COVID-19 Bulletin: March 9

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Oil prices settled several dollars lower on Monday after reaching $70 per barrel over the weekend. Energy prices were lower in mid-day trading today, with the WTI down 1.4% at $64.25/bbl, Brent down 0.94% at $69.19/bbl, and natural gas off 0.4% at $2.65/MMBtu.

- Just seven out of 18 U.S. oil refineries that were down due to the Texas Freeze are back to normal operations.

- Chinese natural gas imports jumped 17.4% in the first two months of 2021 compared to the year-ago period, a result of the coldest winter in decades.

- American and European oil majors, including BP and Exxon Mobil, could shut refining facilities in Australia amid an influx of cheap Chinese petroleum.

- DuPont announced plans to acquire Laird Performance Materials for $2.3 billion as it looks to develop its portfolio of advanced electronic materials.

- Renewable energy leader NextEra is partnering with startup Mainspring Energy to distribute the company’s novel linear generators, a low cost, low temperature, low emissions method for onsite power generation.

- Leading PET recycler CarbonLite filed to reorganize in bankruptcy court, citing low virgin resin prices and pandemic pressures for its struggles.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply Chain

- Port congestion seen on the U.S. West Coast is spreading to Asia, particularly Singapore, with DSV and DHL confirming significantly longer wait times for ships looking to enter port and unload. Congestion at California ports continues to shatter previous records as more importers shift operations to the East and Gulf Coasts.

- Foot Locker is looking for alternative cargo routing after pinning a 24% drop in year-end inventory on port congestion.

- U.S.-bound retail container imports are expected to “grow dramatically” over the first half of the year.

- Citing construction delays, U.K. ports say they are not ready to handle new Brexit customs requirements for imports and exports and are asking the government to push back its July 1 deadline.

- U.S. rail carloads were down 11.1% in February from the year-ago period, while intermodal containers and trailers were up 1.8%.

- Demand for transporting automotive parts remains strong at the start of 2021, suggesting assembly plants around the world are ramping up production.

- Washington state plans to ban polyfluoroalkyl substances (PFAS), known as “forever chemicals,” in four types of food packaging by February 2023.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 44,758 new COVID-19 cases in the U.S. yesterday, pushing total cases above 29 million. There were 719 deaths, and 9.6% of the population has now been fully vaccinated.

- Twenty-nine states are reporting rising COVID-19 case counts.

- U.S. coronavirus cases rose 1.5% in the week ended Sunday, the slowest increase since the pandemic began.

- The virulent U.K. strain of COVID-19 is spreading widely in Florida, where hospitalization rates are higher than any other state. The state will reduce its vaccine eligibility age to 60 beginning March 15.

- Following a two-month closure, New York high schools will reopen for some in-person learning March 22. In Los Angeles, the powerful teachers’ union has not committed to a reopening date.

- People fully vaccinated against COVID-19 can begin gathering privately in small groups without masks or physical distancing, the CDC said.

- The willingness of younger Americans to get COVID-19 shots is well below that of other older populations, a potential challenge to achieving herd immunity.

- Americans could begin receiving $1,400 checks this week if the latest stimulus bill is signed into law, which could happen as early as tomorrow. Once passed, the $1.9 trillion aid bill is not likely to cause an inflation problem, the Treasury Secretary said.

- Only 53% of Americans say they are comfortable eating at restaurants again, complicating menu planning, food ordering and staffing as states loosen restrictions on dining in.

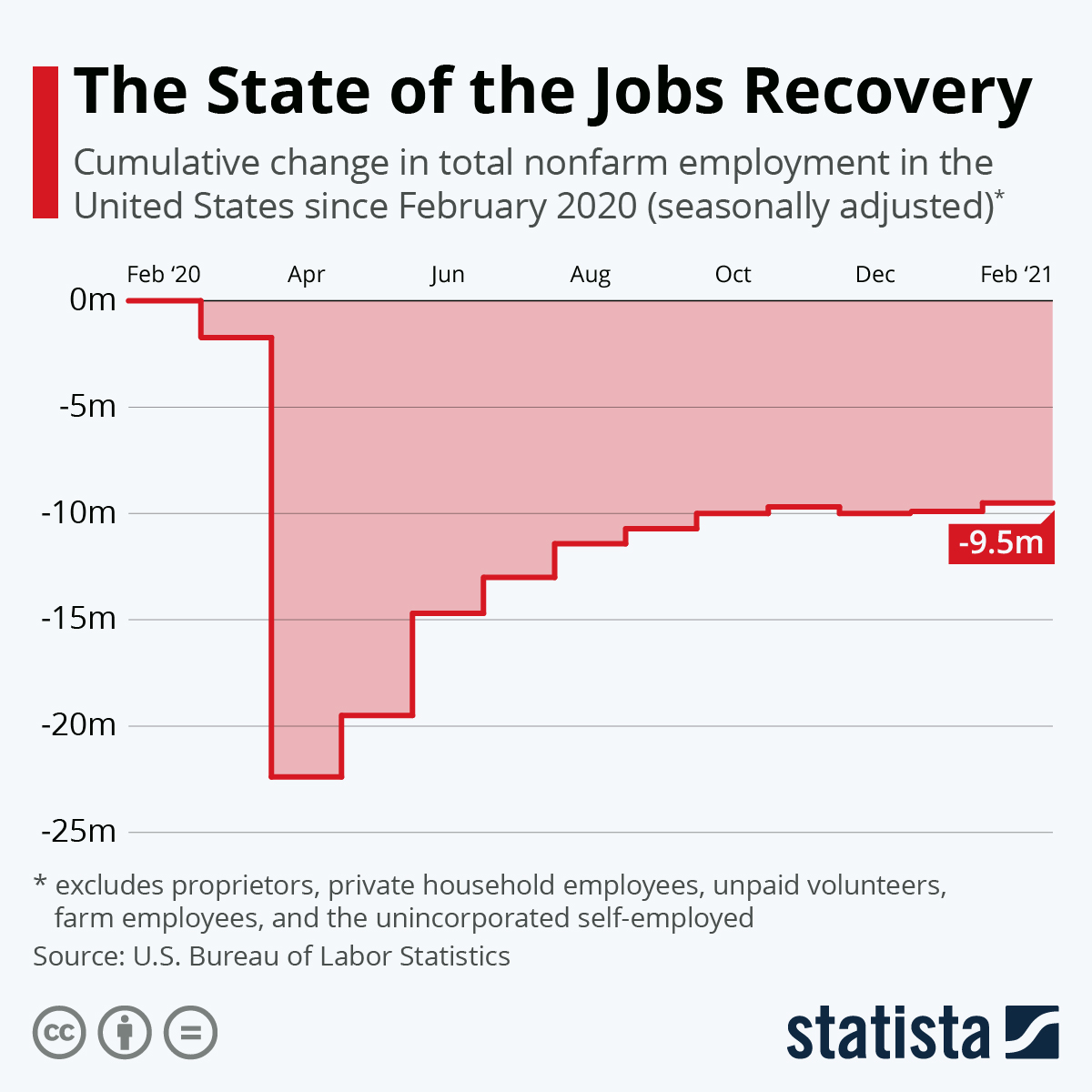

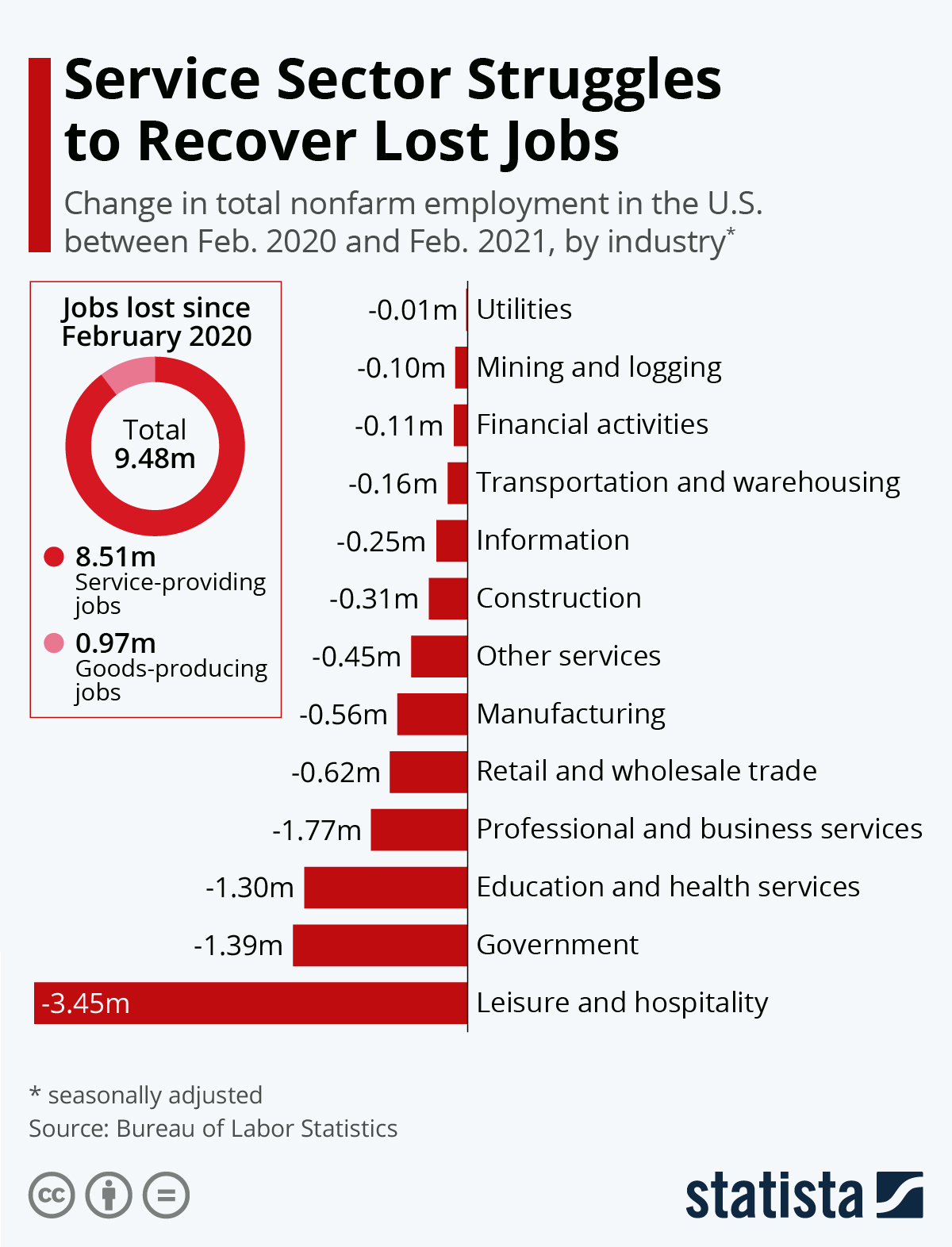

- Service sectors have been largely left out of the U.S. jobs recovery…

- …with most of the 9.5 million job losses since last February in the service sectors:

- Finance chiefs across a range of consumer products companies are considering price increases to offset rising costs of logistics and raw materials, including plastics.

- Booming furniture demand is colliding with factory capacity limits, raw material shortages and logistics snarls to cause long delivery delays for consumers.

- U.S. airlines averaged more than 1 million passengers per day the last week, the highest non-holiday total since early last year.

- Airlines, travel groups and labor are asking the federal government to develop a virus passport that would document a person’s vaccination and test results.

- American Airlines will use cash flow from its frequent-flier program to back $7.5 billion in new financing to pay back government loans.

- Traditional internal combustion automakers are penetrating the U.S. electrical vehicle market, dropping Tesla’s market share from 81% to 69% over the past year.

- Japanese car companies, heavily invested in hybrid vehicles, have been slow in pivoting to electric vehicles compared with their European and North American competition.

- New legislation would give the U.S. Postal Service $6 billion to transition its fleet to electric vehicles.

International

- Total global COVID-19 deaths surpassed 2.6 million yesterday.

- COVID-19 ICU admissions hit a two-week high in France.

- Virus fatality rates in Hungary are among the highest in the world.

- The Netherlands is keeping an evening curfew in place until March 31.

- Syria’s president tested positive for COVID-19.

- The U.S. State Department warned citizens against traveling to Mexico over spring break because of the high rates of COVID-19 infections there.

- COVID-19 deaths in the U.K. are starting to fall as more than a third of its population have received vaccinations.

- Ireland is expecting to receive its first doses of the Johnson & Johnson COVID-19 vaccine in April.

- Germany’s sluggish inoculation program will pick up at the end of March, aided by expected approval of Johnson & Johnson’s one-shot vaccine.

- A new lab study indicates the Pfizer/BioNTech vaccine is effective against new, more virulent COVID-19 strains discovered in Brazil, South Africa and the U.K.

- Brazil’s government is pressing for earlier delivery of Pfizer’s COVID-19 vaccines amid a deadly second wave of the virus.

- AstraZeneca/Oxford’s COVID-19 vaccine protects against the virulent Brazilian mutation of the virus, a study shows.

- India’s COVID-19 vaccine campaign is stalling amid safety concerns over its homegrown shot.

- Thailand cut its quarantine period from 14 to seven days for visitors to the country who are vaccinated against COVID-19. Thai lawmakers are also mulling vaccine certificates.

- Italy approved AstraZeneca/Oxford’s COVID-19 vaccine for those over age 65, reversing a previous limit on the shots.

- Embraced abroad, Russia’s Sputnik V COVID-19 vaccine faces one of the highest levels of vaccine hesitancy at home. Shots are free and widely available, yet only 3.5% of Russians have received at least one dose.

- Japanese lawmakers are maintaining a ban on the entry of foreign nationals just weeks before preparations for the Olympics begin. A limit of 2,000 daily arrivals is set to take place once Tokyo’s virus emergency ends.

- An Israeli airport is testing passengers at check-in before they board flights to New York.

- Singapore Airlines will begin a “digital travel pass” program to store passengers’ health information, including vaccine and testing status.

- European pandemic aid has largely gone to full-time wage earners, leaving many self-employed and temporary workers in economic hardship.

- The Organization for Economic Cooperation and Development boosted its projection for global economic growth this year from 4.0% to 5.6% based on the rapid rollout of vaccines and the likelihood of additional U.S. stimulus.

- France’s economy is poised to grow slightly in the first quarter, staving off a second recession.

- Compared to its recovery from the 2008-2009 financial crisis, the U.K. is relying more on tax hikes and less on spending cuts to re-balance its budget.

- South Africa’s economy rebounded 6.3% in the fourth quarter from the third after shrinking 7.3% for all of 2020, the biggest decline in a century.

- Chinese exports grew at a record pace in February, rising 154.9% compared to the year earlier period when lockdowns paused the country’s economy. Car sales there quadrupled last month.

- Europe’s second largest automotive parts manufacturer, Continental AG, expects a muted recovery for the industry this year due to the pandemic and a computer chip shortage.

- Chargeurs of France, which makes interlinings for major fashion brands, has launched a new brand of interlinings and components made with sustainable products, including recycled plastics.

Our Operations

- Visit our new 3D Printing e-commerce site.

- Listen to M. Holland’s 2021 Market Trends Podcast Series episodes featuring insight from our Market Managers.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.