COVID-19 Bulletin: November 4

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- OPEC+ rejected calls from the U.S. and others to accelerate production increases beyond the 400,000-bpd hike scheduled for next month.

- An unexpected rise in U.S. crude stocks caused oil prices to drop to their lowest level in nearly two months Wednesday. Energy futures fell further in late morning trading today, with WTI down 0.5% at $80.45/bbl and Brent down 0.1% at $81.91/bbl. U.S. natural gas was 1.9% lower at $5.57/MMBtu.

- U.S. LNG exports to China have more than tripled this year and now account for more than 17% of the nation’s LNG exports, a sharp increase from 2019 prompted by a global energy shortage that has sent prices soaring.

- Asia’s LNG prices for December delivery fell last week by 10% to an average of $31/MMBtu, still significantly higher than prices a year ago.

- Nearly 60% of British households say they were worried or very worried about how to pay energy bills this winter amid a shortage of gas.

- U.S. shale producer Chesapeake Energy increased its 2021 production forecast by 1 million barrels to 26.5 million.

- The Asian Development Bank unveiled a plan to buy coal-fired power plants in Indonesia and the Philippines and wind them down within 15 years.

- After a pipeline explosion last week that killed one person, Pemex officials acknowledged that the company’s 17,000 kilometers of pipelines in Mexico are in serious need of maintenance and upgrading.

- China is aiming to reduce coal use for power generation by 1.8% over the next five years, while relying heavily on nuclear energy in the coming decades to reach its 2060 carbon neutrality goal.

- Voters in Maine overwhelmingly rejected a $1 billion power project that would have brought 1,200 megawatts of hydropower from Quebec, Canada, into New England via a 145-mile line through the state’s forests.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Spot market rates for the largest capesize dry-bulk vessels have fallen to around $30,000, down 64% from the decade-high of $87,000 just three weeks ago.

- The global shipping benchmark Baltic Dry Index dropped to 2,892 Wednesday, its lowest level since June, after hitting a 13-year high of 5,650 just one month ago.

- The average third-quarter freight rate per 40-foot container at Maersk Line hit $3,561, up 86.5% from the same time last year and 17.2% from the second quarter.

- The market for chartering midsize and large container ships for the rest of 2021 is practically sold out, as operators shift focus to securing vessels coming open in 2022.

- Transport operators are logging record profits on the freight squeeze, driving up rates for truckload operations and container shipping around the world. Maersk’s $5.44 billion third-quarter earnings nearly equaled that of Amazon and UPS combined, while ArcBest became the most recent trucking company to report stellar profits on double-digit growth in pricing.

- Supply chain outsourcer GXO Logistics raised its 2021 outlook after reporting a 24.6% rise in third-quarter revenue.

- The American Trucking Association is pushing for legislation to lower the minimum age for interstate truck drivers to 18, with the latest data showing the nation’s driver shortage rising to 80,000 from 61,500 pre-pandemic.

- American Eagle Outfitters is the latest retailer to focus on regaining control of supply chains through the acquisition of logistics companies to move transport operations in-house.

- Texas launched a new advertising campaign to persuade carriers to bypass ports in Southern California and dock at less-congested terminals in Texas.

- Roughly 23% of third-party warehouse companies have seen order volumes grow more than 50% this year, new data shows.

- Qualcomm’s third-quarter earnings and revenue beat Wall Street expectations, with chip sales for smartphones up 56% year over year to a new record.

- Apple announced it would cut iPad production to supply semiconductors to its new and bestselling iPhone 13.

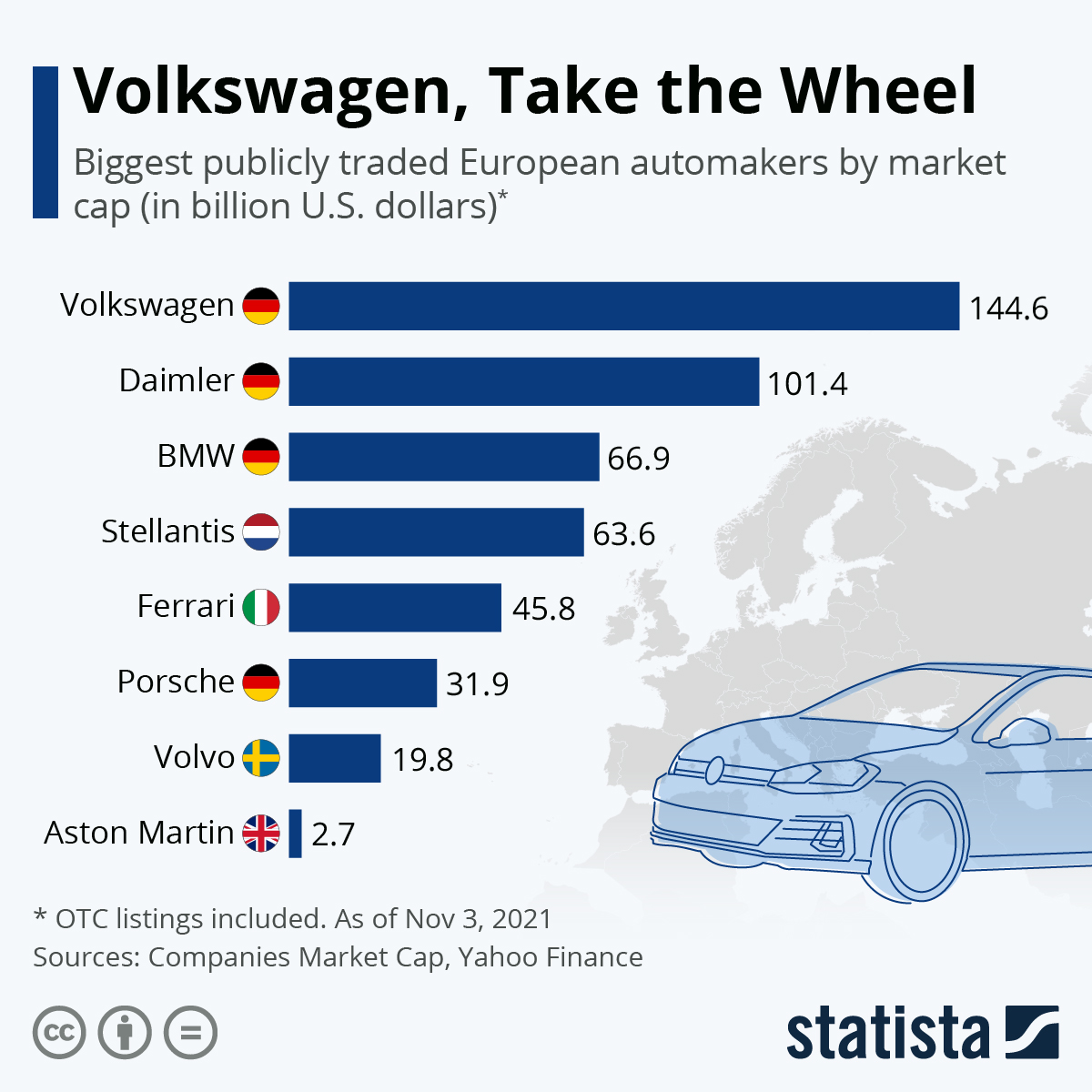

- Strong electric vehicle sales pushed BMW’s quarterly profit up 42.4% despite rising costs for components and the global shortage of computer chips. Despite cutting quarterly production by 550,000 units, Toyota also weathered the chip shortage, raising its full-year profit forecast.

- The three-week strike of more than 10,000 workers at John Deere will continue following the union’s rejection of the company’s contract offer Wednesday.

- Microsoft has launched a new service that allows companies to create digital twins of their supply chain for running simulations of potential disruptions and possible corrective measures.

- Shipping leader CMA CGM Group plans to purchase the remaining 90% it does not own of the Fenix Marine Services terminal in Los Angeles, the third largest terminal at Southern California ports.

- Swedish freight company Einride will begin testing autonomous trucks in U.S. operations of large companies, including General Electric and Bridgestone.

- Global food prices have surged more than 30% the past year to a decade high as the energy squeeze hits crop production. Wheat prices are at their highest since 2012.

- British meat producers have begun shipping animal carcasses to the EU for processing amid a severe shortage of butchers.

- With growing cargo volumes sitting at ports, theft is on the rise, with electronics and refrigerated food the top targets of thieves.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 83,501 new COVID-19 infections and 1,905 virus fatalities Wednesday.

- The U.S. began administering Pfizer’s COVID-19 vaccine to children aged 5 to 11 Wednesday, just one day after the CDC’s approval of the shots. Health officials are urging parents to take advantage of the vaccines even if their children were previously infected.

- COVID-19 hospital admissions are rising in 13 states, suggesting recent improvements in the nation’s virus numbers may be weaker than believed.

- COVID-19 cases and hospitalizations continue rising in Colorado, with state officials predicting a new peak of admitted virus patients in December. On Wednesday, hospitals at capacity were authorized to begin turning away patients.

- Despite having some of the highest COVID-19 vaccination rates in the nation, several U.S. Native American reservations are seeing a resurgence in virus cases.

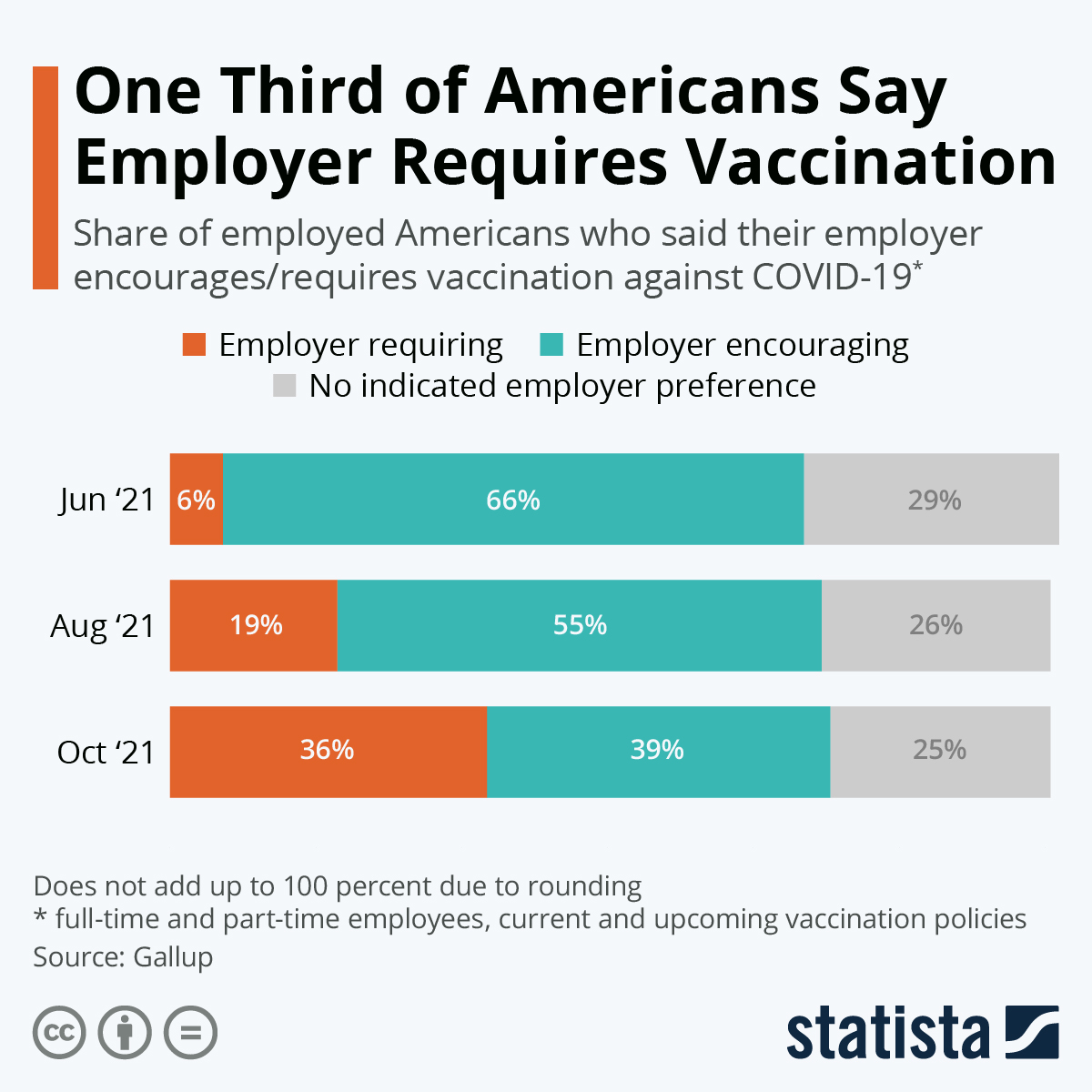

- Ford Motors is the latest prominent U.S. firm requiring employees to be fully vaccinated against COVID-19 by the federal government’s Dec. 8 deadline for large businesses.

- Next year’s Boston Marathon will require all 30,000 participants to be fully vaccinated against COVID-19.

- Roughly 8,500 active-duty members of the U.S. Air Force and Space Force missed their deadline for getting vaccinated against COVID-19.

- The number of job listings requiring candidates to be vaccinated against COVID-19 doubled in October, according to the Ladders job site.

- The standard two-dose regimen of COVID-19 vaccines was less effective in immunocompromised people, new research shows, with efficacy rates dropping to 77% against hospitalization.

- New research shows COVID-19 can cause hearing problems and potential balance issues in some patients.

- First-time jobless claims declined last week by 14,000 to 269,000, a pandemic low.

- The U.S. Federal Reserve will begin winding down its pandemic-induced asset purchases by $15 billion per month, as the central bank reaffirmed its position that factors driving high inflation are transitory.

- U.S. factory orders unexpectedly rose 0.2% in September as businesses rebuilt inventories despite ongoing shortages in raw materials and labor.

- Insurer MetLife reported disappointing third-quarter results as deaths linked to the COVID-19 Delta variant increased for working-aged people. Insurance competitor Allstate similarly reported a 55% drop in net income.

International Markets

- Europe’s top World Health Organization official said rising COVID-19 infections across Europe are a “grave concern.”

- The U.K. reported 41,299 new COVID-19 cases and 217 virus deaths Wednesday, as case rates in the nation return to their highest level of the pandemic. Vaccinations for the nation’s healthcare workers will be mandatory starting in 2022.

- Germany reported 33,949 new COVID-10 infections yesterday, a pandemic record.

- With just 18% of its population vaccinated against COVID-19, Ukraine posted a record 5,935 virus patients in hospitals Wednesday.

- France reported 10,050 new COVID-19 infections Wednesday, the most since September, while mask-wearing requirements were reimposed for students.

- Moscow will end a partial lockdown this Sunday, with officials calling the virus situation stable despite record numbers of daily virus deaths nationwide.

- Nineteen of China’s 31 provinces are seeing COVID-19 outbreaks, the most since the start of the pandemic, with 93 new cases reported nationwide Wednesday. Half of Beijing’s flights were canceled Wednesday as the capital city went under strict pandemic lockdowns.

- Hong Kong began offering COVID-19 boosters to its population Wednesday, as the island works to reopen borders with mainland China.

- New COVID-19 cases in South Korea remained above 2,400 for the second consecutive day, a worrying trend as the nation emerges from its latest pandemic lockdown.

- The president of the Philippines threatened local government officials with unspecified sanctions for failing to reach COVID-19 vaccination targets in their communities, as more than 40 million doses reportedly remain unused in the country due to logistical bottlenecks and rampant vaccine hesitancy.

- New Zealand’s central bank is warning the nation’s new “living with Covid” strategy could cause significant changes to consumer behavior and hamper economic growth.

- New COVID-19 cases across North, South and Central America dropped for the eighth consecutive week last week.

- The U.K. became the first nation to conditionally approve Merck’s new antiviral pill shown to be effective in treating COVID-19.

- Canada’s Ontario province is expanding the use of COVID-19 boosters for its residents.

- Japan plans to resume issuing long-term visas to foreign business travelers amid a drop in COVID-19 infections.

- The World Health Organization authorized India’s first homegrown COVID-19 vaccine, Covaxin.

- Air Canada suspended more than 800 employees Wednesday for failure to comply with federal COVID-19 vaccine mandates.

- Norwegian Cruise Line expects to return to profitability by the second half of 2022, primarily on higher travel demand among Americans.

- Japan Airlines forecast a loss of up to $1.28 billion in 2021, prompting a workforce reduction of more than 2,500 employees.

- Volkswagen purchased a 20% stake in European investor EIT InnoEnergy, a bid to boost funding for decarbonizing the transport sector and help scale up its production of electric vehicles.

- The United Nations will boost funding for weather forecasting technology in 75 developing economies to help them better prepare for unforeseeable disasters caused by climate change.

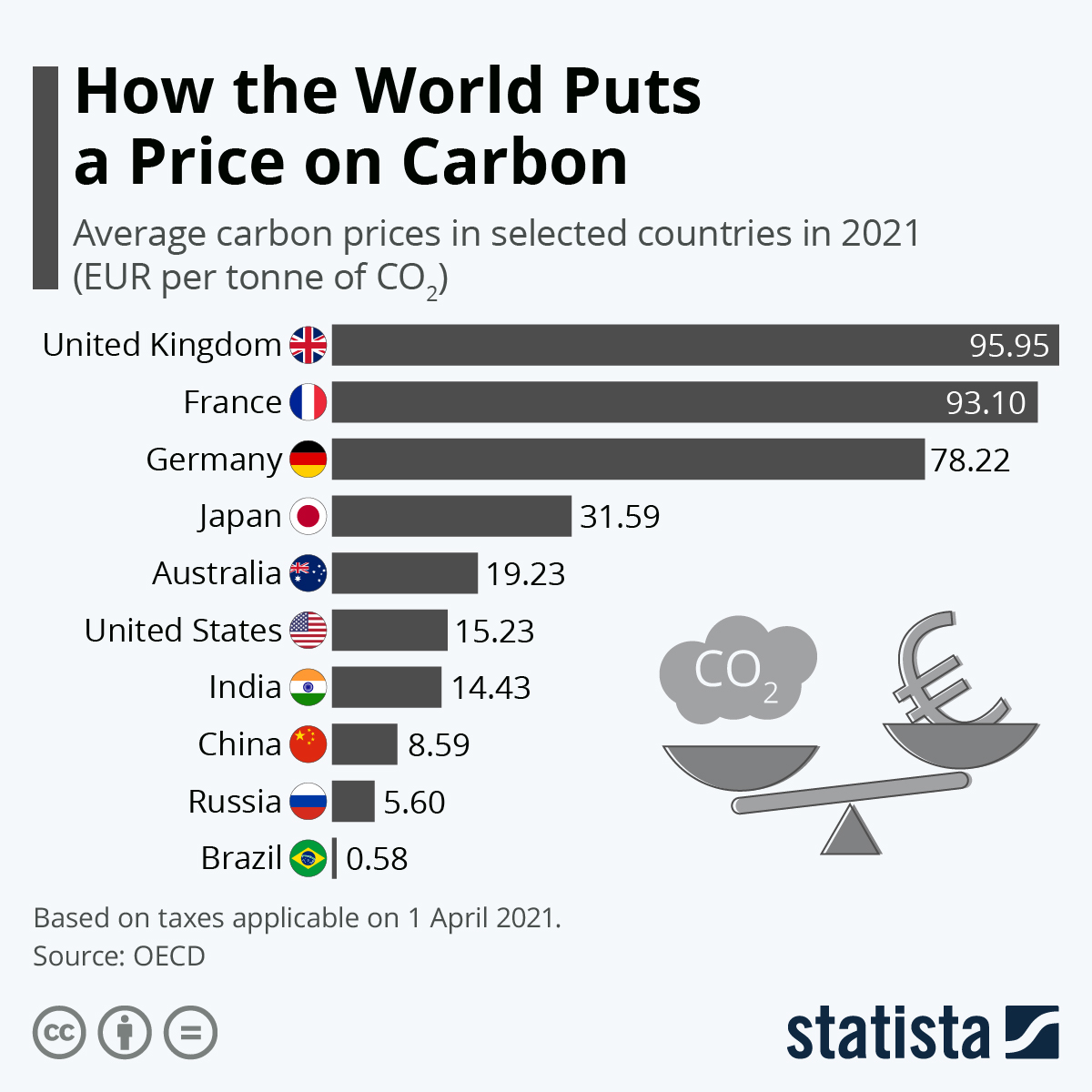

- The U.K.’s finance minister told companies to release their plans for transitioning to lower carbon activity by 2023, part of a broader effort to make the country the world’s first net-zero financial center. The country’s markets watchdog also outlined new measures for asset managers to publish sustainability data.

- As the COP26 climate summit continues in Scotland, new data suggests an international price for carbon emissions could reduce global greenhouse gas emissions by 12% while costing less than 1% of global GDP.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.