COVID-19 Bulletin: September 24

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose roughly 1.5% Thursday on continued tight supplies in the U.S. Gulf Coast, with Brent futures reaching a three-year high of $77.25. The commodity is on track for its fifth weekly gain.

- Energy futures were higher in late morning trading today, with WTI up 0.6% at $73.74/bbl, Brent up 0.7% to $77.75/bbl and natural gas 2.5% higher at $5.10/MMBtu.

- Sixteen percent of Gulf oil capacity remains offline in the wake of Hurricane Ida.

- Shell, the U.S. Gulf’s largest producer, said damage to an offshore transfer facility will limit supplies of its Mars sour crude into early next year.

- BP closed some of its U.K. filling stations Thursday due to a lack of truck drivers to deliver supplies, as British officials cautioned the public against panic buying at the nation’s fuel pumps.

- Surging natural gas prices in Europe have hit businesses in Spain particularly hard, where a high number of energy customers use flexible tariffs that are more sensitive to price movements.

- The U.S. Senate Foreign Relations Committee will meet for a closed hearing Sept. 29 over Russia’s Nord Stream 2 natural gas pipeline, the controversial project long opposed by U.S. officials that would significantly boost Russia’s oil exports to Europe while bypassing Ukraine.

- Power plant failures were ruled the single most significant cause of February’s sweeping outages in Texas and parts of other nearby states, as regulators begin calling for more stringent cold-weather standards.

- Oil producer Tenrgys filed for Chapter 11 bankruptcy protection.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Vessel congestion caused by pandemic-induced supply-chain disruptions have taken 15% of global dry-bulk shipping capacity off the market, new data shows.

- The U.S. Commerce Department issued a voluntary request to industry for information on semiconductor chips following a pair of meetings at the White House Thursday. The administration is considering invoking a national security law to obtain inventory and sales information that could help enforce rules against stockpiling. Many nations are lavishing subsidies to expand their semiconductor sectors, including the U.S., where in June the Senate approved $52 billion to boost domestic chip production and research over the next five years.

- Automakers could lose $210 billion in revenue and production of 7.7 million vehicles this year due to supply-chain disruptions, nearly double previous estimates.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- French car parts maker Faurecia lowered its 2021 financial forecasts Thursday as fewer cars are produced amid the ongoing semiconductor shortage.

- U.S. firms’ borrowing for capital investments rose 21% in August from a year earlier but fell 14% from July, indicating softness in equipment demand likely caused by supply-chain disruptions.

- FedEx called labor shortages “the biggest issue facing our business,” noting it’s been forced to reroute 600,000 packages due to a lack of workers.

- Roughly 80% of electronics manufacturers say it has become harder to find qualified workers, while two-thirds say labor costs are rising.

- Breaking with other retailers, Target announced it would hire fewer seasonal employees than in normal years for the upcoming holiday season, largely a result of the tight U.S. labor market.

- Facing a tight labor market, Apple is giving up to $1,000 bonuses to retail employees as a thank you for their work during the pandemic.

- California became the first state to pass a bill that will require disclosure of, and potentially limit the use of, productivity quotas for warehouse employees, a response to alleged conditions at major employers including Amazon.

- Global aluminum prices have reached 13-year highs as China, the world’s biggest manufacturer, reins in production to meet carbon emissions targets.

- A Minnesota agricultural firm became the second Midwestern farm-services provider in a week to be forced to shut down its systems over cybersecurity breaches, severely disrupting deliveries ahead of the busy autumn harvest. The attack came a day after the White House pledged to work with industry to step up private-sector data security measures.

- FedEx is planning to test Aurora’s self-driving technology on Texas routes with truck maker Paccar.

- Japanese operator “K” Line plans to buy eight new car carriers by 2025 with liquified natural gas fueling capability.

- Here are updates from our logistics team:

- Bulk trucking capacity is extremely limited as demand is greatly exceeding supply.

- Dry van (full, partial and less than truck load) capacity is very limited as demand is greatly exceeding supply.

- Port congestion continues to be a significant problem delaying the delivery of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply.

Domestic Markets

- COVID-19 fatalities in the U.S. jumped to 3,157 yesterday, with 128,731 new infections.

- Just 55% of the U.S. population has been fully vaccinated against COVID-19.

- The CDC’s advisory panel largely approved recommendations from the FDA for authorizing COVID-19 booster shots to many vulnerable Americans, including nursing home residents, people with underlying medical conditions and everyone over age 65, with the CDC director adding a recommendation for third shots for healthcare workers or others in jobs at high risk for infection.

- Eighteen states have yet to vaccinate half of their residents: Alabama, Alaska, Arkansas, Georgia, Idaho, Indiana, Louisiana, Mississippi, Missouri, Montana, North Carolina, North Dakota, Ohio, Oklahoma, South Carolina, Tennessee, West Virginia and Wyoming.

- The U.S. has reported almost 1 million new COVID-19 cases among children over the past month, disrupting return-to-classroom plans for many schools.

- Since July 1, Ohio has seen 466 children hospitalized with COVID-19, among the highest rates in the nation.

- Ninety-five percent of Wisconsin’s ICU beds are full, and children have become the state’s most infected age group.

- School bus drivers have died from COVID-19 infections in at least 10 states since August — 12 drivers in Georgia alone — contributing to a national driver shortage.

- The U.S. wasted at least 15.1 million COVID-19 vaccine doses from March through August due to low demand.

- Montana is the latest state to see its hospitals begin rationing care over a surging number of COVID-19 patients.

- New York City’s transit authority will begin issuing $50 fines to riders not wearing masks.

- Aerospace and defense leaders are throwing their weight behind White House efforts to mandate COVID-19 vaccines for large businesses.

- Burnout is causing a growing number of U.S. public health officials to exit the field, with at least 180 resigning or being fired from positions in 38 states as of late 2020.

- The U.S. Commerce Secretary expects the recent decision to allow entry to foreign nationals who are vaccinated against COVID-19 will be a boon for the nation’s economy, especially for tourist destinations and business travel.

- Apple’s Wallet feature will soon provide verified proof of a person’s COVID-19 vaccination, a plus for iPhone users as vaccine mandates spread.

- The U.S. Department of Education will reimburse a Florida school district roughly $150,000 after its state funding was cut for mandating masks.

- Childcare is a growing problem for businesses and working parents, with the industry at 88% of pre-pandemic capacity due to the closure of facilities during lockdowns and the current labor shortage.

- U.S. business activity expanded at its slowest pace in a year in September, with IHS Markit’s index of domestic manufacturing and services falling to 54.5 from 55.4 in August.

- U.S. household wealth rose to a record $141.7 trillion in the second quarter on the backs of stock market gains and the pandemic’s real estate boom.

- Optimism among U.S. firms over business conditions in China has risen to a three-year high, surpassing levels last seen before a trade war initiated under the former U.S. administration.

- Sales at Costco rose 17% in the latest quarter, with inflation accounting for up to 4.5% of the increase.

- General Electric announced a $1.45 billion cash deal to acquire ultrasound company BK Medical, the company’s largest acquisition since 2018 and a sign of increasing focus on its medical imaging business.

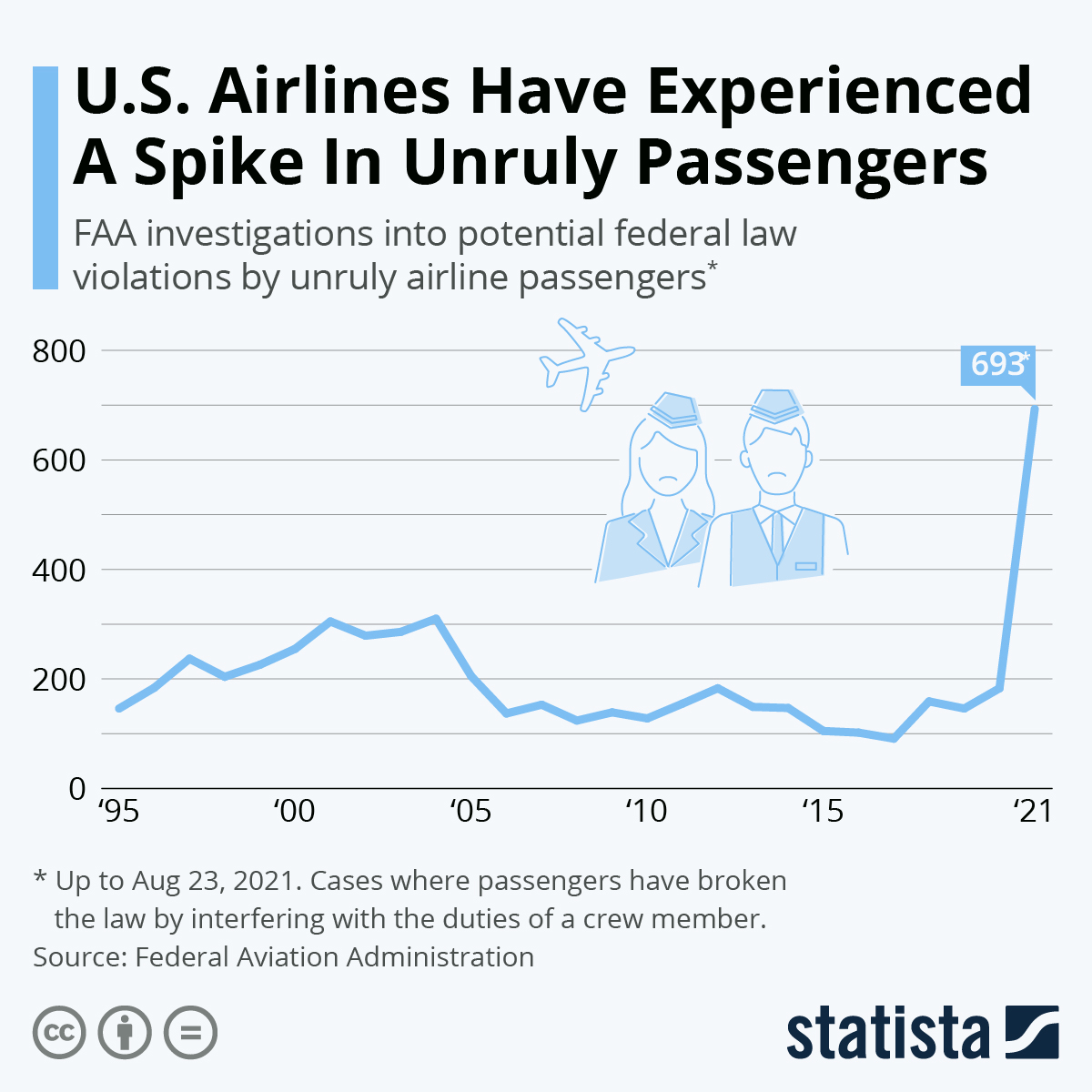

- Delta Air Lines is proposing that the industry adopt a national no-fly list of unruly passengers after a surge in incidents during the pandemic.

- Transport officials in San Francisco are raising concerns over the planned wider rollout of Tesla’s “Full Self-Driving” technology for drivers in the city, saying the feature is not fully autonomous and has not had enough safety testing.

International Markets

- Just 32% of the global population is fully vaccinated with only 16 countries 70% vaccinated, the threshold for achieving herd immunity.

- With 24,611 new COVID-19 cases reported yesterday, Brazil is one day away from surpassing 600,000 total COVID-19 fatalities, second only to the U.S.

- Australia’s Victoria state, home of Melbourne, reported 766 new COVID-19 infections yesterday, a record, as police stepped up their enforcement of pandemic lockdowns after arresting more than 200 people the previous three days.

- The EU’s medicines regulator is expected to make a ruling on third doses of Pfizer/BioNTech’s COVID-19 vaccine by early October.

- New data from Israel shows a third dose of Pfizer/BioNTech’s COVID-19 vaccine provided a tenfold increase in protection.

- Portugal will lift its remaining pandemic restrictions after achieving an 80% full-vaccination rate, and Norway will lift pandemic restrictions tomorrow.

- Moderna’s chief executive made public comments suggesting his belief the pandemic will be over within the next year as COVID-19 vaccine availability picks up globally.

- Various indicators of French and German economic conditions dropped on Thursday, suggesting European business activity is beginning to level off after rebounding sharply over the summer.

- The Bank of England increased its interest rate forecast for year’s end to 4%, more than twice its target rate, as analysts expect the bank to hike rates on a speedier timeline than initially predicted.

- The European Commission proposed rules standardizing charging ports for digital devices, which could eliminate 11,000 tonnes of waste from discarded power cords while crimping revenue streams for some tech companies, especially Apple.

- Swedish carmaker Volvo will eliminate all leather used in its vehicles by 2030 in favor of bio-based and recycled materials.

- General Motors announced a new $300 million investment in Chinese autonomous driving startup Momenta, the automaker’s first substantial foray into using the advanced technology in the world’s largest car market.

- The electric vehicle unit of China’s property behemoth Evergrande has stopped paying staff and factory suppliers.

At M. Holland

- Plastics Reflections Web Series: Supply Chain Constraints & Forecast — Experts from BPI, LyondellBasell and MTS Logistics joined M. Holland to discuss current supply chain challenges impacting the global plastics industry. Click here to read key insights shared during the broadcast and access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.