COVID-19 Bulletin: November 5

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices fell Thursday, reversing early gains after OPEC+ announced it will not accelerate production increases. Oil futures were higher in late morning trading, with WTI up 2.5% at $80.80/bbl and Brent up 2.1% at $82.21/bbl. U.S. natural gas was 2.3% lower at $5.59/MMBtu.

- The average price for a gallon of gas in the U.S. has surged to a seven-year high of $3.40, with Bank of America predicting even more price increases if crude oil hits $120/bbl by mid-2022.

- China’s energy giant Sinopec has signed a 20-year delivery contract for LNG from U.S. Venture Global, the largest such deal to date between China and a U.S. supplier.

- U.S. LNG exporter Cheniere Energy is on track to enter commercial service at a new facility in the first quarter of 2022.

- With the near doubling in capacity of the now 760,000-bpd Enbridge Line 3 from Alberta, Canada, to the U.S., the pipeline could reduce the need for crude transportation by rail and alter pricing dynamics between Canadian and U.S. crude.

- Canadian Natural Resources, Canada’s largest oil and gas producer, posted higher-than-expected profit in the third quarter, boosted by an increase in oil demand.

- Serbia will invest $19.6 billion into renewable energy sources over the next 20 years to replace its coal-fired plants and meet rising demand.

- Dutch lender ING announced it will no longer finance oil and gas trading in Peru due to concerns over its impact on indigenous populations.

- Exxon warned of further potential asset write-downs due to risks associated with climate change.

- Aker Horizons unveiled a new plan to use wind turbines offshore of Scotland to produce 10 GW of energy for domestic consumption and export.

- Royal Dutch Shell announced plans to end crude oil refining at its site in Germany and move toward low- or zero-carbon projects starting in 2025 as it aims to reach net-zero emissions by 2050.

- BP is holding talks with JX Nippon to acquire its stake in the North Sea Andrew Area oil and gas fields, following a failed attempt to sell its own stake earlier.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- October’s U.S. Logistics Management Index hit 72.6, up slightly from September’s reading and the ninth straight month above the high-growth 70-point mark.

- Preliminary North American Class 8 truck orders jumped to around 40,000 units in October, a 27% increase over September.

- Average global air cargo rates in October were 37% higher than a year ago.

- The White House denied requests from trucking industry organizations to exempt drivers from the federal COVID-19 vaccine mandate, sparking fears of further supply chain disruptions.

- The Suez Canal Authority will hike its transit fees by 6% starting next year, allowing only LNG carriers and cruise ships an exemption to pay the 2021 rate.

- Despite the hype around Hertz’s recent order of more than 100,000 Tesla electric vehicles, the rental car company now must negotiate the timing of deliveries amid pandemic-induced production snags.

- Private-equity firm EQT’s $6.8 billion sale of U.S. industrial sites to an Asian wealth fund marks one of the highest prices ever paid for U.S. industrial properties that serve major population centers and air cargo hubs.

- A 10,000-worker strike at John Deere is expected to stretch into its fourth week after an impasse over resuming negotiations.

- Self-driving truck technology firm TuSimple Holdings is expanding its Autonomous Freight Network, partnering with UPS to begin commercial runs to air freight terminals in Orlando and Charlotte. The company separately announced plans to begin testing its fully self-driving trucks on public roads on an 80-mile route between Phoenix and Tucson by the end of the year.

- Toymaker Mattel says it can meet the high demand for its products this holiday season by relying heavily on nearshoring to help bypass port logjams.

- Trucker Forward Air will expand its intermodal capabilities with the acquisition of TKI Intermodal, which specializes in container drayage and transportation, and BarOle Trucking, the largest intermodal carrier in the Twin Cities, Minnesota.

- Trucker Yellow returned a third-quarter profit on its highest occupancy rate in three years and a 15.6% rise in one of the company’s key pricing measures.

- Cargo hauler Atlas Air’s third-quarter net profit rose 61.4% from the previous year to $119.5 million, with revenue increasing 25.5% to just over $1 billion, a record.

- American retail prices for a gallon of milk are up 26% from 2018 due to the largest shortage of U.S. dairy cows in a decade.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 82,061 new COVID-19 infections and 1,131 virus fatalities Thursday. Cases are down about 20% nationwide over the past two weeks, with several former hotspots now having the lowest rates of new infection, including Connecticut, Florida, Georgia, Hawaii, Louisiana and Mississippi.

- The U.S. had the second-largest decline in life expectancy among high-income countries last year, with men losing an average of 2.3 years and women roughly 1.6 years. More than 28 million years of life have been lost across 37 countries due to COVID-19 since March of 2020.

- In a potential treatment breakthrough, Pfizer’s trials of a new COVID-19 pill that can be taken from home showed that it cut the risk of virus hospitalization or death for people with moderate symptoms by about 89%, the company says.

- The White House will require private sector companies with at least 100 employees to ensure workers are fully vaccinated or get tested weekly beginning Jan. 4. Companies that fail to comply with the order could face penalties of nearly $14,000 per worker. The mandate will exclude employees who work exclusively outdoors.

- Federal workers will be granted paid time off to take their children to get vaccinated against COVID-19, the U.S. administration announced.

- New York City is offering $100 cash incentives to parents to get children between 5 and 11 vaccinated. Meanwhile, the city’s mayor-elect announced he will revisit the city’s vaccine mandate for municipal workers.

- Michigan reported 9,764 new COVID-19 cases and 137 virus deaths over the last two days, as the state ranks second for most new daily infections.

- Arizona has reported nearly 50,000 breakthrough COVID-19 infections among fully vaccinated people.

- Hawaii is planning to ease COVID-19 restrictions and resume welcoming international travelers starting Nov. 8.

- San Francisco will soon require children as young as 5 years old to show proof of COVID-19 vaccination to enter some indoor public spaces.

- Florida is continuing to see a drop in its COVID-19 infections and hospitalizations, reporting just 1,804 new cases Tuesday.

- Apple is dropping its mask mandate for customers in most of its U.S. stores.

- The U.S. Air Force is reporting near 97% compliance with its COVID-19 vaccine mandate.

- Tyson Foods is reporting more than 96% compliance with the company’s COVID-19 vaccine mandate.

- Moderna cut its 2021 sales forecast for COVID-19 vaccines to between $15 billion and $18 billion, down from its earlier projection of $20 billion, as the drugmaker struggles with production and distribution issues.

- In a broad-based rally, the U.S. gained a better-than-expected 531,000 jobs in October, lowering the unemployment rate to 4.6%. The nation has regained 81% of jobs lost in the pandemic.

- The Institute for Supply Management’s index of U.S. services activity surged to 66.7 in October, the highest reading since the index began in 1997.

- The U.S. trade deficit widened to a record $80.9 billion in September, topping its previous record of $73.2 billion set in June.

- Employers are making a record number of hires ahead of this year’s holiday season, with UPS and Walmart boosting the number of seasonal workers by 11% so far through October.

- Home fitness maker Peloton reported its smallest quarterly gain in subscriber growth since it went public two years ago, as more people venture out of the home to work out amid eased COVID-19 restrictions.

- AT&T and Verizon are delaying their planned rollout of a new 5G frequency band due to potential interference with airplane cockpits.

- Ford plans to repurchase up to $5 billion of its high-interest debt and begin issuing “green” bonds to help finance a transition to electric vehicles.

- Google is beginning to map New York City streets in preparation to roll out self-driving vehicles in its Waymo autonomous unit.

International Markets

- Europe has seen a more than 50% jump in COVID-19 cases the past month, as it again becomes the world’s new virus epicenter. The World Health Organization warned that the region could see another 500,000 virus fatalities by February.

- Germany saw its second consecutive daily record for new COVID-19 cases Friday with more than 37,100 infections.

- The U.K. reported 37,269 new COVID-19 infections and 214 deaths Thursday, with infections doubling among seniors between September and October.

- Russia reported 1,195 new COVID-19 deaths Thursday, topping its previous single-day record of 1,189 a day earlier.

- Poland saw more than 15,000 new COVID-19 infections Thursday, its highest daily infection count since April.

- On Thursday, Croatia and Slovenia both saw their highest number of daily COVID-19 infections since the start of the pandemic.

- Belgium is seeing a sharp rise in COVID-19 infections and hospitalizations.

- Vienna, Austria, will ban unvaccinated people from restaurants, cafes and events with more than 25 people, a bid to ease a recent virus surge.

- A new law in Latvia will allow employers to fire workers who refuse to get vaccinated against COVID-19.

- China’s latest COVID-19 outbreak spread to a 20th province.

- New Zealand reported 139 new COVID-19 cases Thursday amid a new surge of infections.

- South Korea is imposing mandatory hospitalizations on some people infected with COVID-19, regardless of whether they’ve shown symptoms, in a novel strategy to contain recent virus waves.

- The World Health Organization is asking vaccine manufacturers to prioritize making doses for the international COVAX vaccine-sharing initiative for distribution to low-income nations.

- Researchers at the University of Oxford have identified a specific gene that doubles the risk of dying from COVID-19, found in roughly 60% of people with lineage from South Asia.

- The EU’s drug regulator is reviewing data on AstraZeneca’s COVID-19 vaccine as it considers authorizing booster doses of the shots.

- Employment in the U.K. gig economy has tripled over the past five years to 4.5 million with the introduction of third-party driving and delivery services.

- Chinese electric vehicle battery maker Envision Group is scaling back the size of a planned facility in Northern France for carmaker Renault.

- Byton, a startup electric vehicle maker in China, missed its most recent payroll and is likely headed toward shuttering operations.

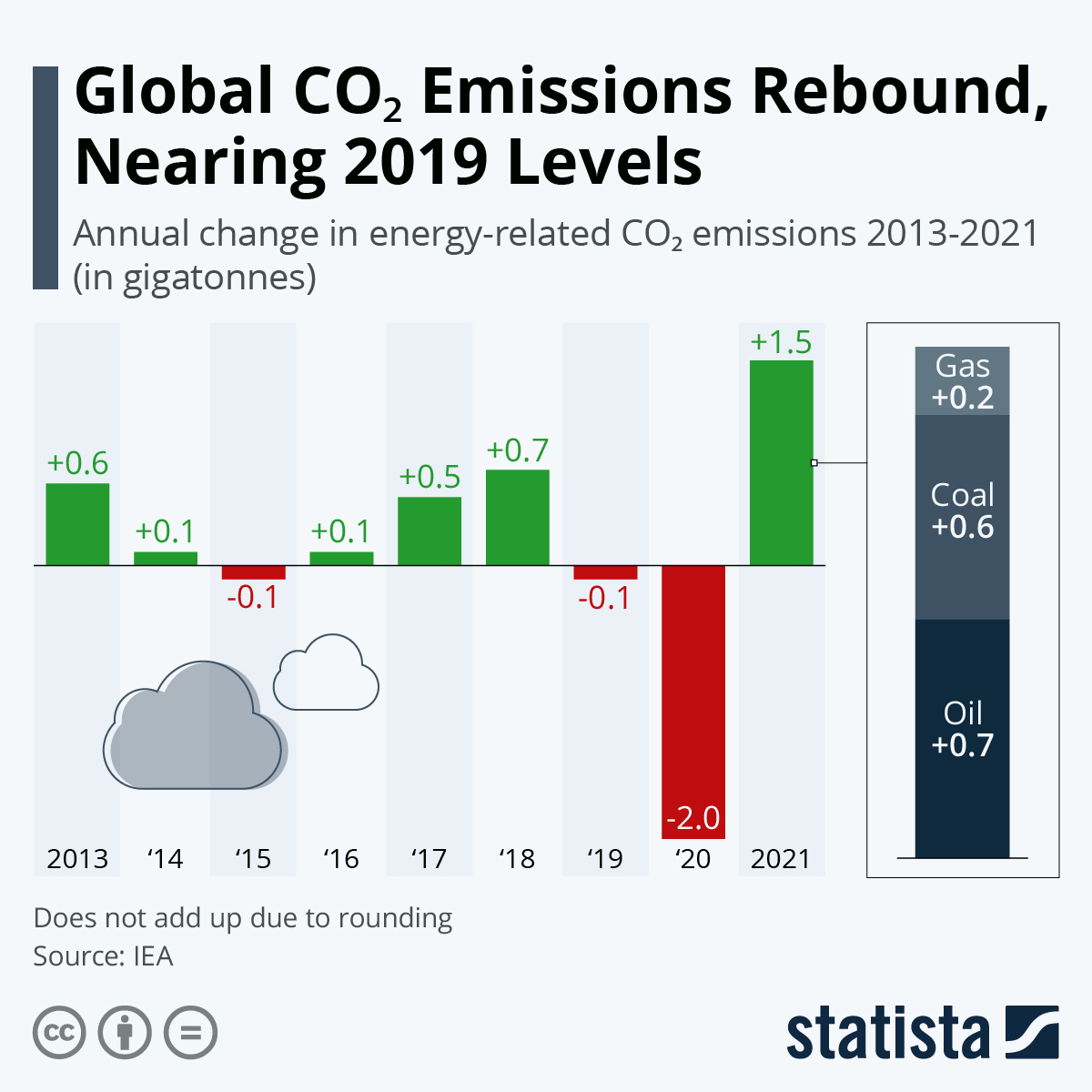

- CO2 emissions are expected to rise 4.9% this year after dropping 5.4% amid reduced economic activity during the pandemic.

- Indonesia rejected calls to pledge against deforestation, citing the importance of the nation’s growing industry.

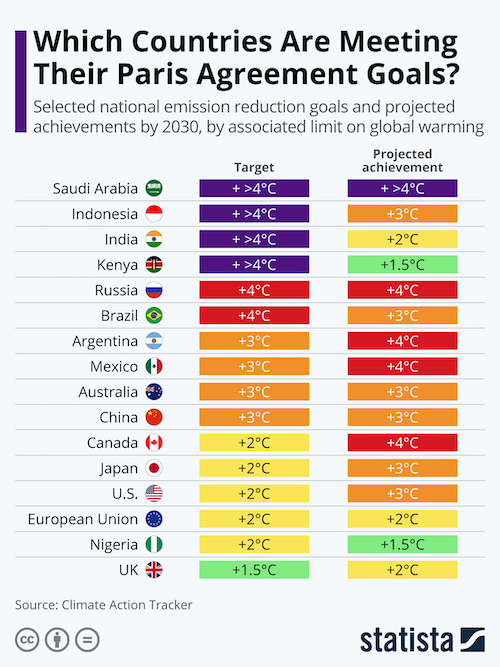

- China, India and many African nations are collectively seeking $1.3 trillion in financial donations to help meet targets set out in the Paris Agreement.

- French luxury retailer Chanel has partnered with Finnish startup Sulapac to develop a new bottle cap made of plant-based materials for its Les Eaux de Chanel perfume collection.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.