COVID-19 Bulletin: November 3

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices were mixed Tuesday but remained close to three-year highs, as the American Petroleum Institute reported its sixth straight week of crude inventory builds. Energy futures were lower in late morning trading, with WTI down 3.2% at $81.26/bbl and Brent down 2.7% at $82.42/bbl. U.S. natural gas was 1.5% higher at $5.63/MMBtu.

- The White House stepped up calls for OPEC to increase monthly output ahead of the cartel’s meeting Thursday.

- For the fourth straight day on Tuesday, Russia reversed one of its large pipeline’s gas flows back to itself from Germany, causing market uncertainty amid already record-high energy prices in Europe.

- Oil exports from OPEC member Venezuela topped 700,000 bpd in October, with about 75% going to Asia and the Middle East.

- BP, the last of the oil supermajors to report third-quarter financials, bolstered its share buyback program thanks to a sharp rise in profits amid soaring oil and gas prices. The company said global oil demand has returned to pre-pandemic levels of around 100 million bpd.

- ConocoPhilips reported $2.4 billion in third-quarter net income compared to a $500 million loss the prior year, topping analyst expectations.

- U.S. shale producer Diamondback Energy beat third-quarter profit estimates and increased its dividend, benefitting from higher oil and gas prices.

- U.S. refiner Marathon posted $694 million in third-quarter net income after suffering losses in the year-ago period, as refining margins nearly doubled.

- Wyoming will sell oil and gas leases on 195 parcels covering some 179,000 acres in the first quarter of 2022.

- More than 100 countries have signed onto the U.S.’s plans to tighten regulations on methane emissions in the oil and gas sector, while more than 30 countries pledged to follow the U.S. in investing a collective $4 billion into cleaner agriculture development. The agreements are among many coming out of this month’s COP26 climate summit in Scotland:

- British and Indian leaders agreed on a joint international effort to improve and better connect electricity grids powered by clean energy, a plan backed by 80 other nations.

- A new White House proposal would give billions in tax breaks to coal-fired power plants that install carbon-capture systems.

- Germany will donate over $800 million to South Africa to help the country phase out coal usage.

- Italian supermajor Eni purchased a 20% stake in the U.K.’s Dogger Bank Wind Farm.

- Exxon Mobil is working with Indonesia’s state-owned energy company to explore carbon capture and storage in the country.

- Honeywell is entering the advanced recycling industry with the announcement of new technology that it says makes 90% of plastic waste recyclable and produces feedstock with 57% fewer carbon emissions than virgin plastics.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Ocean carriers are facing $100 daily fees on almost 59,000 containers stuck in terminals for more than nine days at the Ports of Los Angeles and Long Beach in the first week of fee enforcement. Maersk sees a backup of delayed containers continuing well into 2022 due to a severe truck driver shortage.

- Carrier contract rates rose an average of 4.9% in the third quarter, up slightly from the 4.5% increase in the second quarter, due to unprecedented price increases in the spot market. Charter rates eased last week for the first time in 16 months.

- Global carriers recorded their worst ever schedule reliability in the July to September period, with Evergreen, the world’s seventh-largest liner, getting just 13.2% of ships into ports on time.

- Singapore, one of the world’s largest shipping hubs, has a current backlog of 53 container ships waiting to dock, 22% higher than normal levels.

- More than 91,000 truck drivers have been taken off U.S. roads for drug and alcohol issues since the Drug and Alcohol Clearinghouse was put in place in 2020, aggravating the driver shortage roiling the industry.

- Norfolk Southern will cut the free time for importers to pick up ocean containers at more than two dozen small-market terminals while also raising storage fees.

- Maersk reported a record $5.45 billion in third-quarter net income and announced plans to expand its air freight business with the acquisition of two Boeing aircraft and global freight forwarder Senator International for $644 million. The shipping giant predicted it would reach its goal of carbon neutrality before a 2050 deadline.

- Snack food giant Mondelez will raise prices 7% for its products across the globe in 2022, with the company citing higher costs of ingredients, transportation and wages.

- U.S. steel executives announced support for a carbon levy on “dirty” steel imports produced in China and other countries with high emissions, as carbon tariffs gain support.

- Jaguar Land Rover reported a third-quarter loss, with vehicle sales falling nearly 13% and quarterly revenue declining 11% from a year earlier on deepening impacts of the global computer chip shortage.

- Growing numbers of companies are ditching longtime supply chain strategies built on overseas operations as they prioritize greater reliability over costs.

- The global shipping sector must cut emissions 34% from 2008 levels by 2030 to comply with the Paris Agreement, new figures show.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The U.S. reported 72,754 new COVID-19 infections and 1,461 virus deaths Tuesday. Almost 424 million vaccine doses have been administered.

- Late Tuesday, the CDC authorized use of Pfizer/BioNTech’s COVID-19 vaccine in children aged 5 to 11 as the White House enlisted more than 20,000 pediatricians, family doctors and pharmacies to start administering the doses.

- AY.4.2, a potentially faster-spreading Delta variant of COVID-19, has been spotted in eight states, while health authorities say there is no evidence the strain is more severe or better at evading vaccines than other strains.

- New Mexico and Idaho are seeing surges in COVID-19 cases.

- Utah reported 294 COVID-19 deaths in October, accounting for more than 9% of the state’s virus fatalities since the start of the pandemic.

- Arizona reported 2,350 new COVID-19 cases Tuesday, fueled by outbreaks at the state’s colleges and universities.

- Colorado is edging closer to rationing care at hospitals, despite more than 80% of the state’s population receiving at least one dose of a COVID-19 vaccine.

- Arizona’s top court affirmed a rejection of the legislature’s measure banning mask mandates in schools.

- While more than 2,000 firefighters in New York City called in sick Monday when the city’s COVID-19 vaccine mandate took effect, concerns over sweeping effects on the city’s emergency services have yet to materialize, with just 34 of more than 35,000 police officers so far placed on leave for failing to get shots.

- Up to 7% of U.S. military personnel are yet to be vaccinated against COVID-19, despite a looming federal deadline. The U.S. Air Force has discharged 40 service members for failing to comply with the mandate, while the U.S. Marine Corps announced plans to expel unvaccinated members by Nov. 28.

- Immunity from COVID-19 either by prior infection or by vaccine remains strong for at least six months and likely longer, the CDC said.

- Pfizer expects its COVID-19 vaccine to generate $36 billion in revenue this year, the largest single-year sales for any medical product.

- The U.S. has purchased 614,000 more doses of Eli Lilly’s COVID-19 antibody treatment for $1.29 billion.

- Travel sites are reporting dramatic increases in bookings to the U.S. ahead of the nation’s reopening of international borders to vaccinated travelers on Nov. 8.

- Most Americans said they would spend the same amount or more on holiday trips than before the pandemic, new survey results show.

- Economists expect the Federal Reserve to announce an easing of pandemic-induced monthly asset purchases as it concludes its two-day meeting later today.

- U.S. construction spending declined in September for the first time since February.

- Lyft reported third-quarter revenue 73% higher than last year, boosted by rebounding demand for ride-hailing services and an increase in drivers.

- Zillow is exiting its home-flipping business after losing more than $380 million in the operation in the third quarter, largely the result of an inability to predict home prices.

- Automaker Stellantis is offering buyouts to pension-eligible employees in the U.S., as the company aims to reduce costs amid a shift toward electric vehicles.

- Ford yesterday unveiled the F-100 Eluminator, a concept pickup truck that combines the latest electric vehicle technology with a retro design.

International Markets

- COVID-19 infections in Europe rose for the fifth consecutive week.

- The U.K. reported 33,865 new COVID-19 infections and 293 virus deaths Tuesday, as the country struggles with low compliance with its self-isolation rules.

- Ireland reported 3,726 new COVID-19 infections Tuesday, the most since January.

- Russia reported 1,178 new COVID-19 deaths Tuesday, a record, as authorities warn a partial lockdown of certain regions could be extended. The U.S. raised its travel warning for Russia to Level 4, its highest.

- Bulgaria and Romania are reporting record numbers of COVID-19 infections and deaths.

- The Netherlands reintroduced indoor mask mandates amid an uptick in COVID-19 infections, as booster shots were approved for people over 60.

- Greece reported 6,700 new COVID-19 infections yesterday, its third record in as many days.

- China’s Shanghai Disneyland announced it would reopen after detaining more than 30,000 visitors Sunday when a single guest at the park tested positive for COVID-19. National officials are urging families to stock up on daily necessities in preparation for winter lockdowns.

- Vietnam is suffering its fourth coronavirus wave, with 5,613 new infections reported Tuesday.

- India reported just 10,423 new COVID-19 infections yesterday, its lowest single-day total since February.

- The EU has ended its review of Eli Lilly’s COVID-19 antibody cocktail due to lack of demand.

- Air Canada beat third-quarter revenue projections on the heels of Canada’s decision to reopen borders to fully vaccinated travelers, although passenger volume was down 66% compared to pre-pandemic levels.

- Japan announced plans to boost decarbonization funding for Asia by $10 billion.

- Qatar is partnering with Rolls-Royce to develop green technology startups at home and in the U.K., with plans to create five companies by 2030 and up to 20 companies by 2040.

- Pension funds in the U.K. and Scandinavia have committed some $130 billion toward clean energy and climate investments by 2030.

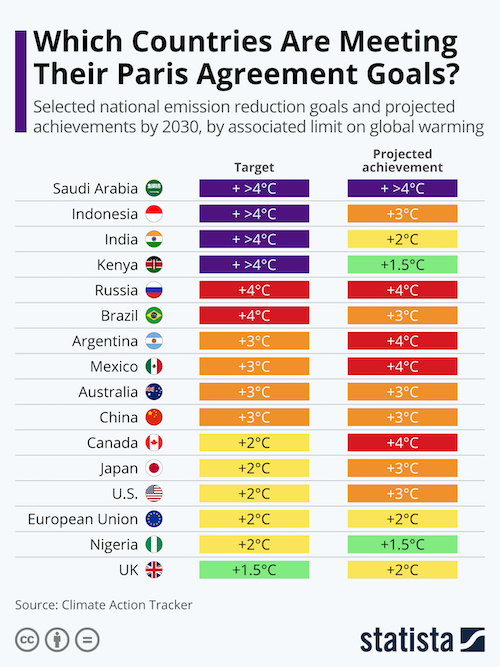

- Banks and asset managers representing 40% of the world’s financial assets have now pledged to meet the goals set out in the Paris Agreement, a group that will collectively be known as the United Nations Glasgow Financial Alliance for Net Zero.

- U.S.-based BlackRock, the world’s largest asset manager, has raised $673 million for an infrastructure fund to invest in renewable energy and other climate-focused projects in emerging markets.

- Chinese battery manufacturer CATL signed a deal with electric vehicle maker Fisker to supply two battery packs for an upcoming SUV model.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.