COVID-19 Bulletin: February 4

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices slipped in afternoon trading yesterday after the Energy Information Administration reported a smaller-than-anticipated inventory draw of 1 million barrels for the last week of January.

- Energy prices were higher in early trading today, with the WTI up 0.8% at $56.13/bbl, Brent up 0.7% at $58.84/bbl, and natural gas 0.7% higher at $2.80/MMBtu.

- While U.S. energy consumption will not return to 2019 levels until 2029, the nation’s oil production is set to surpass 2019’s record annual average of 12.25 million bpd within two years, the Energy Information Administration predicts.

- Brazil’s state-owned major Petrobras exported a record amount of crude oil in January, with 19.3 million bpd passing through the Angra dos Reis terminal.

- Siemens Energy won a bid to provide next-generation turbines for a $9 billion wind farm development off the coast of England.

- Royal Dutch Shell reported lower-than-expected earnings in the fourth quarter and a deterioration of cash flow but still committed to increase its dividend in the current quarter, though dividend costs exceed free cash flow.

Supply Chain

- Pressure is building in China, Europe and Asia for government intervention to address worsening congestion and cost increases in the shipping industry.

- General Motors is the latest to announce production cuts at several factories this month, including three in North America, due to a global shortage of semiconductor chips.

- Shares of Qualcomm dropped 7.6% in after-hours trading Wednesday after the company said semiconductor supply shortages were hampering its sales growth.

- UPS posted a 21% jump in fourth-quarter sales to $24.9 billion, a record, helped in large part by orders from Amazon that made up more than 13% of the service’s full-year revenue.

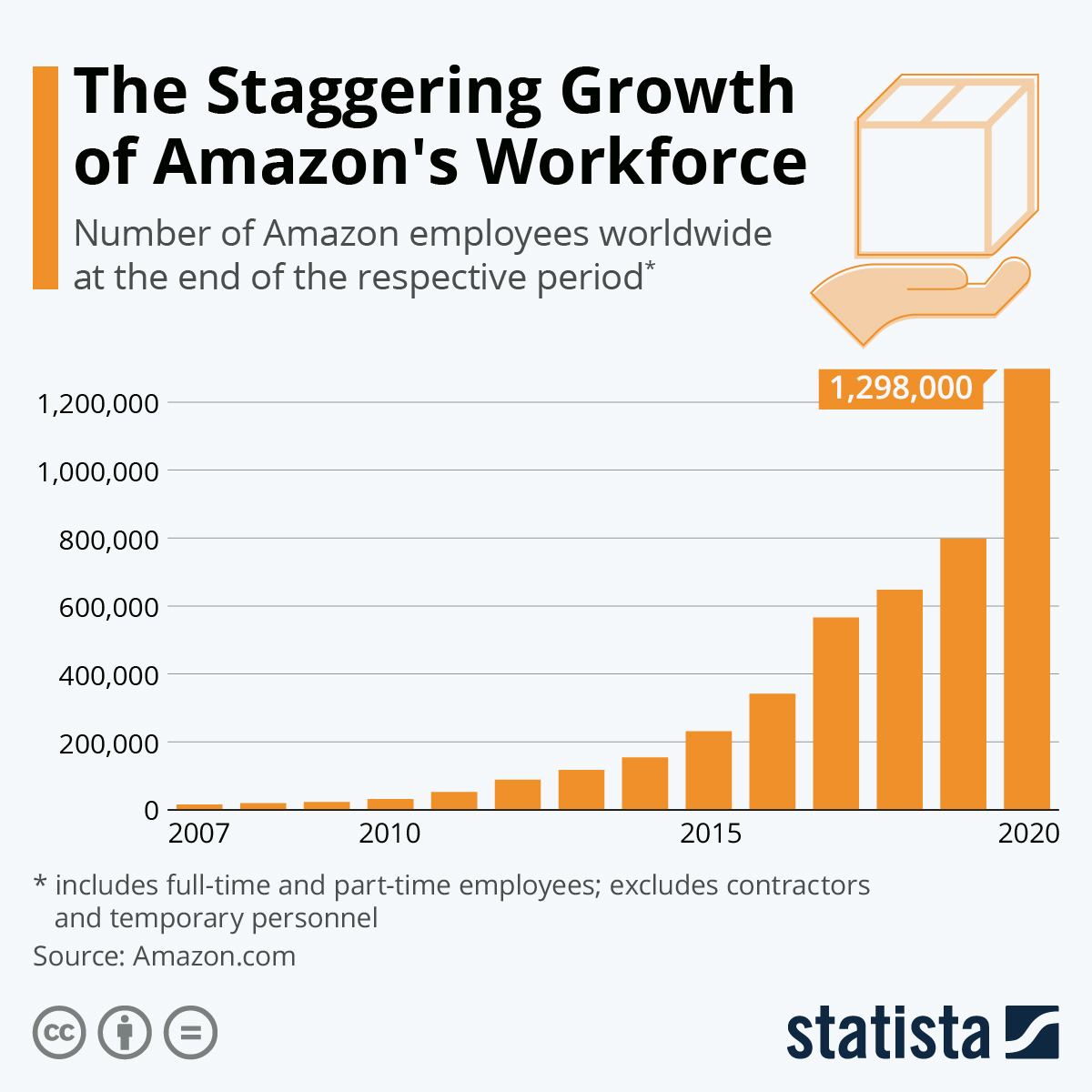

- Amazon began testing its first Rivian electric delivery vans in Los Angeles, with plans to expand the program to 15 more cities this year.

- Warehouse rental rates in the U.S. are predicted to rise 5% in 2021 and 4% globally, with e-commerce expected to drive a need for 200 million square feet of new space in the nation in the next few years.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 121,469 new COVID-19 infections in the U.S. yesterday and 3,912 fatalities, pushing total fatalities to more than 450,000.

- Kansas became the 33rd state to report a case of the more contagious and potentially more deadly variant of COVID-19 first discovered in the U.K., raising the case count for the variant to 541.

- The CDC has begun providing tracking information on COVID-19 variants by state.

- Up to 42% of South Dakota’s population has been infected with COVID-19.

- Coronavirus cases accounted for a fifth or more of overall hospitalizations in three states as of Monday, compared to 11 states on Jan. 15 when COVID-19 hospitalizations peaked.

- New Jersey is raising capacity limits for indoor dining, houses of worship and entertainment venues after a 20% decline in COVID-19 hospitalizations from mid-January.

- Texas has seen a 10% decrease in new COVID-19 infections over the past two weeks.

- A majority of COVID-19 patients still have antibodies in their system at least six months after infection.

- Moderna, Pfizer/BioNTech, Johnson & Johnson, Novavax, CureVac and AstraZeneca/Oxford are all working to develop next-generation vaccines that would target new variants of COVID-19.

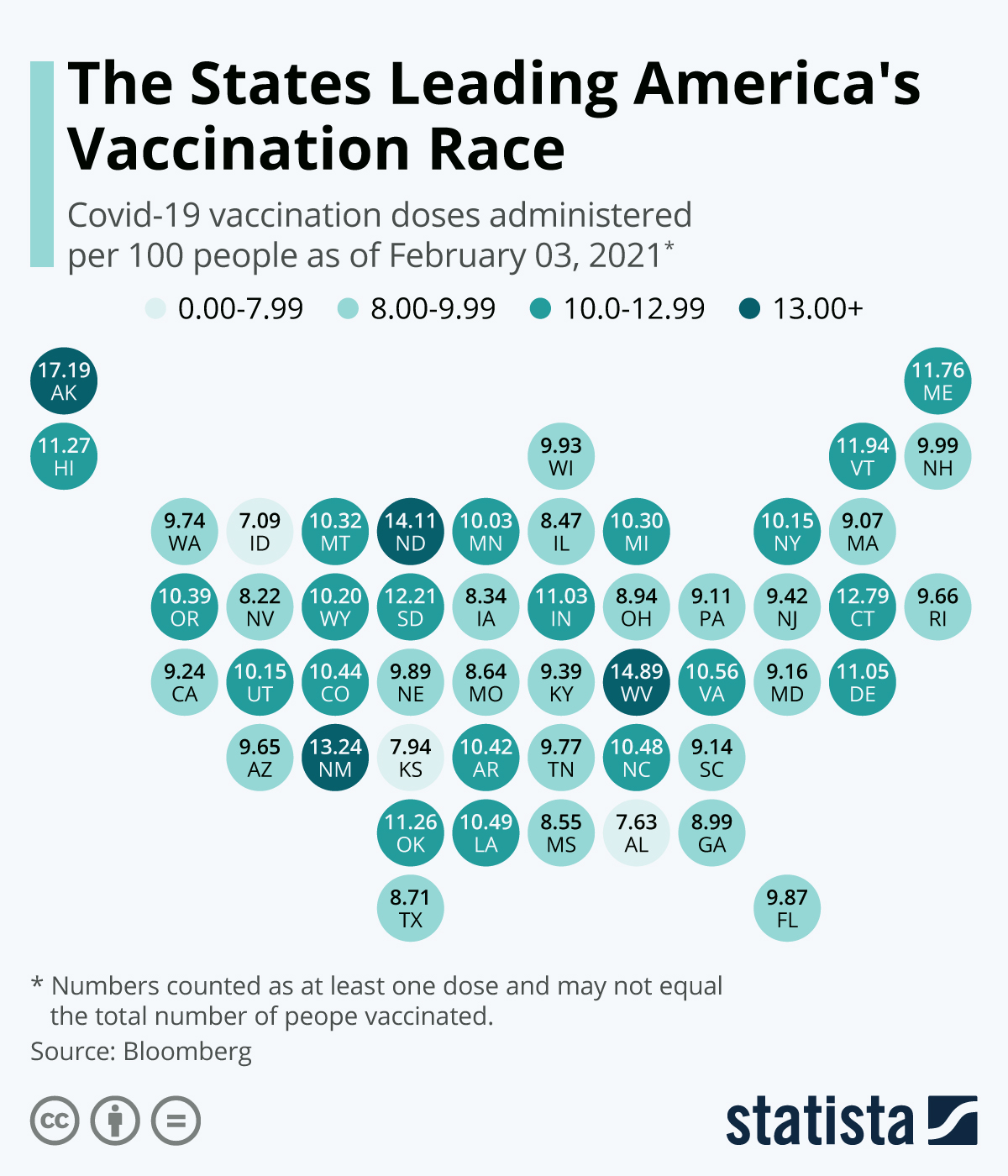

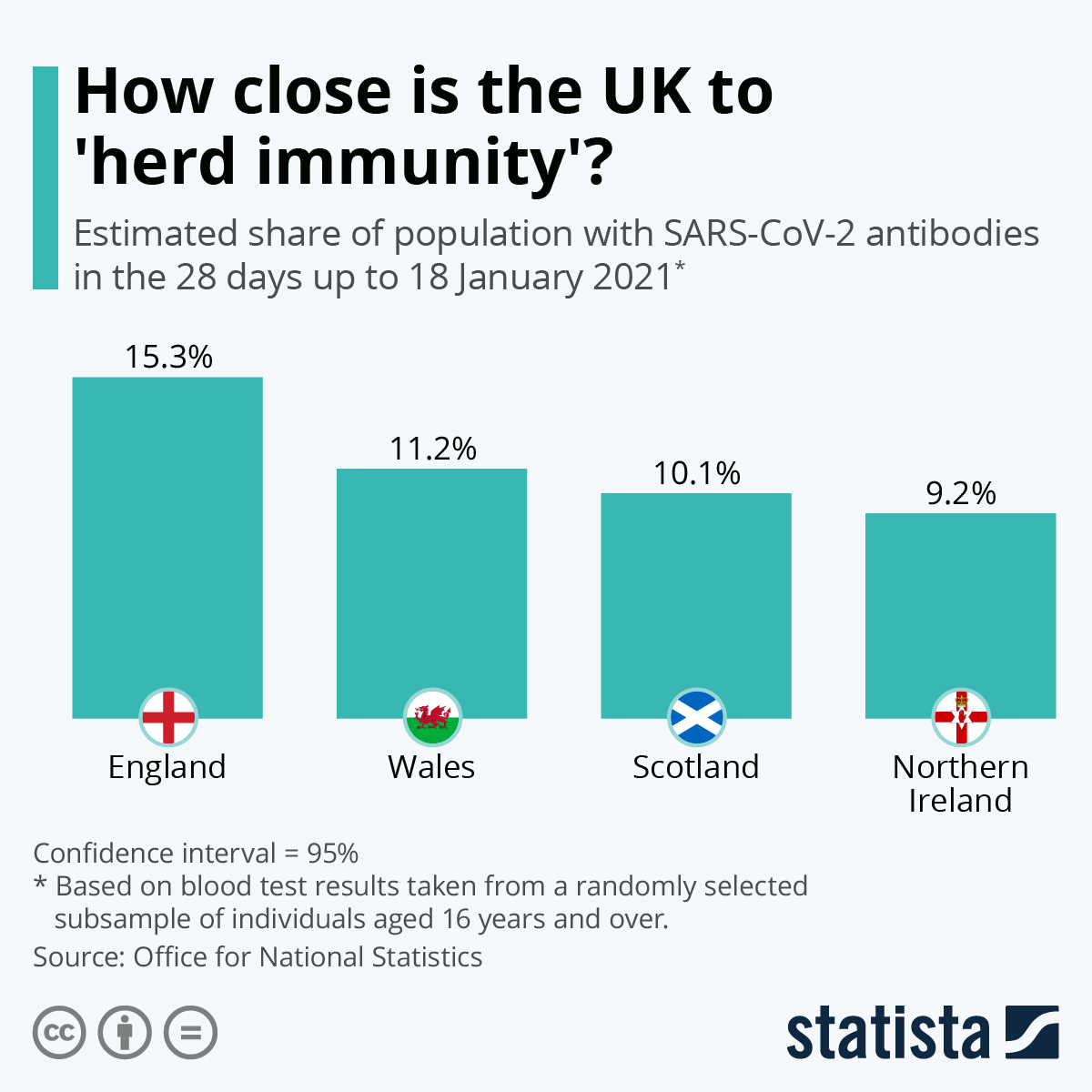

- Nearly a quarter of U.S. adults indicate they won’t get vaccinated against COVID-19, a challenge to herd immunity plans that require 70% to 80% of the population to receive shots.

- On Monday, the U.S. administered nearly a third fewer COVID-19 vaccinations than planned due to severe winter weather in the Northeast, causing many appointments to be canceled or missed.

- Zipline, a drone delivery service for healthcare supplies to remote areas of the world, will begin delivering COVID-19 vaccines in April.

- There were 779,000 first-time jobless claims last week, down 33,000 from the prior week.

- The White House has signaled openness to limiting the pool of Americans who could receive a proposed round of $1,400 direct payments under its $1.9 trillion stimulus and rescue plan.

- More fourth-quarter earnings reports reflect the pandemic’s impact on the economy:

- eBay’s holiday sales jumped 28% on a 7% jump in active buyers, prompting higher revenue and profit forecasts for the current period.

- The booming housing market propelled UWM Holdings, the nation’s fourth-largest wholesale mortgage lender, to a fourth-quarter profit surge of 822% compared to the year-ago period.

- PayPal added a record 72.7 million active accounts in 2020, leading to an overall revenue increase of $6.12 billion in the fourth quarter.

- Consumer brands giant Unilever reported lower-than-expected sales and earnings in the fourth quarter, with modest growth in developed countries but disappointing growth in emerging markets. The company’s Beauty and Personal Care unit, its largest division, was hurt by store closures in 2020 but saw a surge in online sales, with e-commerce accounting for 50% of sales of prestige beauty products.

- American Airlines warned 13,000 employees of potential layoffs, saying a much-anticipated summer travel rebound isn’t materializing.

- Boeing reported its order backlog declined by $100 billion during 2020 to $363 billion due to cancellations and a drop in new orders.

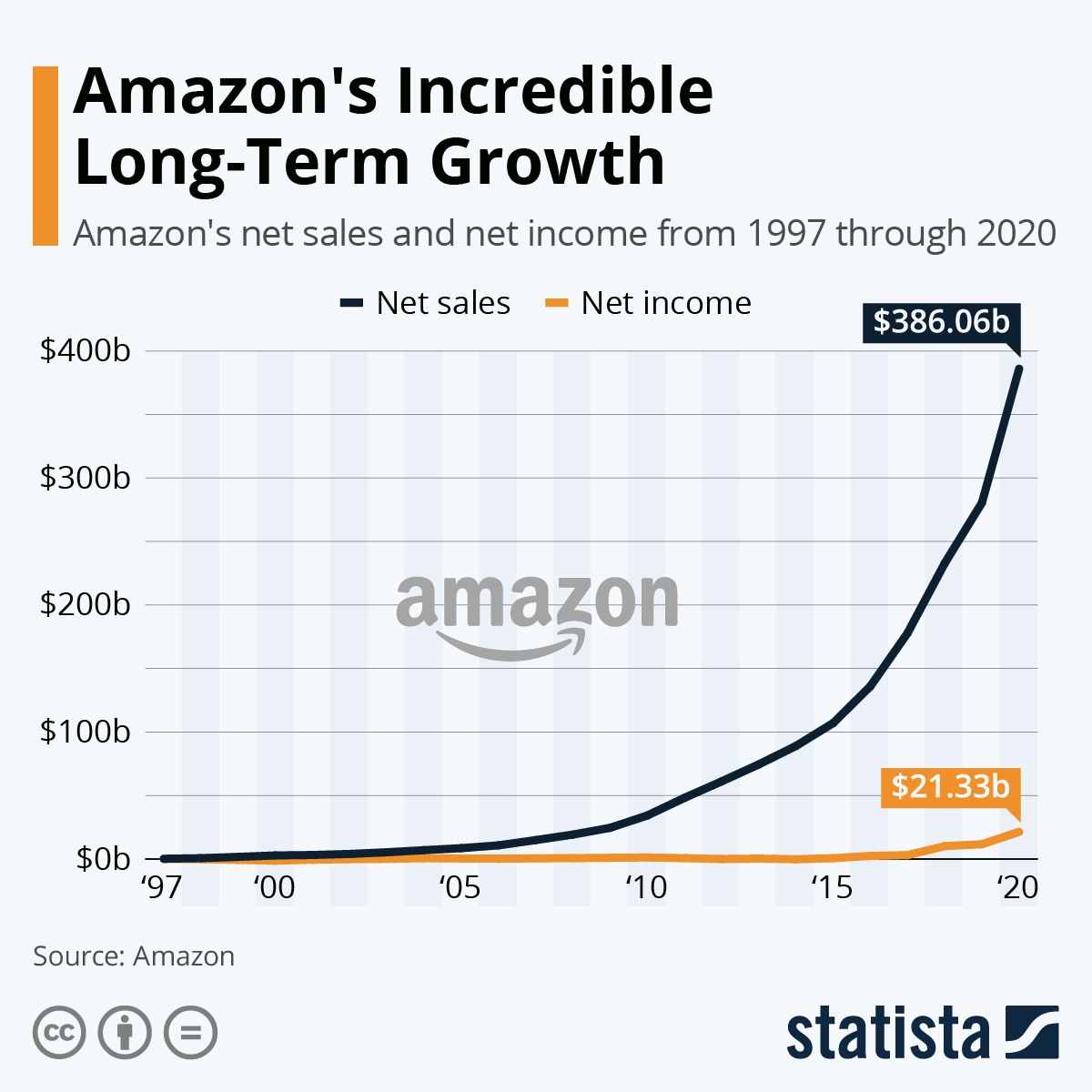

- Amazon is now logging more than $1 billion per day in revenue, the second company to do so behind Walmart.

- Toyota has formed a new technology research unit, Woven Planet Holdings, and will soon introduce its Arene software system to enhance over-the-air downloads as it takes on Tesla in digital technology.

- Daimler will spin off its trucks business and change its name to Mercedes-Benz to sharpen its focus on development of luxury electric cars and automotive software.

- VW’s Porsche unit will spend $1.1 billion this year on vehicle software with a goal of raising the sale of digital products and services to a double-digit percentage of revenues.

- Uber will buy alcohol-delivery service Drizly for $1.1 billion, as e-commerce is expected to represent 7% of total alcohol sales by 2024, growing from only 1% of total sales in 2019.

International

- Mexico exhausted its supply of COVID-19 vaccines as the death rate approached a daily high yesterday.

- Several European governments are extending or considering extending lockdowns, even with declining case rates, due to concern over new strains of the virus.

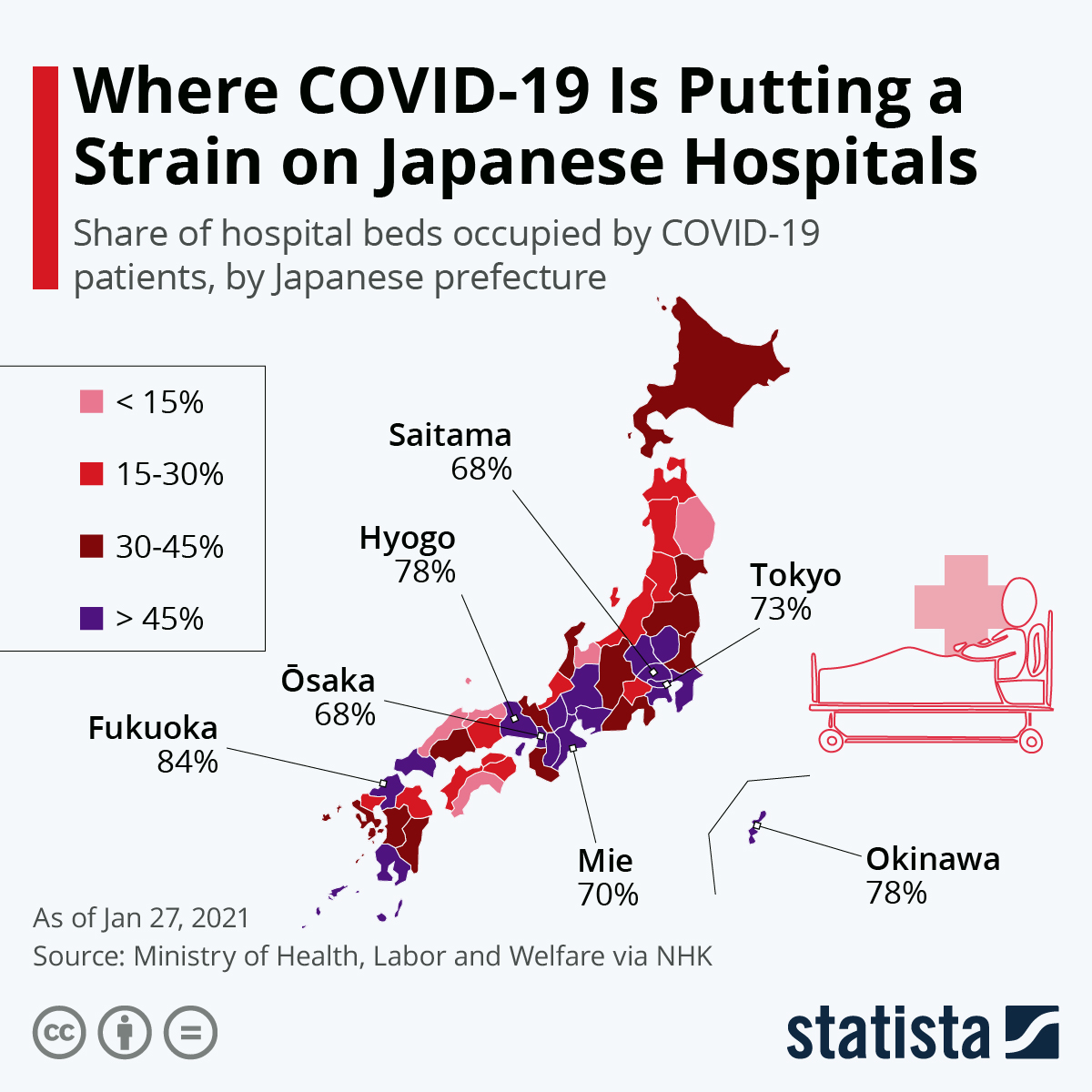

- Japan extended a state of emergency in Tokyo and several other regions by a month, citing a continued strain on hospitals despite a decline in new coronavirus cases.

- Saudi Arabia banned the entry of travelers from 20 countries to stave off new virus strains.

- Melbourne is mandating mask-wearing and tightening rules on gatherings after a quarantine hotel worker tested positive for COVID-19, the city’s first case in 28 days.

- So far, about 90% of people over age 80 and more than half over age 70 in England have received a vaccine, as the nation vaccinated about 15% of its total population in the first two months of rollout.

- Israel is expanding COVID-19 inoculations to anyone over the age of 16 starting Thursday.

- Africa will receive its first COVID-19 vaccine shipments by the end of the month, a result of international group Covax’s efforts to secure doses for low-income countries.

- Latin America’s top development bank must cut lending by at least 25% to nations battered by the pandemic this year, absent approval for more resources — most importantly from the U.S.

- Electric and plug-hybrid vehicles comprised more than 10% of car sales in the European Union last year.

- Battery-electric car sales jumped 54% last month in the U.K., despite a 40% plunge in overall car sales to a 51-year low due to lockdowns.

- Early data suggests Panasonic’s battery supply unit will have its first full year in the black due to growing business with U.S. electric vehicle maker Tesla.

- Food prices are rapidly rising in China ahead of the country’s Lunar New Year festivities due to a combination of resurgent COVID-19 and a colder-than-expected winter.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.