COVID-19 Bulletin: April 8

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices ended lower yesterday after a two-day gain. Energy prices were mixed in mid-day trading today with the WTI down 0.3% at $59.61/bbl, Brent up 0.1% at $63.22/bbl and natural gas up 0.1% at $1.81/MMBtu.

- Despite a drop in local consumption due to lockdowns, gasoline prices in Europe are surging after the continent’s refiners boosted U.S.-bound exports by 60% month-over-month in March.

- U.S. crude stocks fell 3.5 million barrels last week, while gasoline inventories jumped 4 million barrels.

- The White House is mulling a pledge to cut U.S. greenhouse-gas emissions by 50% or more by the end of the decade, effectively doubling the nation’s previous climate commitments and requiring rapid change in the power and transportation sectors.

- Reuters reported that Exxon may be exploring a sale of its Advanced Elastomer Systems business to help reduce debt.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- The U.S. trade deficit widened to a record $71.1 billion in February as exports fell 2.6%, a result of continued port backlogs and unusually cold weather.

- Seven out of 10 container ships globally are arriving late, with on-time arrival performance well below the normal 75%.

- Contract rates for container shipping from Asia to Europe soared 155% in the first quarter.

- A bill addressing the shortage of semiconductors in the U.S. is set to be unveiled by the Senate.

- A severe drought in Taiwan is pitting farmers against the nation’s vital semiconductor industry for water ration priority.

- Cargo surveyed while ships were snared in last month’s blockage of the Suez Canal show a snapshot of global trade, with large shipments of consumer products made in China, more than 11,000 containers of U.S. wastepaper headed to India, more than 1,600 boxes of China-bound auto parts and 641 boxes of China-bound beer from the Netherlands.

- UPS is purchasing 10 small electric-powered aircrafts that employ aerodynamics of both a helicopter and a plane, as the company aims to reduce costs from contracting with small air freighters to reach remote areas.

- The U.S. administration is laying the groundwork for negotiating downward a proposed tax hike on corporations that would fund the nation’s next infrastructure program. Part of the plan calls for $100 billion in rebates for consumers who purchase electric vehicles.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

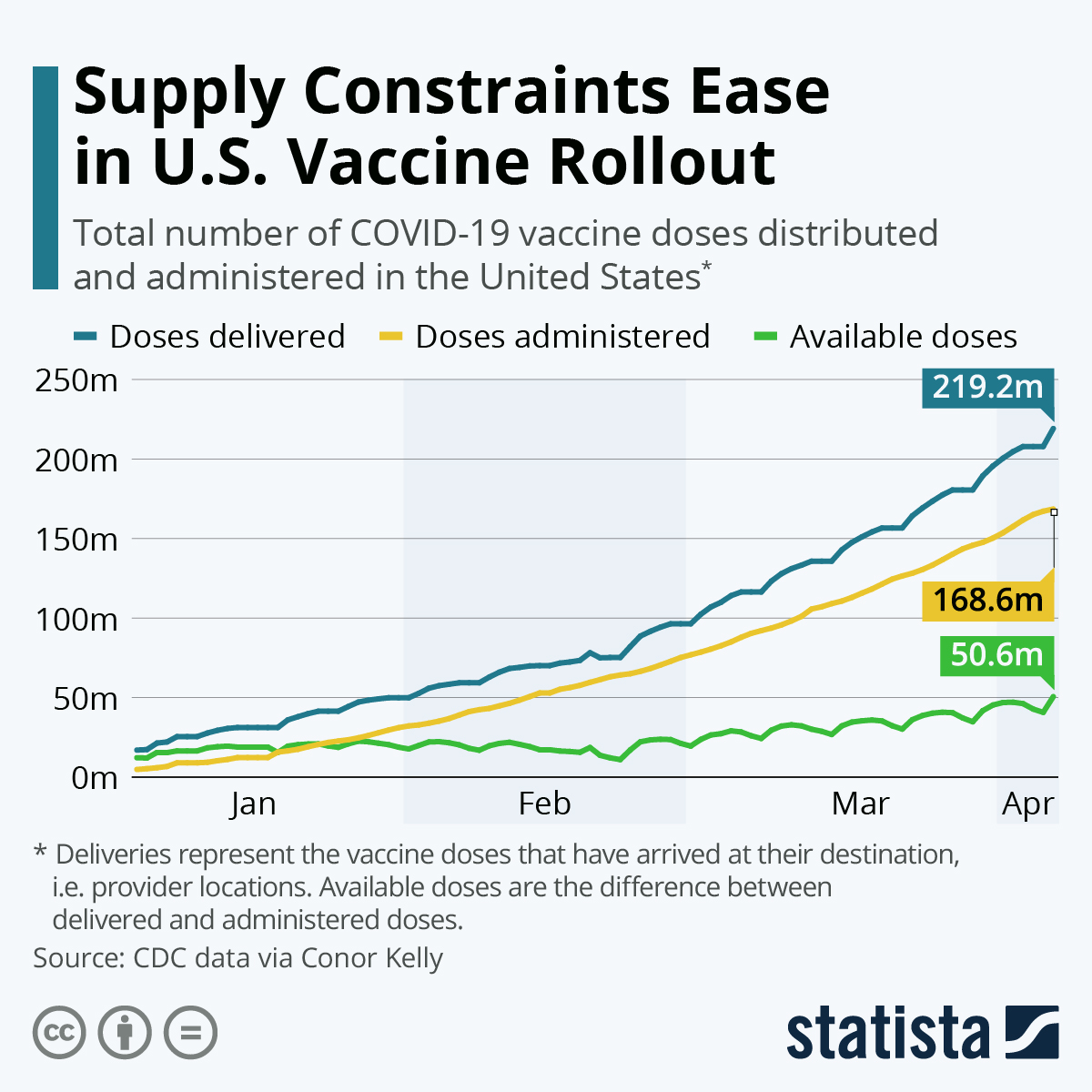

- New COVID-19 infections in the U.S. rose to 75,038 yesterday, with 2,570 reported fatalities. More than 171 million vaccine doses have been administered, with nearly 60 million people, 18.3% of the population, fully vaccinated.

- The highly infectious U.K. variant of COVID-19 has become the most common strain in the U.S., as more young people are hospitalized with severe symptoms.

- Alabama will drop its face mask mandate in the coming days following a decrease in new COVID-19 cases, in the wake of similar moves by Texas and Indiana.

- U.S. pharmacies and health officials are pleading with Americans to cancel duplicate COVID-19 vaccine appointments, arguing the no-shows waste doses and put an undue burden on healthcare professionals.

- The White House is boosting COVID-19 vaccine shipments to more than 2,500 community health centers around the nation, part of an effort to close the racial gap in inoculations.

- The federal government has distributed more than 150 million stimulus checks as of yesterday, totaling roughly $372 billion, with most payments going toward Social Security recipients.

- First-time jobless claims remained stubbornly high last week, rising by 16,000 to 744,000.

- Minutes from the Federal Reserve’s March meeting show optimism about a stronger economic rebound than initially expected, with most of the 18 officials also agreeing that interest rates will remain close to zero through 2023.

- As of late February, U.S. investors had borrowed a record $814 billion against their portfolios, up 49% from the year-ago period and the fastest increase since 2007.

- U.S. property taxes increased at the fastest pace in four years in 2020, with much of the increase coming from traditionally low-cost states in the Sun Belt.

- The EPA has plans to increase its enforcement of pollution violations in disadvantaged communities near highways, factories and refineries.

- The Occupational Safety and Health Administration has yet to issue promised COVID-19 safety rules as more employees return to their workplaces.

- JPMorgan expects “nearly all” of its bank-branch employees to report back to physical locations full-time after the pandemic.

- Big tech companies are setting the most ambitious green energy goals of all major U.S. firms, including financial businesses, pharmaceutical companies and oil majors.

- Mercedes-Benz was the top luxury car seller in the first quarter, led by a remodeled lineup of gas-powered crossovers.

- General Motors is testing a variety of battery chemistries, technologies and manufacturing methods aimed at cutting the cost of future electric vehicle production while reducing dependence on volatile metals like cobalt.

- Hydrogen-powered and electric truck startup Nikola lost the executive in charge of fuel-cell development, further imperiling the company after allegations surfaced last year that it had misled investors.

- After revenue plunged 96% last summer, a reopened SeaWorld is expected to have a record-setting season this year, with earnings forecast to rise more than 1,300% in the first quarter.

- Carnival’s cruise bookings surged 90% higher this quarter from the previous three months, reflecting pent-up demand for cruises even as the industry remains on hold.

- California startup Avelo Airlines will launch its first flights next month, aiming at leisure fliers traveling to select underserved markets in the West.

International

- It will take nearly two years to inoculate the entire world at the current vaccination rate of 16.1 million doses a day.

- COVID-19 infections in India topped 126,000 today, a record, prompting New Zealand to ban travelers from India, including its own citizens.

- Brazil has detected its first case of a patient infected with the virulent South African mutation of COVID-19. Yesterday, the nation’s highest court suspended extensions of drug patents, a ruling that could lower costs for drugs critical to treating coronavirus patients.

- Argentina, setting back-to-back records for new COVID-19 infections Tuesday and Wednesday, is imposing a curfew, restoring restrictions on public transportation and curtailing leisure businesses.

- Ontario issued a four-week stay-at-home order alongside closing in-store shopping for non-essential retailers as Canada’s largest province battles a resurgence of COVID-19.

- The number of COVID-19 patients in French ICUs continued to rise yesterday to total more than 5,600, the highest level in nearly a year.

- European Union regulators issued a warning about the risk of blood clotting associated with AstraZeneca’s COVID-19 vaccine.

- AstraZeneca is set to provide a warning label on its shot regarding the rare side effect.

- Italy is only recommending the AstraZeneca shot for those over age 60. German officials say the risk of blood clotting is highest for women under the age of 60.

- The U.K. is now advising that those under the age of 30 be offered an alternative vaccine if one is available.

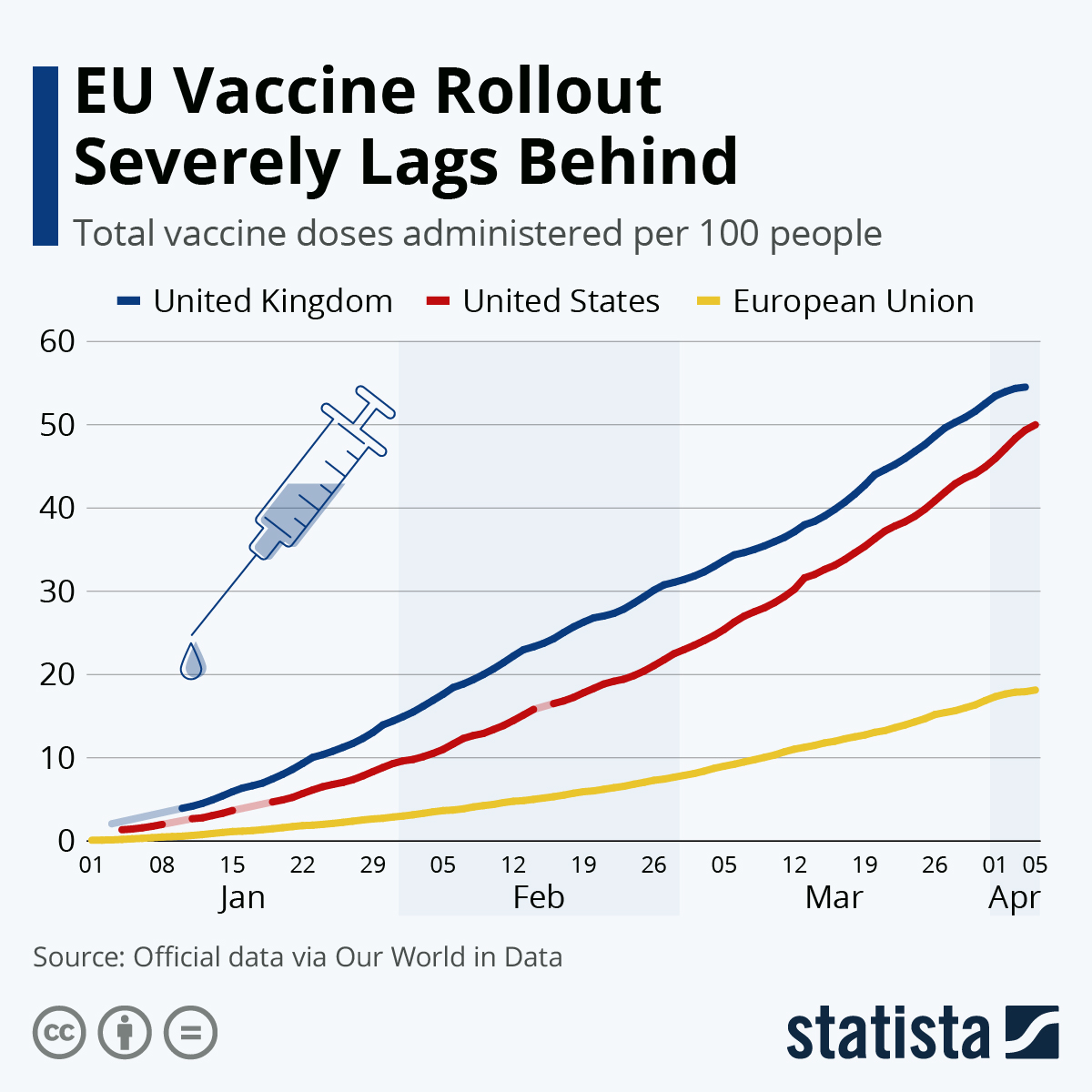

- European Union vaccination rates are severely lagging the U.S. and U.K….

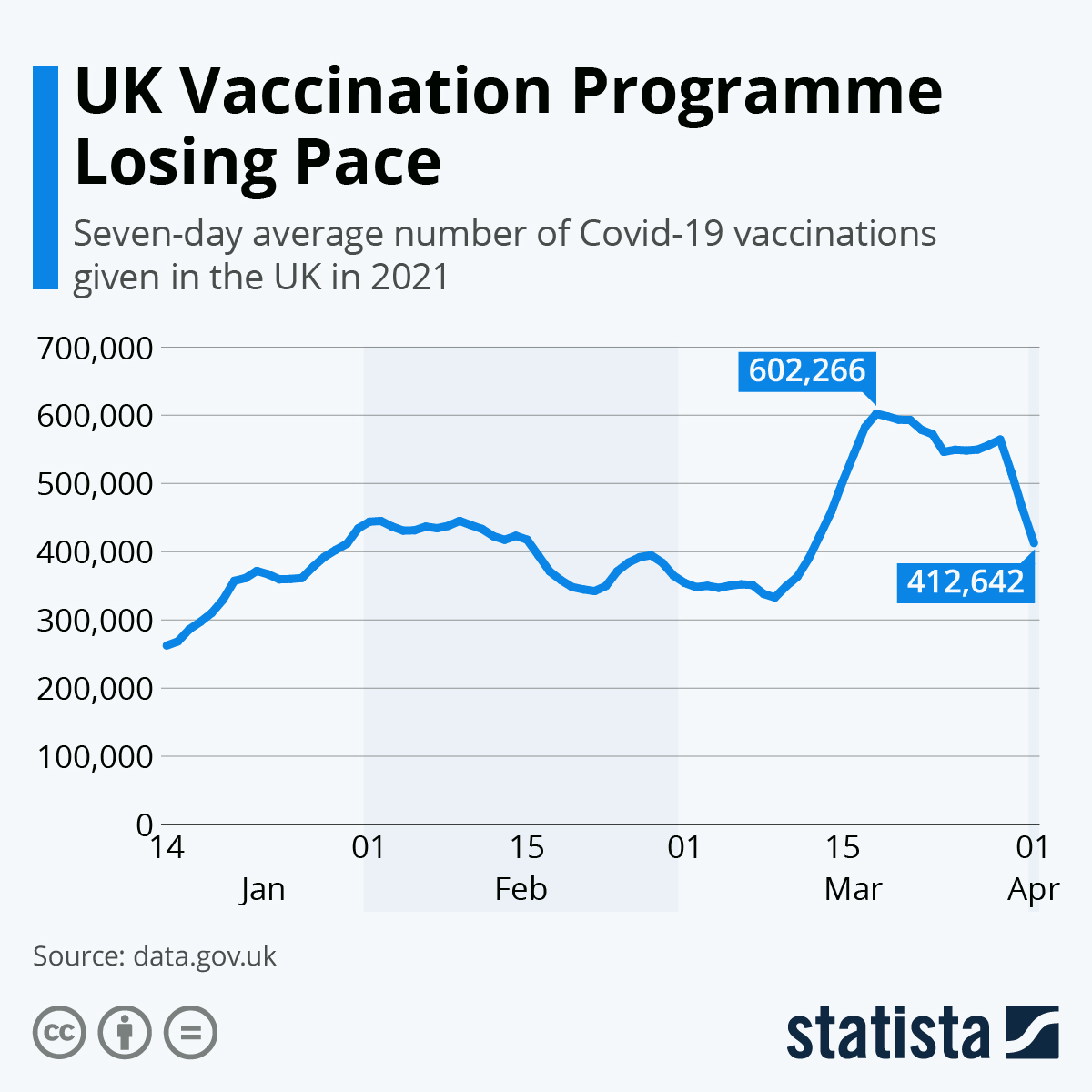

- …while the pace of vaccinations in the U.K. has slowed.

- Germany is preparing to start bilateral negotiations with Russia to obtain doses of its Sputnik V COVID-19 vaccine, pending the shot’s approval from European medicines regulators.

- Hungary reported a daily record in COVID-19 deaths on the same day it started easing virus curbs.

- Despite record numbers of new daily COVID-19 cases, Greece is set to open high schools next week amid the launch of a home-testing campaign expected to control infections.

- Daily COVID-19 cases in Turkey topped 54,700 yesterday, a record.

- Nine out of 10 Spaniards responded favorably to the idea of using a digital health passport to travel, which would include a person’s COVID-19 vaccination status.

- A Venezuelan mayor has started to place red warning symbols on the homes of people infected with COVID-19, alongside threatening to cut welfare payments for those breaking quarantine.

- Amid a third wave of COVID-19, private doctors in Mexico are protesting the country’s prioritization of public healthcare personnel for vaccine deliveries.

- The Rockefeller Foundation is calling for $650 billion in additional reserves for the International Monetary Fund (IMF), which would go toward developing economies to provide for COVID-19 vaccinations. The head of the IMF is considering expanding low- and no-interest financing beyond the poorest countries to include middle-income countries hit hard by the pandemic.

- Canadian economic activity expanded at its fastest pace in 10 years in March, with an index of employment climbing to 72.9 from 60.0 in February.

- Brazil raised nearly $600 million yesterday in the auction of 22 airports, the latest sale in a wave of privatizations.

Our Operations

- Our next Plastics Reflections Web Series is Tuesday, April 20 at 1:00 pm CT. This webinar focused on Driving Sustainability Action in the Plastics Industry will feature panelists from Business Publishing International (BPI), Danimer Scientific and M. Holland. Click here to learn more and register.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight during prevailing force majeure. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.