COVID-19 Bulletin: November 18

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices dropped to their lowest level in six weeks Wednesday following forecasts of looming oversupply from the International Energy Agency and OPEC. Futures were higher in late morning trading, with WTI up 0.3% at $78.61/bbl and Brent up 0.7% at $80.82/bbl. U.S. natural gas was 1.7% higher at $4.90/MMBtu.

- OPEC officials say oil will remain the most used global energy source through at least 2045, when it will account for roughly 28% of the world’s energy consumption. The White House has begun auctioning drilling rights for 80 million acres of federal waters in the Gulf of Mexico, the region’s largest ever sale. On Wednesday, U.S. oil companies bid more than $191 million for 308 tracts covering 1.7 million acres.

- China is releasing crude from strategic national stockpiles, a government official indicated, just days after the U.S. invited the nation to participate in a joint sale that could help lower energy costs.

- The completed Nord Stream 2 gas pipeline from Russia to Germany could remain out of commission until March of next year, sparking fears of extremely high European gas prices throughout winter.

- The U.S. administration will distribute $4.5 billion of leftover pandemic relief dollars to renters this winter to help cover high heating bills and utility costs.

- The White House has designated more than 240,000 acres offshore central California for wind turbine development.

- India’s coal consumption is projected to rise over the next several years despite pledges from other nations to halt financing. On Wednesday, the government was forced to shut down half the coal plants surrounding its capital area until Nov. 21 due to hazardous levels of air pollution in recent days.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Flooding and landslides in British Columbia shut portions of Canadian National and Canadian Pacific rail lines, disrupting operations at the Port of Vancouver.

- Intense flooding in Washington state left 75% of homes in the town of Sumas damaged by floodwater, as utilities work feverishly to restore power to the northwest coastal region. Residents of nearby Vancouver have been stranded for days after the storm severely damaged road and rail links, prompting the Canadian government to deploy air force personnel to help with evacuations.

- A wildfire spread rapidly to 133 acres in Estes Park, Colorado, on Tuesday, prompting mandatory evacuations for nearby residents and businesses.

- Empty container volumes at Southern California ports have risen 30% this year and led to significantly reduced space for imports, as port stakeholders begin urging terminals and shipping lines to accept as many of the boxes as possible.

- The Ports of Los Angeles and Long Beach set a record this week of 86 container ships waiting offshore for a berth, as newly expanded 24/7 operations have not been adopted by inland shippers as quickly as port officials expected.

- Israel’s ZIM Integrated Shipping Services has suspended trans-Pacific service to Southern California due to port congestion.

- The St. Lawrence Seaway connecting the Atlantic Ocean to the Great Lakes has avoided the congestion and turmoil affecting coastal ports, experiencing a steady 1.9% annual increase in traffic between March and October.

- Dutch port operator APM Terminals will build a $1.5 billion multi-modal terminal at Louisiana’s Plaquemines Port Harbor, with expected capacity of more than 22,000 TEUs.

- The Chicago-based maker of Beanie Babies has booked more than 150 cargo flights from China to the U.S. to ensure products are available for Christmas.

- FedEx became the first high-profile company to shift strategy because of Hong Kong’s tough pandemic regulations, announcing it would close its island crew base and relocate pilots overseas.

- Cardinal Health will begin testing the use of drones for deliveries of pills, inhalers and other items to U.S. pharmacies in the Charlotte, North Carolina area next year.

- Medical technology manufacturers are asking the federal government to intervene and prioritize semiconductor chips for critical healthcare products amid the global shortage.

- After a year of disruptive computer chip shortages, Ford is entering the chip business with a pact to collaborate with GlobalFoundries to design semiconductors.

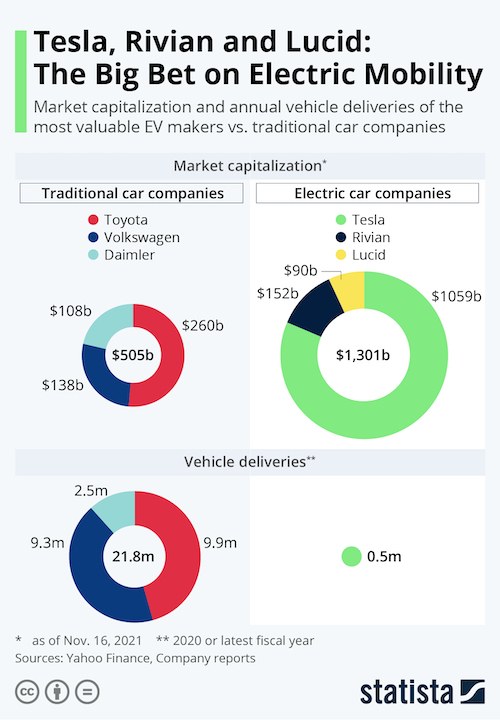

- Volkswagen will suspend electric-vehicle (EV) production at two German plants next week due to the ongoing global chip shortage. Separately, the automaker plans to double staff levels in its charging and energy division as competition grows with American EV-maker Tesla and red-hot startup EV-maker Lucid, which just this week overtook the market value of Ford:

- Roughly 70% of electronics manufacturers plan to raise prices by as much as 8% in 2022 to offset rising material and labor costs.

- Prices for common dessert ingredients including flour, wheat, berries, soybean oil and other commodities have risen by as much as 15% due to global droughts and wildfires. The price of beef, meanwhile, has increased more than 20% since last October.

- Starbucks customers are returning to stores at record levels, prompting the company to add new suppliers and increase production of oat milk, eggs and breakfast sandwiches ahead of the busy holiday season.

- Workers at Deere ratified a new six-year contract Wednesday, ending a month-long strike of more than 10,000 workers at the U.S.’s largest farm and construction machinery company.

- Union Pacific is asking federal regulators to delay and extend their review of the proposed merger of Canadian Pacific and Kansas City Southern rail lines.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 111,106 new COVID-19 infections and 1,622 virus fatalities Wednesday.

- Average U.S. COVID-19 cases have risen to more than 80,000 per day, the highest in a month. CDC computer models suggest the nation could see more than 14,400 virus deaths over the next two weeks.

- COVID-19 cases in the Midwest have surged the past week, with the largest increases in Indiana (+62%), Michigan (+47%) and Minnesota (+47%). U.S. Defense Department personnel were deployed in Minnesota to help the state’s healthcare facilities manage a spike in virus hospitalizations.

- Maine reported 280 patients hospitalized with COVID-19 Wednesday, its third record in as many days. The state’s governor expanded vaccine booster eligibility to anyone over age 18.

- COVID-19 cases in New York jumped more than 25% last week.

- Chicago reimposed self-isolation requirements for travelers to 38 states with a high rate of COVID-19 transmission.

- Diabetes was a factor in more than half of Houston’s COVID-19 deaths, the city said.

- OSHA is suspending enforcement of the White House’s COVID-19 vaccine mandate for large businesses while court challenges work their way through the legal system.

- More than 80% of Americans over age 12 have received at least one COVID-19 vaccine dose, a milestone.

- The U.S. is expected to authorize both Pfizer and Moderna COVID-19 booster shots for anyone over the age of 18 by the end of the week.

- The White House could soon change the definition of “fully vaccinated” to include only those who have received a COVID-19 booster dose.

- Health experts predict the pandemic could shift to an “endemic” by next year, where COVID-19 case counts would be constantly maintained at a baseline level, potentially below 10,000 per day. Case rates this low would rival those of the normal flu, Bill Gates said.

- Disney Cruise Line will require all passengers over age 5 to be vaccinated against COVID-19 starting in January.

- Roughly 40% of TSA workers have yet to be vaccinated against COVID-19 ahead of the government’s Nov. 22 deadline.

- Two-thirds of Americans plan to celebrate Thanksgiving with the same number of people as before the pandemic, a new survey shows.

- As U.S. COVID-19 cases pick up, health officials are pointing to continued research showing masks cut the rate of virus transmission by more than 50%, while frequent hand-washing and social distancing add to protection.

- The White House announced plans to invest billions to expand domestic COVID-19 vaccine production by 1 billion doses per year starting next year.

- There were 268,000 first-time jobless claims last week, essentially flat with the prior week and near the pandemic low.

- JPMorgan Chase expects the U.S. Federal Reserve to raise interest rates in September 2022 after the nation’s goal of full employment is met.

- Foreign investments in U.S. property dropped 31% in the year to March 2021, as pandemic restrictions halted most international travel.

- More than 58 million people flew on U.S. airlines in September, double the same time last year but still 20% lower than pre-pandemic levels.

- British Airways and American Airlines will start offering free COVID-19 tests to trans-Atlantic passengers next year, a bid to boost international business travel.

- Lowe’s joined a growing list of U.S. retailers posting better-than-expected third-quarter results despite prolonged supply chain congestion.

- The parent company of off-price retailers TJ Maxx, Marshalls and HomeGoods reported a 24% rise in quarterly sales compared to the same time last year.

- Facing increased pressure to update its repair policies, Apple will begin making parts and tools available for customers to fix their own devices starting next year.

- Amazon announced plans to use new curbside-recyclable packaging that it claims will eventually eliminate the need for bubble bags and plastic liners.

International Markets

- Germany shattered its previous single-day COVID-19 case count, reporting more than 65,000 infections Wednesday. The nation administered 436,000 COVID-19 vaccinations Tuesday, the most in three months, spurred by the government’s threat to impose pandemic restrictions exclusively on unvaccinated people.

- The Netherlands saw a 44% increase in COVID-19 cases and a 12% increase in virus hospitalizations the past week, as lawmakers consider imposing restrictions exclusively on unvaccinated people.

- COVID-19 infections in the U.K. dropped slightly week over week, a promising sign amid a recent spike in cases.

- Northern Ireland will require proof of COVID-19 vaccination starting next month for entry into pubs, restaurants, theaters and indoor and outdoor events.

- Hungary saw 10,265 new COVID-19 infections Wednesday, the most since March.

- The Czech Republic reported a record 22,479 COVID-19 cases Tuesday, as unvaccinated people face new restrictions on access to public events and services.

- COVID-19 deaths in Russia set a record on Thursday for the second consecutive day.

- European countries are reimposing work-from-home rules as COVID-19 cases spike.

- Belgium strengthened its indoor mask mandate and imposed a new work-from-home requirement amid a fourth wave of COVID-19.

- China reported just eight new local COVID-19 cases Wednesday, its third day of declines from a recent outbreak.

- South Korea experienced its second highest COVID-19 case count of the pandemic just three weeks after easing pandemic restrictions.

- COVID-19 deaths across North, Central and South America decreased 17% over the past week, continuing a weeks-long decline.

- The EU is expected to approve Novavax’s COVID-19 vaccine in the coming weeks, making it the fifth shot authorized in the bloc.

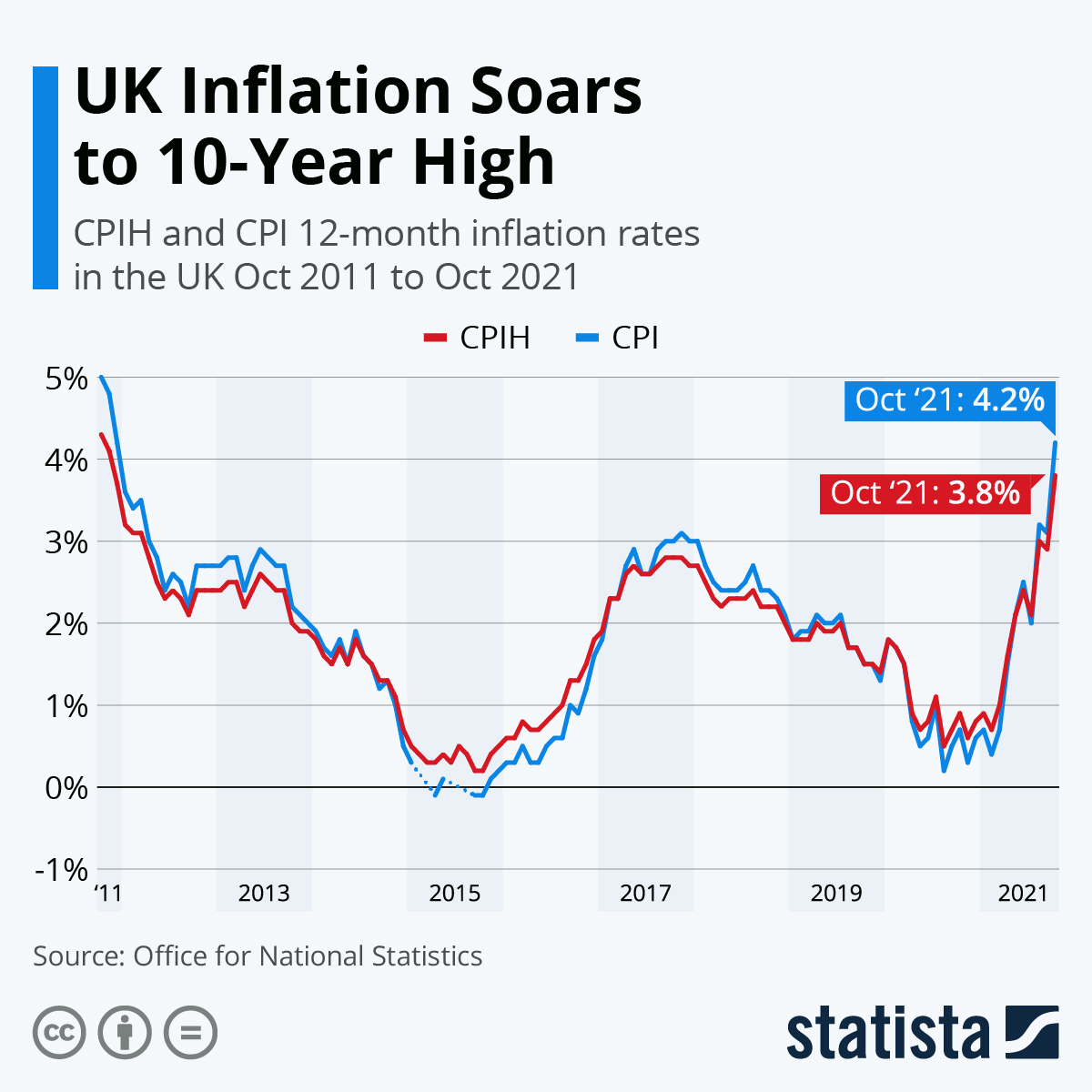

- Canadian inflation rose 4.7% in October, a nearly 20-year high led by energy prices. The U.K. saw a similar inflation spike to a 10-year high:

- Proposed EU legislation would make it harder for member states to send their trash to low-income nations, a measure officials hope would spur more recycling of metals and plastic.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.