COVID-19 Bulletin: July 19

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

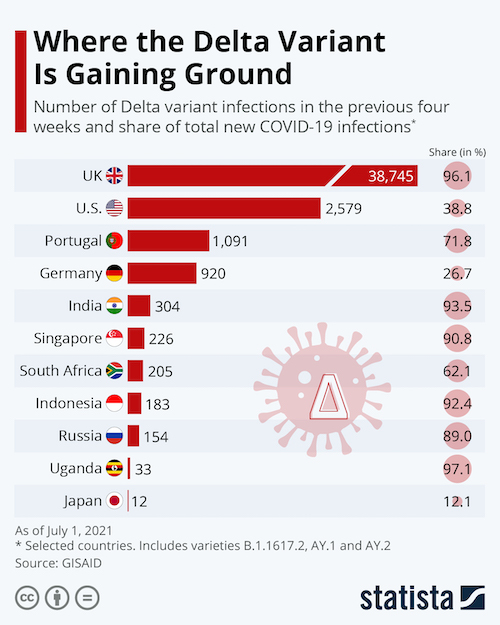

- Fears that the spreading Delta variant of COVID-19 could stall the economic recovery sent crude futures lower in morning trading, with WTI down 6.5% at $67.07/bbl and Brent down 6.0% at $69.18/bbl. Natural gas futures were 1.8% higher at $3.74/MMBtu.

- Oil prices fell Friday, closing the week down more than 3.0% in the steepest drop since March.

- OPEC agreed to a two-year timeline for restoring all pandemic-induced production cuts, with monthly 400,000-bpd increases starting next month.

- The number of active U.S. oil and gas rigs increased by five last week to 484, up from 231 the same time last year.

- The U.S. Energy Information Administration predicts oil demand will return to pre-pandemic levels in the second quarter of 2022.

- Iran’s Gulf of Oman port will send out its first oil exports this week, with an expected exporting capacity of 350,000 bpd in its first phase.

- A new federal program lets local governments speed up the permitting process for rooftop solar panels, a move expected to significantly lower installation costs and lead to greater adoption.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- A “heat dome” that brought extremely hot temperatures to parts of Idaho, Montana, Utah and Wyoming over the weekend will continue into the first half of this week.

- Southern Oregon’s Bootleg fire, the nation’s largest, has burned more than 227,000 acres and displaced roughly 2,000 residents since erupting July 6. At least 70 wildfires are burning more than 1 million acres in the U.S. West as severe drought conditions persist, with evacuations also ordered in northern California Sunday.

- While the hurricane season remains quiet in the Atlantic, two storms — Hurricane Felicia and Tropical Storm Guillermo — churned in the eastern Pacific over the weekend.

- The death toll from recent severe flooding in Germany and Belgium increased to 180 over the weekend, officials report, as torrential storms moved further south into Bavaria and Austria Sunday.

- General Motors will idle production at four of its North American plants for two weeks due to the global semiconductor chip shortage.

- Container shipping rates from Asia to the U.S. and Europe surged to record levels over the past week, topping $10,000 on average, with high costs likely to continue through peak season.

- Intermodal units accounted for 56% of all railcars in 2020, compared to just 52% in 2019, following the surge in e-commerce activity driven by the pandemic.

- Second-quarter revenue at Kansas City Southern jumped 37% to $749.5 million on increased freight volumes and fuel surcharges.

- South Africa’s Port of Richards Bay has cleared its shipping backlogs, while operations at the Port of Durban are improving after days of civil unrest in the area.

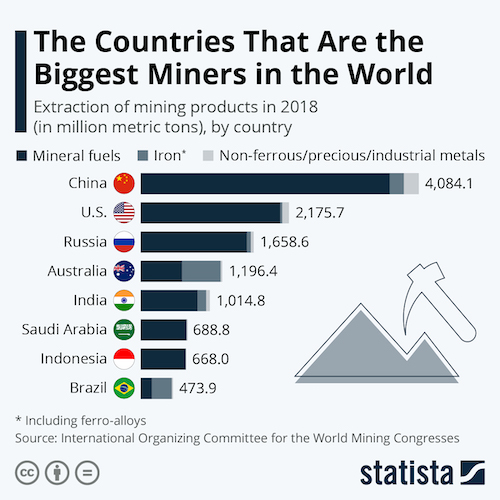

- China will continue auctioning state reserves of copper, aluminum, zinc and other materials in a bid to lower global commodity prices. The nation has plenty of reserves to sell:

- A surge in demand for electric vehicles has small-scale miners for lithium, cobalt and rare earth metals developing mines and building refining capacity in Europe, hoping to break free from China’s market dominance.

- Honda is exploring new alliances to increase production and reduce the cost of electric vehicles, which the company hopes will account for 100% of its sales by 2040.

- Volkswagen has signed charters for four new liquefied natural gas-powered car carriers to enter service by the end of 2023, with routes planned between Germany and Mexico.

- Cosco Shipping announced plans to purchase 10 new container ships for $1.5 billion, with plans for the vessels to be delivered on a staggered basis from 2023 to 2025.

- Our logistics team reports that bulk trucking firms are often declining to book long-haul, out of network loads due to extreme capacity constraints.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports primarily due to increased volume of ships and containers. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- COVID-19 cases were rising in all 50 U.S. states by the end of last week, led by outbreaks in patches of the country’s center, south and west, with small increases almost everywhere else.

- The CDC is referring to a “pandemic of the unvaccinated,” with a recent surge in cases, hospitalizations and deaths mostly among unvaccinated people. The U.S. reported 226,012 new infections and 1,806 COVID-19 deaths last week.

- New COVID-19 cases in Florida currently account for roughly 20% of all new infections in the U.S.

- New York City’s seven-day moving average for new COVID-19 cases surged 62% the past week.

- COVID-19 cases in Texas are rising, with its positivity rate at over 10%, its highest since February.

- More than 260,000 unused COVID-19 vaccines are set to expire in Michigan, reflecting persistent vaccine hesitancy despite widely available shots.

- Despite roughly half the U.S. population being fully vaccinated against COVID-19, the virus is still deadlier than firearms, car accidents and influenza combined, new research shows.

- The FDA will review Pfizer/BioNTech’s COVID-19 vaccine for full regulatory approval in January 2022. The vaccine is currently approved only by emergency order.

- A U.S. appeals court ruled in favor of the CDC in its case against Florida, blocking a state order that barred the agency from enforcing its COVID-19 sailing rules.

- Pandemic-induced service cutbacks and labor shortages in the U.S. tourism industry have led to increased trash piling up at hotels and resorts, an uncomfortable new reality as leisure and business travel begin to rebound.

- U.S. airline travel traffic reached almost 2.2 million passengers Sunday, the most since February 2020.

- State Department staff shortages and a backlog of passport applications is upending plans for travelers seeking to travel abroad this summer who need passport renewals.

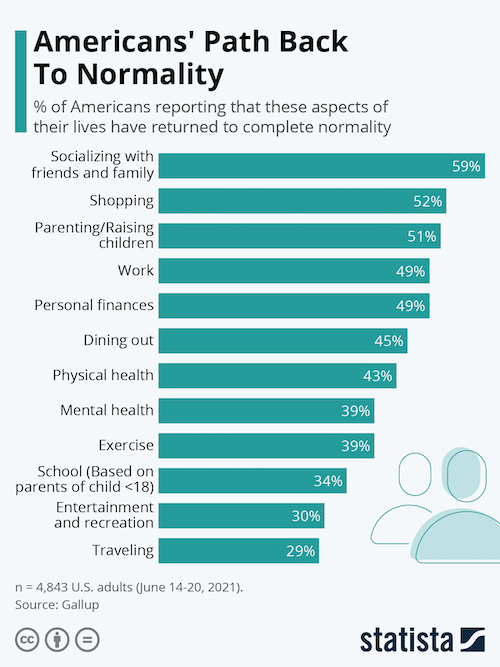

- Despite rising COVID-19 cases across the country, 64% of Americans in a recent survey are optimistic about the nation’s response to the virus, up from just 34% in January.

- U.S. retail sales unexpectedly rose 0.6% in June from a 1.3% decline the previous month, bolstering expectations that economic growth accelerated in the second quarter.

- An index of U.S. consumer sentiment dropped to its lowest level in five months amid rising fears of inflation, falling to 80.8 for the first half of July.

- Widespread business reopenings, rising vaccination rates and government stimulus likely pushed the U.S. to its peak pandemic growth surge in the spring, economists say.

- U.S. urban rent prices are surging past pre-pandemic levels after dropping off last spring, with the nationwide median reaching a record-high $1,575 in June.

International

- U.K. officials are warning of surging COVID-19 infections following a planned lifting of most pandemic restrictions today, even as the prime minister self isolates after exposure to the virus. The nation’s infection rate in recent days is among the highest in the world.

- COVID-19 infections in Italy are steadily rising, with 3,127 new cases reported Sunday.

- France reopened the Eiffel Tower for the first time in nine months despite the nation tightening pandemic rules amid a rise in COVID-19 Delta variant infections, reporting over 12,500 new cases Sunday, its third straight day where new infections crossed 10,000.

- With just 6% of its 270 million people vaccinated against COVID-19, Indonesia reported nearly 52,000 new infections Saturday, as officials mull tightening pandemic curbs.

- COVID-19 deaths in Africa surged 43% last week, with 49 nations expected to soon receive a combined 25 million donated vaccines from the U.S.

- Roughly 0.4% of COVID-19 deaths in India have been among fully vaccinated people, with the Delta variant causing 86% of post-vaccination infections. The nation reported 38,164 infections and 488 deaths yesterday.

- With the Tokyo Olympics set to kick off within the week, the first COVID-19 cases have been reported in Olympic Village, bringing the total infections associated with the games to 55.

- South Korea extended tighter pandemic restrictions outside the Seoul area following more than 1,500 new COVID-19 infections Friday and 1,400 Saturday.

- Thailand expanded coronavirus curbs Sunday following 11,397 new daily infections, mostly from the Delta variant.

- Vietnam is restricting movement for two weeks following a record 3,718 new COVID-19 infections reported Saturday.

- Singapore reported 88 new COVID-19 cases Sunday, the most in 11 months.

- Australia’s Sydney region posted 111 new COVID-19 infections Saturday, leading to widespread retail shutdowns and stay-at-home orders for more than 600,000 people.

- Mexico’s daily COVID-19 cases have risen to levels not seen since February, with 12,631 new infections and 225 deaths reported Saturday.

- Canada could reopen borders to international travel as early as September as its countrywide COVID-19 vaccination rate approaches 50%, surpassing that of the U.S.

- Israel is sounding the alarm that Pfizer/BioNTech’s COVID-19 vaccine may be significantly less effective against the Delta variant compared with previous strains.

- Italy, Spain and Switzerland are sending aid to Tunisia as the nation’s recent COVID-19 surge strains hospitals and healthcare workers.

- The U.S. began shipping 3.5 million doses of Moderna’s COVID-19 vaccine to Argentina Friday as part of a bilateral vaccine deal between the two countries.

- The U.K. suffered significant business disruption last week after the government’s coronavirus warning app alerted more than 500,000 people to stay home from work and avoid potential infections.

Our Operations

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.