COVID-19 Bulletin: November 17

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- The White House asked the FTC to investigate whether oil and gas companies are illegally inflating gasoline prices.

- Oil prices settled mixed on Tuesday as expected production increases over the next few months offset concerns over continued tight supplies. Futures were lower in late morning trading, with WTI down 2.3% at $78.89/bbl and Brent down 1.7% at $81.03/bbl. U.S. natural gas futures were 5.1% lower at $4.91/MMBtu.

- Lawmakers are calling on the White House to release crude from the nation’s strategic reserves to help lower gas prices that have risen 24% the past six months, despite U.S. Energy Information Administration assessments that the move would have a limited impact on markets.

- OPEC anticipates oil markets could be oversupplied as soon as next month; the forecast was shared with member nations ahead of the group’s next output meeting on Dec. 2.

- The International Energy Agency raised its forecast for Brent crude next year to an average of $79.40/bbl, up from the estimated $71.50/bbl for 2021.

- Gas prices in California continue to reach new records, with the average price for a regular gallon rising to $4.68 Monday.

- Two more U.K. energy suppliers, squeezed by soaring wholesale prices, have closed.

- Iraq will send Lebanon 500,000 tonnes of gas oil to help it manage a severe power shortage.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Washington state’s governor declared a state of emergency after intense flooding and landslides knocked out power to northwest coastal regions and forced hundreds to evacuate. Neighboring British Columbia, Canada, also experienced states of emergency and evacuations, while most of the region’s highways remained closed.

- Operations at the northern Chinese Port of Dalian were partially suspended following an outbreak of roughly 50 COVID-19 cases, with city officials also limiting outbound residential travel and ordering schools to go remote.

- The number of import containers at the Port of Los Angeles has fallen by a quarter to 71,000 since last month, with the threat of possible container dwell fees cited as a major factor in clearing yards.

- The World Trade Organization saw its goods trade barometer drop to 99.5 points in November, down from a record reading of 110.4 in August, as production and supply chain disruptions cool demand for imports across the globe.

- The Baltic Exchange’s dry bulk sea freight index fell 6.1% to 2,591 Tuesday, its lowest level since June.

- Container shipping rates, currently up 300% from pre-pandemic levels, could take up to 26 months to ease back to normal, maritime data firm Sea-Intelligence predicts.

- The average spot rate for capesize bulkers fell 9.8% Tuesday to $28,059 per day, with further declines expected over the next several months.

- Constrained freight volumes pushed the shipments component of the Cass Freight Index up just 0.8% year over year in October, while the expenditures index rose by more than 37% for the same period.

- Norwegian car carrier Wallenius Wilhelmsen posted $65 million in third-quarter earnings, the most since 2017, despite lower volumes.

- The California Energy Commission has approved a three-year, $1.4 billion plan to boost statewide electric vehicle infrastructure ahead of the state’s planned phaseout of gas-powered vehicle sales by 2035.

- Salaries for truck drivers and warehouse workers in the food service industry have risen between 12% and 17% since 2020, new survey results show.

- E-commerce furniture retailer Wayfair carried over 40,000 TEUs across its international network in 2020, putting it on par with the top 30 U.S. importers by volume.

- Gaming chipmaker Nvidia’s CEO expects the global chip shortage to dent the firm’s production at least through 2022 and possibly longer.

- Sixty-five companies in the S&P 500 had net-zero emissions targets in place as of Oct. 31 before the COP26 climate summit in Scotland, with suppliers increasingly pressured to provide climate data and improve their carbon footprints.

- The EU is proposing new rules for companies selling commodities such as soy, beef, palm oil, wood, cocoa and coffee that will go toward ensuring limits on deforestation and other harmful practices in countries that produce them.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 87,481 new COVID-19 infections and 1,448 virus fatalities Tuesday.

- The U.S. reported over 122,000 new COVID-19 cases in children last week, up 22% from two weeks ago.

- Arizona reported 3,240 new COVID-19 cases and 83 deaths Tuesday amid a broad rise in the state’s virus metrics.

- Vermont and New Hampshire are both experiencing two of the sharpest increases in COVID-19 infections in the U.S., with case rates rising by a respective 60% and 56% the past two weeks.

- Illinois reported 22,600 new COVID-19 infections the past week, a 29% rise from the week prior.

- Michigan surpassed Minnesota as the worst COVID-19 hotspot in the nation, with the state’s seven-day case rate rising to more than 500 per 100,000 people while hospitalizations increased 50% the past month.

- Officials in Minnesota are prepping to open COVID-19 booster eligibility to all adults amid the recent spike in cases, which some health experts attribute to more people staying indoors as the weather gets colder.

- West Virginia and Arkansas opened boosters to all adults yesterday.

- The White House is looking to expand access to COVID-19 booster shots to all U.S. adults later this week.

- Pfizer formally applied for FDA approval of its COVID-19 antiviral pill, which was 89% effective in preventing hospitalizations and deaths in trials. The government will pay $5 million for its first large order of the pill, slated for delivery next year, and also placed a $2 billion order for a previously approved antibody treatment from GlaxoSmithKline.

- The CDC added Iceland, Hungary and the Czech Republic to its highest-risk category for travel due to rising COVID-19 cases in the regions.

- Despite encouragement for vaccinated Americans to gather for the holidays this season, health experts are still recommending people get rapid tests prior to meeting indoors.

- New York City will fully reopen Times Square for people vaccinated against COVID-19 this New Year’s Eve.

- Washington, D.C. will lift its indoor mask mandate in bars, restaurants and gyms starting Monday amid declining COVID-19 infections.

- The University of Michigan is being hammered by a sudden flu outbreak, with more than 300 cases reported the past week alongside a 37% test positivity rate. The CDC is sending a team of investigators to Ann Arbor to investigate how the virus spread and check the effectiveness of this year’s flu vaccine.

- Amazon will pay a $500,000 fine related to its handling of COVID-19 reports at factories in California.

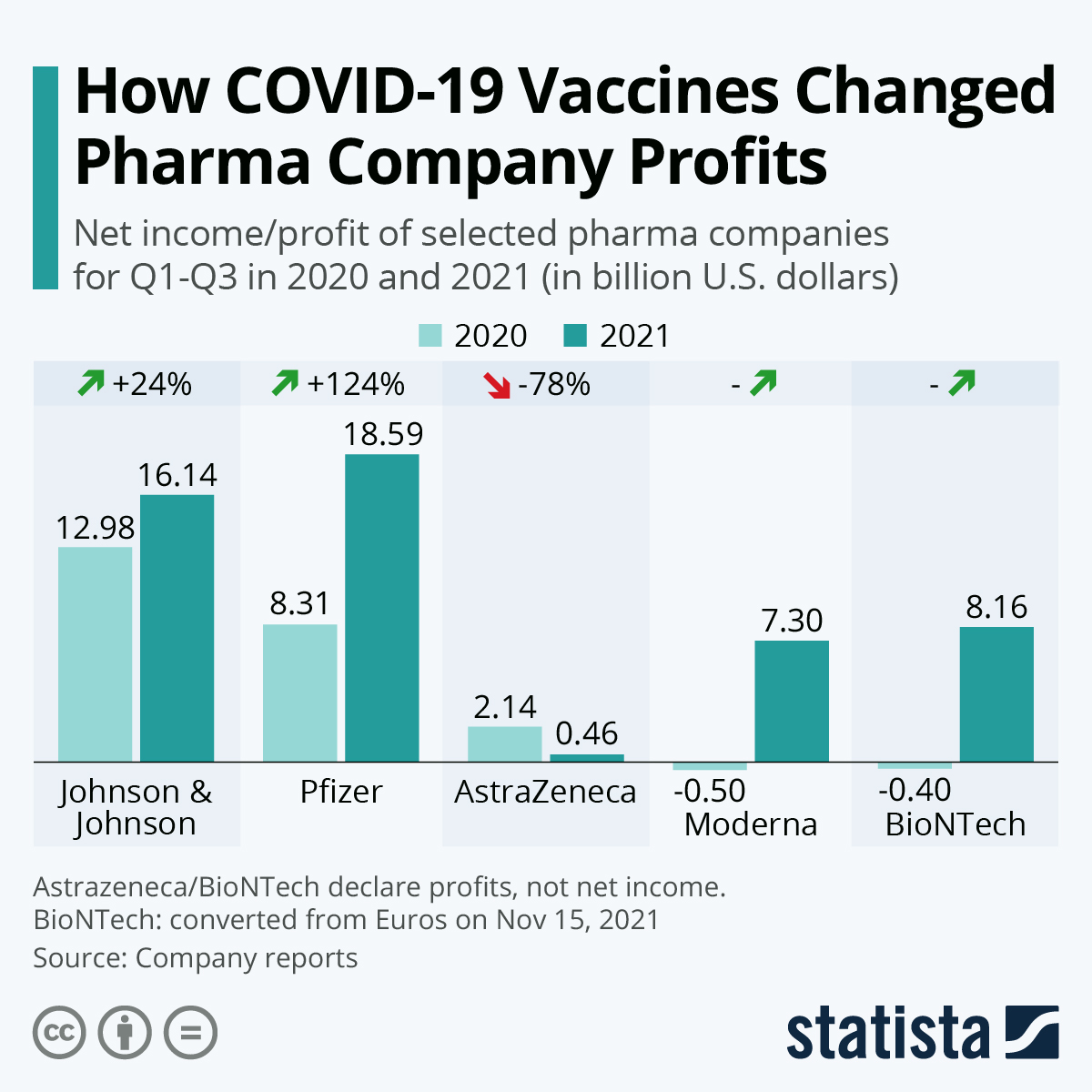

- Pfizer, BioNTech and Moderna are making a combined $65,000 every minute from the sale of COVID-19 vaccines.

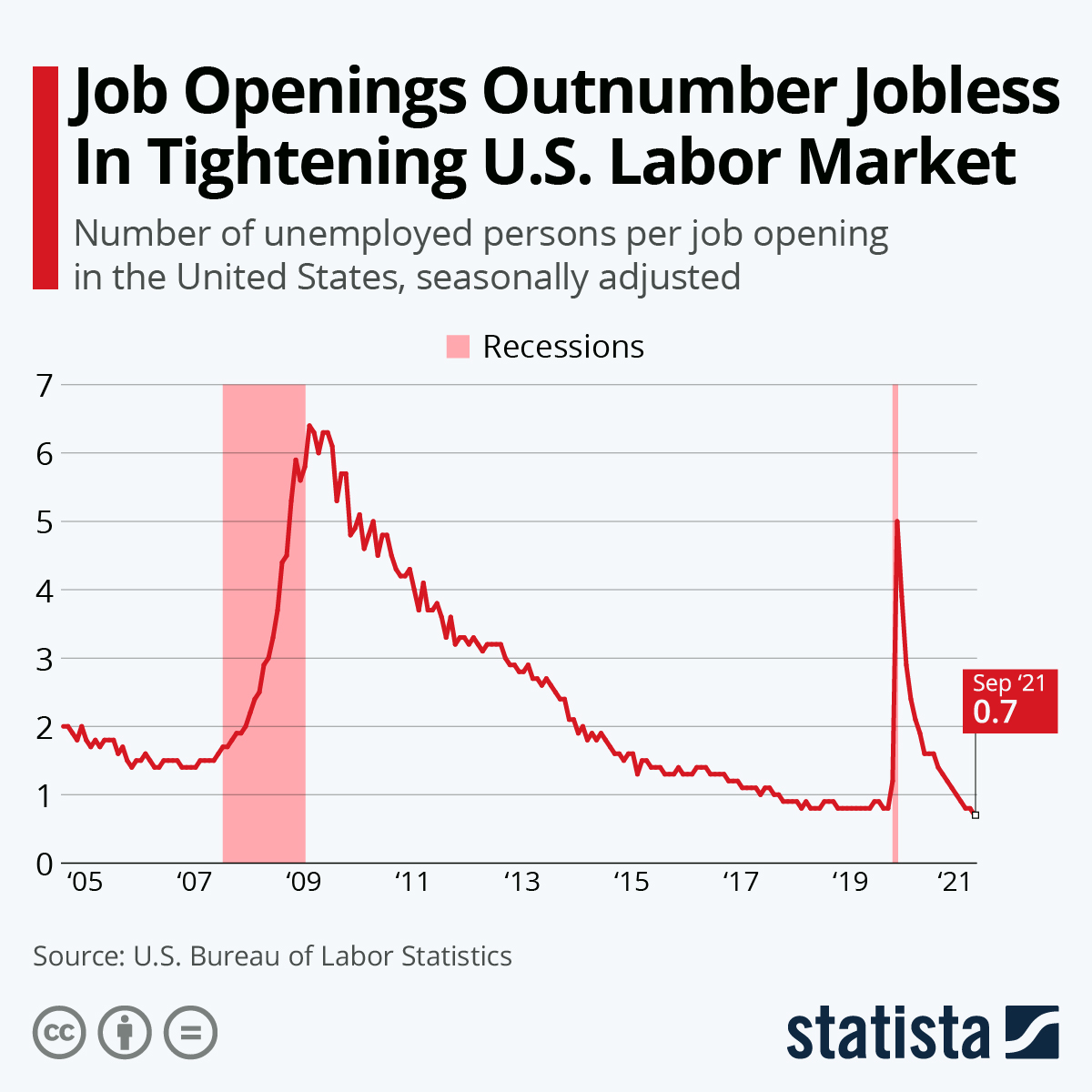

- The number of U.S. job openings remains roughly 3 million higher than the number of unemployed people, the most recent jobs data show:

- The U.S. Treasury Secretary warned that without Congressional action the U.S. could be unable to meet its debt interest obligations as soon as Dec. 15.

- This year’s spike in U.S. home prices prompted Fannie Mae and Freddie Mac to back loans approaching $1 million for the first time ever.

- Manhattan condo prices have risen 150% above pre-pandemic levels in some areas, new data shows.

- Boeing will pay $237.5 million to settle claims over safety issues that caused two 737 MAX jets to crash in 2018 and 2019, resulting in an emergency grounding of the aircraft for 20 months.

- Target posted a 12.7% rise in in-store sales and a 29% rise in e-commerce sales for the latest quarter, joining several other major U.S. retailers with strong quarterly results despite persistent supply chain disruptions.

- The average annual nurse salary has increased roughly 4% so far this year, well above the pre-pandemic growth rate of 2.6% as the healthcare industry sees one of the country’s tightest labor squeezes.

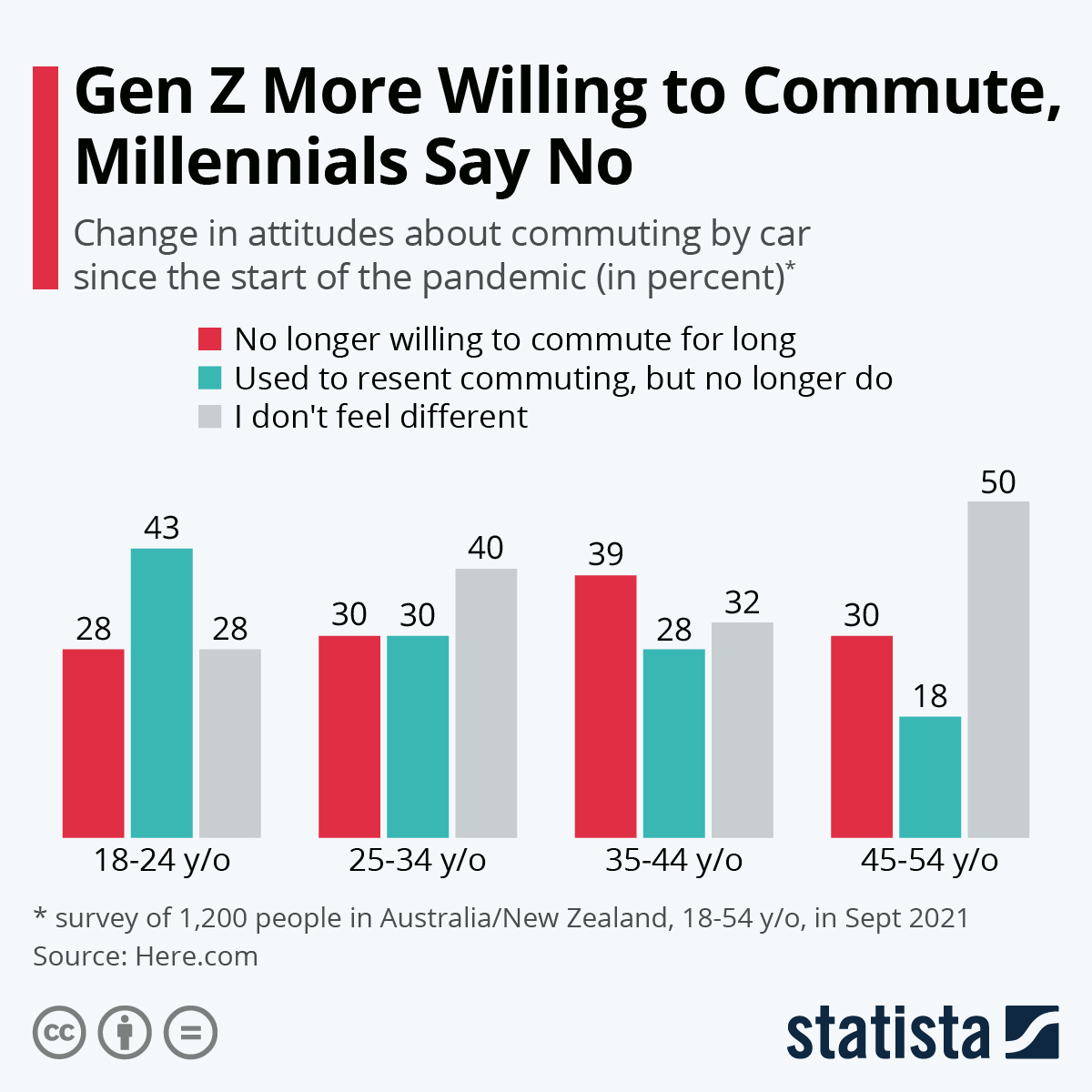

- New survey results suggest young workers up to age 24 are more eager to return to the office than older generations, with opinions reflected in shifting attitudes toward daily commutes:

- A joint project between Purdue University and Ford has led to a new electric-vehicle charging cable that could support re-charging in as little as five minutes, researchers claim.

- The EPA unveiled the U.S.’s first national recycling strategy Tuesday in a bid to achieve a 50% recycling rate by the end of the decade.

- Northern Indiana will be the site for the U.S.’s largest ever solar wind farm of 13,000 acres, more than 1,000 times the size of a football field.

- Philly Shipyard has inked a $197 million contract with Great Lakes Dredge & Dock for a new offshore wind vessel, its first commercial newbuild order since 2013.

International Markets

- Amid a record rise in COVID-19 cases, Germany will begin imposing tighter pandemic restrictions on unvaccinated people while canceling or requiring proof of vaccination for several national holiday events.

- Slovakia followed Austria in limiting access to shops and services for people unvaccinated against COVID-19.

- Portugal reported 1,816 COVID-19 infections Saturday, the most in two months, leading lawmakers to call for reintroducing pandemic curbs despite the nation having one of the highest vaccination rates in Europe.

- Ireland is reimposing a midnight curfew on bars, restaurants and nightclubs due to a recent spike in COVID-19 hospitalizations.

- Australia will begin vaccinating children as young as age 5 against COVID-19 in January.

- Mexico will begin testing teenagers as young as age 15 for COVID-19. Case numbers in the nation have declined for 16 consecutive weeks.

- Japan will start administering booster doses of Pfizer/BioNTech’s COVID-19 vaccine regardless of the initial shot a person received. The nation also announced plans to shorten quarantine times for some international business travelers.

- COVID-19 inoculations wane in effectiveness over time, regardless of recipient age, according to a study on the Pfizer vaccine in Israel.

- U.K. inflation rose 4.2% annualized in October, a 10-year high.

- Singapore Airlines is looking to resume Boeing 737 MAX flights before the end of the year following the aircraft’s prolonged regulatory grounding.

- Airbus announced its third large deal in the past week Tuesday, with 28 single-aisle planes contracted for a low-cost carrier in Kuwait.

- Boeing is nearing a deal to sell 80 737 MAX planes to Indian airline Akasa for an estimated $10 billion.

- French telecom giant Nokia announced ambitious plans to run its operations with 100% renewable electricity by 2025.

- German carmaker BMW plans to use chips manufactured by Qualcomm in its next generation of self-driving systems, set to begin production in 2025. The automaker expects profits to reach the upper end of forecasts this year following better-than-expected sales in October.

- Honda is asking its main part suppliers to lower carbon emissions 4% annually from 2019 levels starting in 2025, as the automaker aims for net-zero emissions by 2050.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.