COVID-19 Bulletin: December 1

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. benchmark WTI fell 5.4% Tuesday, ending November down 21% in the largest monthly decline since the start of the pandemic. Brent fell 3.9%, a 17% loss for the month.

- Energy futures regained some of Tuesday’s lost ground in late morning trading, with WTI up 3.5% at $68.48/bbl and Brent up 3.6% at $71.69/bbl. U.S. natural gas was 4.6% lower at $4.36/MMBtu.

- The American Petroleum Institute reported a smaller-than-expected crude draw of 747,000 barrels last week. Inventories at the U.S. hub in Cushing, Oklahoma, likely gained over 1 million barrels, the third straight week of builds.

- The average U.S. gas price could fall from $3.40 to $3.15 per gallon by Christmas, traders predict.

- Global oil supply could exceed demand by 3 million bpd in the first quarter of 2022, an OPEC+ report warned, as member nations meet today to discuss production policy. Economists expect the cartel to keep tight control on supply next year, likely keeping prices well above $70/bbl.

- Concerns are growing over the risk of blackouts in Europe amid continued high energy prices heading into the winter heating season.

- Thermal coal futures in China are down substantially this week after the nation’s economic planner indicated it would further intervene in the markets.

- OPEC released 27.74 million bpd of crude in November, an increase of 220,000 bpd from October but short of its planned 254,000-bpd target.

- 43% of oil and gas workers surveyed want to leave the energy industry within the next five years, with more than half of them contemplating a switch to the renewables sector.

- The Texas Railroad Commission, which regulates the state’s energy industry, is requiring more Texas natural gas providers to winterize their facilities this year.

- Russia’s next LNG megaproject, the Arctic LNG 2, secured $10.8 billion in financing from Chinese, Japanese and Russian banks.

- Exxon Mobil is in talks to sell its shallow-water oilfields in Nigeria, as it seeks to divest assets in Europe and Africa to finance U.S. shale expansion. The company said it will maintain conservative spending for the foreseeable future due to uncertainty about the outlook for fossil fuels.

- Royal Dutch Shell is planning to invest in new oil, gas and solar projects in Libya for the first time in a decade.

- Google entered a 12-year contract for wind power offshore Germany as part of a plan to power all its data centers and offices with carbon-free electricity by 2030.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Canada’s westernmost province extended fuel rationing to Dec. 14 as repairs continue on flood-damaged infrastructure. Lumber shipments from one of the nation’s largest producers fell 30% the past two weeks.

- Two hundred container truckers serving the Port of Vancouver plan to strike this Friday over failed contract negotiations.

- Hapag-Lloyd and Ocean Network Express issued disruption warnings from late December to mid-February in the key port hub of South China’s Pearl River Delta, citing the nation’s COVID-19 quarantine policies for ship crews returning from New Year travels.

- Container shipping rates at the Ports of Los Angeles and Long Beach have fallen 11% since August.

- Walmart has seen a 51% increase in throughput at the Ports of Los Angeles and Long Beach following their switch to 24/7 operations, allowing the company to move cargo 26% faster nationwide.

- For-hire U.S. truck tonnage in October rose 0.4% from September and 1.8% from a year ago, new data shows.

- Drive time limits for pandemic-related freight haulers have been waived through Feb. 28. The waivers were initially set to expire Tuesday.

- Inventories at top suppliers for vehicle chips were up for the first time in nine months at the end of September.

- The EU will unveil new legislation in the first half of next year that could significantly expand subsidies for domestic chipmakers, potentially doubling production by 2030.

- China suspended imports at a rail terminal in Inner Mongolia that handles 65% of the nation’s trade with Russia after a local outbreak of COVID-19.

- Taiwanese shipping line Wan Hai has acquired more than a dozen secondhand containerships the past year, recently purchasing two medium-sized vessels for $85.5 million. The shipper is one of many logistics firms using record profits during the pandemic to expand capacity.

- Singapore shipper Pacific International Lines will pay creditors $1 billion ahead of schedule, signaling its improved financial position.

- Walgreens plans to open eight more micro-fulfillment centers across the U.S. next year, supporting nearly 4,000 company pharmacies.

- Food product distributor Sysco pledged to electrify 35% of its U.S. tractor fleet by 2030.

- The world’s first methanol-fueled towboat will be available to charter in 2023.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 116,588 new COVID-19 infections and 1,539 virus fatalities Tuesday.

- The CDC will tighten testing and quarantine rules for some incoming travelers over concerns of importing the COVID-19 Omicron variant, while federal surveillance programs at four major airports were expanded.

- COVID-19 hospitalizations in Indiana rose by 170 to 2,000 on Sunday, a 9% increase from the Tuesday before Thanksgiving.

- COVID-19 hospitalizations in Arizona now outnumber those from the same time last year when vaccines were not available.

- Hard-hit El Paso, Texas, has returned to more than 300 COVID-19 hospitalizations, the most since vaccines became available in March.

- Los Angeles began enforcing an expanded COVID-19 vaccine mandate for access to most indoor public spaces Monday.

- Chicago removed California and North Carolina from its COVID-19 travel advisory, citing declines in their virus infections.

- New COVID-19 cases in Oregon fell 25% the past week. The state is developing a digital pass for access to businesses that mandate vaccines.

- Hawaii will lift most statewide pandemic restrictions on bars and restaurants later this week.

- Merck’s new COVID-19 antiviral pill was recommended for emergency authorization by the FDA Tuesday, with final approval expected shortly.

- Legal clashes are growing over the White House’s COVID-19 vaccine mandate for healthcare workers, with a federal judge in Missouri denying the mandate in 10 states and the U.S. Supreme Court effectively ruling the opposite for Massachusetts.

- Pfizer could release an updated COVID-19 vaccine tailored to the Omicron variant within 100 days, the company’s chief executive said.

- BioNTech’s founder said the COVID-19 Omicron variant could lead to more breakthrough infections but is unlikely to cause harsher symptoms than other variants.

- The Federal Reserve indicated it could raise interest rates as soon as the first half of next year and reduce monthly asset purchases as soon as mid-December.

- U.S. consumer confidence dropped to 109.5 in November, the lowest in nine months, due to inflation fears and rising COVID-19 cases.

- Average limits for government-backed home loans will rise from $585,250 to $647,200 next year, with near-$1 million loans available in some California and New York markets.

- The annual rise in U.S. home prices slowed in September for the first time since May 2020.

- U.S. consumers are applying for credit cards at a faster clip than before the pandemic.

- The U.S. added a higher-than-expected 534,000 private sector jobs in November, according to ADP.

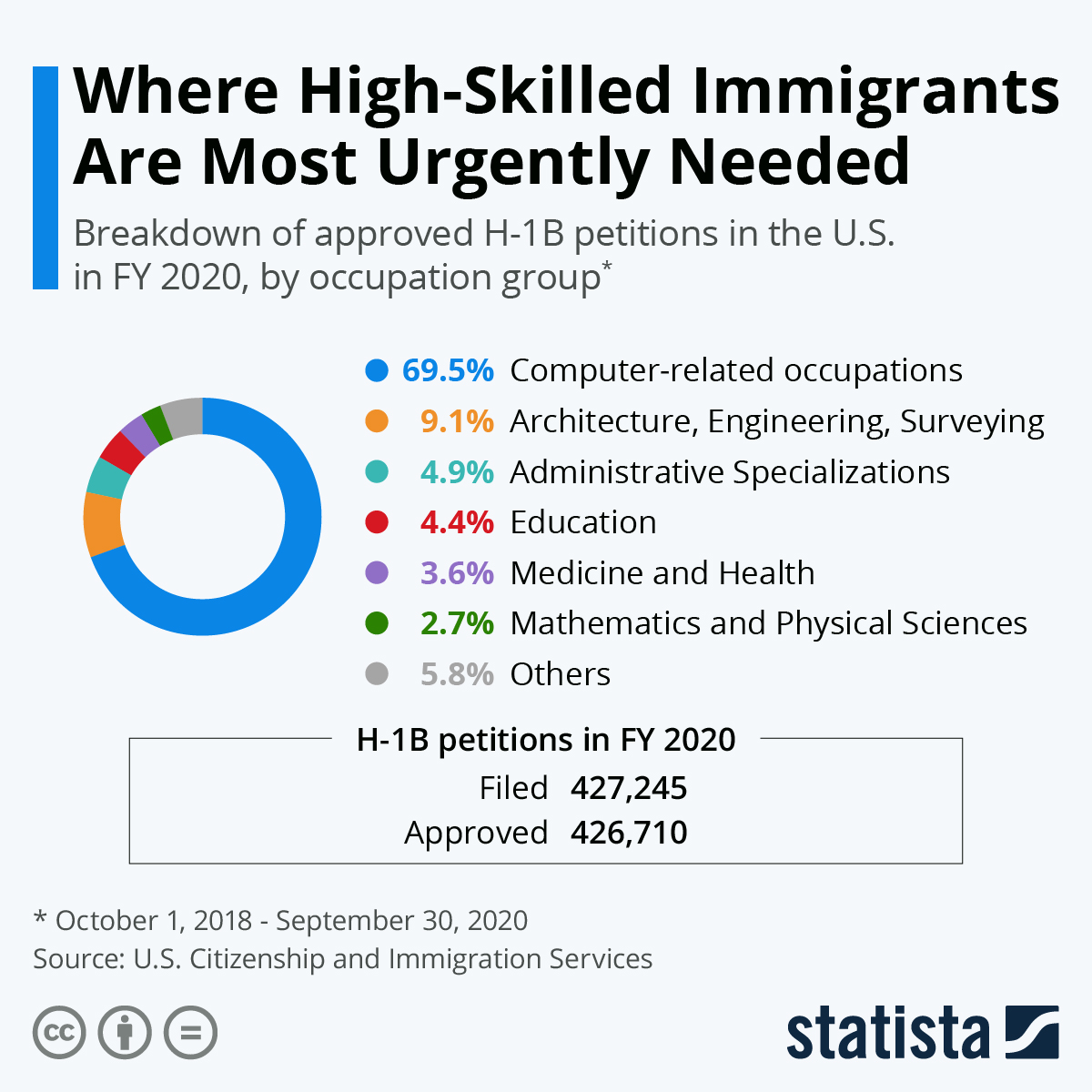

- The U.S. administration held a historically unprecedented third lottery draw for high-tech job visas after the number of immigrants in the program dropped to a decade-low this year:

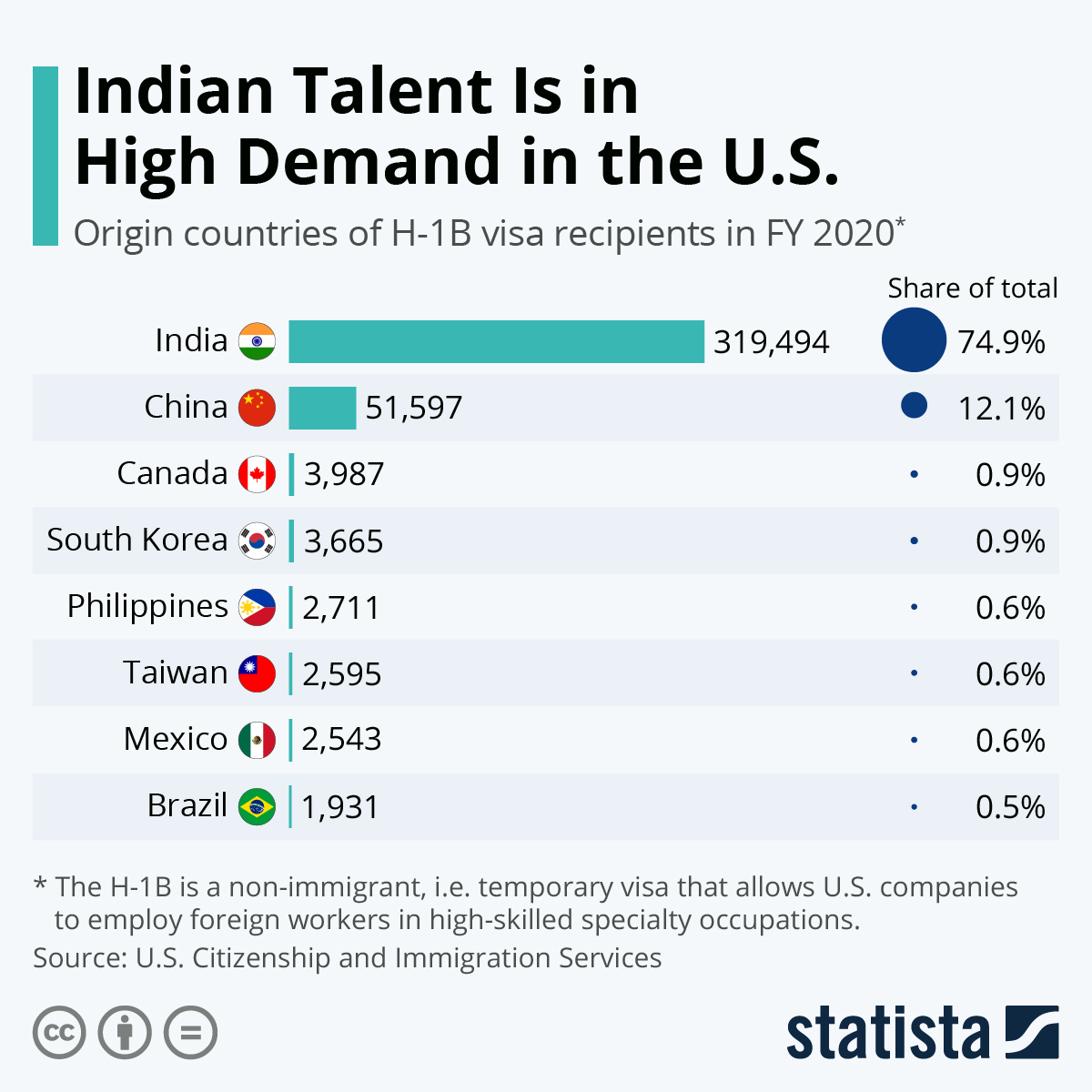

- Data shows talent from India is in the highest demand:

- More than 2.4 million travelers were screened at U.S. airports Sunday, the most since the start of the pandemic.

International Markets

- At least 200 cases of the COVID-19 Omicron variant have been found in over a dozen countries, led by South Africa’s 114 infections. The EU’s 44 infections with the strain have included cases with zero or mild symptoms, health officials report.

- Brazil reported Latin America’s first two cases of the COVID-19 Omicron variant yesterday, and Saudi Arabia reported the first Omicron case in a Gulf Arab nation.

- The U.K. reported 39,716 new COVID-19 infections and 159 virus fatalities Tuesday. Lawmakers reimposed mask requirements in most indoor public spaces amid a drive to significantly boost inoculations.

- France reported a record 47,177 new COVID-19 cases Tuesday, as regulators work to authorize shots for children as young as age 5.

- Germany’s parliament is expected to vote by year’s end on a measure that would mandate COVID-19 vaccines for the general population and bar unvaccinated people from non-essential stores.

- Dutch hospitals are running out of ICU beds after new weekly COVID-19 cases hit a record high.

- Ireland and Sweden have imposed tighter testing measures for incoming travelers due to the COVID-19 Omicron variant.

- Finland significantly expanded its general COVID-19 vaccine mandate and will require digital passports to be used in most indoor public spaces.

- Switzerland could impose new remote work requirements and expand proof-of-vaccine requirements amid a surge in new infections.

- Despite having one of the highest COVID-19 vaccination rates in Europe, Portugal will open a new vaccine mega-facility in Lisbon amid a spike in new cases.

- Russia reported 32,648 new COVID-19 infections Tuesday, the lowest since mid-October.

- Greek senior citizens will receive a monthly $114 fine for not getting vaccinated against COVID-19.

- The EU medicines regulator indicated it would fast track approval of COVID-19 vaccines tailored to the Omicron variant. The U.K.’s AstraZeneca said it was open to retooling its vaccine if necessary.

- Returning Canadians will no longer need to test for COVID-19 when crossing the border if they spent less than three days abroad.

- Canada’s economy grew a faster-than-expected 5.4% in the third quarter, driven by a strong rebound in manufacturing activity.

- Surging energy costs pushed Euro zone inflation to 4.9% in November compared to the same time last year, the highest rate on record. German inflation hit a record high 6%, while inflation in France hit a 13-year high of 3.4%.

- Global inflation forecasts have been raised as economists warn consumers could start growing accustomed to faster price rises.

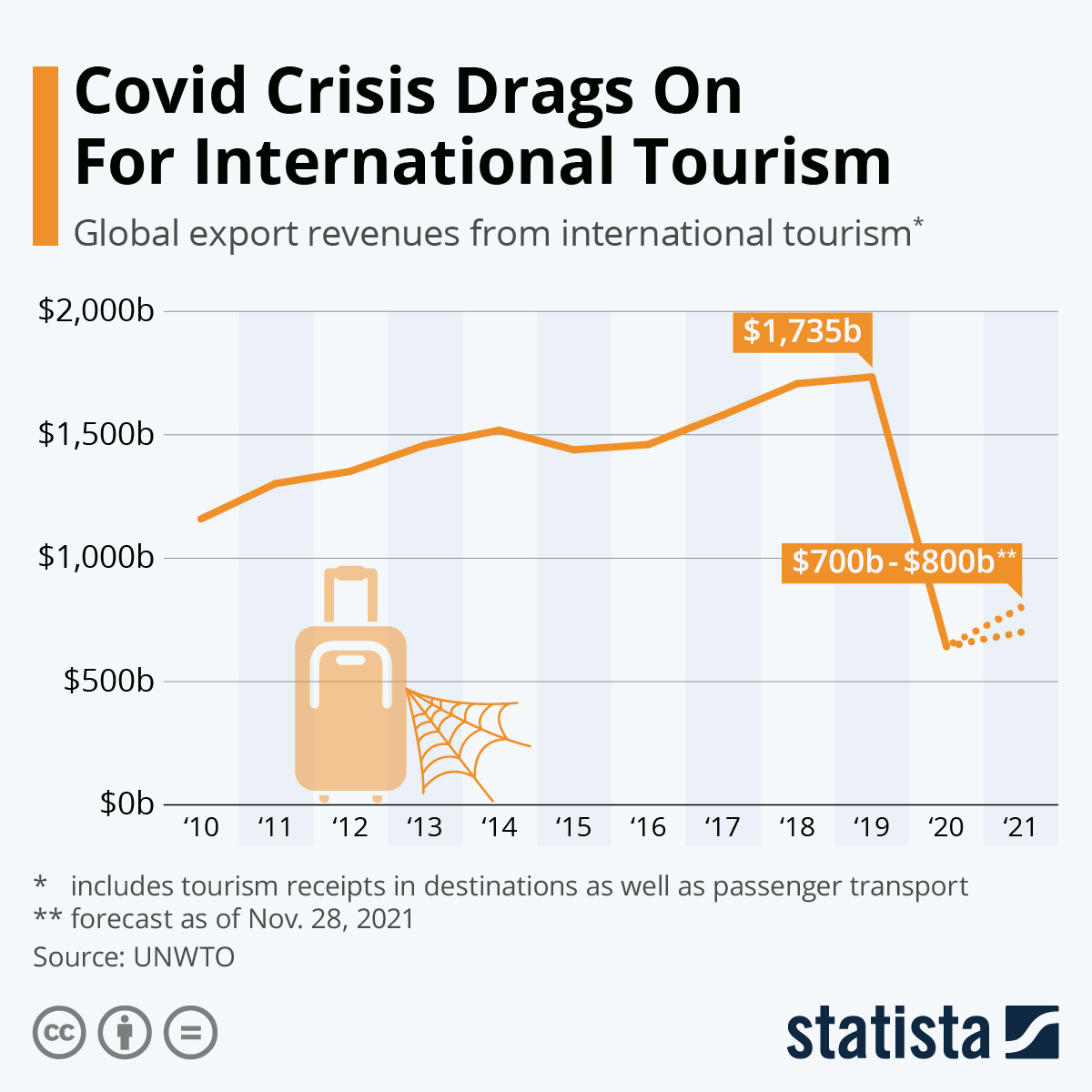

- Tourism spending will likely weaken in the economic fallout from the COVID-19 Omicron variant after rebounding sharply in the third quarter:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.