COVID-19 Bulletin: October 11

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. benchmark WTI briefly rose above $80/bbl Friday, its highest level in seven years. Crude prices were up roughly 1.1% on the day and nearly 5% on the week on further signs that industries have begun switching from high-priced gas to oil, a transition that could push prices toward $100/bbl, some analysts predict.

- U.S. natural gas prices spiked over $6/MMBtu Friday, the highest levels in a decade and more than double prices in January, yet still just a fraction of extreme prices in Europe that rose to the crude oil equivalent of about $200/bbl Friday.

- Oil futures were higher in late morning trading, with WTI up 2.3% at $81.16/bbl and Brent up 2.0% at $84.02/bbl. U.S. natural gas futures were down 4.0% trading at $5.34/MMBtu.

- Higher U.S. energy prices in everything from liquid fuels to natural gas to coal could push up inflation in the coming months and slow the nation’s recovery, economists predict.

- Wholesale gas prices have increased 400% this year in Europe due to low stocks and strong demand from Asia.

- China demanded a 10% coal production increase from mines in Inner Mongolia to deal with the current energy crunch, after torrential rain in the nation’s top coal-producing province of Shanxi halted operations at more than 400 coal and non-coal mines and at least 14 chemical factories. The nation also raised its price ceiling for coal in a bid to slow consumption.

- India, the world’s second largest coal consumer after China, is suffering electricity outages due to a lack of coal, with over half of its 135 coal-fired power plants having less than three days of supply. Residents in many regions are experiencing power cuts stretching up to 14 hours a day.

- The global power crisis has reached Lebanon, forcing two of its power plants to shut down due to shortages of diesel supplies. More than 6 million people are without power.

- Greece doubled its subsidies for power and gas bills to help residents manage a surge in energy prices.

- The U.K.’s energy regulator plans to significantly increase a price cap on energy prices in April of next year.

- Indian conglomerate Reliance Industries announced two deals to buy solar capacity, as the owner of the world’s biggest refining complex seeks to become net-carbon-zero by 2035.

- Exxon discussed terms of a labor contract with locked-out union workers at a facility in Beaumont, Texas, over the weekend.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Facing supply shortages and supply chain disruption, major brands are prioritizing their most popular products, which is limiting consumer selection and causing empty spaces on store shelves.

- Some of the U.S.’s largest retailers have resorted to chartering their own cargo ships to import goods in time for the holiday season, a tactic used to mitigate supply chain disruptions that could also end up further raising prices.

- An uptick in freighters landing at major U.S. gateways is creating more logjams at almost every link in U.S. logistics networks.

- Daily rates for LNG carriers on U.S. Gulf-to-Japan routes are 93% higher than the same time last year, as Europe and Asia boost their competition for gas cargoes.

- Red-hot container shipping markets have prompted the market reentry of Hanjin Heavy Industries, which received its first commercial shipbuilding order in six years for four boxships.

- Dutch aluminum-maker Aldel will idle production until early 2022 due to rising European energy prices. British producers of steel, glass, ceramics and paper have warned they may be forced to take similar measures.

- Ford is suspending production today and tomorrow at a plant in Hermosillo, Mexico, due to material shortages.

- Chip shortages have taken a greater hit to Stellantis’ bottom line than the pandemic did in 2020, with the carmaker expecting to produce 1.4 million fewer vehicles this year.

- Taiwan’s TSMC and Japan’s Sony Group are considering jointly building a chip factory in Japan with a focus on supplying auto and camera chips.

- The 13 biggest shipping markets in the world were responsible for 131 billion posted packages in 2020, a 27% increase compared to the previous year.

- Labor shortages have forced fast-food chain Raising Cane’s Chicken Fingers to deploy one-third of its corporate staff to work in its restaurants.

- North American oat production has fallen to the lowest level in a decade due to widespread droughts this season.

- Cotton prices have surged 18% over the past month and more than 40% year to date, sending the shares of apparel companies tumbling.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- Our Logistics team reports the following:

- Bulk trucking capacity is very limited as demand is exceeding supply.

- Dry van (full, partial and less-than-truckload) capacity is very limited as demand exceeds supply.

- Port congestion continues to be very problematic, delaying deliveries of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply.

Domestic Markets

- The U.S. reported 22,194 new COVID-19 infections and 255 virus deaths Sunday.

- The U.S.’s daily average for COVID-19 cases dropped below 100,000 Thursday for the first time since August. With just 56% of the U.S. population fully vaccinated, officials are warning about another winter surge.

- Florida saw the most COVID-19 deaths per capita of any state throughout the summer. Meanwhile, state officials withheld funds from eight more school districts that imposed mask mandates contrary to the governor’s orders.

- COVID-19 outbreaks among Minnesota schoolchildren have risen 74% in the past week.

- Wyoming’s largest hospital ran out of available ICU beds Friday due to surging COVID-19 patients, most of whom are unvaccinated. At least 12 of the patients were children.

- Vermont is reporting record-high levels of daily COVID-19 infections.

- North Dakota’s governor is calling on its residents to avoid participating in any risky behavior to help alleviate the burden on the state’s hospitals, where COVID-19 infections remain high amid low vaccination rates.

- San Francisco will begin easing masking requirements in indoor settings Oct. 15.

- COVID-19 cases in Alaska decreased 32% week over week Thursday despite the state still having one of the highest rates in the nation.

- Merck requested emergency use authorization for its COVID-19 antiviral pill.

- Health officials are cautioning against rushing booster vaccine doses for people previously infected with COVID-19 who also had their first two shots, as previous infection effectively serves as a dose of the vaccine.

- In a significant policy shift, the U.S. will begin accepting travelers vaccinated against COVID-19 with shots approved by the World Health Organization, a broader range of vaccines than those expressly approved in the U.S.

- The number of U.S. workers who were unable to work at some point over the last four weeks due to COVID-19 fell in September, a sign that the Delta variant’s impact on the labor market is waning.

- Third-quarter earnings season starts this week, with investors on the lookout for signs of problems posed by rising inflation this quarter and beyond.

- Consumer sentiment trends and other indicators suggest the U.S. may have entered a recession.

- An unusually high number of homes across the U.S. are being appraised below their agreed-upon sales prices, causing some deals to collapse.

- Southwest canceled more than a quarter of its scheduled flights Sunday, citing issues with air traffic control and disruptive weather.

- Roughly 10% fewer Americans are considering traveling this holiday season amid continued high levels of COVID-19.

- The bulk of Walmart’s employees have already complied with the company’s COVID-19 vaccine mandate, while remaining unvaccinated staff have until the end of the month to get inoculated.

- A top Federal Reserve official is urging regulators to issue new climate-change rules for the nation’s biggest banks, including measuring and monitoring risks for investments.

- U.S. electric-vehicle manufacturing is shifting south, with car and battery makers planning to spend nearly $24 billion in new factories from Arizona to Georgia.

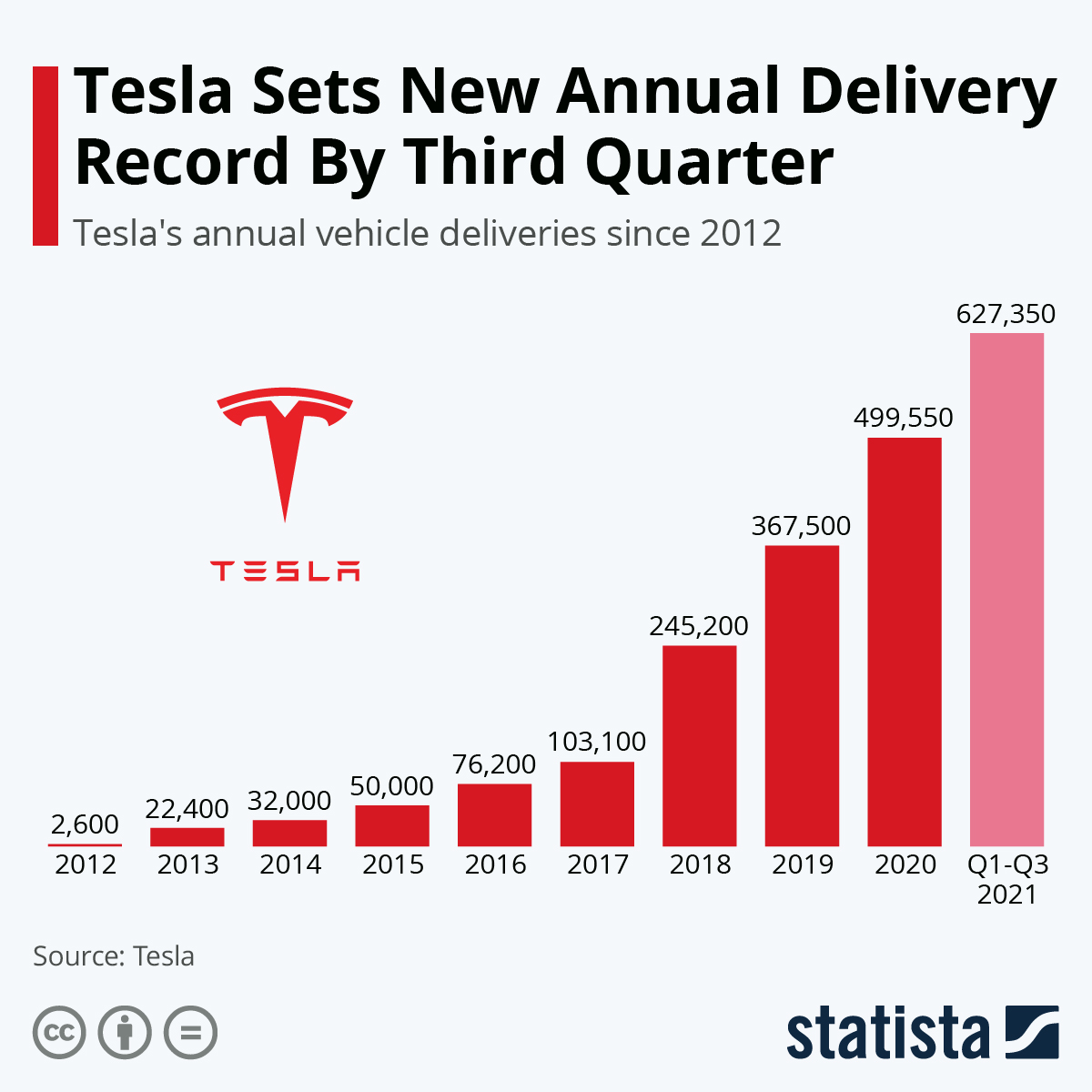

- Tesla delivered more than 627,000 new vehicles in the first nine months of 2021, defying many of the impacts suffered by competitors from the global chip shortage.

- A growing number of automakers and energy firms are investing in direct lithium extraction, a method of extraction that uses less land and water and could provide up to 25% or more of global demand for the key battery metal by 2030.

International Markets

- COVID-19 case rates in the U.K. rose to the highest level since August last week. Officials are launching the biggest flu drive in British history over rising concerns that months of pandemic lockdowns broadly lowered the population’s immunity.

- With COVID-19 vaccine mandate deadlines looming, Canada’s healthcare industry is bracing for an expected wave of staff shortages and layoffs. Meanwhile, the nation’s Ontario province is prepping to lift some pandemic restrictions amid forecasts of fewer virus cases the next few weeks.

- Officials in Sydney, Australia, are bracing for more COVID-19 infections and hospitalizations as the city reopens its economy for fully vaccinated people, ending a 100-day strict lockdown.

- Brazil surpassed 600,000 COVID-19 deaths over the weekend, second only to the U.S.

- Venezuela reported more than 10,000 COVID-19 cases last week, a record high amid extremely low vaccination rates.

- Russia reported more than 49,000 COVID-19 deaths in August, the second-most on record, as the nation surpassed 420,000 virus fatalities since the start of the pandemic. The nation reported an additional 957 COVID-19-related deaths Monday, nearing the country’s all-time high of 968 it reported just two days ago, while the number of hospitalizations from the virus has doubled over the last two weeks. Russia is suspending rocket testing at one of its design bureaus to save oxygen for hospitals.

- Amid its most recent wave of COVID-19, Romania is preparing to send some COVID-19 patients to hospitals in neighboring European nations due to overflow.

- Singapore is loosening COVID-19 travel restrictions in a bid to regain its status as one of the world’s biggest travel and finance hubs. The move caused the website for Singapore Airlines to crash over the weekend, as travel agencies reported a surge in demand for flights to the region.

- Malaysia is the latest nation to authorize Pfizer’s COVID-19 booster shot.

- Mexico’s inflation rate topped 6% in September, double Central Bank targets.

- Canada reported a net 157,100 new jobs in September with the jobless rate slipping below 6.9%, an 18-month low.

- The volume of German exports fell in August for the first time in 15 months, following a string of economic indicators showing the impact of supply chain inflationary pressures.

- Chinese leaders are scrambling to address roughly $5 trillion in property debt taken on by developers in recent years, a growing threat to the nation’s ability to borrow and stave off economic decline. Activity in the nation’s services sector returned to growth in September, with an index rising to 53.4 from 46.7 in August.

- Several major European cities topped the list of best places for travelers during the pandemic due to high vaccination rates and fewer pandemic restrictions.

- The U.K. is facing a pilot shortage that could hamper the reopening of the travel industry following hundreds of pilot retirements or career-switches during the pandemic.

- Indonesia is set to become Asia’s fourth country to introduce a carbon tax, with analysts worrying the measure could undermine the nation’s manufacturing competitiveness.

- During the first eight months of 2021, global companies spent more than $107 million on carbon offsets, up from $72.1 million in all of 2020.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.