COVID-19 Bulletin: January 11

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- After rising about 45% since late October, oil prices eased in early trading today as the U.S. dollar strengthened and China, the world’s second largest oil consumer, imposed new virus restrictions. The WTI was down 0.9% at $51.75/bbl and Brent was down 1.5% at $55.18/bbl. Natural gas was 3.5% lower at $2.61/MMBtu.

- U.S. spot prices for natural gas in 2020 averaged the lowest since 1997 due to milder weather and decreased demand caused by the coronavirus pandemic.

- With a return of the “polar vortex” of unusually cold temperatures and high snowfall this year, prices for gas in Spain and liquefied natural gas in Asia have reached record highs, a trend expected to spread as the winter weather reaches into North America.

- Middle East oil producers raised February prices to Asian refiners, possibly opening the door to global rivals, including the U.S.

- Oil demand in India fell nearly 11% last year, the first drop in two decades.

- Brazilian state oil major Petrobras posted record output in 2020 of 2.3 million bpd, a production volume in line with OPEC-member Kuwait.

- Oil kingdom Saudi Arabia, among the world’s biggest polluting nations, will invest $500 billion to build a futuristic “eco-city” on the Red Sea coast that has no cars or streets and zero carbon emissions.

- Norway’s central oil and gas association is criticizing government plans to triple carbon taxes as part of a comprehensive climate action plan.

Supply Chain

- Unforeseen costs and paperwork are clogging trade between the U.K. and Europe post-Brexit with some continental European consumers receiving unexpected bills for customs declarations on British exports.

- Amazon and Walmart are using new algorithms to determine whether it makes economic sense to process returns or whether consumers should keep their goods and get a refund of high shipping costs. The trend is expected to spread to other, smaller retailers.

- Despite progress in increasing safeguards against COVID-19 on factory floors, manufacturers are still facing labor shortages that back up supply chains and delay deliveries.

- Heavy-duty Class 8 truck orders in December more than doubled from the year-ago period to the fourth-highest volume on record, reflecting continued demand for consumer goods and robust recovery in manufacturing.

- The U.S. Postal Service was the worst-hit parcel deliverer during the 2020 holiday season, recording more complaints of delays than rivals FedEx and UPS.

- Indian third-party logistics giant Mumbai Mahindra is deploying a fleet of electric vehicles for last-mile delivery in six cities, with plans of expansion to 14 cities by the end of 2021.

- The Spanish government is sending convoys of COVID-19 vaccines and food supplies to the country’s central region after the heaviest snowfall in decades fell during the weekend.

- A global shortage of computer chips has reached U.S. automakers, some of whom are reducing production forecast for coming weeks and planning to stockpile chips.

- Logistics conditions remain strained, with trucking demand exceeding availability, continuing congestion at ports, and backlogs at warehousing and packaging facilities due in part to operating challenges related to the pandemic. Shipping containers are in short supply, with demurrage charges rising. Clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. recorded 283,204 new COVID-19 cases Friday, the second highest in the pandemic, ahead of Saturday’s case count of 269,000, the fourth highest in the pandemic. Daily fatalities neared 3,500 both days, while a holiday spike of new cases and deaths could continue throughout January.

- Northern New England, previously successful in stemming COVID-19, is now seeing the nation’s largest increase in virus cases and hospitalizations relative to population.

- With more than 20,000 people consistently hospitalized with COVID-19, California medical staff are turning to making triage decisions about who gets a slice of the state’s limited hospital resources first.

- New York found three more COVID-19 patients infected with a highly contagious strain discovered in the U.K.

- Many lawmakers may have been exposed to COVID-19 while they were held in a secure room during last Wednesday’s riot at the Capitol.

- New research shows long-term symptoms of COVID-19, including fatigue, muscle weakness and anxiety, could last six months in most patients.

- Pfizer/BioNTech’s COVID-19 vaccine will be effective against highly contagious virus strains discovered in the U.K. and South Africa, the companies say.

- A decentralized rollout of COVID-19 vaccines in the U.S. is causing unnecessary delays in distribution due to complicated last-mile logistics. As of Friday, more than 22 million vaccine doses were distributed to states while only 6.7 million people received shots.

- Connecticut has the most successful vaccine rollout among states, administering nearly half of allotted doses compared to a national average of 28%.

- New York expanded the pool of people eligible to receive COVID-19 vaccines to teachers, police officers, transit workers and residents 75 or older.

- Supermarkets are likely to play a larger role in distributing COVID-19 vaccines to the public, with federal and state officials tapping retail-based pharmacies to help speed up vaccine rollouts.

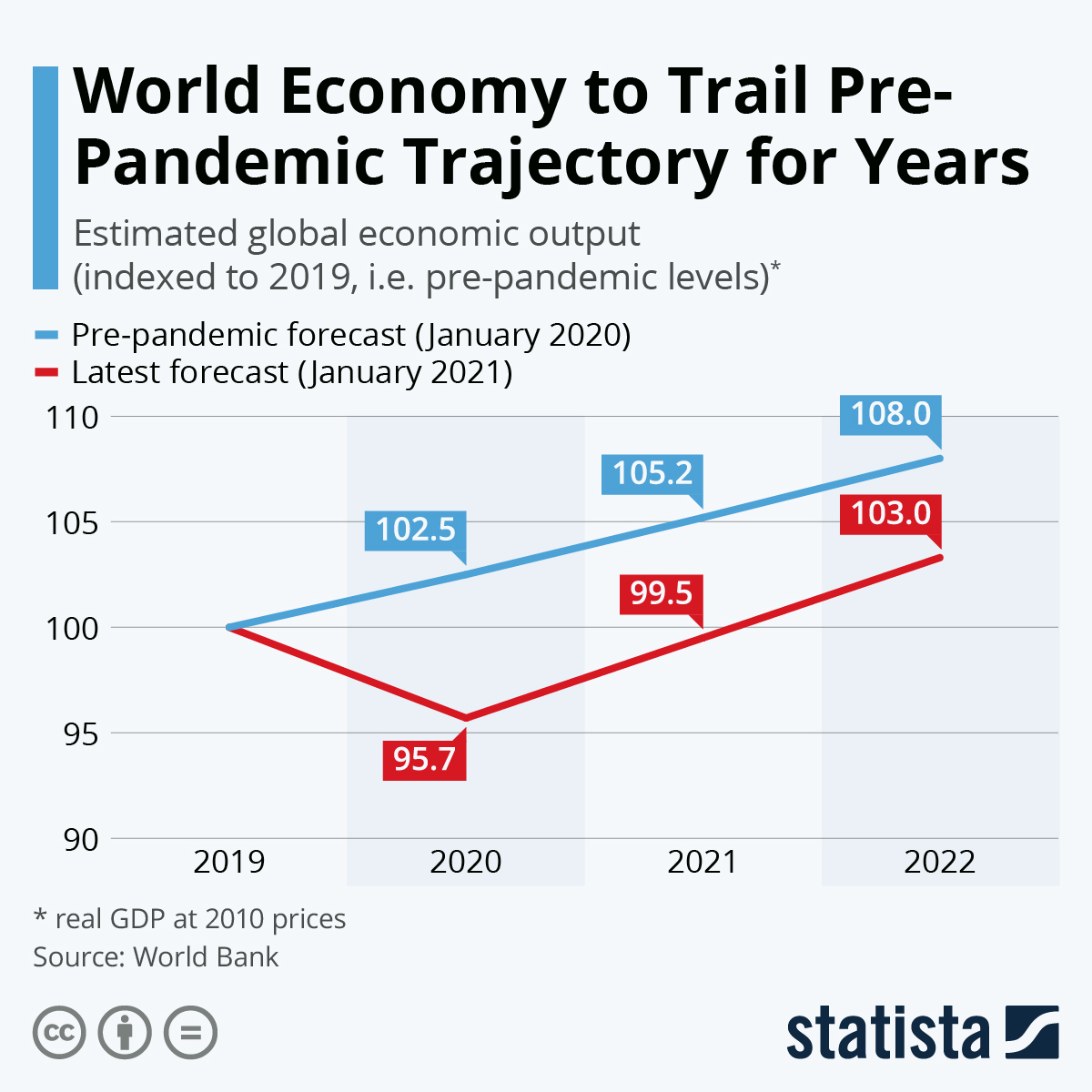

- The release of earnings reports for the last quarter of 2020 begins this week, as investors and officials wait anxiously to see whether the numbers portend an expected strong economic rebound in 2021.

- While the U.S. lost 140,000 jobs in December, ending seven months of job growth amid surging COVID-19 cases and restrictions imposed in many states, the tech sector was robust, with 390,000 new jobs added and a 3% unemployment rate. There were further job gains in logistics, parcel delivery, warehousing and trucking.

- With a net loss of 9.37 million jobs — nearly double the number of jobs lost in the 2008 financial crisis — 2020 was the worst year for job losses in the U.S. since 1939, with minority groups, teenagers and high-school dropouts suffering the brunt of the pandemic’s effects.

- In contrast, 2021 is shaping up to be the best year ever for U.S. job growth in terms of absolute numbers. The economy is poised to gain 6.7 million jobs by December 2021, according to IHS Markit forecasts.

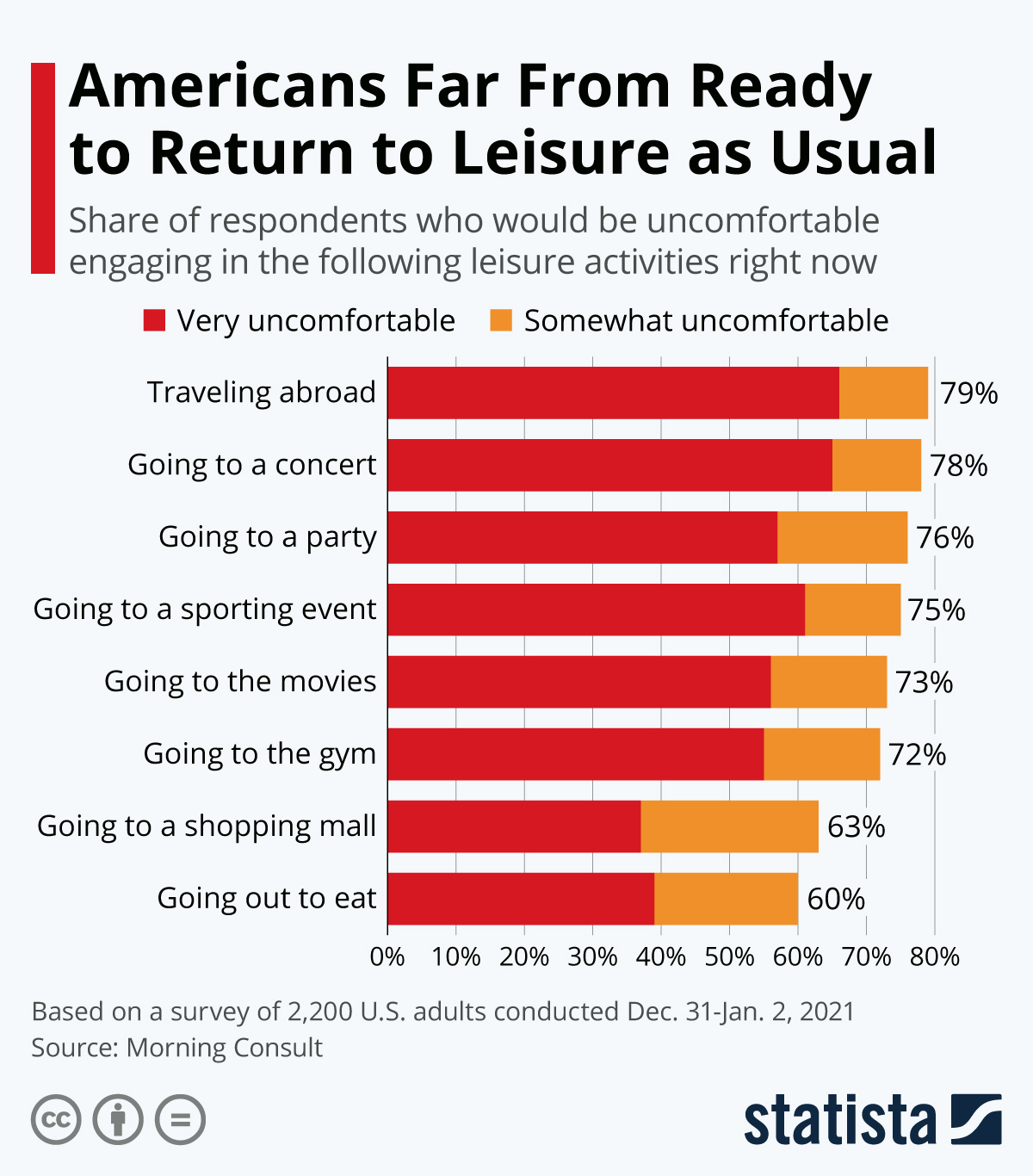

- Americans are leery of returning to pre-pandemic lifestyles, and caution about travel will likely persist well into the future.

- The Paycheck Protection Program (PPP) will reopen for small businesses today with an initial focus on first-time loan applicants and community-based lenders. With nearly half the budget of the initial PPP rollout, the reopened program is part of Congress’ recently passed $900 billion economic stimulus package.

- Hyundai Motor Co. held preliminary talks with Apple about development of a driverless electric vehicle, sending the automaker’s stock up 20% in a day ahead of an expected partnership deal.

International

- Global COVID-19 infections surpassed 90 million over the weekend.

- The U.K. became the first western European country to surpass 3 million COVID-19 cases, and fatalities surpassed 80,000, with officials expressing confidence in a sped-up vaccine rollout even as more patients strain the nation’s hospitals.

- Ireland is experiencing one of the highest COVID-19 infection rates in the world after recently easing restrictions, forcing some overwhelmed hospitals to treat patients in ambulances.

- COVID-19 fatalities in Belgium surpassed 20,000, among the world’s highest per capita.

- Quebec, Canada, imposed a nighttime curfew after one-day surge of more than 3,000 COVID-19 cases, a record. Canada’s vaccine rollout has been slow, with only 0.5% of the population vaccinated compared to 1.6% in the U.S. and 18% in Israel.

- China suffered 103 new COVID-19 cases yesterday, the highest level in five months, prompting new restrictions that have created food shortages and a spike in food prices.

- COVID-19 cases in Africa topped 3 million, with South Africa accounting for 30% of infections.

- Amid soaring COVID-19 infection and death rates, South Africa is suffering a critical oxygen shortage, with hospitals using three to four times more than normal.

- Mexico registered record new infections yesterday. Coronavirus fatalities among healthcare workers in the U.S. and Mexico are nearing the same levels, though Mexico’s total population is nearly a third smaller. Poorly paid Mexican medical staff often must take on other jobs that risk exposure to COVID-19 at the same time as vaccine rollouts are lagging.

- The more contagious COVID-19 variant first discovered in the U.K. is now spreading in 40 countries on its way to becoming the dominant form of the virus.

- The U.K. is opening seven regional COVID-19 inoculation centers at sports venues and conference centers with plans to inoculate 15 million of its most vulnerable citizens by mid-February. The country authorized Moderna’s COVID-19 vaccine for distribution to the public, adding an initial purchase order of 17 million doses of the vaccine.

- India is set to begin one of the world’s largest COVID-19 vaccination campaigns Jan. 16, with an aim to inoculate up to 300 million people in three to four months despite the nation’s homegrown vaccine not having cleared final-stage human trials yet.

- South Korea announced plans to inoculate all its citizens against COVID-19 for free. The country has experienced a drop in spiking infections after imposing new restrictions.

- Indonesia approved China’s Sinovac Biotech COVID-19 vaccine for emergency use, enabling a rollout in inoculations in Southeast Asia’s most populous nation.

- Japan has discovered a new COVID-19 strain in four travelers from Brazil with similarities to the more infectious strain found in the U.K.

- The world is unlikely to achieve herd immunity to COVID-19 in 2021 due to delayed vaccine rollouts, public resistance to the vaccines and further mutations of the virus.

- Global debt will have grown by $9 trillion in 2020 to 103% of global GDP, creating financial and social risk to emerging markets and strapping future generations with an enormous economic burden. The International Monetary Fund is increasing its reserve target considering rising credit risks.

- In a recent survey, 43% of Europeans, 40% of Americans and 65% of Chinese respondents said they will minimize air travel when pandemic restrictions are lifted to help the environment.

- Despite an 18% decline in unit sales in 2020, BMW beat its rivals in sales of luxury cars.

- Chinese electric vehicle maker Nio launched its first sedan model over the weekend as it vies for a piece of the world’s largest car market.

- While nowhere near as deadly as the Black Death in the 1300s, the COVID-19 pandemic has the same potential to massively disrupt labor markets and technology that could lead to permanent societal shifts.

Our Operations

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.