COVID-19 Bulletin: February 23

Hello,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Winter Storm Uri

- Several Permian-focused U.S. shale producers — including Occidental Petroleum, Diamondback Energy and a host of smaller companies — are forecasting lower oil output in the first quarter as a result of last week’s storm.

- Texas power sales totaled $50.6 billion last week compared to just $4.2 billion for the week prior, with utilities expected to pass the costs of Winter Storm Uri repairs onto customers and taxpayers for decades to come. The state’s government ordered utilities not to cut customers’ power over payment issues.

- The federal government extended the tax deadline for Texans to June 15 alongside a 90-day foreclosure moratorium for federal mortgages.

- At least seven Texas refineries were trying to restart as of early Monday, with varying degrees of success. Several lacked the power needed, and others struggled with storm-related damage, including water leaks, burst pipes, cracked pumping and other equipment damage.

- Texas’s grid was mere seconds away from facing involuntary, cascading blackouts that would take months to restore, similar to a 2012 disaster in India that cut power for 700 million people.

- Commodities trader Macquarie Group realized a $215 million windfall by shifting gas and electricity around the country to take advantage of soaring energy demand caused by Uri.

- Following is our compilation of force majeure and production disruption announcements:

- BASF declared force majeure on nylon products and intermediates made at its Freeport, Texas, plant and on Ultraform® POM Q600 grades.

- Braskem declared force majeure on polypropylene products.

- Celanese declared force majeure on a broad list of products.

- Chevron Phillips declared force majeure on polyethylene products.

- Covestro announced a new force majeure effective Feb. 14 on all polycarbonate products, superseding a prior force majeure that was in place.

- DuPont declared a global force majeure for Zytel® (including Zytel® HTN and Zytel® Specialty Nylons), Crastin®, Rynite®, Selar®, Minlon® and Pipelon®.

- Flint Hills declared force majeure on polypropylene products due to the storm.

- ExxonMobil said it is allocating polypropylene products.

- Formosa expanded and extended its force majeure declaration to all Formolene® polyolefin products.

- Ineos declared force majeure on polypropylene products due to the storm.

- Ineos Styrolution declared force majeure on Luran® S ASA, Terluran® ABS, and Novodur® high heat ABS.

- Invista declared force majeure on U.S. supply of PA66 intermediate chemicals.

- LyondellBasell declared force majeure on polyethylene and polypropylene products due to the storm.

- LyondellBasell announced a partial lifting of force majeure, affecting Line 5 at its Morris, Illinois, facility and LD1, LD2 and PF4 at its Clinton, Iowa, facility.

- Occidental, the second largest producer in the Permian Basin, declared force majeure on oil deliveries.

- OxyChem declared force majeure on U.S.-based PVC products.

- Sabic declared force majeure on LEXAN™ resins, CYCOLOY™ resins, XENOY™ resins, GELOY™ XP series resins, VALOX™ FR resins and XYLEX™ resins, as well as ABS product from its Tampico, Mexico, plant.

- Total declared force majeure on polypropylene products made at its La Porte, Texas, facility.

- Vestolit declared force majeure on suspension, copolymer and emulsion PVC resins produced in Colombia and Mexico due to feedstock disruptions from the Gulf Coast.

Supply

- Crude prices were higher in early trading today, with WTI up 0.2% to $61.94/bbl and Brent up 0.4% at $65.52/bbl. Natural gas was off 2.0% at $2.89/MMBtu.

- Early reports suggest Russia and Saudi Arabia are at odds over whether to keep OPEC cartel production flat into next month or further ease restrictions. A decision is expected next week.

- The U.S. and Canada accounted for more than 11% of India’s crude oil imports in January, a record-high share for North American crude for the world’s third-largest oil importer.

- Shares in Brazilian state-owned oil major Petrobras dropped more than 20% Monday, wiping out $13 billion in market value as the company’s leaders clash with the nation’s administration.

- Jet fuel prices hit a 13-month high last week as oil prices rose, adding injury to insult for the beleaguered airline industry.

- Goldman Sachs expects Brent Crude prices to hit $75 a barrel in the third quarter of 2021 in the wake of lower expected inventories and traders hedging against inflation.

- Under pressure from an activist investor, Exxon has revised its climate goals, published carbon emissions data and committed to spend $3 billion on green technology.

- Japanese construction equipment maker Komatsu announced plans to develop hydrogen power as an alternative to diesel for heavy-duty mining dump trucks, an industry first.

Supply Chain

- With U.S. retail inventories at pandemic lows, growth in the container shipping market will likely continue for most of the year, an outlook supported by the CEO of Hapag-Lloyd.

- Manufacturers took rapid cost-cutting measures at the start of the pandemic, which proved a boon to saving cash but left many unprepared for the sharp rebound in consumer demand that began weeks later and never let up.

- Intermodal container volumes were up 6.9% last week from the year-ago period, while rail carloads were down 7%, data from the Association of American Railroads shows.

- Mediterranean Shipping Co is set to overtake Maersk as the world’s largest container line, a title the carrier has held for over 25 years.

- During last week’s cold front, Werner was idling nearly 1,000 trucks per day throughout half of North America.

- A tanker sailed through Arctic sea ice in February for the first time, the latest evidence of rapidly increasing global temperatures.

- Many manufacturing sectors, including aerospace, appliances and automotive, are suffering disruptions due to a national shortage of steel, with the hot-rolled steel price at the highest level in 13 years.

- We expect continuing logistics disruption in the U.S. from severe winter conditions that blanketed much of the country last week.

- Logistics conditions remain strained, with trucking demand exceeding availability and continued congestion at ports due in part to operating challenges related to the pandemic. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

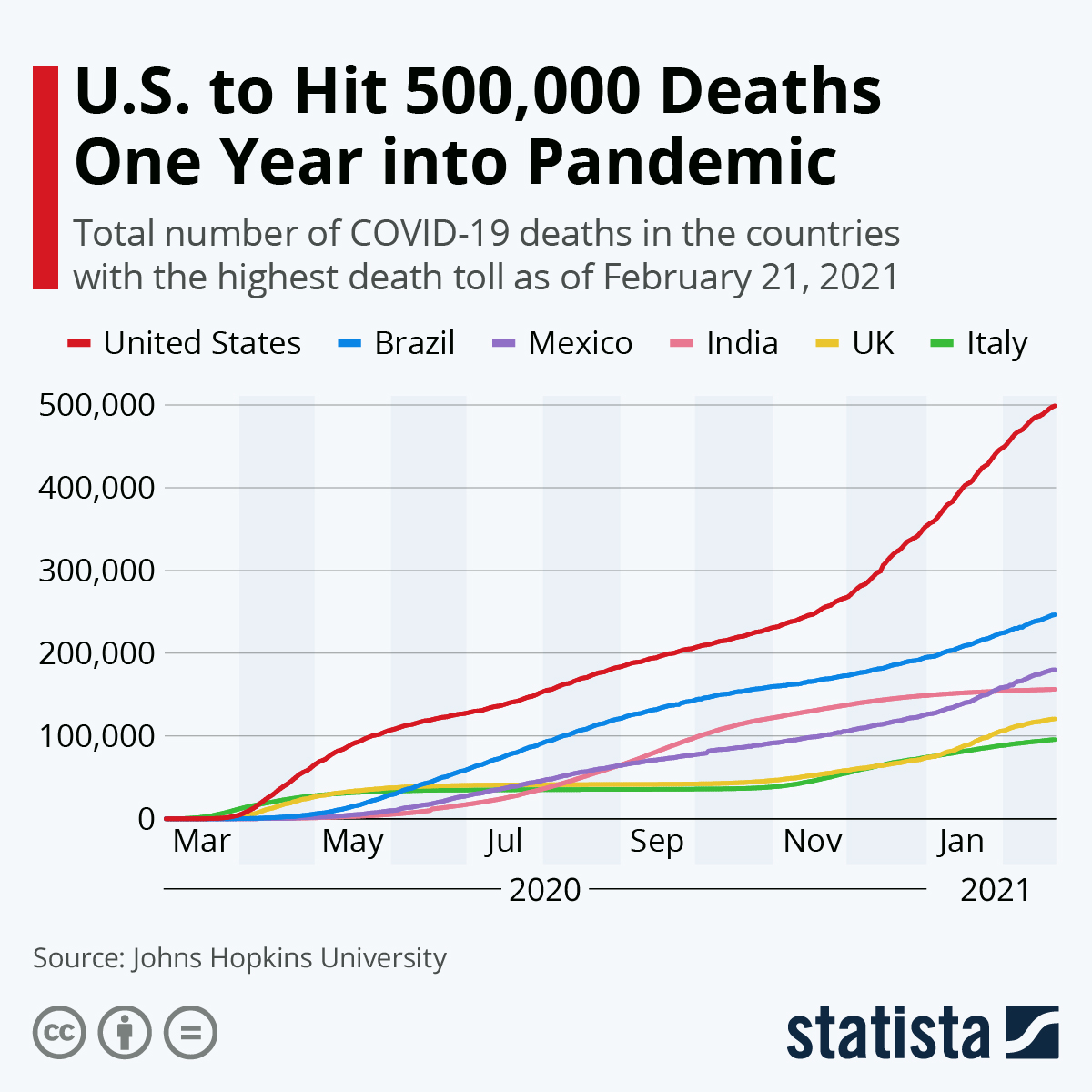

- In the U.S. yesterday, there were 56,044 new COVID-19 cases and 1,413 deaths.

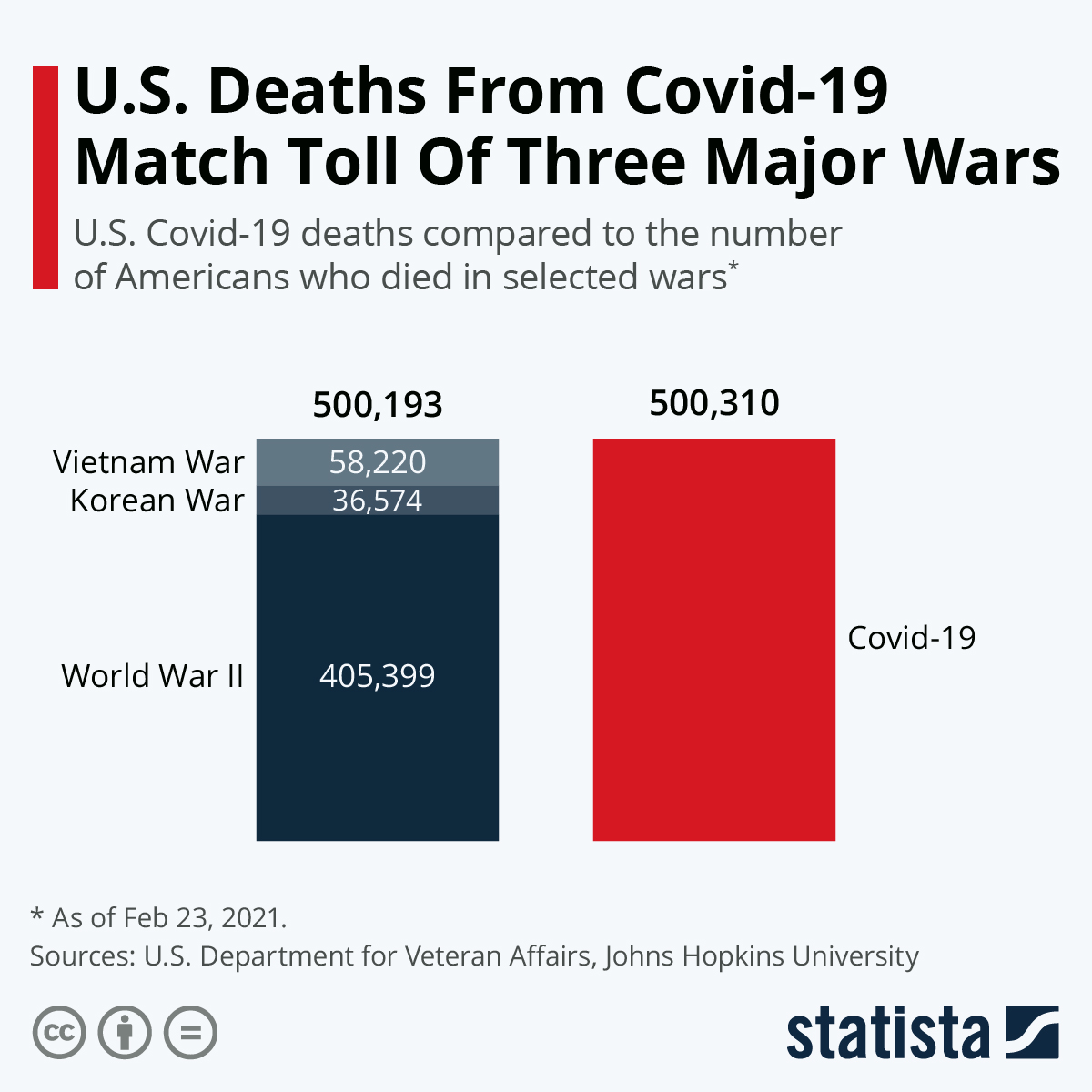

- The White House held a candlelight vigil commemorating the 500,000 COVID-19 deaths suffered over the past 11 months.

- New York City is reopening theaters, wedding halls and sports arenas on March 5 in the wake of declining infection rates.

- Black and Latino Californians account for nearly 60% of the state’s reported COVID-19 cases but have received only 19% of all vaccinations.

- A single shot of COVID-19 vaccines from Pfizer/BioNTech and AstraZeneca/Oxford substantially reduced the risk of hospitalization for the virus.

- The FDA is implementing a new fast-track process for the rapid authorization of future COVID-19 vaccines targeted at variants of the virus.

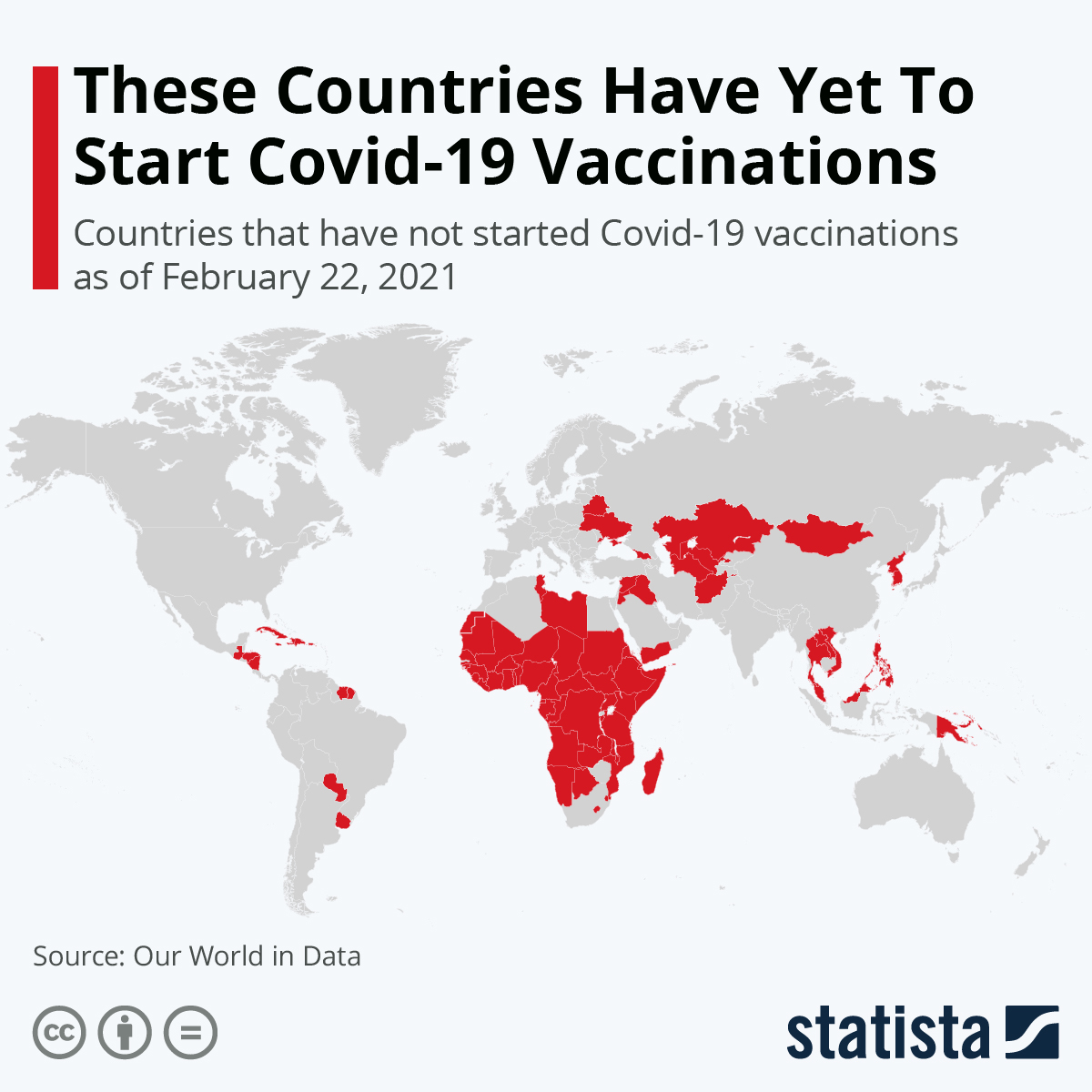

- More vaccines are coming: Moderna received encouragement from regulators to expand the number of COVID-19 vaccine doses in each of its vials, Pfizer is ramping up production, and Johnson & Johnson’s vaccine could be approved as early as this week.

- An anti-inflammatory drug traditionally used to treat rheumatoid arthritis is showing signs of promise in treating COVID-19 as well, helping the most severely infected patients battle many symptoms.

- For two weeks starting Wednesday, the White House will restrict applications for Paycheck Protection Program loans to businesses with fewer than 20 employees.

- Commodities hit their highest levels in almost eight years amid booming investor demand, with the Bloomberg Commodity Spot Index for 23 raw materials rising 67% since reaching a four-year low last March.

- A combination of factors is drastically reducing the number of cars dealerships keep on lots, a shift likely to become permanent post-pandemic.

- The pandemic has upended the lives of millions of American hospitality workers, often forcing them to utilize well-developed public-facing work skills to remake themselves for different occupations.

- The rapidly growing battery technology sector saw historic investment last year, attracting $8.1 billion in corporate funding compared to only $3.8 billion the prior year.

- U.S. college enrollment of first-time undergraduates declined 13.1% last fall, the fastest decline in decades, while overall enrollment dropped 3%.

- The FDA issued a statement dispelling concerns that food and food packaging can spread COVID-19.

- Home improvement bellwether Home Depot reported a 25% year-over-year rise in revenue in the fourth quarter but warned that growth could flatten in 2021.

- HP launched its first PCs made with post-consumer and ocean plastics.

International

- India’s Maharashtra state ordered fresh restrictions after reporting 7,000 new cases of COVID-19 on Sunday.

- In Germany, the COVID-19 incidence rate has risen for the past several days to 61 per 100,000 population.

- Portugal, recently suffering the highest per-capita COVID-19 infection rate in the world, saw daily infections drop below 1,000 yesterday, the lowest level since October, after imposing strict lockdowns on Jan. 15.

- Britain will begin weaning its citizens off some of the world’s harshest COVID-19 restrictions in two weeks, a four-part process not expected to be completed until mid-June at the earliest. Early studies show the nation’s rapid vaccine rollout contributed to a substantial drop in infections, hospitalizations and deaths from the virus.

- Some countries are imposing penalties for not getting COVID-19 shots, ranging from fines to restricting access to public places to threatening the loss of priority access to vaccines.

- Global debt last year rose by $24 trillion to $281 trillion, representing 355% of global GDP, a higher debt-to-GDP ratio than during the Great Recession. Government debt jumped to 105% of GDP from 88% in 2019.

- Latin America and the Caribbean, which suffered 25% of global COVID-19 deaths and a 7% GDP contraction last year, the worst in the world, may not see a return to pre-pandemic economic activity until 2023 due to stumbling vaccination efforts.

- Mexico’s poverty levels increased 3.4% to over 40% of the population in 2020.

- The number of people heading out to shops across the U.K. increased by 6.8% last week over the previous week, a fifth straight weekly increase, while the nation’s unemployment rate rose to the highest level since 2016.

- South Africa’s unemployment rate rose to 32.5% in the fourth quarter, a record high.

Our Operations

- Last week’s Plastics Reflections webinar on 2021 Drivers and Trends for the North American Plastics Market can be viewed here.

- Our 3D Printing business unit has launched a new e-commerce site. Access the new site here.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.