COVID-19 Bulletin: September 3

More news relevant to the plastics industry:

Some sources linked are subscription services.

Hurricane Ida

- At least 45 people have died from remnants of Hurricane Ida sweeping through the U.S. Northeast, unleashing record rainfalls, flash floods and tornadoes.

- The White House authorized release of emergency fuel stocks Thursday as only a quarter of the 288 Gulf Coast oil platforms evacuated ahead of Hurricane Ida have been able to restart operations. Critical oil hub ports handing up to 1.8 million bpd of crude also remained shuttered.

- With White House authorization, Exxon tapped the Strategic Petroleum Reserve to restore gasoline refining in Louisiana.

- Most ports along the U.S. Gulf Coast had reopened as of Thursday afternoon, including the central ports of New Orleans and Baton Rouge, while the Mississippi River reopened with only daylight-time restrictions from the Southwest Pass through New Orleans.

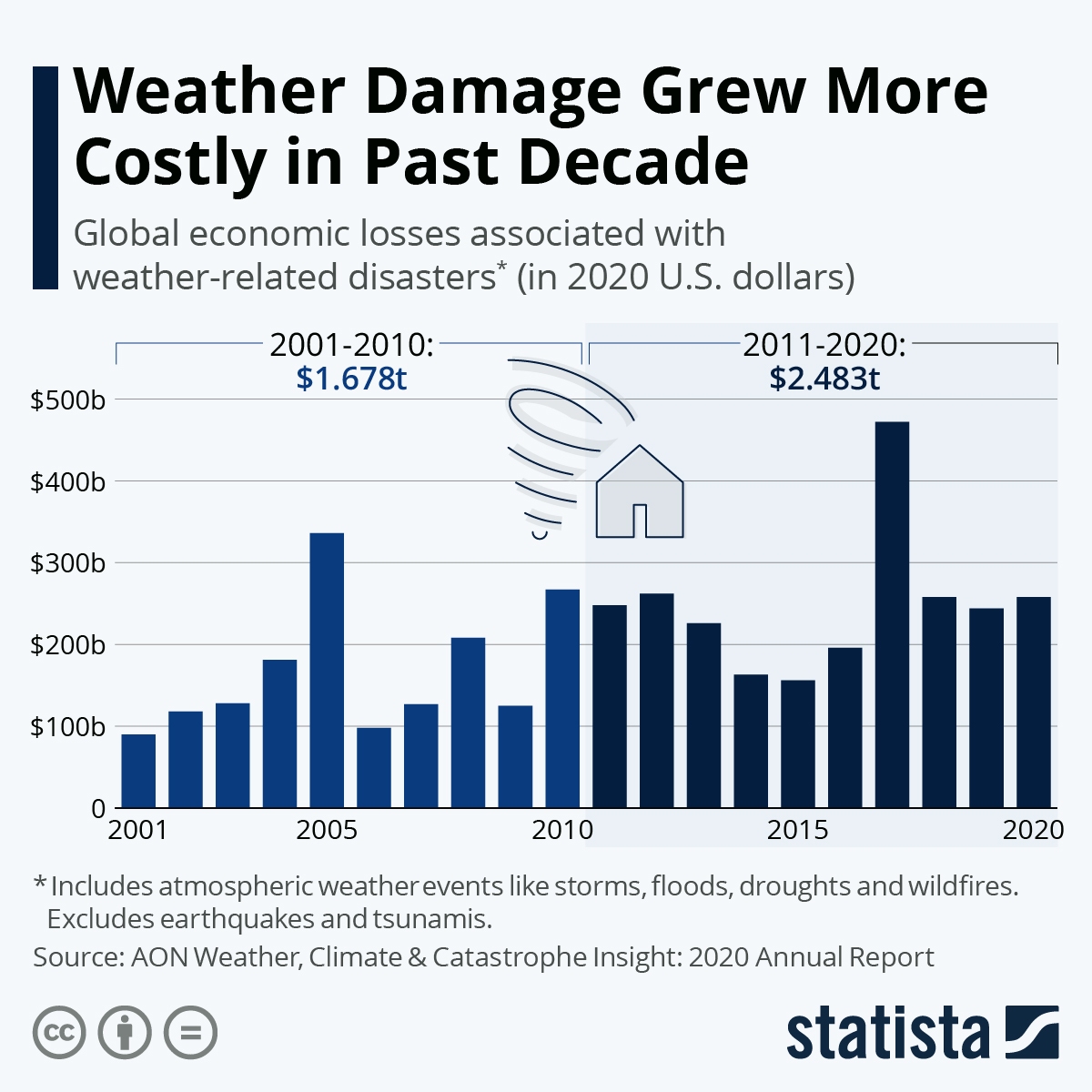

- Weather events across the globe are becoming increasingly costly:

Supply

- Oil prices closed 2% higher Thursday on rebounding optimism in the U.S. economy and a larger-than-expected drop in crude inventories.

- Energy prices were mixed in late morning trading today, with WTI down 0.5% at $69.61/bbl, Brent down 0.2% at $72.86/bbl, and natural gas up 1.0 % at $4.69/MMBtu.

- After five months of suppressed oil imports by China, spot demand is showing signs of a strong recovery fueled by improving economic activity, lower inventories and the near end of a government investigation of refiners.

- CITGO curtailed production at its oil refinery in Corpus Christi, Texas, due to a shortage of oxygen, which is in tight supply because of soaring COVID-19 hospitalizations.

- Chevron announced plans to invest $600 million in two U.S. soybean crushing facilities, a future feedstock for renewable fuels. The company is girding for a possible proxy fight with Engine No. 1, the investment firm that recently won three seats on Exxon’s board after pressuring the firm regarding its sustainability policies.

- Crude output in Venezuela’s highest production oil belt fell by 25% to less than 300,000 bpd in August, as producers grappled with a shortage of diluents needed to blend the region’s heavy crude.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- High winds near South Lake Tahoe pushed California’s Caldor Fire closer to the town of 22,000 Thursday, with the 210,000-acre blaze 25% contained.

- California’s two-month-old Dixie Fire slowed as it approached 900,000 acres on Thursday, with containment rising to 55% after a period of calmer winds.

- In the latest news of the global chip shortage’s effects on the vehicle industry:

- General Motors announced it will idle two main pickup plants in Mexico and Indiana, while also suspending production at three other factories for up to two weeks.

- Ford will scale back pickup production at three truck plants next week in Missouri, Michigan and Kentucky.

- Mercedes-maker Daimler forecast a larger-than-expected hit to third-quarter sales.

- India’s Mahindra expects a 20%-25% drop in September vehicle production.

- The chip shortage is hampering production of badly needed heavy trucks, with July’s output at the lowest level since May 2020.

- Entering the normally robust Labor Day sales weekend, U.S. automobile inventories were at a record low in August with just a one-month supply, down 58% from the already lean level of a year ago.

- Canadian Pacific Railway gave Kansas City Southern a Sept. 13 deadline to accept its buyout offer, which still faces regulatory hoops after a higher offer from Canadian National Railway was withdrawn after an unfavorable agency ruling earlier this week.

- Bulk carriers are increasingly looking at using their largest vessels to carry containers for the highly constrained box shipping market. Greece’s Star Bulk became one of the first carriers to convert a 175,000-DWT capsize vessel into a 1,400-TEU container ship.

- Clothing retailers have dealt with rising supply-chain disruption by decreasing standard inventories and offering fewer end-of-season markdowns, a strategy that also boosted margins to record highs.

- Amazon has expanded its U.S. air operations to roughly 164 flights per day.

- Niche passenger carrier Eastern Airlines has amassed a fleet of Boeing 777 jets that it plans to convert to freighters, capitalizing on a shift to air cargo as seaborne shipping faces continued disruption.

- Consumer packaged-goods companies are forecast to invest $23.8 billion to further digitize their supply chains by the end of the decade.

Domestic Markets

- The U.S. saw 153,143 new COVID-19 infections and 1,588 virus fatalities yesterday.

- COVID-19 infections per 100,000 Americans rose 14% over the past two weeks, with the largest increases clustered in the U.S. Southeast, along with Indiana, West Virginia and South Dakota.

- States with highest COVID-19 infections the past week also saw the most vaccinations administered, new data shows.

- Many U.S. hospitals have reported treating more children with COVID-19 than at any other time during the pandemic. In Florida, the number of pediatric hospital admissions for the virus is hovering around 68 per day, while Texas currently has nearly 300 child hospitalizations.

- Florida reported more than 1,300 new COVID-19 fatalities on Thursday, as hundreds of unreported deaths from the past several weeks were finally included in official data. August was the state’s deadliest month of the pandemic, which saw an average of more than 175 fatalities per day. Meanwhile, Florida schools, businesses and agencies will be fined $5,000 for requesting proof of vaccination under new state orders.

- Alabama currently has roughly 100 more ICU patients than available beds, as surging COVID-19 patients force overcrowded hospitals to come up with temporary treatment sites.

- More than 80% of Americans showed some level of immunity to COVID-19 in blood tests prior to the Delta variant surge.

- The risk of “long-haul” COVID-19 is reduced by half for fully vaccinated people who catch breakthrough infections, new data shows.

- Moderna is asking the FDA to approve a booster shot with roughly half the dosage of its normal COVID-19 vaccine. The company says it will reduce side effects while still providing significant protection.

- The White House announced $2.7 billion of new investment in vaccine production and distribution, a bid to strengthen supply, as top health officials suggest making a three-shot COVID-19 regimen standard practice.

- Hospitals are engaged in a bidding war for nurses, as many are leaving the profession over COVID-19 fatigue and others are signing up for higher wages as travel nurses.

- Nearly half of Manhattan office employers have delayed return-to-office plans due to surging COVID-19 cases, survey results show.

- The NBA is considering rules that will segregate unvaccinated players in locker rooms, eating facilities, on buses and on planes, while the Tampa Bay Buccaneers claim to be the first NFL team fully vaccinated against COVID-19.

- The U.S. added 235,000 jobs in April, lower than expected and the smallest gain in seven months, as the unemployment rate fell to 5.1%, the lowest of the pandemic.

- U.S. layoffs dropped to their lowest level in a quarter-century in August as the number of people on state unemployment rolls fell to a 17-month low. Despite the news, more than half of small business owners in the U.S. report having unfilled job openings amid an exceptionally tight labor market that recently prompted Walmart to raise its minimum wage by $1.

- New orders for U.S.-made goods rose 0.4% in July after gaining 1.5% in June, indicating a robust manufacturing sector despite persistent supply-chain disruptions.

- The White House expects consumer prices to rise 4.8% in the fourth quarter of 2021 from a year earlier, up sharply from the expected 2% rise from previous forecasts in May.

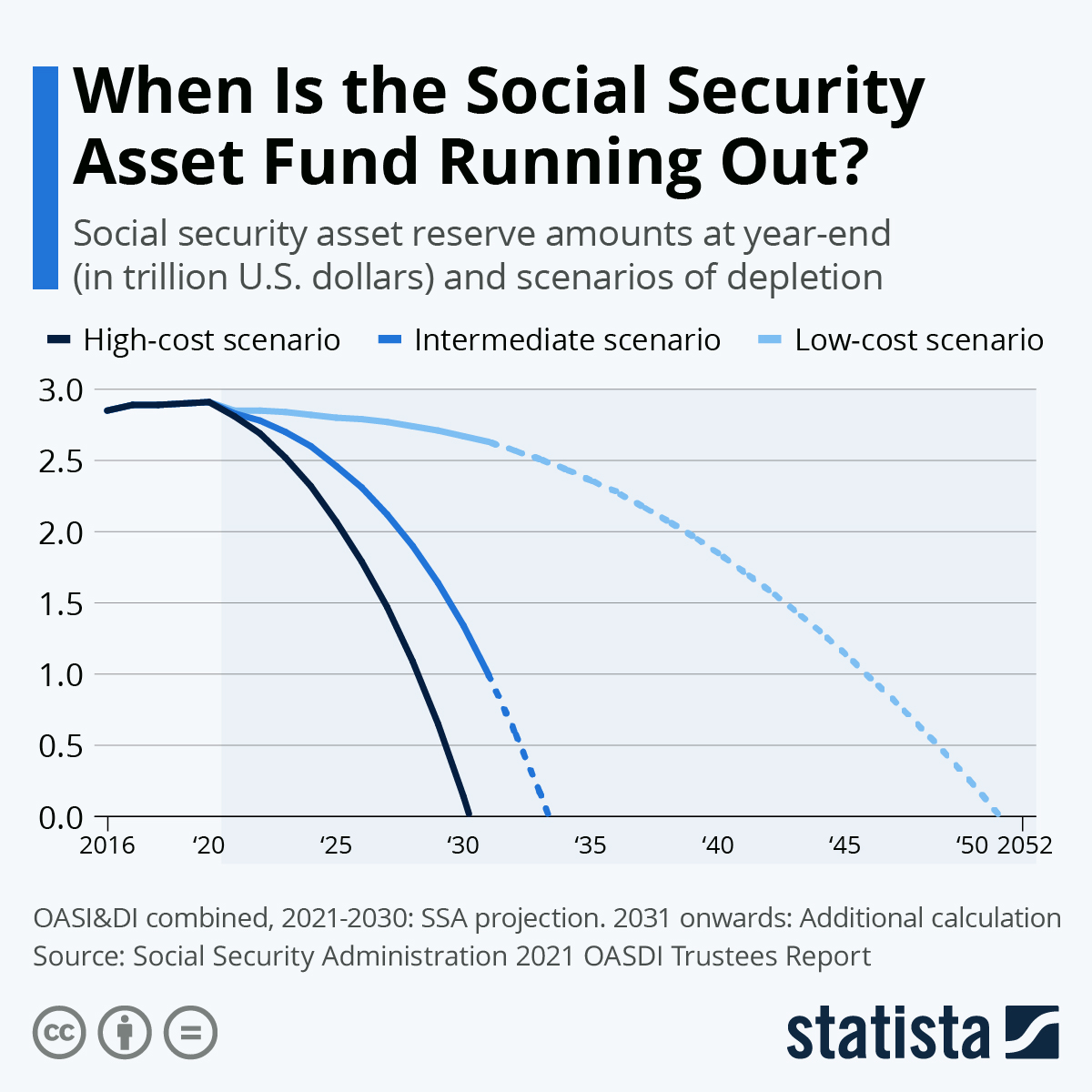

- For the first time in nearly four decades, Social Security payments made to retired Americans will exceed tax dollars coming into the program, a longtime trend accelerated by last year’s pandemic downturn.

- Apple stopped short of a COVID-19 vaccine mAmazon is looking to hire 55,000 people globally for corporate and technology positions, continuing a hiring spree that has nearly doubled its American workforce to 950,000 people since the beginning of the pandemic, making it the second-largest U.S. employer behind Walmart.

- Hyundai’s luxury Genesis brand will phase out all gas-powered cars by the end of the decade, with its entire fleet from 2025 onward running on fuel cells and batteries.

- The SEC’s recently confirmed probe into Workhorse, an Ohio-based electric vehicle (EV)-truck startup, is the fourth known investigation into EV manufacturers in the past year. The company has significant overlap with Lordstown Motors, another EV-truck startup facing SEC scrutiny over misleading investors.

International Markets

- Mexico reported over 18,000 new COVID-19 infections yesterday, raising active cases by 3%, even as 30 of the country’s 32 states report declining pandemic curves.

- Sweden is banning entry for inbound passengers from the U.S., Israel and four other countries until Oct. 31.

- Europe’s economic recovery eased in August, with the purchasing managers index slipping to 59 due to rising COVID-19 infections and supply chain bottlenecks.

- Japan’s service sector activity plunged in August to the lowest level since May 2020.

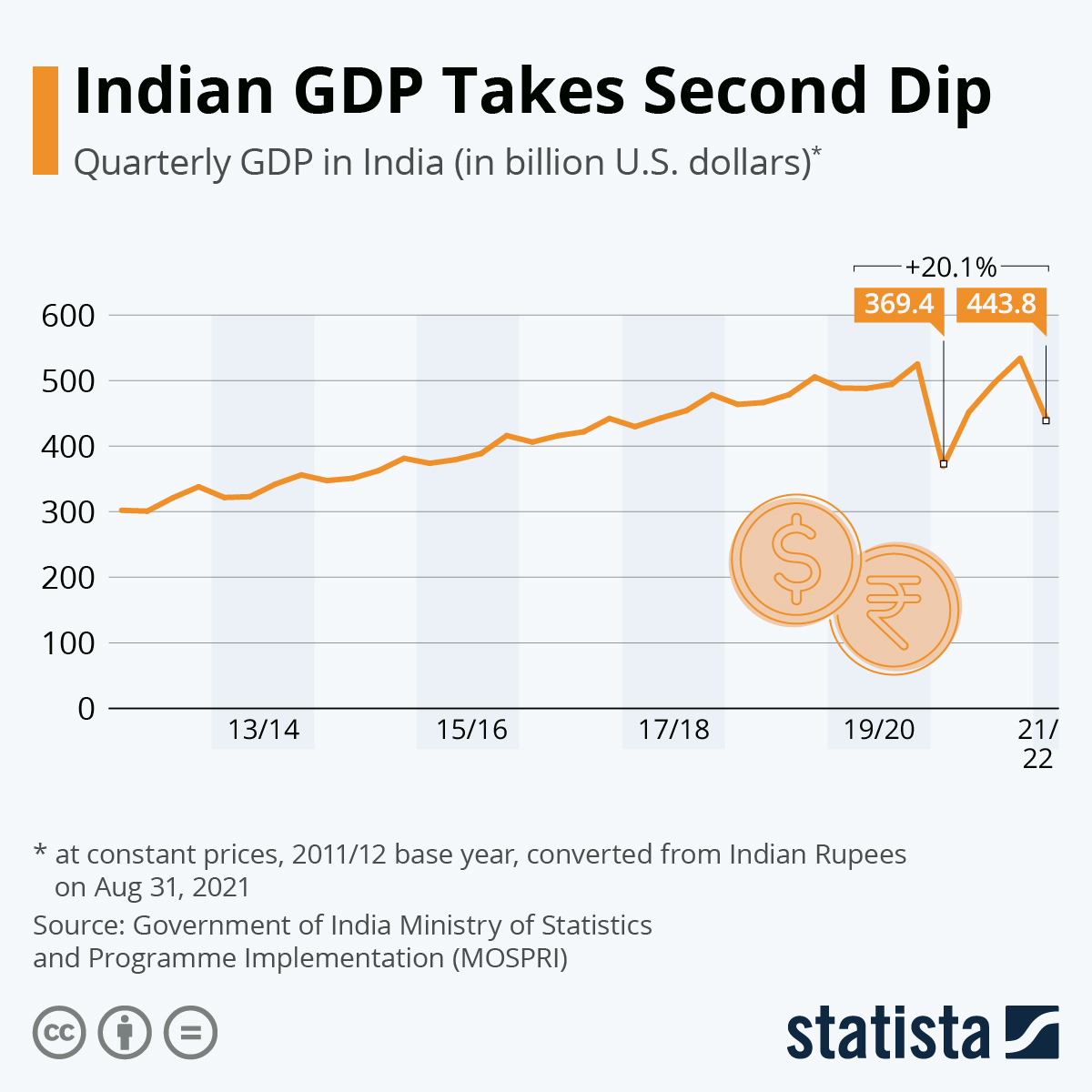

- The impressiveness of India’s 20% GDP growth in the second quarter is tempered by the nation’s record-setting economic plunge for the same period last year.

- Canada’s trade activity with the U.S., its largest trading partner, reached record levels in July, driven mostly by growth in auto market trade.

- The resurgence of COVID-19 has stalled the nascent recovery of the Caribbean’s all-important tourism industry.

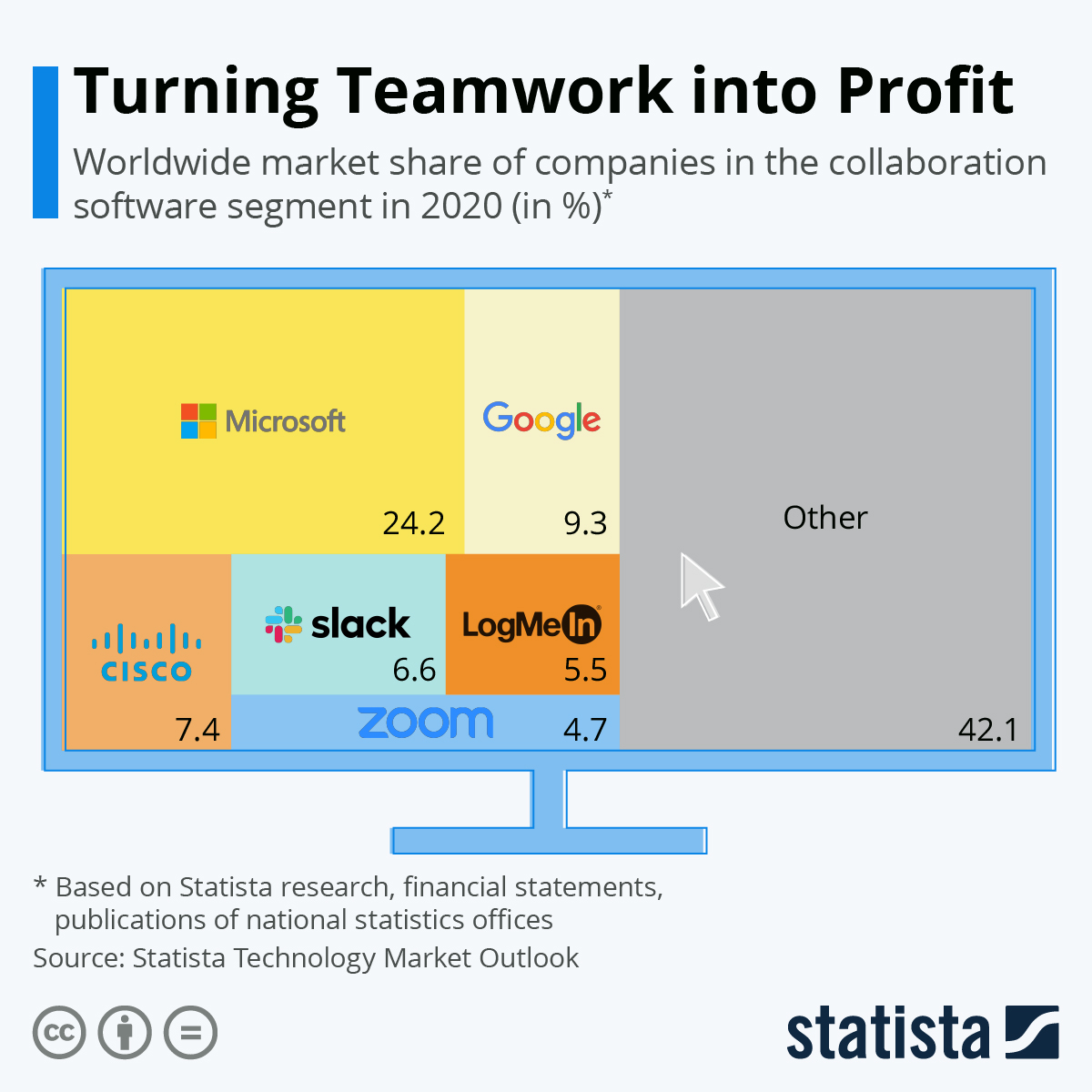

- Global spending on collaboration software reached a record $22.6 billion in 2020, up more than 32% from 2019 as analysts predict the trend will continue even as more companies return to the office.

- Short of protective gear and facing a COVID-19 surge, Thailand is recycling plastic bottles into fiber for PPEs.

At M. Holland

- M. Holland will be closed Monday, Sept. 6 in observance of the Labor Day holiday.

- During last week’s Plastics Reflections Web Series event, panelists from M. Holland, BPI, LyondellBasell and MTS Logistics discussed how global supply chain complexities are impacting the plastics industry. Click here to access the recording.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.