COVID-19 Bulletin: September 22

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices seesawed most of Tuesday before ending slightly higher. Energy futures were higher in morning trading today, with the WTI up 1.8% at $71.77/bbl, Brent up 1.8% at $75.72/bbl and natural gas 0.5% higher at $4.83/MMBtu.

- The American Petroleum Institute reported a 6.2-million-barrel draw from crude inventories last week, nearly triple the expected draw.

- As global oil demand rises, OPEC+ is struggling to meet rising production quotas due to underinvestment and maintenance shutdowns in several countries.

- The energy crisis in Europe is being exacerbated by production cutbacks in the Netherlands, which has pledged to shut down its fossil fuel industry by 2050 and plans to shut down one of the world’s largest natural gas fields next year.

- The average U.S. price per gallon of gas rose to a seven-year high of $3.20 yesterday, fueled by continued production and refinery disruption caused by Hurricanes Ida and Nicholas.

- With its $9.5 billion purchase of Shell’s West Texas properties, ConocoPhillips’ investments into U.S. shale have ballooned to $23 billion in less than a year.

- Increased adoption of electric vehicles could cut global oil refinery demand in half by 2050, new research suggests.

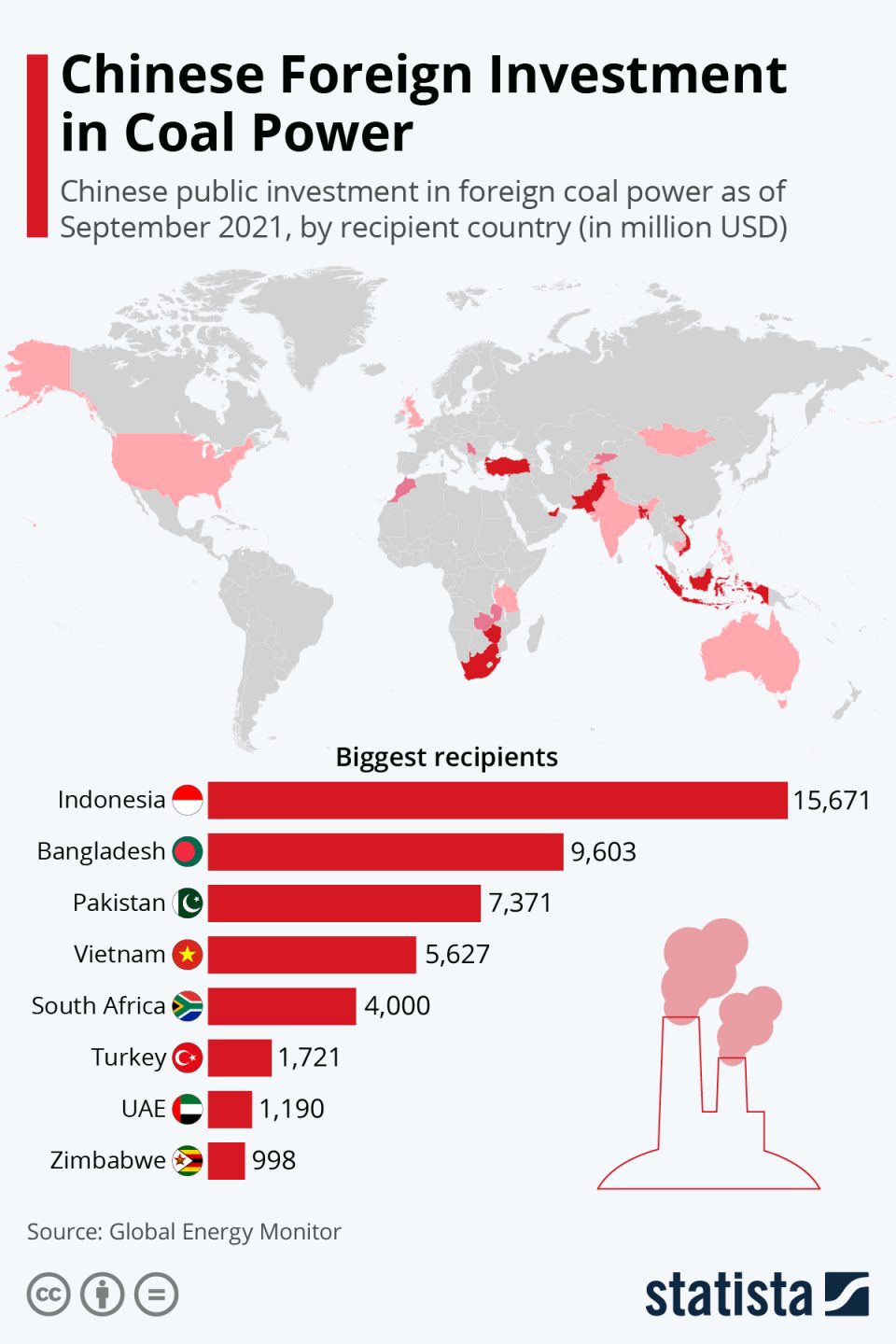

- China will stop building new coal-fired power projects abroad, China’s leader announced.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The queue of vessels waiting offshore at the ports of Los Angeles and Long Beach surpassed 70 yesterday, a record high.

- The average time container ships spent in ports across the globe rose 11% in the first half of 2021.

- Wait times for deliveries of semiconductor orders stretched to 21 weeks in August, a record.

- Honda’s Japanese factories have been operating at 40% of capacity in August and September due to semiconductor shortages, the automaker revealed, while output could rise to 70% of capacity by early October.

- GM’s CFO warned third-quarter wholesale deliveries could be down by 200,000 vehicles due to the global chip shortage.

- Hundreds of workers at a Ford plant in India are protesting the automaker’s recent announcement to permanently halt production in the country because of competition from low-cost domestic rivals.

- For a partial list of automotive disruptions caused by semiconductor and component shortages, click here.

- FedEx posted a 7% drop in quarterly profit and cut its full-year forecast yesterday as labor costs rose by $450 million year over year on higher wages and overtime payments.

- A 5.9 magnitude earthquake struck near Melbourne, Australia, Wednesday, a day after heated protests in the city over pandemic restrictions.

- China’s soybean imports from the U.S. fell nearly 90% in August as volumes from Brazil surged.

- With U.S. steel mills running near 85% of capacity, U.S. steelmaker Nucor announced plans to build a $2.7 billion steel mill in the Midwest to serve nearby regional markets in the Northeast. The news follows U.S. Steel’s recent announcement of a new $3 billion mill.

- Revenue from Egypt’s Suez Canal rose 11.6% to $4.09 billion in the first eight months of the year compared to the same time last year.

- Most companies have shifted their supply chain focus from controlling costs to ensuring supply, new data shows.

- Japanese industrial land prices rose for the fourth consecutive year in 2020 on booming demand for warehouses.

- Macy’s is hiring 76,000 full- and part-time workers ahead of this year’s expectedly busy holiday season.

- Here are updates from our Logistics team:

- Bulk trucking capacity is extremely limited as demand is greatly exceeding supply.

- Dry van (full, partial and less than truck load) capacity is very limited as demand is greatly exceeding supply.

- Port congestion continues to be a significant problem delaying the delivery of imported containers.

- Packaging and pulverizing/grinding production challenges persist as demand is exceeding supply.

Domestic Markets

- There were 120,788 new COVID-19 infections and 2,331 fatalities in the U.S. yesterday.

- Mortality rates for adult Americans with COVID-19 rose in July from all-time lows, a disappointing reversal after months of improvement.

- Eight in 100,000 people are dying of COVID-19 in the nation’s 10 least vaccinated states, four times the death rate in the 10 most vaccinated states.

- Texas, Georgia and Alabama accounted for more than a third of the 9,500 U.S. fatalities from COVID-19 last week.

- For the first time since its peak surge last winter, Alabama is reporting more than 100 COVID-19 fatalities per day.

- Roughly 70% of ICU patients in Idaho hospitals have COVID-19. The state had more than 680 hospitalized virus patients as of Tuesday, a record.

- Pennsylvania’s seven-day average of new COVID-19 cases is up 12% from a week ago and nearly 100% from a month ago.

- Wyoming activated its National Guard to assist overwhelmed hospitals with a surge in COVID-19 cases.

- Virginia is providing those vaccinated for COVID-19 with QR codes to validate proof of vaccination for employers or businesses.

- The new R.1 variant of COVID-19, first discovered in Japan, has been detected at a nursing home in Kentucky.

- A booster shot of Johnson & Johnson’s COVID-19 vaccine received two months after initial injection significantly boosted protection against the virus, the company said. The company’s proposed two-dose regimen was 94% effective in clinical trials.

- A third of U.S. small businesses have voluntarily reinstated pandemic restrictions, new data shows.

- San Francisco’s international airport became the first in the U.S. to require COVID-19 vaccines for all workers.

- U.S. railroad Amtrak will require all 18,000 of its employees to be vaccinated against COVID-19 by Nov. 22.

- North Carolina’s Novant Health suspended 375 employees across its network of 15 hospitals and hundreds of clinics for failing to meet a vaccination deadline. Suspended employees have five days to comply or will lose their jobs permanently.

- Two of the U.S.’s largest retail associations are asking for a 90-day delay on implementing COVID-19 vaccine and testing requirements recently laid out by the White House.

- The value of U.S. imports exceeded the value of exports by $190.3 billion last quarter, a 14-year high as businesses replenished inventories and consumer spending stayed strong.

- Single-family housing starts, accounting for the largest share of the U.S. housing market, dropped 2.8% in August for the second decline in as many months.

- The U.S. House passed legislation that would fund the government through Dec. 3 of this year and suspend the nation’s debt limit until December 2022. The bill now heads to the Senate where it faces an expected partisan standoff.

- Uber indicated it could post its first ever adjusted profit in the current quarter as online food ordering continues to surge and ride bookings begin rebounding.

- Tech giants have been taking advantage of lower office building prices across U.S. cities, with Google recently picking up prime real estate in Manhattan for $2.1 billion.

- Disney’s TV group is reporting delays on hundreds of new programs in production due to spreading COVID-19 outbreaks in the U.S.

- Americans are turning to the bottle during the pandemic, with 17% of respondents in a recent Harris Poll survey reporting “heavy” drinking in the past 30 days.

- Airlines face a growing pilot shortage after many pilots left the workforce during the pandemic and airlines shift to smaller passenger aircraft.

- The U.S. Justice Department is suing American Airlines and JetBlue Airways in a bid to stop a partnership that antitrust regulators say would raise fares in busy northeastern airports.

- McDonald’s is phasing out fossil fuel-based plastic in Happy Meal toys, replacing it with recycled or renewable sourced materials.

- A growing number of U.S. firms are tying interest rates on corporate loans to environmental and other sustainability targets amid increased investor pressure to combat climate change.

International Markets

- New COVID-19 infections globally dropped to 3.6 million last week, down from 4 million the week before, the first significant decline in two months, due to meaningful improvements in the Middle East and Southeast Asia.

- The roughly 17% of Israel’s population unvaccinated against COVID-19 now accounts for nearly half of the nation’s virus deaths.

- Panama joined Chile and Ecuador in authorizing third COVID-19 vaccine shots to vulnerable citizens.

- White House plans to boost COVID-19 vaccine exports to low-income nations are stalling over a lack of required storage and distribution infrastructure.

- The Organization for Economic Cooperation and Development lowered its growth forecasts for the global and U.S. economies in 2021, the first downgrade since December of last year on resurgent COVID-19 cases.

- Despite a record share of British manufacturers reporting rising new orders this month, output continues to suffer over supply chain disruptions and labor shortages.

- BMW and Daimler are being sued for alleged refusal to tighten carbon emissions targets and give up fossil fuel-emitting cars by 2030.

- European lawmakers are set to unveil a proposal that would mandate uniform chargers for mobile phones, tablets and headphones, a move likely to affect Apple more than its rivals.

- A Brazilian airline has agreed to buy up to 250 electric air taxis for use in Sao Paulo by 2025.

- China, facing a property debt crisis, boosted injections of short-term cash into the financial system on Tuesday, the third such move since last Friday.

- Bank of America cut forecasts for China’s annual GDP expansion through 2023, largely a response to a recent crisis in the nation’s property market, with widespread ripple effects starting to hit neighboring economies.

- The Asian Development Bank lowered its growth forecast for Asia due to the surging pandemic, warning of “lasting scars” to the region’s economy.

- Most European nations broke at least one pollution limit last year despite COVID-19 lockdowns that broadly improved air quality.

- The White House announced a goal to double available funds by 2024 to help developing nations combat climate change.

At M. Holland

- Plastics Reflections Web Series: Supply Chain Constraints & Forecast— Experts from BPI, LyondellBasell and MTS Logistics joined M. Holland to discuss current supply chain challenges impacting the global plastics industry. Click here to read key insights shared during the broadcast and access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

For all COVID-19 updates and notices, please refer to the M. Holland website.