COVID-19 Bulletin: November 29

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices dropped more than $10/bbl Friday, the seventh-worst decline in history and the largest since April 2020, on fears of lower demand caused by the COVID-19 Omicron variant. WTI fell 13% to $68.15/bbl, while Brent dropped 11.2% to 73.02/bbl.

- Crude futures recovered ground in late morning trading, with WTI rising 4.1% to $70.94/bbl and Brent gaining 3.0% to $74.91/bbl. U.S. natural gas was 11.4% lower at $4.86/MMBtu.

- OPEC delayed a series of technical meetings until later this week to assess the Omicron variant’s impact on demand. Market watchers predict the group will take a cautious stance on continuing monthly output increases.

- The White House recommended new rules that would raise fees and impose greater limits for oil and gas development on federal lands.

- Asian LNG prices slipped last week to $36.1/MMBtu, remaining just $2.40 shy of a mid-October record.

- After reporting strong financials in the third quarter, Brazil’s Petrobras will expand crude production investments to $68 billion by 2026, $13 billion higher than earlier plans.

- Italy’s Enel group plans to exit coal and gas generation by 2027 and 2040, respectively, while boosting green power investments by $191 billion this decade.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Southern California utilities cut power to almost 50,000 homes on Black Friday to avert wildfires.

- U.S. gasoline barges were sent to Vancouver to help manage a fuel shortage caused by flooding and landslides two weeks ago. Lasting impacts from the severe weather have pushed up lumber futures 45% the past week.

- U.S.-bound containerized imports rose an annual 2.7% in October to a record 2,995,176 TEUs, more than 20% higher than pre-pandemic levels.

- The Ports of Los Angeles and Long Beach handled 6 million empty export containers from January to October, 20% higher than in all of 2019.

- The U.S. Navy has begun handling some containerized freight imports in Southern California.

- Hapag-Lloyd is asking customers to divert refrigerated containers from China’s Port of Dalian due to COVID-19 lockdowns.

- China is curtailing the flow of information coming out of its ports over national security concerns, with shipping lines reporting a reduced ability to accurately track activity.

- China replaced Japan as the world’s top shipowner, with a total of $191 billion in vessel assets.

- A Bloomberg gauge of supply disruption in the U.S. declined in October while remaining at historically elevated levels, suggesting shortages are becoming less severe.

- FedEx expects holiday shipping volumes to jump 10% this season to record levels, translating to 100 million more packages compared to 2019.

- Amazon has allocated more than $4 billion to meet demand this holiday season, including chartering its own containerships and doling out sign-on bonuses up to $3,000 for seasonal workers.

- Amazon is adding an extra layer of upstream inventory warehousing between its fulfillment and distribution centers. Amazon has nearly doubled the size of its fulfillment network since the start of the pandemic, adding more than 450 new facilities used to store, sort and ship items, to keep up with surging customer demand.

- Protesters blocked operations at 15 Amazon sites in Europe on Black Friday, the firm’s biggest sales day of the year.

- Walmart completed its first ever drone delivery in Farmington, Arkansas, with plans to operate the service 8 a.m. to 8 p.m. every day.

- Cadillac rebranded its holiday-season campaign from “Season’s Best Sales Event” to “Season’s Best” after cancelling sales events due to a shortage of cars.

- Industrial metals prices rebounded several percentage points late last week on news that Chinese regulators would dial back crackdowns on the nation’s property markets, likely increasing demand for steel.

- Germany’s new government wants to increase the nation’s freight rail transport by 25% and have at least 15 million electric vehicles on roads by 2030.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply.

Domestic Markets

- White House officials are rushing to get scientific data on a new and potentially more transmissible COVID-19 variant first identified in South Africa. The Omicron strain may be more infectious than Delta while posing a higher risk of re-infection, health officials warn, and is likely already present in the U.S. Researchers expect currently available vaccines to retain their effectiveness against the strain, while there are no indications that it causes more severe symptoms.

- The U.S. reported 28,131 new COVID-19 infections and 103 virus fatalities Sunday. Cases were up 18% on average the past week.

- Michigan’s COVID-19 case rate was more than triple the national average last week, as hospitalizations approach new records with more than 85% of ICU beds currently filled.

- New York declared a state of emergency to expand hospital capacity ahead of an expected wave of new Omicron virus cases. New York City’s COVID-19 positivity rate has risen above 2% for the first time since September, causing the number of virus-related hospitalizations to jump 25% over the past two weeks.

- Merck’s new COVID-19 antiviral pill was shown to be only 30% effective in preventing virus hospitalizations and deaths, a significant downgrade from previous estimates.

- Moderna could release a reformulated COVID-19 vaccine to target the Omicron variant as early as next year.

- Health experts have largely settled on a six-month interval for getting COVID-19 boosters.

- The latest data shows U.S. federal workers are more than 92% compliant with the White House’s COVID-19 vaccine mandate.

- U.S. Armed Forces deaths from COVID-19 have fallen to zero after more than tripling the last several months, with officials crediting a 98.5% vaccination rate.

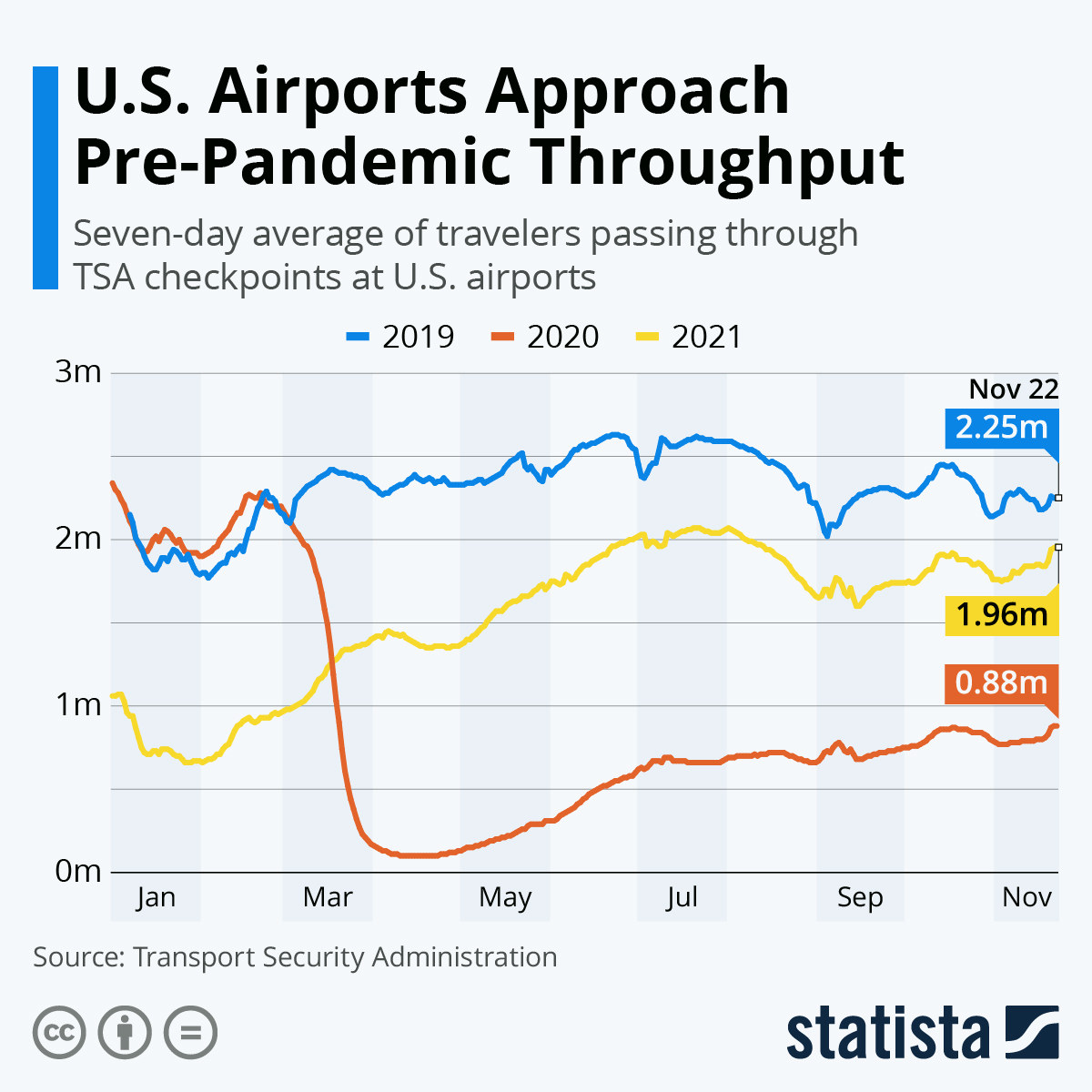

- U.S. stock indices saw their worst day of 2021 on news of the COVID-19 Omicron variant, slumping more than 2.2% across the board on Friday. Shares of U.S. international airlines fell more than 8% on an expected reduction in travel, even as Thanksgiving travel volumes surged to their highest of the pandemic:

- Federal Reserve officials have downplayed the COVID-19 Omicron variant, while also signaling they are more willing to speed up reductions in monthly asset purchases to battle inflation.

- U.S. businesses are urging caution on changing operations over fears of the COVID-19 Omicron variant.

- Survey results suggest half of large U.S. firms have delayed implementing the White House’s COVID-19 vaccine mandate due to uncertainty over current legal challenges.

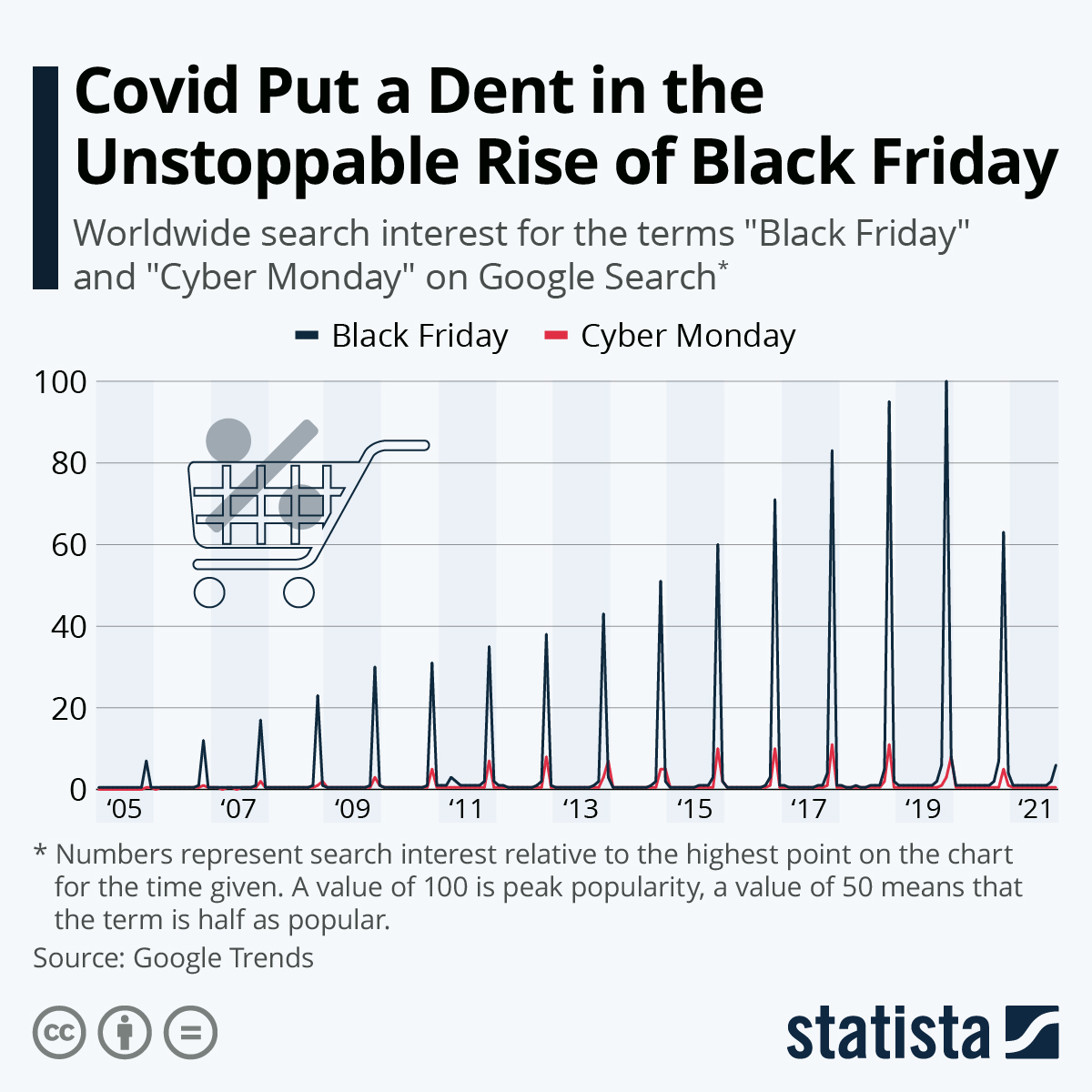

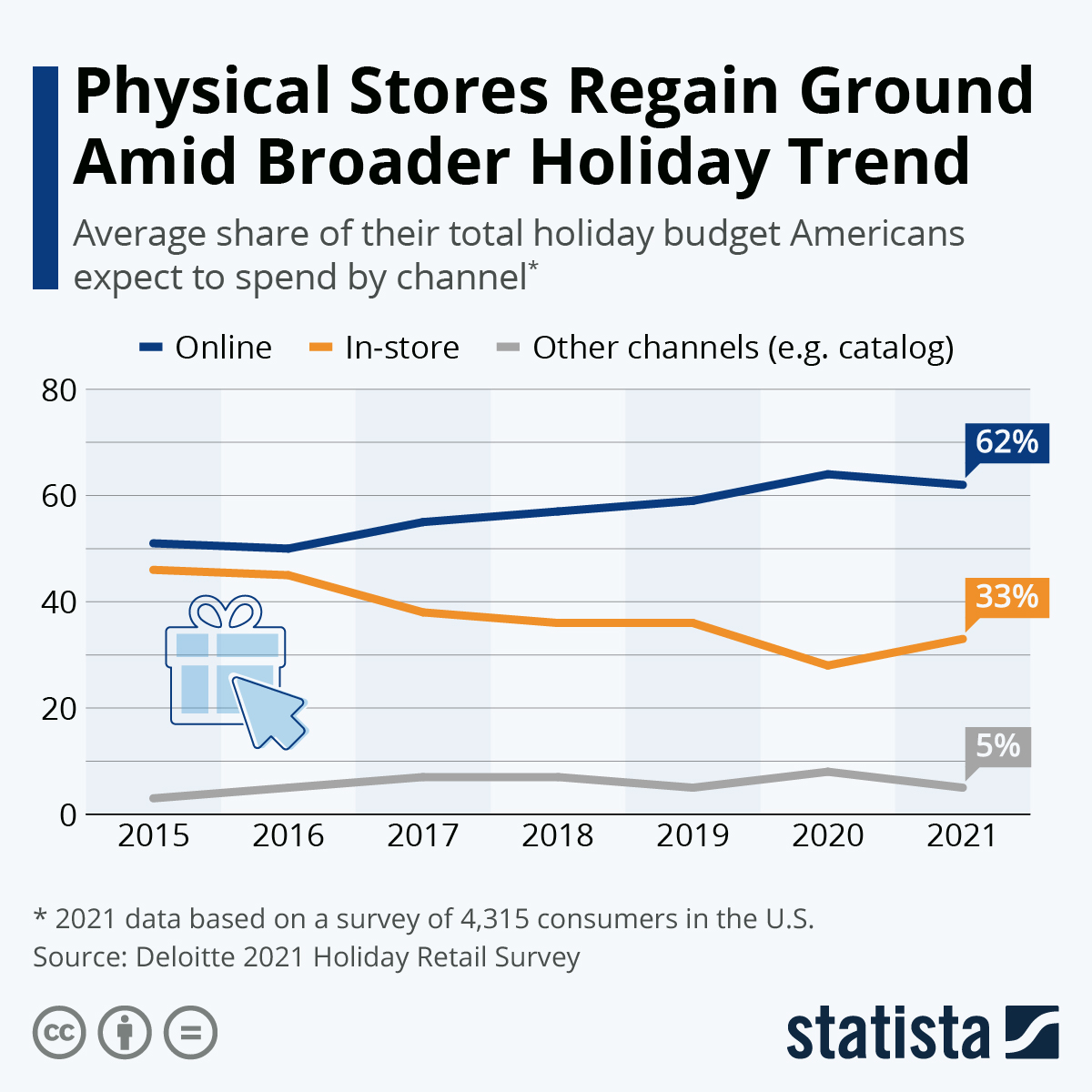

- After in-store Black Friday shopping fell sharply the first year of the pandemic…

…early data show retail shopping on Thanksgiving weekend was up over 60% this year.

- U.S. shoppers got an earlier start to the holiday season this year, with online spending rising 20% the first three weeks of November compared to 2020. Overall holiday spending is expected to rise 10.5% from last year’s record,

- U.S. economic growth in the third quarter was slightly better than initially reported, new spending data shows.

- Private–equity firms have announced a record $944.4 billion of buyouts in the U.S. so far this year, more than double the previous peak in 2007.

- The median sales price for a new home was up 18% in October from a year earlier at $407,700.

- Average rent prices rose 13% the past month, the largest rise in two years.

- Sales of new private jets are booming, with orders rising more than 50% in the third quarter from the same time last year.

International Markets

- Cases of the COVID-19 Omicron strain have now been detected in Australia, Belgium, Botswana, Britain, Denmark, Germany, Hong Kong, Israel, Italy, the Netherlands, France, Canada and South Africa, spurring many nations to reimpose pandemic restrictions and travel curbs over fears of importing the variant. The U.S. and EU have so far limited new travel curbs to South Africa and neighboring countries.

- The Netherlands reimposed stricter pandemic lockdowns after 13 Omicron cases were discovered Sunday.

- Germany reported 76,414 new COVID-19 infections Friday, a record, as the government edges closer to making vaccines mandatory for the general population. The nation also surpassed 100,000 total virus fatalities.

- Hungary, the Netherlands, Slovakia and the Czech Republic are each reporting record new cases of COVID-19.

- Italy has barred unvaccinated people from many indoor public spaces, including restaurants and sports venues.

- COVID-19 infections in Switzerland rose 50% the past week. Most Swiss voters in a referendum approved the government’s COVID-19 certificate program.

- Portugal will make remote work mandatory the week of Jan. 2 to get ahead of an expected spike in COVID-19 cases.

- Early data compiled by Israeli researchers suggests the COVID-19 Omicron variant does not lead to more severe symptoms than other more prevalent strains.

- The EU approved Pfizer’s COVID-19 vaccine for children as young as age 5.

- Australia’s New South Wales dropped most remaining pandemic restrictions, formerly the strictest in the world, as the state’s full COVID-19 vaccination rate approaches 95%.

- Despite the emergence of the Omicron variant, New Zealand will lift some pandemic restrictions this week but will maintain tough border control measures for another five months.

- Colombia will extend its COVID-19 state of emergency through February because of the emergence of the Omicron variant.

- Rising COVID-19 infections and hospitalization rates coupled with news of the new Omicron variant prompted South Korea to postpone the further lifting of pandemic restrictions.

- Japan joined a growing list of countries to close borders to foreign travelers due to the new COVID-19 Omicron variant. More than 80% of people in Japan plan to continue wearing masks in public after the pandemic ends, survey results show.

- The EU will likely adopt a nine-month interval for the efficacy of COVID-19 vaccinations, after which a person must receive a booster to travel.

- Britain could soon approve the U.S.’s Novavax COVID-19 vaccine after clinical data showed the shot was 90% effective with fewer side effects than current options.

- Industrial profit in China grew 24.6% in October from a year ago, the second month of double-digit increases.

- The EU will grant $2.54 billion to Greece for meeting its target of 61% renewable energy consumption by 2030.

- Nissan, an early pioneer in electric vehicles, will seek to regain its prominence by investing $17.6 billion to introduce 20 new models over the next five years.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.