COVID-19 Bulletin: September 30

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- U.S. natural gas futures dropped nearly 7% Wednesday, retreating from seven-year highs on forecasts for milder weather over the coming weeks and an expected large storage build. Prices were up 3.9% in mid-day trading at $5.69/MMBtu.

- Crude futures were mixed mid-day, with a potential boost in demand caused by the global energy crunch tempered by a stronger dollar. WTI was up 1.1% at $75.65/bbl and Brent was up slightly at $78.65/bbl.

- Despite oil rising above three-year highs of $80/bbl Tuesday, OPEC+ has indicated it will stick to its plan of increasing output by just 400,000 bpd in November as part of a broader return from pandemic-induced production cuts.

- Goldman Sachs predicts Brent crude could reach $90/bbl by the end of the year.

- U.S. frackers are giving early warnings that an upcoming federal COVID-19 vaccine mandate will tighten the industry’s already short supply of workers.

- India is expected to return to pre-pandemic oil demand of 4.9 million bpd by the end of this year, with demand forecast to more than double to 11 million bpd by 2045.

- The U.K. deployed 150 soldiers as oil tanker drivers to help refuel empty gas pumps and ease queues at filling stations in the nation, the result of a week’s worth of panic-buying amid a severe gas shortage.

- China’s Shanxi province, the nation’s biggest coal producing region, will begin supplying 14 additional regions with the fuel in the fourth quarter amid nationwide power shortages and even unexpected blackouts.

- Saudi Arabia’s Arab Petroleum Investments Corporation made its first sale of $750 million in green bonds Wednesday, as ESG concerns continue to grow in popularity among oil-heavy Gulf nations.

- Norwegian refiner Equinor and Russia-based Rosneft announced broad new goals to lower their methane and CO2 emissions, boost carbon capture and storage, and explore alternative fueling for joint plants in Russia.

- A large group of investors managing a combined $30 trillion in assets has called on 1,600 of the world’s most polluting companies to set science-based emissions reduction targets to help cap global warming at no more than 1.5°C over pre-industrial levels by 2050.

- With just 1% of the world’s population, the Philippines generates over 36% of plastic waste in oceans, with Asia accounting for over 80% of ocean plastic waste.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Category 4 Hurricane Sam continued to churn northwest across the Atlantic Wednesday and is expected to bring dangerous surf conditions along the U.S. East Coast this weekend, including potential flooding.

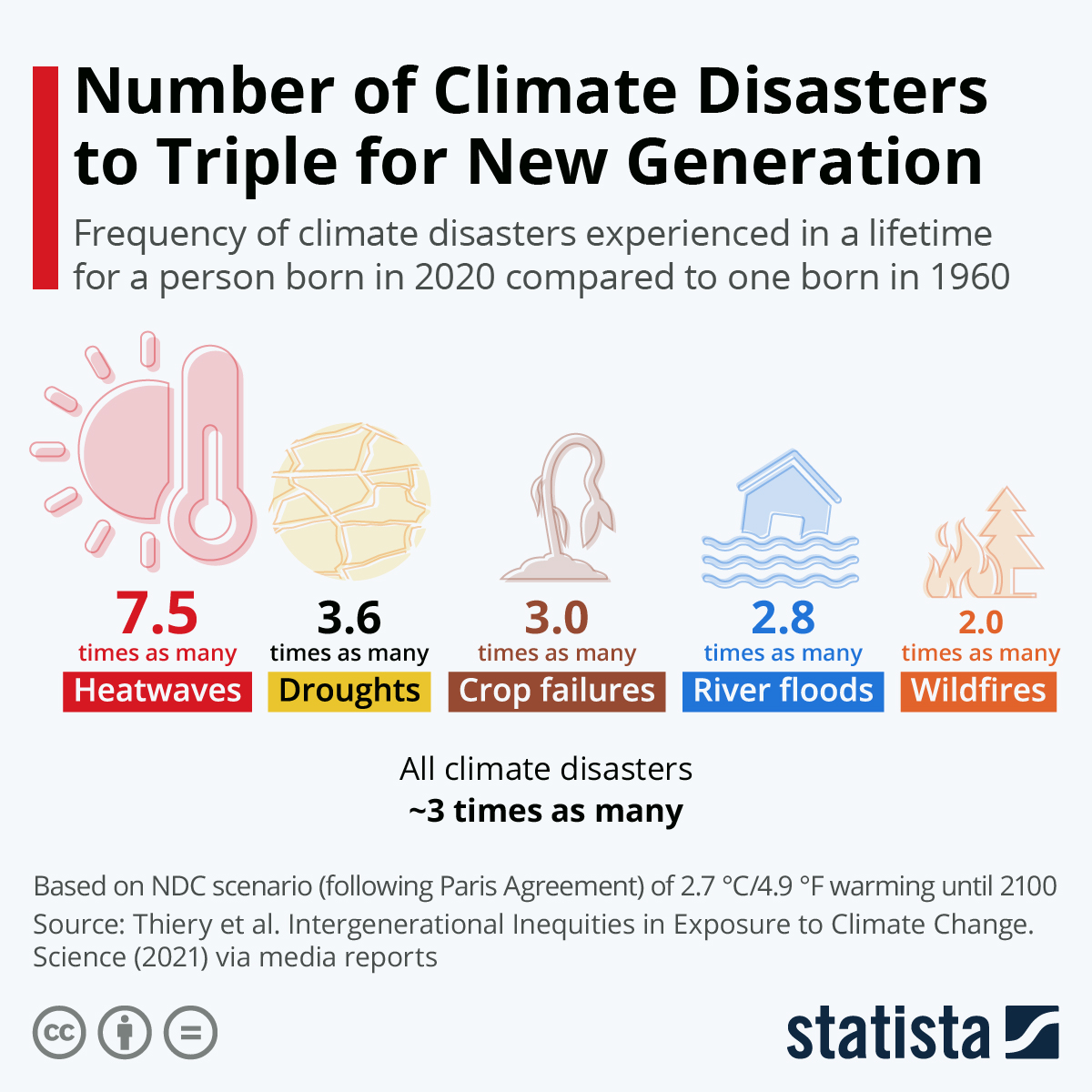

- New data suggests children born in 2021 will see seven times more heat waves, twice as many wildfires, and almost three times as many droughts, river floods and crop failures than people born 60 years ago.

- The backlog of cargo ships at the Port of Los Angeles and Long Beach is continuing to grow, with roughly 500,000 containers waiting to be offloaded between the two ports.

- Tight capacity and high costs in the logistics industry continue to drive expansion, with a managers’ index dipping only slightly from July to 73.8 in August, a near-record high.

- Canadian pension fund CPP Investments inked a $4 billion deal with Oaktree Capital Management to take 100% ownership of Ports America, North America’s largest marine terminal operator.

- First-class mail delivery is expected to slow beginning tomorrow as the U.S. Postal Service cuts office hours as part of a controversial restructuring plan.

- The Baltic Exchange’s main dry bulk sea freight index jumped 4.7% to 5,197 Wednesday, its highest level in 13 years.

- China’s power crunch ended the nation’s 18-month manufacturing expansion in September, with an index of sector activity falling to contraction territory at 49.6. The ensuing power cuts have prompted several smelters to cut production over the past several weeks.

- A high-level meeting between U.S. and EU trade officials in Pittsburgh led to agreement on the need for greater cooperation to boost semiconductor supplies and on ways to address the global shortage without contentious government subsidies.

- Paint is the latest product to face industry-wide shortages due to global supply chain disruptions, prompting manufacturer Sherwin-Williams to lower revenue and profit forecasts.

- Dollar Tree will begin selling some items above $1 to offset cost increases caused by supply chain disruptions and inflation.

- The U.S. Agriculture Department will send $1.5 billion in aid to help ease supply chain issues wreaking havoc on school meal programs, as cafeterias throughout the country experience product shortages, delivery delays and difficulties hiring new workers.

- The price of bacon is up 28% in the past 12 months to the highest level in four decades due to supply chain issues and other factors.

- Our Automotive team informs us of the following plant updates:

- GM’s Lansing, Michigan, Grand River Assembly Plant, maker of the Chevy Camaro and Cadillac CT4 and CT5 models, will resume regular production on Oct. 4.

- GM’s Ramos Assembly Plant in Mexico will extend the production shutdown of the Chevy Blazer through the week of Oct. 11.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

Domestic Markets

- The nation suffered 123,269 new COVID-19 infections and 2,531 deaths yesterday.

- Forty-seven states and the nation’s capital have reported a COVID-19 reproduction level below one, suggesting the U.S.’s most recent virus wave has peaked.

- The FDA is considering authorizing half-dose booster shots of Moderna’s COVID-19 vaccine. Nearly 1 million Americans have scheduled appointments to get boosters so far.

- A second hospital in Alaska has begun rationing care due to surging levels of COVID-19 patients.

- A Montana hospital system has hit 150% capacity in its ICU unit, with National Guard troops on hand to help care for and screen an increasing number of younger and sicker patients with COVID-19.

- Florida reported 5,819 new COVID-19 cases and four additional virus fatalities Wednesday.

- San Diego will require all staff and students over age 16 to be fully vaccinated against COVID-19 by Dec. 20.

- The Los Angeles City Council is considering a sweeping proposal that would require vaccines to enter indoor businesses and venues.

- New York City’s mayor announced the permanent establishment of the NYC Public Health Corps and the launch of the city’s Pandemic Response Institute, a long-term strategy to be better prepared for future health emergencies.

- Over 180 Minnesota healthcare workers sued their employers, hoping to prevent the implementation of COVID-19 vaccine mandates.

- YouTube is banning vaccine misinformation and anti-vaccine content from its platform.

- Flyers have a 59% higher risk of catching COVID-19 during a one-hour meal service on airlines compared with staying fully masked for the duration of the flight, a new study shows.

- The COVID-19 Mu variant, which caused concerns over its potential to evade vaccines, has been eradicated in the U.S.

- Older adults vaccinated against COVID-19 are more worried about the virus and take more precautions in protecting themselves compared to unvaccinated older adults, a new survey shows.

- The Vatican mandated vaccines or regular testing, undermining Catholics seeking a religious exemption from vaccine mandates.

- A growing number of Hispanic adults are getting vaccinated against COVID-19, with the share of those vaccinated growing to 73% in September, up from 61% in July.

- The CDC is encouraging more pregnant women to be vaccinated against COVID-19, as only 31% of the demographic is reportedly inoculated.

- AT&T will extend its COVID-19 vaccine mandate to 85,000 union workers.

- The International Olympic Committee announced that foreign spectators will be banned from the upcoming Winter Olympics in China.

- The NBA says it will withhold pay from players who are not vaccinated against COVID-19 when they miss games.

- Wells Fargo pushed back its return-to-office date for the fourth time, now planning to bring workers back to the office Jan. 10 of next year.

- A new COVID-19 antiviral pill developed by Merck is likely to be effective against all the known virus variants, new studies show.

- COVID-19 patients are 1.4 times more likely than flu patients to experience persistent symptoms.

- Though still below pre-pandemic numbers, rides booked through Uber were up 16% and rides booked through Lyft were up 21% through July compared to the same period last year.

- First-time jobless claims, though expected to drop, rose by 11,000 to 362,000 last week.

- The U.S. Senate may vote this morning to extend government funding until Dec. 3 and avert a potential shutdown tonight at midnight. The head of JP Morgan, America’s largest bank, warned of “potentially catastrophic” consequences if Washington fails to lift the nation’s $28.4 billion debt ceiling and causes a federal default.

- Charitable donations from wealthy Americans increased during the pandemic, with average giving rising by 48% to $43,195 from $29,269 in 2017.

- An all-time high of 10.9 million U.S. jobs are waiting to be filled, while roughly 8.4 million workers are unemployed.

- IHS Markit projects U.S. GDP to grow at a 3.6% annual rate in the third quarter as COVID-19 infections ease and the nation’s economic rebound accelerates.

- Walmart announced plans to add 150,000 store employees for mostly permanent and full-time roles ahead of the holiday season.

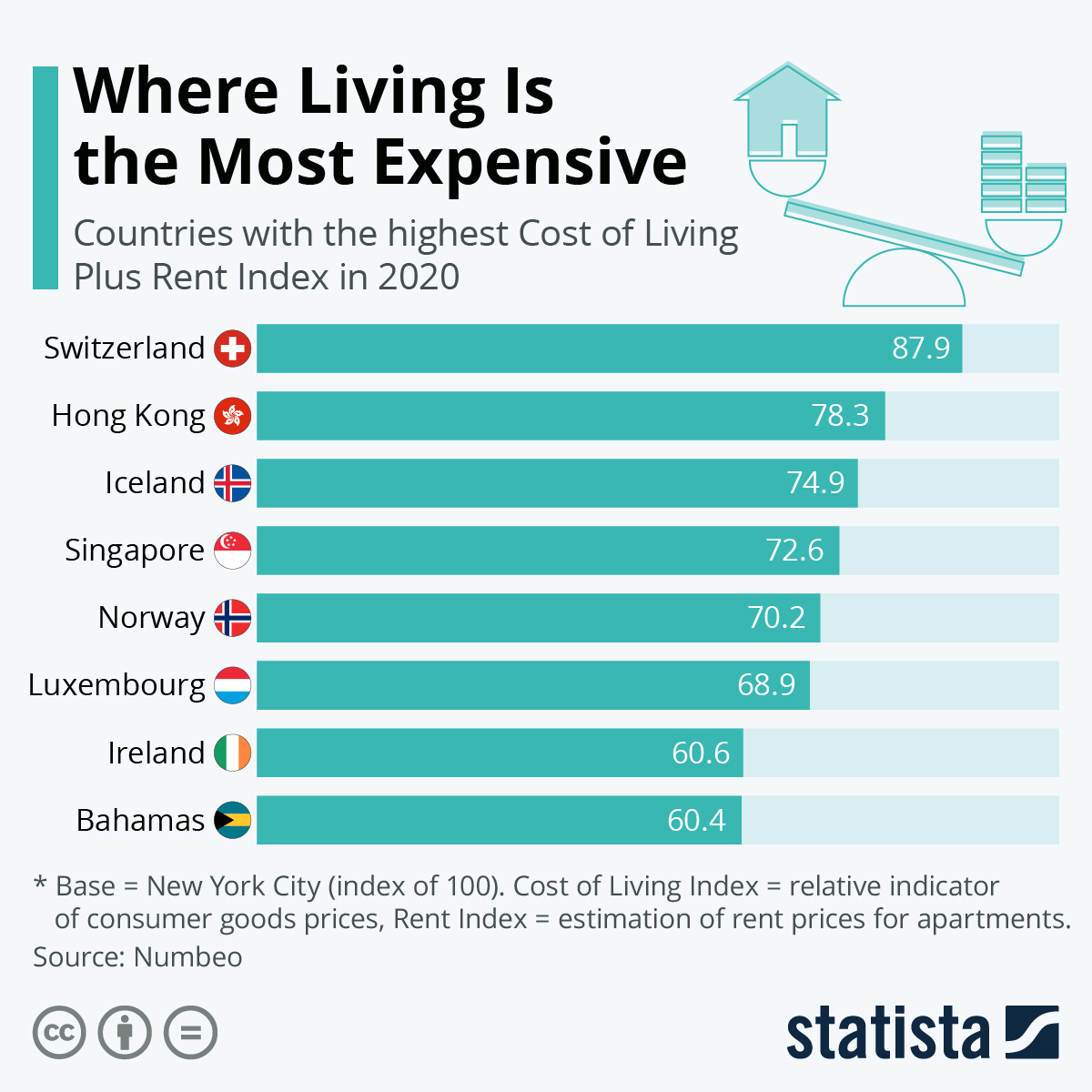

- Soaring real estate values are making it harder for young renters and minority groups to purchase new homes in the U.S., with the average mortgage rising by more than $50,000 last year, while rent prices soared above 11%, including over 25% for some cities in Florida, Georgia and Washington state.

- Contracts to purchase previously owned homes rose to a seven-month high in August, with the National Association of Realtors Pending Home Sales Index jumping 8.1% to 119.5 and snapping a two-month decline.

- In October, U.S.-based electric carmaker Lucid will begin delivering its luxury electric sedans, which it says can best the single-charge range of the Tesla. The firm expects to meet production targets set for 2022 and 2023.

- Jeep yesterday introduced its first plug-in hybrid, the Grand Cherokee 4xe.

- Luxury carmaker Rolls-Royce announced that it will produce only electric cars by 2030, with its first fully electric vehicle to hit the market in the fourth quarter of 2023.

International Markets

- The U.K. reported 36,722 new COVID-19 cases and 150 virus deaths Wednesday, with nearly 7,000 people currently hospitalized with the virus.

- Singapore recorded eight COVID-19 deaths Wednesday, a record.

- More than 60% of COVID-19 deaths in Israel over the past week have been among unvaccinated people.

- Unvaccinated residents of Sydney, Australia, will be barred from participating in many everyday social activities when restrictions are lifted in December.

- India reported 18,870 new COVID-19 infections Wednesday, the lowest since March, and just 179 deaths Tuesday, down from roughly 4,000 per day in May.

- South America now makes up just 6% of global cases and 9% of deaths compared to its June peak of 38% of global infections and 44% of virus fatalities.

- Canada’s population grew by just 0.2% in the three months ending in June, well below pre-pandemic figures.

- Hospitals in England are relaxing certain COVID-19 restrictions in a bid to clear a growing backlog of patients waiting for procedures and treatments.

- Spain will allow soccer stadiums to return to 100% capacity starting Friday as the country’s COVID-19 infection rate continues to fall.

- Japanese telecom firm Nippon is mulling letting its 320,000 employees work remotely permanently.

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.