COVID-19 Bulletin: October 21

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices finished higher Wednesday, buoyed by a surprise 400,000-barrel decline in U.S. crude inventories last week and a drop in gasoline stocks to their lowest level in almost two years. Brent closed above $83/bbl, the highest in seven years, as year-to-date growth in global crude prices has exceeded 60%.

- Crude futures were lower in late morning trading, with WTI down 2.5% to $81.33/bbl and Brent down 2.3% to $83.87/bbl. Natural gas was 2.3% lower to $5.05/MMBtu.

- Exxon Mobil is mulling dropping several major oil and gas projects as a reconstituted board of directors presses for a shift toward clean energy.

- High prices threaten India’s target to boost natural gas use from 6.2% to 15% of the nation’s energy consumption by 2030, with several industries looking at switching back to coal and petcoke use.

- Germany is lowering allowable returns for the nation’s power networks until 2029 in a bid to reduce high energy bills.

- Peru’s state-owned Petroperu will begin supplying crude to its Talara refinery for the first time in more than two decades, capitalizing on the global rise in oil prices.

- The United Nations predicts the world’s 15 largest economies will produce more than double the amount of coal, oil and gas in 2030 than targeted for the year in the Paris climate agreement.

- LNG tanker rates have more than doubled since Oct. 1 to their highest levels since January, as power shortages in Asia and Europe drive up demand for vessels.

- Canadian gas distributor Enbridge briefly shut down its Line 5 oil pipeline through the Midwest Tuesday following an incident of civil unrest at a Michigan valve facility.

- Record-low river and rainfall levels are throttling output at the Itaipu dam between Paraguay and Brazil, which accounts for a respective 86% and 10% of total energy generation in the nations.

- Baker Hughes reported an adjusted net income of $141 million for the third quarter, falling short of expectations on persistent disruption in global supply chains.

- Swiss energy firm Guvnor will begin supplying Dow with plastic waste feedstock from its Rotterdam refinery for use in making recyclable plastics later this year.

- Canadian National Railway foresees hydrogen rail shipments growing to rival crude shipments based on several new hydrogen-production projects in Alberta.

- A $22.5 billion project will export energy from the world’s largest solar farm and battery storage site in northern Australia to Singapore by 2027.

- Twenty-nine of the world’s biggest pension funds and investment firms have pledged to cut portfolio emissions by at least 25% by 2025.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- California’s governor extended a regional drought emergency to the entire state amid the second driest year ever recorded.

- The number of vessels waiting to berth outside the ports of Los Angeles and Long Beach is hovering near 100, a record.

- The infinite product variety taken for granted in globalized supply chains could fall by the wayside as supply chain disruptions brought on by the pandemic boost efforts to shrink supply chains and avoid systemic shocks.

- Adobe predicts “out of stock” messages on online retail websites will rise 172% this holiday season from last year and 360% from two years ago.

- Global ports operator ICTSI handled 5.45 million TEUs in the first half of 2021, up 14% from the same time last year as the firm predicts global supply chain disruptions to continue for the foreseeable future.

- The White House has reportedly considered sending National Guard troops to backlogged U.S. ports in a bid to alleviate supply chain disruptions.

- The shortage of U.S. truckers has risen to a record-high 80,000, up 30% from pre-pandemic levels.

- Higher per-mile incentive pay for truck drivers is being offset by extended wait times to load and unload, with average wait times since June extending two hours or longer.

- XPO Logistics opened a 150,000-square-foot LTL terminal near Chicago, its 14th service center in Illinois, to help alleviate the backlog in one of the nation’s critical shipping hubs.

- French carmaker Renault is forecasting a production shortfall of 300,000 vehicles this year, up 80,000 units from previous estimates, while global production losses among all carmakers could exceed 11 million units.

- Amazon is offering bonuses of more than $4,000 to attract British workers ahead of the holiday season.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, clickhere.

- Our Logistics team reports the following:Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply

Domestic Markets

- The U.S. reported 86,759 new COVID-19 infections and 3,071 virus fatalities Wednesday.

- The new COVID-19 mutation spreading in the U.K. has been detected in North Carolina, California and Washington, D.C., with early data suggesting it could be 10% more transmissible than Delta.

- Through August, U.S. COVID-19 fatalities among men during the pandemic have exceeded deaths among women by 65,000.

- The White House is preparing to distribute COVID-19 shots to children as young as five at doctors’ offices, pharmacies and schools ahead of expected regulatory clearance in the coming days.

- The FDA authorized mixing and matching of approved COVID-19 shots and is expected to approve Moderna’s booster shots for anyone over 40.

- Booster shots for COVID-19 in the U.S. have exceeded first-time doses by a ratio of 1.3 to 1.

- Given the choice of vaccination or losing their jobs, 99% of Los Angeles school district employees opted for shots.

- More than 1,880 Washington state employees have quit or been fired after the state’s COVID-19 vaccine mandate took effect this week.

- San Francisco has made good on warnings that it would shut down businesses that do not check the COVID-19 vaccination status of entering customers.

- U.S. workers opposed to COVID-19 vaccines argue that previous infection with the virus should count as a vaccine dose, despite data showing that immunity wanes over time like with vaccines.

- More than 5,200 U.S. children have developed MIS-C, a rare but life-threatening complication of COVID-19, weeks after recovering from the virus.

- First-time jobless claims fell to a pandemic-low 290,000 last week.

- The pandemic has prompted prospective employees to place greater emphasis on workplace benefits.

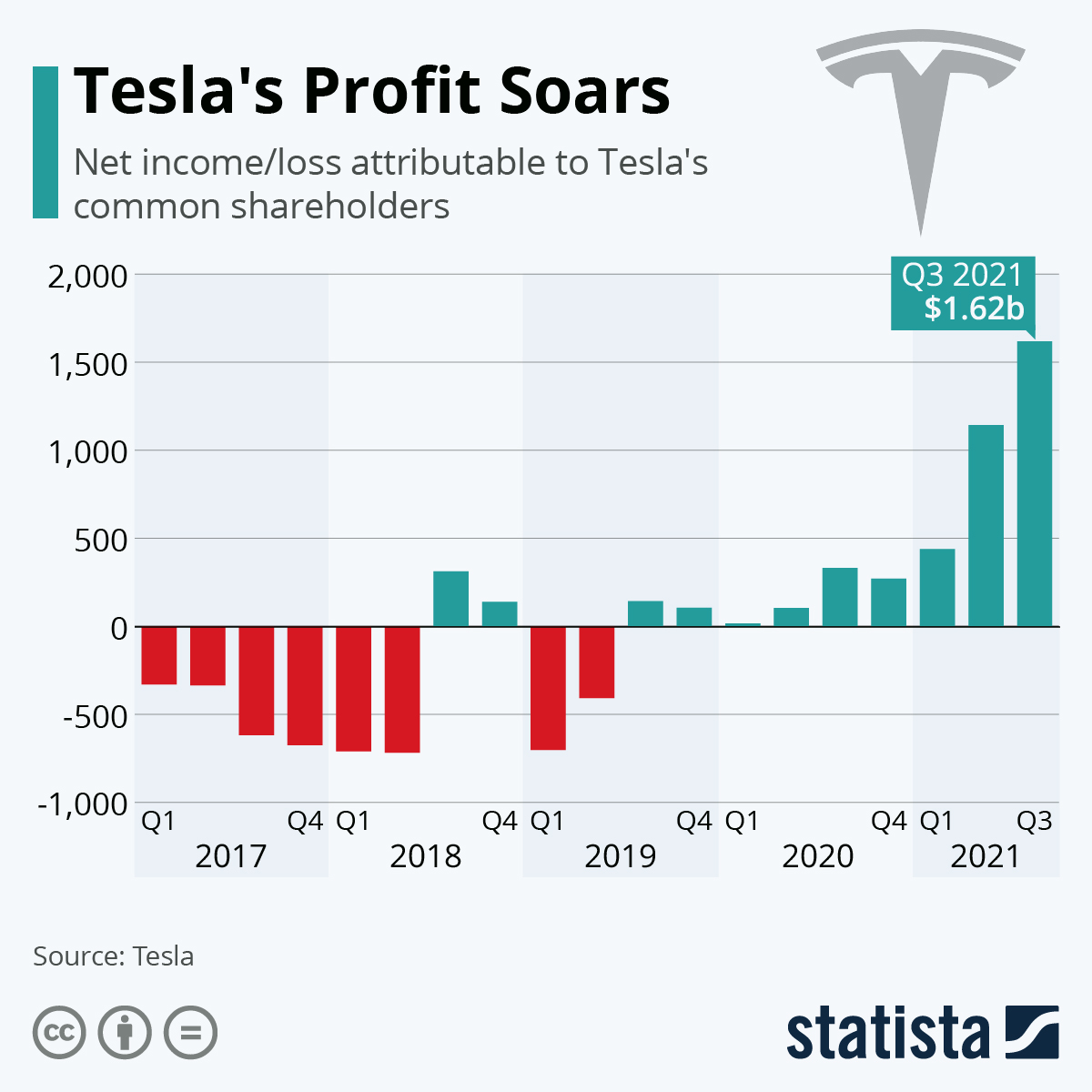

- Tesla successfully navigated supply chain disruptions to post its third consecutive quarter of record results.

- Southwest Airlines said it will cut scheduled flights in December due to staffing shortages, with fourth-quarter capacity expected to be 8% below the 2019 level.

- COVID-19 test maker Abbott Laboratories raised its full-year earnings forecast Wednesday after sales in its diagnostics unit grew nearly 50% in the third quarter from last year.

- New York state announced significant additions to rooftop solar capacity for public buildings, part of a plan to reach 100 megawatts of rooftop generation by 2025.

- Wildfire smoke has more serious health effects on densely populated areas in the eastern U.S. compared to the West, new research shows, with roughly 75% of all smoke-related asthma emergencies and deaths reported east of the Rocky Mountains over the past decade.

- U.S.-based wind and solar producer NextEra Energy added a record 2,160 megawatts to its backlog of projects in the third quarter, with profits rising sharply to $619 million.

International Markets

- COVID-19 infections across Europe rose 7% last week to 1.3 million.

- COVID-19 infections in the U.K. increased 16% the past week, as the nation suffers more new cases than France, Germany, Italy and Spain combined. The country reported 49,139 new cases and 179 deaths Wednesday, as healthcare leaders call for renewed pandemic restrictions and government officials warn daily infections could rise again to 100,000 or more.

- Russia posted 1,028 COVID-19 deaths Wednesday, its third record in as many days, as Moscow imposed a week-long workplace shutdown across the nation starting Oct. 30. Moscow’s mayor ordered unvaccinated people over 60 or in ill health to remain home for the next four months.

- Poland reported more than 5,000 new COVID-19 infections Thursday, the most in five months.

- Romania has averaged one COVID-19 death every five minutes for the past month, as hospitals and funeral homes in the nation are strained to capacity.

- A record 538 people died in Ukraine Tuesday, which has the lowest vaccination rate in Europe, as health officials grapple with widespread vaccine skepticism and the spread of counterfeit vaccine certificates.

- Protesters took to the streets in Bulgaria in opposition to the nation’s “Green Certificate” COVID-19 passport program that takes effect today.

- Serbia, suffering thousands of daily COVID-19 infections and about 50 deaths a day, is imposing a vaccine passport requirement to enter indoor venues after 10:00 p.m.

- Swiss officials declined to lift remaining pandemic restrictions, warning the country is still at risk for a winter virus wave.

- Nearly 80% of COVID-19 patients in Dutch hospitals are unvaccinated.

- India has administered more than 1 billion vaccine doses, with nearly half of the population having received at least one shot and 20% fully vaccinated.

- Seventy percent of Australians age 16 and older have been fully vaccinated, a national milestone.

- A Brazilian Senate panel recommended that criminal charges be brought against the nation’s president for mismanaging the COVID-19 response.

- The Bill and Melinda Gates Foundation will invest up to $120 million to boost production of COVID-19 antiviral pills in low-income nations.

- The World Health Organization warned that the pandemic may last deep into 2022 because of slow global vaccination rates.

- Britain’s Lloyds Bank will close an additional 48 locations on top of the 44 closures announced in June, part of an effort to lower costs by reducing the bank’s physical presence.

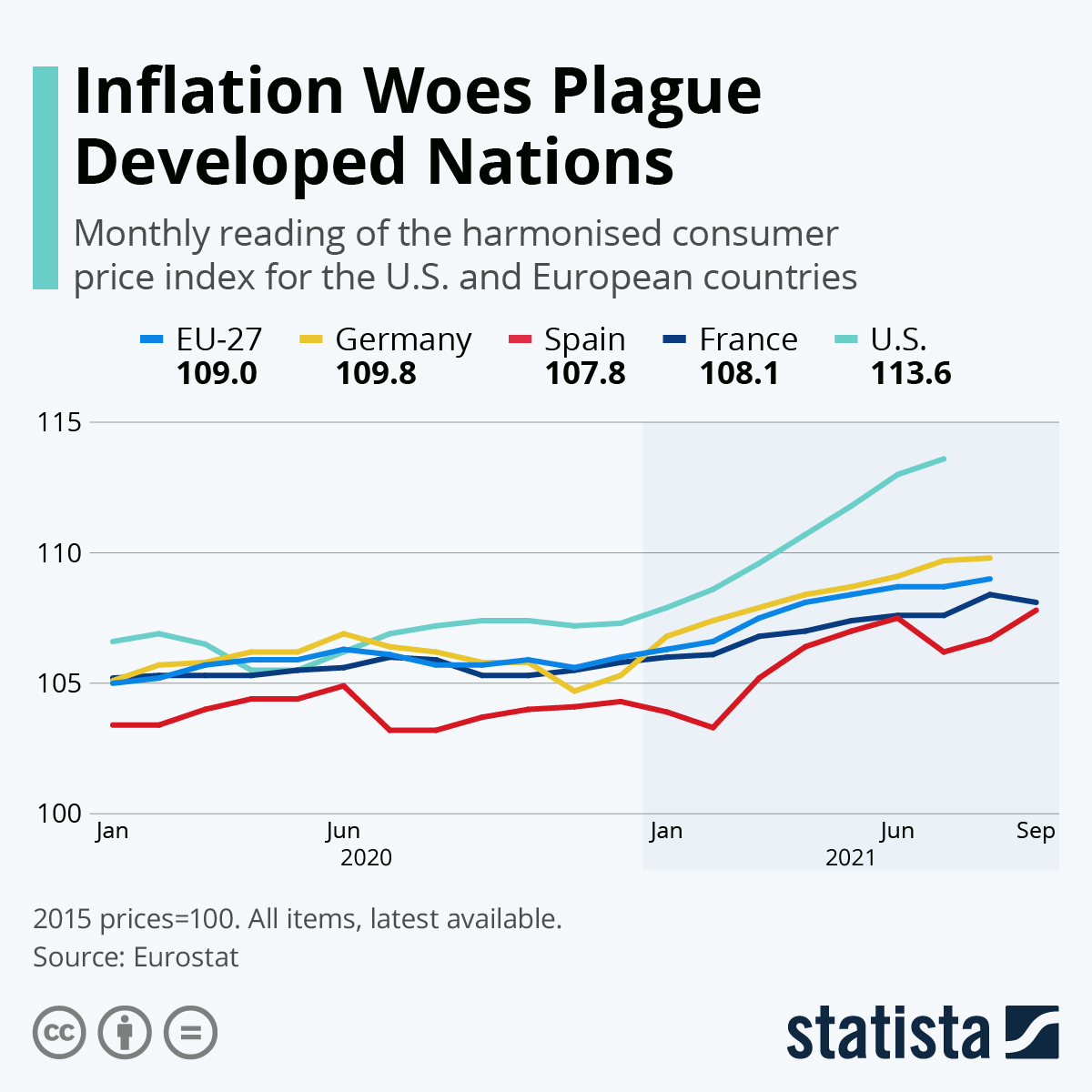

- Canada’s inflation rate increased to 4.4% in September, an 18-year high, driven by increases in transportation, housing and food prices.

- U.K. housing prices rose 10.6% in August compared to a year earlier, up from an 8.5% rise in July.

- Taiwanese tech giant and Apple supplier Foxconn is looking at setting up electric vehicle manufacturing sites in Europe, India and Latin America.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.