COVID-19 Bulletin: February 24

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Winter Storm Uri

- Nearly 80 people so far have lost their lives due to the extreme cold front, with a final tally of deaths not expected to come until months down the line.

- Federal regulators are scrutinizing the Texas energy market after natural gas prices spiked as much as 10,000% during last week’s winter storm.

- Several board members of the Texas power grid, including the chair and vice-chair, resigned yesterday following the decision to shut off power for millions of people in rolling blackouts last week.

- Harris County, home to Houston, is considering leaving Texas’s unregulated energy market to join the national grid.

- Customers of Texas’s deregulated energy market have paid $28 billion more for electricity since 2004 than customers of the state’s traditional utilities.

- Canadian energy retailer Just Energy Group posted a $250 million loss due to last week’s storm, causing the company’s stock to fall 31%. Meanwhile, the company announced its storm-battered residential customers in Texas will be protected against higher energy rates in February.

- Texas refineries are working to restart with varying degrees of success, with some facing continuing shortages of power and water as well as needed repairs from last week’s storm.

- Plastics prices are soaring in Asia, which depends heavily on U.S. imports of propane and naphtha feedstocks.

- Our most recent list of force majeure and allocation announcements from suppliers is here.

Supply

- The American Petroleum Institute reported a build in crude oil inventories of 1.026 million barrels last week, a contrast to analysts’ expectations of a 5.190 million-barrel draw. The news sent crude prices modestly lower yesterday.

- Crude prices were higher in early trading today, with the WTI up 1.1% at $62.32/bbl and Brent up 1.2% at $66.14/bbl. Natural gas was off 0.2% at $2.87/MMBtu.

- Bank of America lifted its forecast for Brent crude prices this year to an average of $60 a barrel, with the potential of hitting $70 a barrel in the second quarter, citing tighter supplies due to the Texas freeze and continued OPEC production cuts.

- Prospects for improving oil demand have some speculators projecting triple-digit crude prices in the next 12-18 months.

- Mexico’s lower house of congress passed a bill that prioritizes state-owned power over private providers, a move that could put billions of private investment dollars in jeopardy.

- An oil spill from an unidentified vessel has spoiled 120 miles of Israel’s Mediterranean coastline in one of the worst ecological disasters in the nation’s history.

Supply Chain

- Cancellation of the Keystone XL pipeline could prove a boon for railroads as oil producers in Canada are turning to trains to move their crude to U.S. refineries, a prospect that presents its own environmental and safety risks.

- Ocean shipping spot rates increased 7% last week between China/East Asia and the North American West Coast. Prices are expected to remain elevated in the coming weeks.

- The European Commission instructed six EU nations to ease travel and border restrictions, citing their impact on the flow of goods which is threatening to shut down parts of the Franco-German border.

- Nikola unveiled a planned line of hydrogen fuel-cell electric vehicles with a driving range up to 900 miles, including a long-haul freighter for the North American market and two variants of an existing truck model.

- The U.S. Postal Service signed a multi-billion-dollar contract with tactical vehicle manufacturer Oshkosh Defense to replace its delivery fleet with high-tech electric and hybrid vehicles over the next 10 years.

- The White House is holding a meeting with lawmakers today to discuss supply-chain issues in semiconductor manufacturing, part of a broad federal review aimed at increasing domestic production of the goods.

- We expect continuing logistics disruption in the U.S. from severe winter conditions that blanketed much of the country last week.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 71,436 new COVID-19 cases and 2,350 deaths in the U.S. yesterday.

- Over 65 million vaccine doses have been administered in the U.S., with nearly 20 million people, 6.1% of the population, fully vaccinated.

- A new COVID-19 mutation discovered in California is showing early similarities with other highly infectious strains from the U.K., South Africa and Brazil.

- Florida entered the next stage of its COVID-19 rollout, opening eligibility to classroom teachers and law enforcement officers over the age of 50.

- The top U.S. infectious disease expert suggested the CDC will soon begin relaxing some COVID-19 protocols for people who have received vaccinations.

- Cautious mask and distancing requirements likely proved better than testing measures for preventing COVID-19 among in-person employees at large companies.

- Novavax’s COVID-19 vaccine will likely be approved in the next month, with early clinical results suggesting the shot may halt asymptomatic spread of the virus, a potential first for vaccines.

- AstraZeneca’s antibody cocktail for COVID-19 showed signs of effective resistance against variants of the virus, a key development for those not yet able to get shots.

- Cyber scams for sham COVID-19 vaccines are on the rise, with $33 million in illicit proceeds recently seized by the federal government.

- The frantic pace of developing coronavirus vaccines has led several pharmaceutical giants, normally fierce rivals, to band together to assist in production and research.

- The hundreds of thousands of people suffering from months-long lingering symptoms of “long-haul” COVID-19 are making the case for qualifying for disability benefits.

- The Federal Reserve suggested no urgency on changing easy-money policies of near-zero interest rates and large-scale asset purchases, citing the continued financial impact of the pandemic. The central bank’s chairman also said the U.S. could see up to 6% GDP growth in 2021.

- U.S. consumer confidence increased in February on upbeat projections about labor market conditions amid declining COVID-19 infection rates.

- U.S. bank profits fell 36.5% in 2020 from the previous year, a result of initially setting aside massive amounts of money to safeguard against potential losses.

- Home prices in 20 U.S. cities surged in December, with an S&P index of property values climbing 10.1% from the year-ago period.

- After suffering 2020 losses in the billions of dollars, Delta expects a rebound in passenger air travel by the second half of this year.

- Aircraft parts maker Spirit AeroSystems, which counts Boeing as its largest customer, reported a 55% slump in quarterly revenue, a much larger loss than expected.

- Medical equipment maker Medtronic reported a one-third drop in year-over-year earnings per share in its latest quarter as a rise in virus cases led people to defer non-essential health care.

- Macy’s announced better-than-expected fourth quarter results and expects a retail rebound in the second half of 2021, fueled by increased COVID-19 vaccinations and expected government stimulus checks.

- Art sales in 2020 took off as more people looked to beautify their dwellings, providing a backstop for many galleries that were expecting steep losses or shutdowns.

- Copper prices are at their highest price in a decade, surging 14% since the start of the year on increased real estate and infrastructure activity.

- Toshiba and General Electric are preparing a partnership to produce core equipment for offshore wind power systems.

International

- Global COVID-19 deaths fell 20% last week from the prior week.

- The Czech Republic is the latest country whose health system is being overrun with COVID-19 patients, leading to a lack of intensive-care beds and forcing hospitals to curb care or seek help from neighboring countries.

- Scotland will begin easing pandemic restrictions in three-week intervals with the goal of re-opening the entire economy by the last week of April.

- Group gathering limits were eased in Hong Kong, a reflection of declining coronavirus cases.

- Thailand is considering scrapping its two-week mandatory quarantine for foreign visitors with proof of a COVID-19 vaccination.

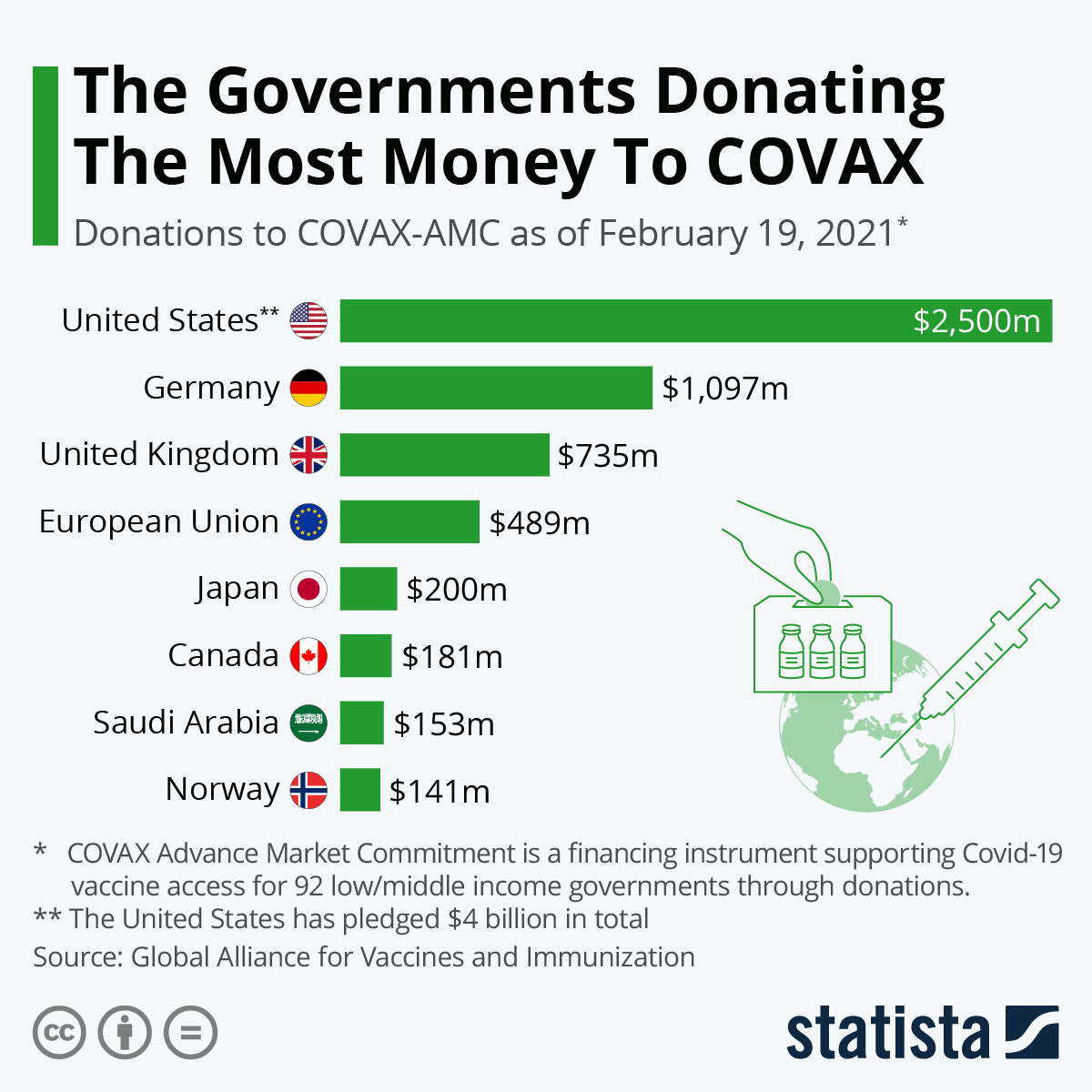

- COVAX, the global collaboration to extend vaccinations to developing nations, made its first major shipment yesterday, delivering 600,000 vaccine doses to Ghana.

- Mexico’s president is urging the United Nations to do more to ensure equitable access to COVID-19 vaccines for poorer countries.

- Brazil gave emergency approval to Pfizer/BioNTech’s COVID-19 vaccine but is restricted in rolling out the shots until a supply dispute is resolved.

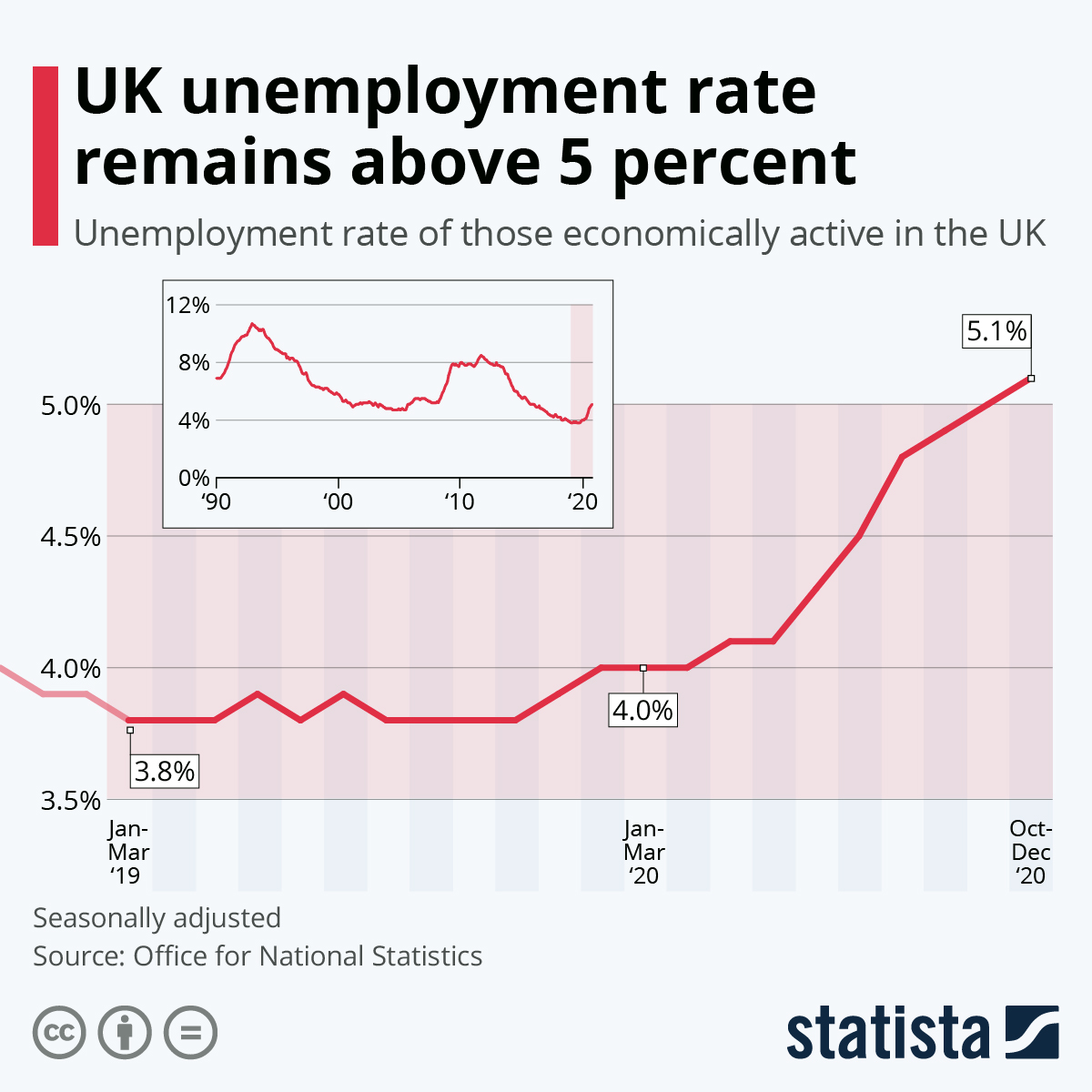

- The U.K. is on track to offer COVID-19 vaccines to all adults by July, though the government’s disease modelers suggest some restrictions may have to be reintroduced periodically even after many people have received shots. With the nation’s unemployment rate reaching a five-year high, the government is in talks to spend billions of pounds over the next four months to support businesses and consumers.

- Annual inflation in Mexico likely sped up to its highest rate in three months in the first half of February, mostly due to rising energy prices.

- The German economy grew more than expected in the fourth quarter, up 0.3% over the third quarter.

- Global demand for computer chips drove Taiwan’s export orders up nearly 50% in January, the 11th monthly increase.

Our Operations

- Last week’s Plastics Reflections webinar on 2021 Drivers and Trends for the North American Plastics Market can be viewed here.

- Our 3D Printing business unit has launched a new e-commerce site. Access the new site here.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.