COVID-19 Bulletin: April 16

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude futures were off in mid-day trading today, with the WTI down 0.8% at $62.98/bbl and Brent 0.3% lower at $66.62/bbl. Natural gas was 0.3% higher at $2.67/MMBtu.

- Oil prices are on pace for a 7% gain this week, the best performance since early March.

- Guyana, the world’s newest oil hotspot, predicts it will be able to produce 1 million bpd by 2027, a significant increase from current production levels of 130,000 bpd.

- Fuel sales in India fell in the first half of April as a resurgence of the coronavirus and renewed lockdowns take an economic toll.

- Mexican lawmakers are in the early stages of passing a bill that would give the government power to restrict private oil companies’ ability to import oil and fuel, which critics warn could have a negative effect on competition in the domestic market.

- The Canadian government’s financial aid to the oil and gas industry reached $14.4 billion in 2020.

- Canada’s main opposition party has dropped its resistance to carbon pricing, embracing the fee on emissions and fuels as a crucial part of its own climate plan.

- Washington state lawmakers passed a bill setting a start date of 2030 to stop sales of gas-powered vehicles, five years sooner than a similar plan recently approved in California.

- Eight bankruptcies by North American oil producers were the highest for a first quarter since 2016, the last time U.S. crude futures dipped under $30 per barrel.

- Sometime next month, Royal Dutch Shell will let shareholders decide whether it should become a net-zero energy company by 2050.

- Australian officials announced further details on their plans to phase out single-use plastics by 2025, saying the ban will include “problematic and unnecessary” waste, such as plastic utensils and straws.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Taiwan, experiencing it worst drought in 50 years, warned that the water shortage could impact its semiconductor industry, which accounts for two-thirds of global supply.

- Nissan will cut production at several Japanese factories for 8-15 days next month due to the global semiconductor shortage.

- The White House is expecting its $2.25 trillion infrastructure package to be passed in smaller pieces by Congressional lawmakers, with specific proposals likely to come at the end of May.

- Airline KLM is starting to use custom-made cargo bags fitted for seats of 777 passenger jets for freight-only flights, an attempt to carry more shipments amid crushing demand.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 74,289 new COVID-19 cases and 887 deaths in the U.S. yesterday. Over 198 million vaccine doses have been administered, with 21.6% of the population fully vaccinated.

- As many as 1 in 3 COVID-19 vaccine doses go unused in some states, a sign that demand for the shots is slowing despite a large percentage of the population still uninoculated.

- Despite warnings of a new wave of COVID-19, New Hampshire’s governor announced an end to the state’s mask mandate on Friday.

- Young adults, particularly males aged 18-20, are more likely than other populations to be reinfected with COVID-19, highlighting the importance of getting vaccinated even after having the virus.

- It is likely that people who receive a COVID-19 vaccine will need a booster shot within a year afterward to maintain immunity.

- The hold on Johnson & Johnson’s COVID-19 vaccine could stretch out for several more weeks as regulators weigh scientific evidence of the shot’s side effects.

- Merck and partner Ridgeback Biotherapeutics are halting a trial of an experimental COVID-19 drug after it failed to help hospitalized patients.

- With new strains of COVID-19 emerging, drugmaker Eli Lilly has asked U.S. regulators to revoke the authorization of its single antibody drug to combat the virus. The company will shift its focus on distributing a combination two-drug antibody cocktail instead.

- Scientists working with the U.S. Defense Department have unveiled a new chip that can detect COVID-19 in human bodies within minutes of it being implanted under the skin.

- U.S. stock indexes hit record highs on Thursday on upbeat earnings reports from several companies and a 9.8% gain in retail sales in March, the largest monthly gain since last May.

- U.S. business inventories rose 0.5% in February, in line with analyst expectations.

- A Federal Reserve survey indicated the U.S. economy grew quickly in the early spring but was hindered by production losses from companies facing shortages.

- Southwest recalled a second batch of 382 pilots ahead of an expected uptick in summer travel.

- Delta posted a higher-than-expected first-quarter loss on Thursday on increased fuel prices and lower average fares, while forecasting a return to profitability later this year.

- German car and truck maker Daimler posted a better-than-expected surge in first-quarter profit on higher vehicle prices and strong demand in China.

- Self-driving company TuSimple Holdings will test its autonomous trucks without backup drivers on Arizona public roads later this year.

- U.S. grocer Kroger unveiled its new customer fulfillment center in Ohio, where 1,000 robots will deliver items to workers at picking stations, who can bag them for multiple customers at a time.

- Verizon is launching 5G internet services for businesses in 21 U.S. cities this month, expanding its current presence in Chicago, Houston and Los Angeles.

International

- The global rate of COVID-19 transmission has nearly doubled in the past two months and is approaching the highest level of the pandemic. Variants of COVID-19 are almost exclusively behind the resurgence.

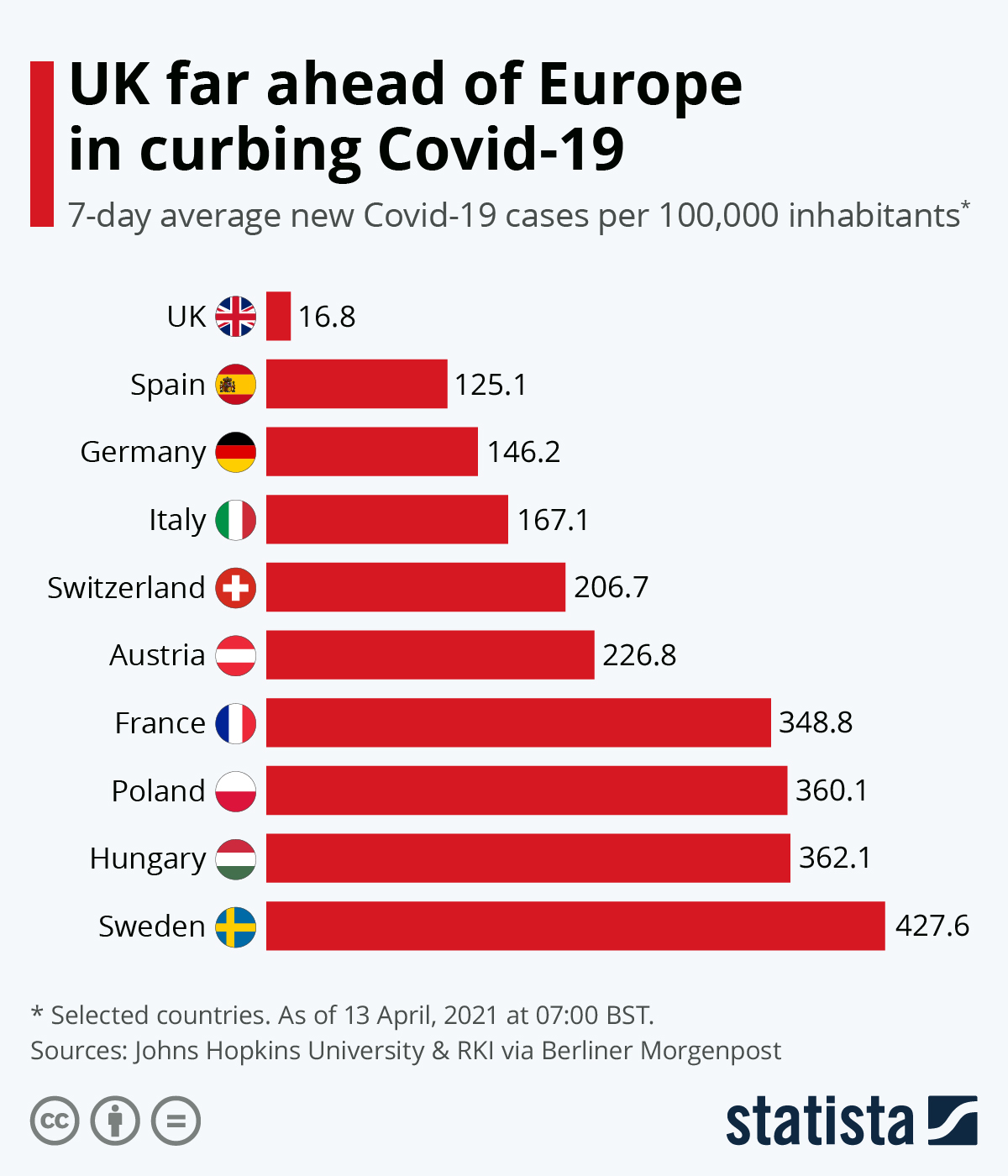

- The U.K. is far outpacing Europe in taming the coronavirus:

- France became the third country in Europe behind the U.K. and Italy to record 100,000 total COVID-19 deaths.

- Poland has begun administering Johnson & Johnson COVID-19 vaccinations to its citizens saying that the vaccine’s benefits outweigh the risks that have caused other countries to halt the distribution.

- Portugal, once ravaged by a lack of medical resources to deal with COVID-19 patients, will enter its third phase of easing pandemic restrictions next week.

- Northern Ireland is easing restrictions from the end of April, opening all retail stores, outdoor restaurants and bar services, and gyms.

- Denmark became the first country to stop using AstraZeneca’s COVID-19 vaccine altogether.

- Despite having about the same number of total COVID-19 cases, Brazil has had nearly twice the deaths from the virus as India, puzzling scientists and contributing to the nation’s quickly expiring supply of medical resources, particularly sedatives.

- Argentinian states are resisting a recently imposed two-week school lockdown and additional pandemic restrictions imposed by the national government.

- Chilean officials believe the country reached a pandemic peak of around 9,000 new COVID-19 cases per day last week as case counts start to decline.

- India will import enough of Russia’s Sputnik V COVID-19 vaccine this month to cover as many as 125 million people, as the once leading virus exporter seeks more supplies. India’s growing domestic outbreak has led to record daily infections in 8 of the last 9 days, fueled by the spread of virulent mutations.

- Despite a record 1,543 new COVID-19 cases in Thailand, the country will not impose new lockdowns, although it is banning the sale of alcohol in some regions.

- A growing number of lawmakers in Japan are questioning the nation’s plans to move forward with hosting this summer’s Olympic Games, as the nation is set to expand quasi-emergency measures to 10 regions on Friday amid a fourth wave of infections.

- A South Korean company will lead a consortium in the production of 100 million doses of Russia’s Sputnik V COVID-19 vaccine.

- Australia is considering gradually reopening its international borders, including both arrivals and departures, for people who are fully vaccinated against COVID-19.

- Many Africans do not know when they will receive their second required COVID-19 vaccine due to a severe shortage in new deliveries.

- The Gavi vaccine alliance is sounding the alarm on the global availability of COVID-19 vaccines, saying that the COVAX initiative, which aims to help lower-income countries secure doses, is in need of additional funding to help procure more shots.

- Citing concerns about future profits, Johnson & Johnson and Pfizer have asked South Africa to stop trying to loosen patent protections related to their COVID-19 vaccines.

- China’s economy surged 18.3% in the first quarter compared to the same period last year, the highest growth rate since data collection began in 1992. But quarter-over-quarter growth of 0.6% was the slowest in a decade outside the collapse early in the pandemic amidst growing indications of economic weakness.

- Home prices in China rose 0.41% month over month in March, the fastest pace in seven months.

- Japan’s exports for March are expected to post their strongest growth in three years.

- The biggest risk to the euro zone economy is the slow pace of current COVID-19 vaccine rollouts, expected to delay the lifting of restrictions significantly.

- Over 400 U.K. financial firms have shifted activities, staff and nearly $1.4 trillion in assets to hubs in the EU due to Brexit, a study shows. The EU has backed the U.K.’s proposed trade and cooperation agreement with the bloc, clearing the path toward final ratification of the deal.

- Italy hiked its target for this year’s budget deficit to 11.8% of GDP from an 8.8% projection made in January, the result of a recent 40-billion-euro economic stimulus package.

- Argentina consumer prices rose nearly 5% in March, the fastest pace since late 2019, with 12-month rolling inflation hitting nearly 43%.

- The economy of Peru, the world’s second-largest copper producer, contracted 4.18% in February amid a second wave of COVID-19.

- The U.S. denied Brazil’s demand that it pay upfront for protection of the Amazon rainforest, with the U.S. wanting to see results prior to doling out funding.

Our Operations

- Our next Plastics Reflections Web Series is Tuesday, April 20 at 1:00 pm CT. This webinar focused on Driving Sustainability Action in the Plastics Industry will feature panelists from Business Publishing International (BPI), Danimer Scientific, Coca-Cola and M. Holland. Click here to learn more and register.

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates & Masterbatch Virtual Summit on April 26-29. Christopher Thelen, Regulatory Specialist for M. Holland, will be speaking on Monday, April 26 at 8:00 am CT.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.