COVID-19 Bulletin: November 12

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices recovered some of Wednesday’s losses yesterday on signs of a strong U.S. dollar and continued high inflation. Energy futures were lower in late morning trading, with WTI down 0.7% at $81.01/bbl and Brent down 0.7% at $82.26/bbl. U.S. natural gas was 5.0% lower at $4.89/MMBtu.

- U.S. prices for ethanol, the common corn-based additive in gasoline, have risen 50% since January to their highest levels since 2014, as traffic picks up on American roads.

- Amid soaring energy prices in every part of the world, OPEC downgraded forecasts for global oil demand in 2021 by 160,000 bpd from last month’s projection of 96.4 million bpd. Separately, the cartel fell short of planned output hikes for October, boosting production by just 217,000 bpd compared to an expected 253,000 bpd.

- Western Europe’s largest oil field shut down Thursday over a power outage at Norwegian refiner Equinor. Power was restored by evening, the firm said, with production resuming shortly after.

- Surging EU energy prices are threatening the bloc’s economic recovery, the European Commission warned, with output expected to grow 5% this year and then slow to 4.3% next year and 2.5% in 2023.

- China’s top oil and gas producer imposed a state of emergency for all its units in Beijing after four employees tested positive for COVID-19.

- Belarus threatened to halt natural gas supply through a pipeline connecting Russia and Germany that passes through the nation in response to threatened EU sanctions.

- India’s government is asking its state-owned oil producer ONGC to sell majority stakes in two large offshore oil and gas fields in a bid to boost domestic production.

- Efforts to reduce the use of coal for energy are creating a divide between developed countries and coal-dependent developing nations that lack the wherewithal to convert to cleaner fuels.

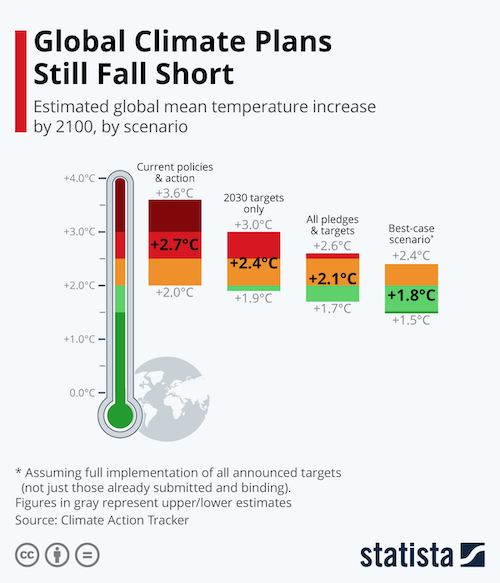

- France is the latest major addition to the Beyond Oil and Gas Alliance, a Denmark and Costa Rica-led alliance of nations that support fixing a date to end oil and gas production within their borders. The alliance, launched at the COP26 climate summit in Scotland, lacks any significant oil and gas producers promising to end extraction, mirroring difficulties with negotiations on several other measures to tamp down global temperatures over the next century:

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- La Niña climate conditions this winter could prolong drought conditions in the U.S. West and keep northern areas colder than usual, climate scientists warn.

- California is expanding weekend DMV hours and moving examiners from other parts of the state to the Los Angeles region, a bid to administer more commercial driving tests and help clear backlogs at the region’s ports.

- The ports of Los Angeles and Long Beach have seen a 20% reduction in the number of container ships spending more than nine days at dock following their recent shift to 24/7 operations, the White House said. Despite this, the backlog of vessels anchored offshore rose to 81 Tuesday, a record, while wait times for Los Angeles have doubled from September. Anxiety is growing with just four days left until new excess-dwell fees kick in for some 51,000 containers past time limits, potentially generating $100 million in fees within days.

- Taiwanese container shipper Wan Hai Lines has begun diverting ships from its Asia to U.S. West Coast routes toward its intra-Asia operations, a result of heavy congestion plaguing Southern California.

- Container rates on China to U.S. routes dropped 26% week over week to Nov. 8., their lowest levels since July.

- Officials at the Port of Rotterdam, Europe’s largest, predict congestion and backlogged container traffic to persist through 2022.

- CSX and Norfolk Southern are struggling to rebuild workforces slashed early in the pandemic, which is impacting rail service.

- North American factories ordered a record 29,000 robots in the first nine months of 2021, a 37% increase from the same time last year, part of efforts to improve assembly lines and boost production amid the ongoing labor shortage.

- U.S. wholesale inventories rose 1.4% in September, exceeding analyst expectations as companies sought to stock up before the holiday season.

- GM, Toyota and Nissan each announced they would boost near-term production in a sharp reversal from recent cuts caused by the global chip shortage. Nissan is aiming to produce 300,000 more units in the second half of the year than in the first half, while Toyota plans for up to 10% more output year over year in November.

- Second-quarter wholesale and retail labor costs in the U.K. were 3% below the 2019 level, while output per hour was 10% higher, highlighting the benefits of more merchants moving online.

- The U.S. Postal Service reported a net loss of $4.9 billion for the year ending Sept. 30, nearly halving losses from the prior year.

- The Cleveland Clinic took first in a recent ranking of top supply chains in the U.S. healthcare sector.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- Health experts are warning that a new surge of COVID-19 will likely grip the U.S. around Thanksgiving, with the nation averaging 74,000 new cases per day, up 4% the past two weeks. There were 63,245 new infections reported Thursday alongside 760 virus fatalities.

- California’s governor extended the state’s COVID-19 state of emergency for the third time, pushing it to March 31, 2022, for a combined total of two years.

- Colorado’s governor is calling for 500 emergency hospital beds amid a surge in COVID-19 patients throughout the state, as new modeling predicts more than 2,000 people will be hospitalized with the virus by the end of the year. The state also expanded its offering of booster shots to all adults over age 18.

- New Mexico will extend a COVID-19 indoor mask mandate beyond its Nov. 17 expiration, with the state reporting 1,337 new cases and 13 virus fatalities Wednesday.

- COVID-19 cases in Minnesota are spiking, with the state counting 5,123 new infections Thursday alongside 43 deaths.

- Wisconsin reported 3,370 new COVID-19 cases Wednesday, its second consecutive day over 3,000, while eight counties in the state have “critically high” virus activity levels, up from four the week prior.

- Illinois reported 5,044 new COVID-19 cases Wednesday, the first time above 5,000 in two months, while new infections in Chicago have increased 24% the past week.

- Connecticut’s COVID-19 test positivity rate rose to its highest level in two months.

- New COVID-19 infections in Vermont surged to 591 Thursday, a pandemic record.

- Despite having 70% of its population vaccinated against COVID-19, Michigan’s COVID-19 case rate currently tops every other state, with hospitalizations ballooning to 2,728 from 1,667 in early October.

- Roughly 20% of Alabama’s hospitalized COVID-19 patients have been fully vaccinated against the virus.

- Ten states are suing the U.S. administration over its COVID-19 vaccine mandate for healthcare workers.

- A federal judge in Texas ruled the state’s ban on mask mandates in schools is unconstitutional under the Americans with Disabilities Act.

- Wyoming, Idaho and Oklahoma have the highest rates of COVID-19 vaccine opposition in the U.S.

- A growing number of U.S. school districts are loosening their mask and quarantine requirements amid a rollout of COVID-19 vaccines among school-aged children.

- New research shows that the risk of developing severe illness from COVID-19 increases for people who suffer from sleep apnea and other breathing-related problems.

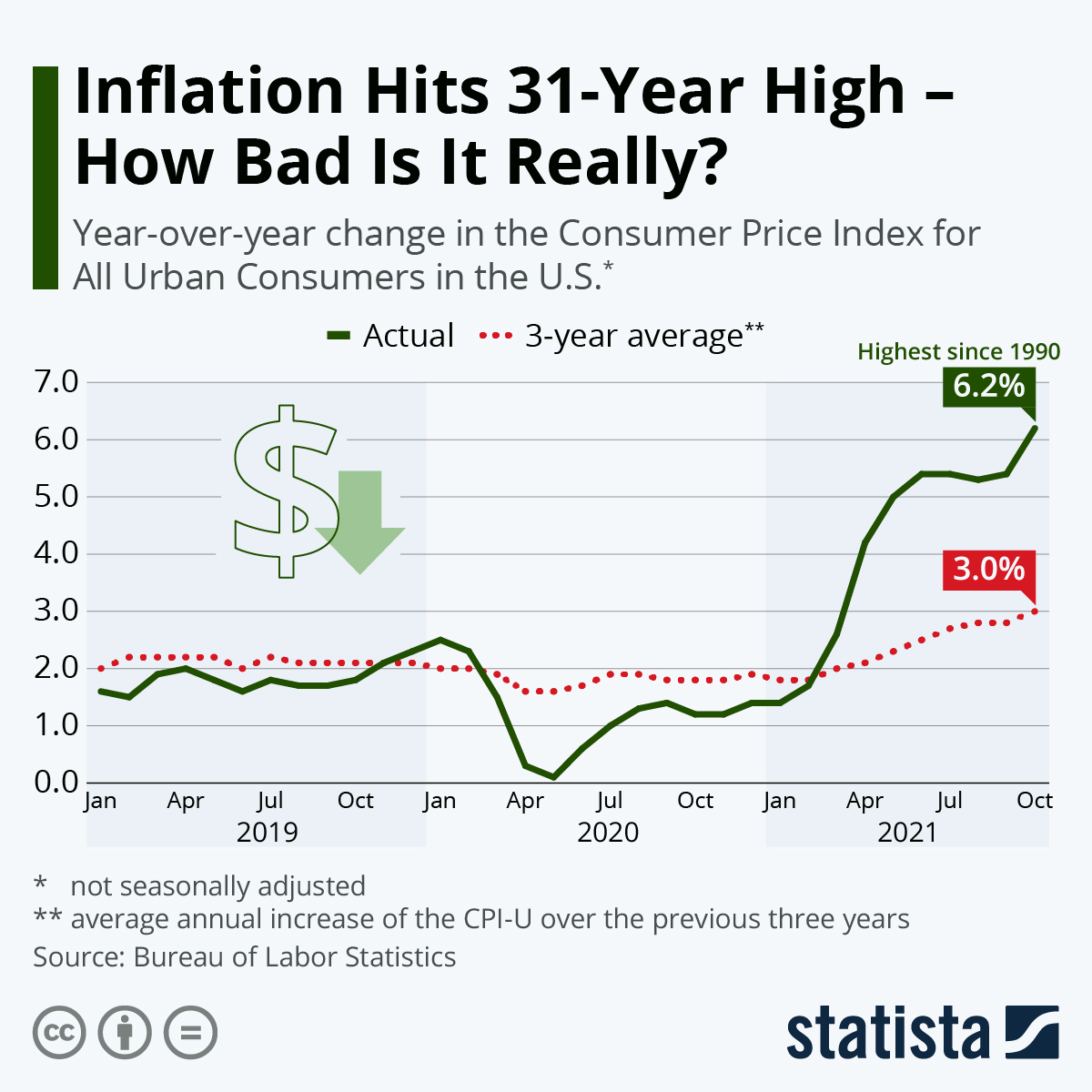

- High U.S. inflation has hit some regions harder than others, with the steepest rate of 7.3% taking hold in central states including Iowa, Kansas, Missouri, Nebraska, North Dakota, South Dakota and Minnesota.

- Job openings in the U.S. topped 11 million entering this month, dwarfing the pre-pandemic record high of 7.5 million set in November 2018, with 7.4 million people currently looking for work.

- A growing number of employers, including some fast-food chains and retailers, are allowing employees to withdraw money from their paychecks daily in a new tactic to attract workers.

- Nearly half of U.S. workers recently surveyed said they would take a 5% pay cut to continue working remotely.

- The U.S. federal government collected a record total $283.9 billion of taxes in October while federal spending topped $448.9 billion, the second highest ever for the first month of a fiscal year.

- An increase in vehicle prices is putting U.S. auto dealerships on track to shatter annual profit records, with the average dealership recording a net pre-tax profit of $3 million through September, more than double the amount from the same period last year.

- New data from the Bureau of Labor Statistics shows that prices shoppers paid for groceries were up 1% from September to October and 5.4% from the same time last year.

- Johnson & Johnson, the nation’s largest healthcare company, is joining Merck and Pfizer in carving out its slower growth consumer product businesses into a separate public company to focus on higher margin pharmaceuticals and medical devices.

- Toyota announced plans to invest $240 million in its West Virginia engine and transmission plant to build parts for hybrid vehicle models.

- Carnival Cruise Line is planning to have its entire U.S. fleet back in operation by the end of March 2022.

- Global consumer spending on personal luxury goods is expected to rise 29% this year to $325 billion, marking a return to pre-pandemic levels.

International Markets

- COVID-19 deaths in the EU rose 10% the first week of November, making up more than half of globally reported virus deaths for the period along with nearly two-thirds of global cases.

- COVID-19 infections in Germany topped 50,000 Thursday, a pandemic record, with the nation’s new government pleading for people to get vaccinated. Berlin, the capital, will deny unvaccinated people access to indoor dining, bars, gyms and hairdressers.

- Austria will place millions of residents not fully vaccinated against COVID-19 under lockdown if 30% of the nation’s ICU beds become occupied by virus patients, an event likely to occur in the coming days.

- Ukraine will require all healthcare and municipal workers to be vaccinated against COVID-19, as the country looks to boost inoculation rates amid a new wave of infections throughout Europe.

- Russia reported 1,237 COVID-19 deaths Thursday, near a record high set earlier in the week.

- Sweden will no longer require fully vaccinated residents to get tested for COVID-19 even if they start showing symptoms.

- Denmark will require all travelers from Singapore to self-isolate following a recent surge of COVID-19 in the east Asian city-state.

- Hong Kong has placed 120 students into quarantine and is recommending an international school shutdown after exposure from the family of a Cathay Pacific Airways pilot who tested positive for COVID-19.

- Bars and restaurants in Singapore will be allowed to play music again, ending nearly five months of silence over officials’ concerns that patrons would raise their voices and increase the risk of transmitting COVID-19.

- Malaysia and Indonesia will allow fully vaccinated travelers to fly between the countries starting early next year, with plans to possibly open travel lanes from Kuala Lumpur to Jakarta and Bali.

- Pfizer is seeking approval of its COVID-19 vaccine for children as young as age 5 in both Brazil and Japan. Moderna is also seeking to have a booster dose of its vaccine approved in Japan.

- The European Medicines Agency is recommending COVID-19 antibody cocktails from Regeneron and Celltrion, the first approval of new virus therapies since last year.

- Mexico’s middle class shrank by 6.3 million people, nearly 12%, from 2018 to 2020. Inflation in the country increased more than 0.8% from September to October, the second highest jump on record.

- London’s Heathrow Airport is looking to hire more than 600 employees to handle an increase in traffic, as the travel hub averaged more than 100,000 passengers per day in October, a 144% increase from the same time last year.

- Japanese carmaker Subaru unveiled its first all-electric vehicle, an all-wheel drive SUV with a range of 329 miles, developed over the last two years in partnership with Toyota.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.