COVID-19 Bulletin: January 25

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices fell on Friday after the Energy Information Administration reported crude inventory builds of 4.4 million barrels for the week ending Jan. 25, compared with a 3.2 million-barrel decline the previous week. Energy prices inched higher in early trading today, with the WTI up 0.2% at $52.39/bbl and Brent up 0.2% at $55.52/bbl. Natural gas was up 3.2% at $2.53/MMBtu.

- The Baker Hughes count of active U.S. oil and gas rigs rose by 5 last week to 378, the ninth consecutive weekly rise.

- Iran is ramping up crude oil production to return to pre-sanction levels in as little as two months, bringing output to around 4 million bpd.

- The fourth quarter promises to be the worst earnings period yet for oil refiners, who encountered a perfect storm of rising oil prices, weak demand and cost inflation.

- Major oil companies purchased the fewest new exploration licenses in five years in 2020. BP has been among the most aggressive scaling back its search for new fossil fuels, cutting its exploration team from 700 to 100.

- Total SE has committed to adding 8.8 gigawatts of renewable energy capacity, the most among oil majors shifting toward renewable sources.

- The canceled Keystone XL oil pipeline project is expected to yield more than 48,000 tons of scrap steel, a haul that would go for more than $50 million at current market prices.

Supply Chain

- La Niña, a cooling of the equatorial Pacific that triggers unusually dry or wet conditions in certain parts of the world, is expected to intensify this year, portending more severe climate events, including dry wildfire conditions in the West.

- Rates on multiple ocean shipping lanes have surged in January, with the Drewry World Container index hitting its highest point since 2011 at just over $5,340 per 40-foot container.

- British shoppers buying items from European websites are facing post-Brexit demands of more than 100 euros in import duties before parcel carriers will complete deliveries.

- This year will likely bring reduced capacity, higher driver wages and continued high spot rates to the truckload carrier market, according to a forecast from U.S. Express Enterprises.

- Dutch COVID-19 protocols are prompting airlines KLM and Martinair to suspend all long flights, including cargo and freighter aircraft.

- Rebounding demand for manufactured goods coupled with depleted inventories are broadly disrupting supply chains, causing delivery delays and soaring commodity prices.

- Forty percent of multinational companies reported in a recent survey that their supply chains were overwhelmed by the pandemic, and 8 in 10 have beefed up digital strategies to build greater resilience.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- On Saturday, hospitalizations, new COVID-19 infections and deaths all declined from the day before as the U.S. topped 25 million confirmed cases of the virus.

- The seven-day average of new COVID-19 cases had been incrementally declining since Jan. 11, while hospitalizations have declined for 12 consecutive days, led by the largest single-day drop in hospitalizations (2,773) late last week.

- COVID-19 positivity rates in Florida are dipping from recent highs after the one-day fatality toll reached a record 272 on Friday.

- New COVID-19 infections and hospitalizations eased in California on Saturday, a day after the state reported a record-high 764 fatalities in a single day.

- The White House is extending travel limits on those from the U.K., Ireland, 26 other European countries and now South Africa. Pending new rules requiring returning Americans to test negative for COVID-19 are forcing the travel and tourism sectors to scramble.

- The U.S.’s top infectious disease expert warned that a highly infectious South African COVID-19 variant, while not yet detected in America, could make existing vaccines less effective.

- Pfizer and the FDA say an extra vaccine dose can be retrieved from vials if a certain type of syringe is used, potentially giving each shipment of vaccines an additional 20% capacity.

- Almost 200 National Guard members sent to secure Washington during inauguration proceedings have contracted COVID-19. Thirty-eight Capitol police officers have tested positive since the riot there on Jan. 6.

- According to some estimates, for every documented case of COVID-19, there are at least two undetected infections, a result of unbalanced data gathering and tracking across states and communities.

- Based on current and expected rates of COVID-19 vaccinations in the U.S., it could take until January 2022 for every American to get at least one shot. Young, healthy Americans may not get vaccines until late summer.

- The CDC has OK’d the practice of delaying second doses of COVID-19 vaccines up to six weeks after the first injection, which for some shots would be twice as long as recommended.

- About 1 in 400,000 recipients of Moderna’s COVID-19 vaccine experience a severe allergic reaction, compared to about 1.3 reactions per million doses of annual flu shots.

- Dallas County, Texas, the eighth most populous county in the nation, is under pressure to devise a more equitable method to distribute COVID-19 vaccines after initial doses went mostly to wealthy neighborhoods.

- Merck scrapped its COVID-19 vaccine program after early testing showed its two candidates were marginally effective against the virus.

- Oxford University researchers will perform large-scale trials of an inexpensive parasitic-worm drug that could reduce COVID-19 deaths if taken shortly after symptoms appear, early findings indicate.

- A White House directive ordered government agencies to immediately enhance federal benefits, including expanding food assistance and improving stimulus check distribution, ahead of an expected push for a $1.9 trillion virus bill.

- IHS Markit’s index of U.S. manufacturing activity increased to 59.1 in the early weeks of 2021, the highest level in more than a decade where any figure above 50 indicates sector expansion. The U.S. service-sector reached 57.5, while poor numbers for Europe indicated growing risks of a second recession there.

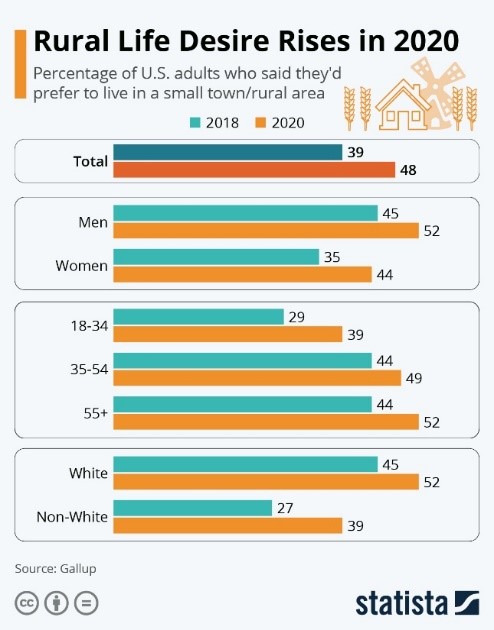

- U.S. home sales last year rose to their highest levels in 14 years on ultralow interest rates and increased demand for larger living spaces, with more people interested in moving to small towns and rural communities:

- Late payments on U.S. credit cards were at their lowest level ever in 2020, indicating many consumers are tightening their budgets.

- The U.S. Farm Belt is experiencing an unexpected recovery as a years-long crop glut is beginning to subside, with rising commodity prices increasing farm income on strong export demand from China.

- A major U.S. producer of nitrile gloves will triple its production capacity by 2022, aiming to produce 800 million gloves per year by April.

- United Airlines is considering requiring workers to get vaccinated against COVID-19.

- A recent survey suggests that a third of workers will continue working from home post pandemic.

- A New York surgeon recently performed the U.S.’s first knee-replacement surgeries using augmented reality, a superimposition of digital content over real-world images using special glasses.

- The University of Michigan paused athletics operations indefinitely after the school’s most recent round of screenings revealed several athletes infected with virulent new strains of COVID-19.

International

- The U.K. variant of COVID-19 could be 30%-40% more fatal than other strains, according to preliminary studies. The nation is expected to further tighten travel restrictions to prevent importing new strains of the virus.

- European leaders are considering closing all internal European Union borders for nonessential travel as governments struggle to contain the spread of virulent new COVID-19 strains.

- Total COVID-19 cases in France surpassed 3 million on Friday, while hospitalizations remain more than five times higher than in August. French health officials recommend doubling the time between two required COVID-19 vaccine doses to stretch supplies and give first shots to as many people as possible. The nation has distributed 1 million COVID-19 vaccines.

- Mexico recorded 1,803 one-day COVID-19 fatalities late last week, the highest of any Latin American country. Mexico’s president, who has shunned mask wearing and downplayed the virus, has tested positive for COVID-19.

- The Brazilian city of Manaus, capital of the state of Amazonas, ran out of hospital oxygen earlier this month, highlighting distressed conditions in one of the world’s hardest hit countries. More than three-quarters of residents of the city have detectable COVID-19 antibodies.

- Taiwan imposed its harshest lockdown yet, with up to 5,000 people required to quarantine after an outbreak in the northern city of Taoyuan.

- China continued to report more than 100 new COVID-19 cases per day over the weekend.

- South Africa’s COVID-19 fatality toll topped 40,000 amid a decline in hospitalizations and a lower positivity rate.

- New Zealand recorded its first COVID-19 case in two months.

- Australia’s most populous state eased restrictions after reporting no new COVID-19 cases for 16 days, while the nation at large has reported no new infections for nearly a week.

- New infections and hospitalizations in a large group of vaccinated Israelis were down 60% within days of getting shots.

- European nations will receive 60% fewer COVID-19 vaccines from AstraZeneca in the first quarter of 2021, a result of an unspecified manufacturing issue.

- Hong Kong lifted its first COVID-19 lockdown, imposed just days prior, after testing 7,000 people in a virus hotspot.

- Responding to COVID-19 surges, global statistical agencies are revamping the way they count deaths to give decision makers faster and more accurate data.

- Evidence points to COVID-19’s presence on frozen-food packaging, suggesting one way the virus pops up in countries where the pandemic is under control. China is increasing scrutiny of imported cherries after COVID-19 was detected on packaging on Friday.

- Low-wage migrant workers in Southeast Asia have borne the brunt of recent COVID-19 waves, prompting lawmakers to start talks on raising living wages and working standards.

- Shipping disruptions are driving up the cost of rice, a staple for billions of people and a concern in countries that depend on imports.

- Airbus lowered monthly estimates for a planned ramp-up in production, retreating from optimism expressed in October about a rebounding industry.

- For the first time, China overtook the U.S. as the world’s top destination for new foreign direct investment, with investments by foreign companies increasing 4% compared to a 49% decline in the U.S. in 2020.

- A nine-year-old’s petition calling on U.K. lawmakers to halt shipments of plastic waste to developing countries received more than 70,000 signatures of support in less than a week.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.