gradual build in inventories:

- Other analysts predict the opposite happening, with crude prices potentially rising over $100/bbl.

- The average U.S. diesel price rose for the first time in nine weeks, ending last week 4.4 cents higher at $3.657/gallon.

- Petrobras imported 23 million cubic meters of LNG per day in 2021, a 200% increase from the previous year, as drought in Brazil impacted hydroelectric reservoirs.

- The White House is considering scaling back this year’s ethanol blending mandate after pushback from refiners who say the shrinking U.S. ethanol industry cannot support the target.

- The International Energy Agency says that surging COVID-19 Omicron cases have not dented global oil demand as much as expected, likely due to the strain being milder than other variants.

- Europe’s gas storage levels have remained well below five-year levels for about a year because it is more cost effective to withdraw gas than pay higher prices for ebbing Russian supply, which provides about one-third of the continent’s gas. Europe’s total power bill could double this year from 2019 levels, Citigroup predicts.

- Italian lawmakers signaled they could raise corporate taxes on energy companies that have profited from surging gas prices.

- Indonesian officials continue their back-and-forth on resuming the nation’s coal exports halted since Jan. 1, with the government now waiting on state utilities to confirm they have secured enough of the fuel.

- Germany’s ruling party will press forward with phasing out coal and nuclear while expediting approvals for new solar and wind farms, an effort to push prices down and meet increased power demand by 2030.

- The U.S. plans to hold its largest ever offshore wind auction this February for waters off New York and New Jersey.

- British chemicals company Johnson Matthey has launched a new technology that uses captured CO2 to make feedstocks for aviation fuel, a potential tool for lowering aviation emissions.

Supply Chain

- The cost of last week’s severe snowstorms across the U.S. Southeast and Mid-Atlantic could total $5 billion in lost revenue, logistics firm Resilinc predicts, as more than 7,000 suppliers and 14,000 logistics sites were disrupted.

- Shipping congestion is growing at the world’s largest port complex as carriers reroute to Shanghai to avoid trucking snarls at the COVID-restricted Ningbo port.

- A new safety measure at the Port of Oakland will require container lines seeking berths to wait more than 50 miles offshore.

- Egypt’s Suez Canal aims to account for 15% of global energy trade by 2040, up from 8% in 2019.

- Israeli ocean carrier ZIM will pay $200 to truckers for each container they pick up within four days after it is discharged from their vessels at a Port of Los Angeles terminal.

- The National Retail Federation predicts 2022 U.S. import volumes to stabilize after a record-setting 2021.

- Most midsize businesses have started strategically stockpiling goods and sourcing from suppliers with greater geographic diversity to work around supply chain disruptions.

- Mounting COVID-19 absences are slowing operations and cutting manufacturing staff thin, with some companies resorting to unusual measures such as day-by-day worker shuttling to the most critical operations.

- Prices for highly protective KN95 masks are skyrocketing following the CDC’s recommendation of the face covering.

- Prices for new and used U.S. vehicles have consistently grown by double-digit percentages each month in 2021, detailed inflation data shows, sometimes rising over 45%.

- Intermodal container and trailer volumes fell 8.2% in December from the year-ago period, contributing to a disappointing second half for intermodal last year after a record-setting first half.

- Union Pacific announced it would drop its peak-season surcharges in a sign of easing intermodal congestion.

- Advanced robots that can pick up separate objects are making their way into more distribution operations.

- Taiwan Semiconductor Manufacturing Co., the most important chip supplier for Apple, raised growth forecasts after setting aside a record $44 billion in spending this year to remedy the global chip shortage and regain its stature from Intel as the world’s top chip builder.

- Delivery times for computer chips increased by six days to about 25.8 weeks in December from the previous month, marking the longest wait time since data collection began in 2017.

- Available warehouse space in the U.K. is at its lowest level ever recorded, Canadian real estate investment firm Colliers said.

- Philippine Airlines is emerging from bankruptcy proceedings with a new plan to grow revenue with air cargo.

- Australian miner Rio Tinto is buying up more electric locomotives to curb transport emissions 50% by 2030.

- Maersk accelerated its plans for net zero emissions by a decade to 2040.

M. Holland’s 2022 Plastics Industry Trends & Predictions

M. Holland’s market experts weigh in on what we can expect for the plastics industry in 2022. View the infographic and read more on current trends and predictions.

Domestic Markets

- The U.S. reported 894,971 new COVID-19 infections and 2,421 virus fatalities Wednesday.

- The White House is deploying military medical teams to New York, New Jersey, Ohio, Rhode Island, Michigan and New Mexico to help overtaxed hospitals.

- Florida recorded its highest seven-day average for daily COVID-19 infections — 65,551.

- Thirty percent of Coloradans who test for COVID-19 are positive, the state’s highest rate of the pandemic.

- A recent study of 70,000 California COVID-19 patients suggests the Omicron strain causes less severe disease and results in shorter hospital stays compared to other variants. Despite the lowered severity, the sheer number of new patients is still overloading the U.S. healthcare system.

- Nearly all Americans will be exposed to the COVID-19 Omicron variant, the nation’s top infectious disease expert predicts.

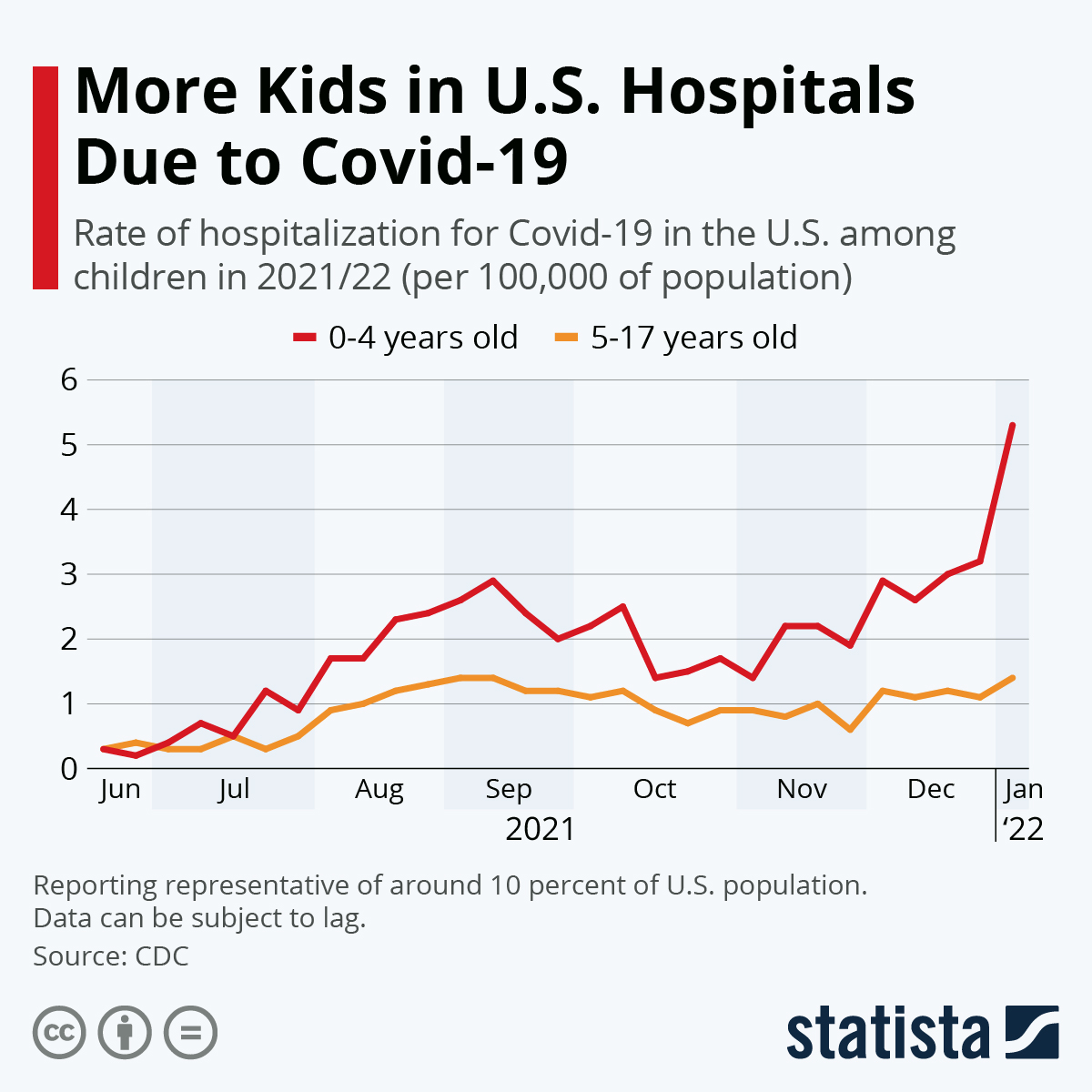

- The rate of COVID-19 hospitalizations in American children under age 5 has doubled since last November…

…while nearly every U.S. teen hospitalized with the virus has been unvaccinated.

- U.S. public schools are reporting drastic drops in attendance due to COVID-19 infections among students.

- Students in New York City and Oakland, California, are protesting inadequate COVID-19 protocols at high schools.

- Starting Feb. 1, everyone over age 5 in New Orleans will be required to show proof of full COVID-19 vaccination or a negative test to enter restaurants, bars and other businesses.

- Starbucks closed all of its dining rooms in Cleveland, Ohio, due to local COVID-19 conditions and staff shortages due to sickness.

- Nearly half of Broadway seats went unfilled the first week of 2022 due to show cancellations and COVID-19 fears.

- Reduced quarantine recommendations from the U.S. government have led to reduced paid sick leaves at some retailers.

- The U.S. is set to double its purchase of AstraZeneca’s preemptive COVID-19 antibiotic to 1 million courses by the end of March.

- The U.S. will continue to manufacture large quantities of COVID-19 tests every month to prevent future shortages, even when demand starts to fade.

- U.S. investment giant Blackstone will require staff to get COVID-19 boosters to work in the office.

- Online trading platform Robinhood will allow most of its 3,400 employees to work from home permanently.

- The president of the St. Louis Federal Reserve predicts the central bank will need to raise interest rates as many as four times this year, up from a planned three.

- More than 11.7 million Americans were lifted out of poverty by the government’s first two rounds of pandemic stimulus payments, the U.S. Census Bureau estimates.

- U.S. college enrollment has declined by more than 1 million students, or 7%, since the start of the pandemic, translating to deep cuts to university budgets and more school closings.

- Median monthly rents in Manhattan rose an annual 16% in December to an all-time high of $3,475.

- California regulators are reconsidering Tesla’s exemption from strict rules governing self-driving vehicles as more videos surface of the automaker’s cars driving themselves into dangerous situations.

International Markets

- France registered more than 360,000 new COVID-19 cases for the second day in a row Wednesday, just shy of Tuesday’s record.

- The U.K. reported 398 COVID-19 fatalities Wednesday, the most in a year.

- Germany saw 80,430 new COVID-19 cases Wednesday, surpassing November’s record of around 65,000.

- Austria reported a record 17,006 new COVID-19 infections Wednesday.

- Denmark, a nation of 5.8 million people, has surpassed 1 million total COVID-19 infections.

- Australia reported a near-record 100,000 COVID-19 cases Wednesday, with virus fatalities reaching an all-time high in New South Wales.

- Japan registered more than 13,000 new COVID-19 cases Wednesday, the most in four months.

- Greece has started giving out fourth COVID-19 shots to some of its population.

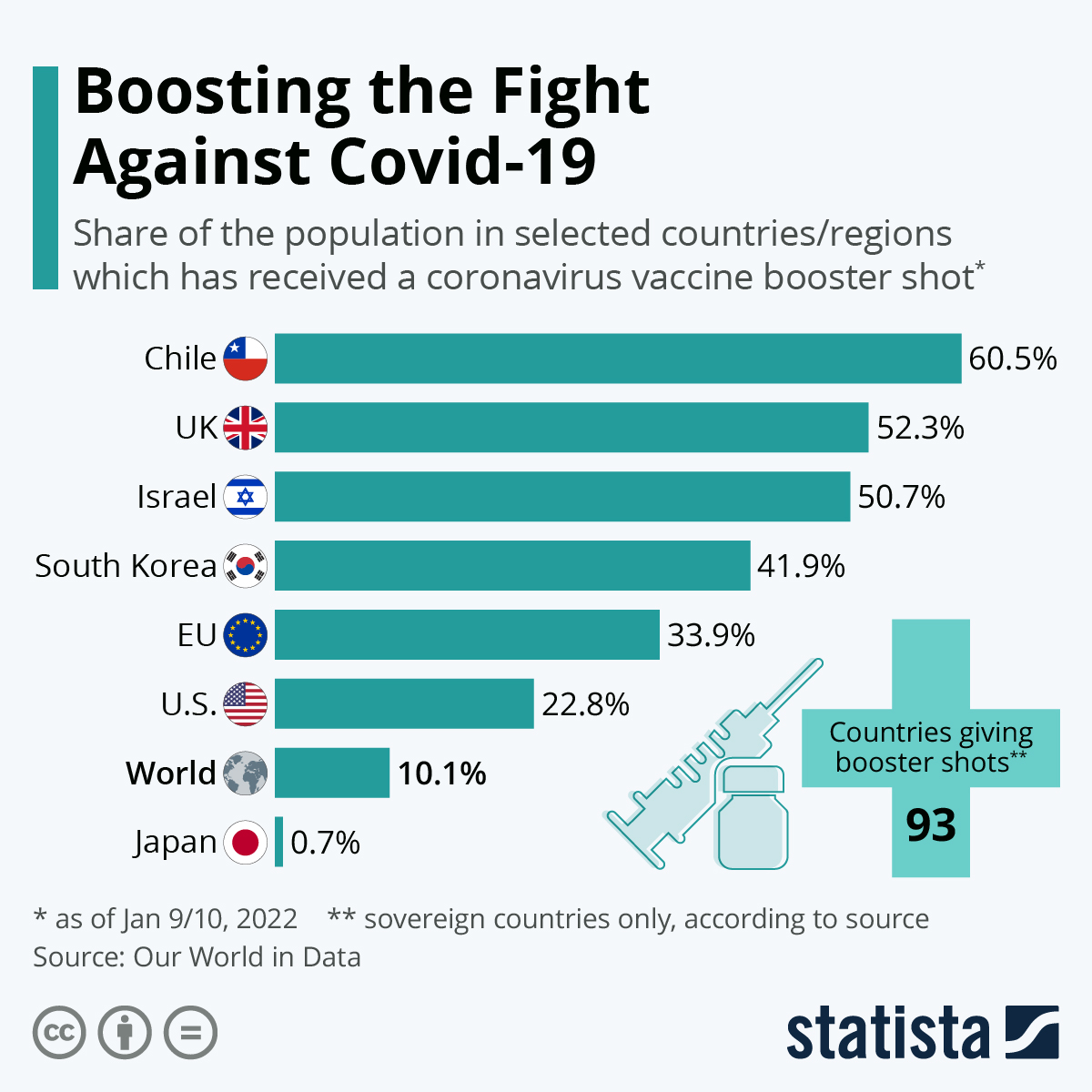

- Chile leads the world in administering COVID-19 booster shots:

- South Korea granted approval for the U.S.-made Novavax COVID-19 vaccine for adults.

- European medicine regulators are considering timing annual COVID-19 shots to the onset of cold seasons, similar to the flu.

- The pandemic has increased global extreme poverty rates and disproportionately affected lower-income populations, reversing progress made on bridging global inequality the past 20 years.

- The Bank of England is calling on the nation’s banks to better quantify their climate change risks and exposures ahead of possibly tighter regulations.

- Mercedes-Benz will become the first global luxury carmaker to build electric vehicle models in India.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.