COVID-19 Bulletin: September 23

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices rose roughly 2.5% Wednesday on news that U.S. crude stocks fell to their lowest levels in three years, a result of continued hits to Gulf Coast production from recent hurricanes.

- Futures prices were higher in morning trading, with the WTI up 1.2% at $73.11/bbl, Brent up 0.9% at $76.86/bbl and natural gas 1.6% higher at $4.88/MMBtu.

- The U.S. administration is considering significant cuts to the nation’s biofuel blending mandates, a potential boon to refiners after years of high costs incorporating ethanol and other ingredients into gas.

- On the heels of more than $23 billion in U.S. shale acquisitions the past year, ConocoPhillips is predicting crude oil demand will bounce back to pre-pandemic levels by early 2022.

- Soaring British gas prices have prompted two domestic energy traders, collectively serving more than 830,000 customers, to announce their departure from the market over solvency issues. The news is the latest in what could be a string of bankruptcies related to soaring energy prices.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Skyrocketing electricity costs in the U.K. have made it impossible for British Steel, the nation’s second-largest steel producer, to profitably run its factories at peak periods during the day.

- Record-high natural gas prices are increasingly pushing heavy industrial companies to curtail production, further adding to global supply-chain disruptions.

- The average dry-bulk charter rate for five leading routes rose to more than $56,000 per day at close on the Baltic Exchange, the highest since records reaching back to 2014.

- Prices for base metals and agricultural products from corn to sugar rose Wednesday, tracking a rebound in U.S. stocks and oil as fears over a crisis in the Chinese housing market began to abate.

- Air freight spot rates out of Asia surged again this week to their highest level this year, with the largest increases from Hong Kong and Shanghai to North America and Europe.

- U.S. beef, chicken and pork reserves have dropped as much as 44% since last year to their lowest levels since 2017, with prices remaining elevated compared to seasonal expectations.

- Plans to extend gate hours at the ports of Los Angeles and Long Beach are running into increasing opposition from truckers, terminal operators and shippers.

- Container handling came to a halt in Bangladesh’s major coastal and financial center of Chittagong yesterday after owners and drivers of trucks, vans and prime movers began a three-day strike over various contractual provisions.

- FedEx plans to invest more than $100 million to improve delivery van safety and reduce costs from accidents, signaling a potential hit to short-term earnings a day after the company posted significant earnings declines for the first fiscal quarter.

- Nike is expected to scale down its full-year earnings outlook today following at least two months of heavily disrupted production related to the latest surge of COVID-19 in Vietnamese factories.

- Import congestion along with shortages of glass bottles and truck drivers could hamper the liquor market for the foreseeable future, with some states forced to ration alcohol sales.

- The White House meets today with industry executives to explore ways the government can help alleviate the global semiconductor shortage.

- Transportation planners are cautioning against overly optimistic projections of U.S. road use when calculating how much to spend on infrastructure, a potentially significant factor as Congress takes aim at a $1 trillion bipartisan infrastructure bill moving toward passage.

- When drafting new contracts and renewing existing ones, companies are adding more provisions that cover unforeseen impacts of pandemics or epidemics and higher levels of inflation, a response to soaring commodity and shipping prices the past two years.

- Meteorologists are tracking the season’s 18th tropical depression off the coast of Africa, which could turn into Hurricane Sam this weekend and head for the Caribbean and U.S.

- Here are updates from our logistics team:

- Bulk trucking capacity is extremely limited as demand is greatly exceeding supply.

- Dry van (full, partial and less than truck load) capacity is very limited as demand is greatly exceeding supply.

- Port congestion continues to be a significant problem delaying the delivery of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply.

Domestic Markets

- The U.S. registered 132,903 new COVID-19 infections and 2,785 fatalities yesterday.

- Average daily COVID-19 deaths in the U.S. surpassed 2,000 for the first time since March, at a rate nearly 10 times higher than in July.

- COVID-19 could have started spreading widely in the U.S. as early as September of 2019, new research suggests.

- The FDA cleared Pfizer/BioNTech COVID-19 booster shots for Americans over 65 and those at high risk of severe infection, adopting the recommendation of a CDC panel that met last week. The agency cautioned against getting the booster for those who received a first shot of a different vaccine, saying there isn’t enough data to support the mixing and matching of doses.

- Alaska’s governor has activated crisis standards of care at hospitals statewide, a move that will allow care to be rationed amid surging COVID-19 patients.

- Roughly 95% of staffed intensive care beds in Idaho hospitals are full, with nearly two-thirds of them taken by COVID-19 patients.

- Ohio’s governor is warning that many of the state’s hospitals are currently at or verging on full capacity due to high numbers of COVID-19 patients, a problem compounded by a shortage of healthcare staff.

- The total number of hospitalized COVID-19 patients in Los Angeles County, the nation’s largest, dropped below 1,000 for the first time in two months, pointing to a slow but steady decline in regional virus trends.

- Modelers advising the CDC presented four possible scenarios for the pandemic, ranging from infections spiking to 232,000 per day before peaking to a steady decline in infections through the spring assuming no new variants and rapid vaccination of children.

- The U.S.’s top infectious disease expert suggested COVID-19 vaccines for children aged 5 to 11 could be approved by regulators within the coming weeks.

- Roughly 32% of teachers surveyed said the pandemic is driving them to make plans to leave the profession earlier than expected, as COVID exacerbates an already tight labor supply for public schools nationwide.

- A COVID-19 vaccine mandate for teachers in New York City has survived an initial court challenge, while opponents are planning to appeal the decision in the months ahead.

- Florida’s new surgeon general ruled that students exposed to someone with COVID-19 who remain asymptomatic can continue to go to school and participate in school activities, a measure drawing widespread opposition from public health and education associations.

- New research suggests that pregnant women who get mRNA COVID-19 vaccines pass high levels of antibodies to their newborns.

- Severe infection with COVID-19 could trigger autoimmune conditions that attack healthy tissue and cause inflammatory diseases, new research shows.

- With just 60% of nursing home personnel in the U.S. vaccinated against COVID-19, officials are warning that residents of the facilities are still at high risk of infection.

- A leading asthma patient group is warning against inhaling hydrogen peroxide, the latest unproven and harmful COVID-19 treatment spreading in viral videos.

- The Mormon church will now require facemasks for all worshipers in its temples.

- Over 97% of United Airlines staff have been vaccinated against COVID-19 after the company mandated the shots, with the remaining unvaccinated opting into religious or medical exemptions.

- The U.S. Olympic and Paralympic Committee will require all staff members, athletes and contractors to be vaccinated against COVID-19 for the 2022 Beijing Olympics.

- Few medical conditions warrant exemptions from approved COVID-19 vaccinations, with employers given wide discretion on who gets approved for exemptions under the pending federal mandate.

- Congressional lawmakers are proposing legislation that would reinstate a nationwide moratorium on evictions.

- The Federal Reserve indicated it could begin reversing monthly asset purchases in November, with possible interest rate hikes as soon as next year amid signs of sustained inflation. U.S. stocks largely recovered from Wednesday’s losses following the news, closing for their best day in nearly two months.

- First-time unemployment claims unexpectedly rose last week to 351,000, the second consecutive weekly increase.

- Manufacturers plan to boost wages by 3.5% and employment by 3.8% in the coming year, record rates from quarterly surveys dating back to 1997, according to the National Association of Manufacturers.

- With third-quarter earnings reports expected to come next month, investors are keeping a close eye on whether U.S. firms will be able to sustain record margins brought on by the pandemic’s forced cost-cutting and price inflation.

- Existing-home sales fell 2% from July to August, the biggest monthly decline since April, as near-record asking prices prompt a cooldown in recent frenzied buying activity.

- Cheerios-maker General Mills posted better-than-expected quarterly sales Wednesday, showing strong growth in its pet foods business that made up for a slowdown for its cooking sauces and baking products.

- The pandemic has prompted advancements and innovations in online learning for corporate universities and learning centers.

International Markets

- The officially recorded global tally of COVID-19 cases is set to surpass 230 million.

- Australia’s Victoria state reported 766 new COVID-19 infections yesterday, a record.

- Brazil’s entire delegation to a U.N. meeting, including its unvaccinated president, are in quarantine after the nation’s health minister tested positive for COVID-19.

- With only 34% of citizens fully vaccinated, the second lowest rate in Europe, Romania is facing a fourth COVID-19 wave with intensive care cases doubling over the past week.

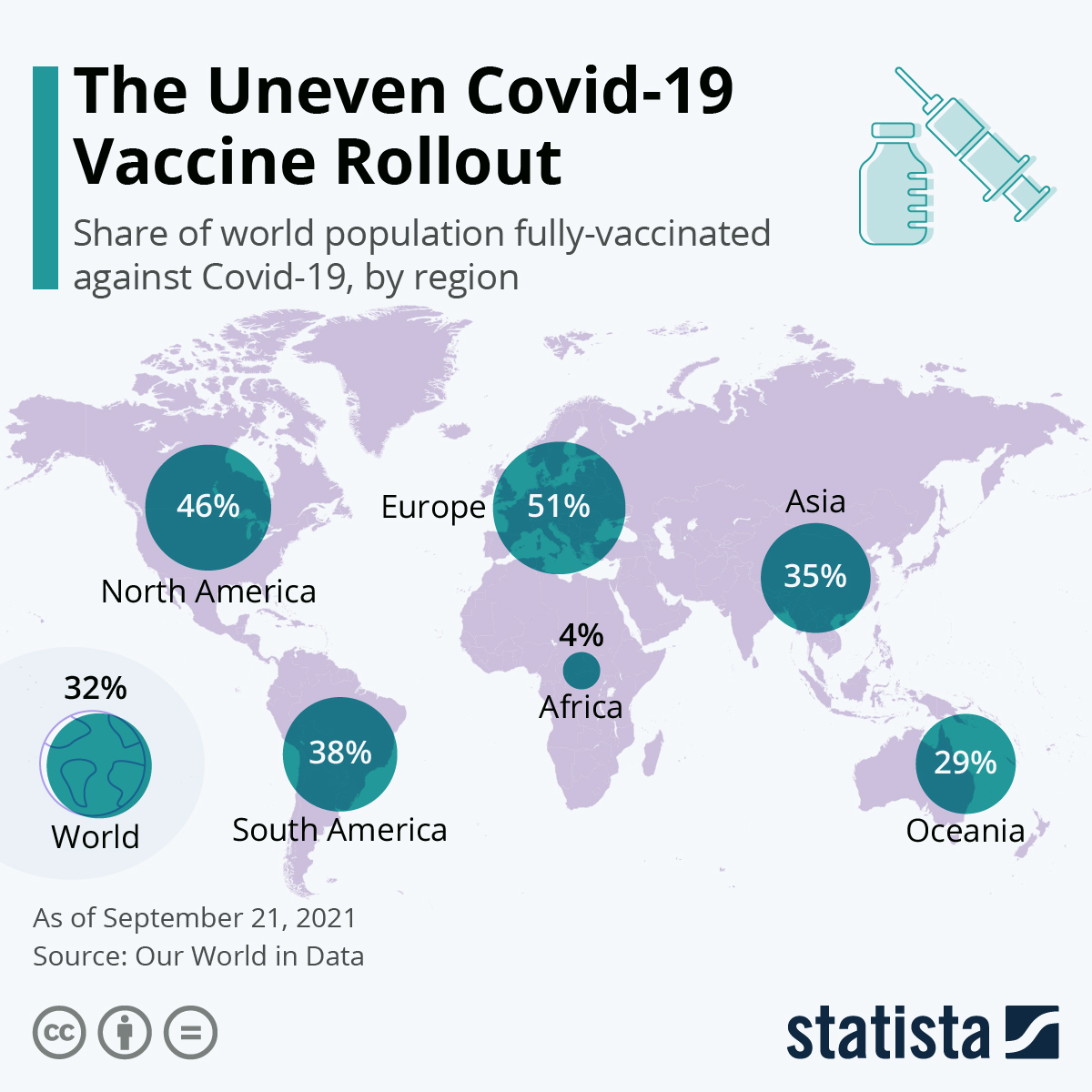

- Europe has the highest vaccination rate globally:

- Russia recorded 820 COVID-19 deaths in the past 24 hours, matching the peak daily death rate set in August.

- Germany will stop compensating unvaccinated workers forced into quarantine by pandemic safety measures.

- India and some African nations are calling the U.K.’s relaxed rules for international travel discriminatory because they only apply to vaccinations OK’d by an “approved health body,” which excludes many nations in Africa, Asia, the Caribbean and the Middle East.

- Portugal claims to have fully vaccinated more than 80% of its 10.3 million citizens against COVID-19, making it one of the highest-vaccinated nations in the world.

- Mexico will inoculate up to 1 million children with underlying health conditions for COVID-19.

- Japan and Italy announced major new orders of COVID-19 vaccines for donation to other countries.

- An index of Eurozone economic activity fell to 56.1 in September, the second monthly decline and lowest reading in five months as the spreading virus slows the region’s economic recovery.

- Despite the current crisis in the Chinese housing market, the nation is still pulling in large investments from U.S. firms overlooking the risks of high-profile regulatory crackdowns on the nation’s property developers, technology firms and other private enterprises.

- An air taxi startup recently landed a deal to sell 150 aircraft to a Chinese automaker, the latest in a series of similar moves that included a Brazilian airline’s purchase order of 250 electric air taxis for use in Sao Paulo.

- The World Health Organization tightened its air pollution guidelines for the first time since 2005, a bid to clamp down on deaths caused by dirty air.

At M. Holland

- Plastics Reflections Web Series: Supply Chain Constraints & Forecast — Experts from BPI, LyondellBasell and MTS Logistics joined M. Holland to discuss current supply chain challenges impacting the global plastics industry. Click here to read key insights shared during the broadcast and access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.