COVID-19 Bulletin: December 2

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- The American Petroleum Institute reported a larger-than-expected increase in U.S. crude inventories yesterday, putting downward pressure on prices. Crude prices were higher in late trading today, with the WTI up 1.5% at $45.20/bbl and Brent up 1.6% at $48.20/bbl. Natural gas was off 4.4% at $2.75/MMBtu.

- Higher oil prices in the wake of hopeful vaccine news have complicated OPEC’s looming decision about whether to extend pandemic-induced production cuts into 2021, with hard-hit cartel members less willing to forgo revenue in the short term.

- As OPEC+ nations debate the future of oil production and prices, Mexico, which exited the consortium earlier this year, will benefit by nearly $2.5 billion from successful crude price hedges.

- Norway, Western Europe’s largest oil producer, will end government-imposed production cuts at the end of the year.

- To protect against a sharp drop in oil supplies, Japan and Kuwait are partnering to stockpile oil.

- Venezuela nearly tripled crude exports in November to more than 500,000 bpd with most going to China, even as the U.S. deepens sanctions against the country.

- Midstream leader Enbridge received the final approval for a pipeline linking oil producers in Alberta, Canada, with the U.S. Midwest.

- Evidence suggests 2019 may mark the premature arrival of peak oil, with the 2020 pandemic cutting global demand by a staggering 29 million bpd alongside weak forecasts from industry leaders. The West’s five supermajor producers have announced asset write-downs of some $70 billion so far this year.

Supply Chain

- Volkswagen’s Bentley unit has purchased five cargo jets to protect against supply chain disruptions in the event of a disorderly Brexit.

- Carriers are avoiding congested Northern European ports, causing a backlog of waiting export shipments and stranded containers and creating pressure for regulatory intervention as exporters face a premium as high as $5,000 to ship a box to Asia.

- Shipping giants Maersk and CMA CGM are asking the European Commission to allow free emissions allowances ahead of the bloc’s entry into a cap-and-trade emissions program scheduled for mid-2021.

- Volvo and Japan-based SoftBank are betting on new technology startups that could reshape freight logistics, announcing a $100+ million investment in a software app that matches trucks with freight headed in the same direction, akin to ride-hailing companies’ pooled rider services.

- CSX is acquiring Pan Am Railways, a regional rail service in the Northeastern U.S.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- The U.S. suffered 180,083 new COVID-19 cases yesterday, with 2,597 deaths, the second highest daily fatalities on record.

- COVID-19 hospitalizations rose to a record 96,039 on Tuesday, more than double the count from one month ago. Nearly 37,000 Americans died of the disease in November alone, straining the capacity of morgues and funeral homes.

- Florida became the third state behind California and Texas to register more than 1 million COVID-19 infections.

- Texas recorded a record 15,182 new COVID-19 infections Tuesday, as the White House’s coronavirus task force called on state leaders to intensify their response to the pandemic.

- After shattering the one-day record of new COVID-19 cases on Tuesday, Los Angeles County officials are predicting up to 9,000 new cases per day by the middle of next week, adding to California’s strained hospital capacity.

- With coronavirus infection rates approaching early pandemic levels in New York City, public health officials are urging at-risk residents to stay home except for essential activities. Along with Pennsylvania, the state is currently seeing the largest rise in hospitalizations in the nation.

- Healthcare workers and long-term care residents will likely be the first in line to get vaccinated for COVID-19 due to their high risk of infection, government advisors say. However, many states say they are not prepared for rapid COVID-19 distribution if a vaccine were to be approved soon.

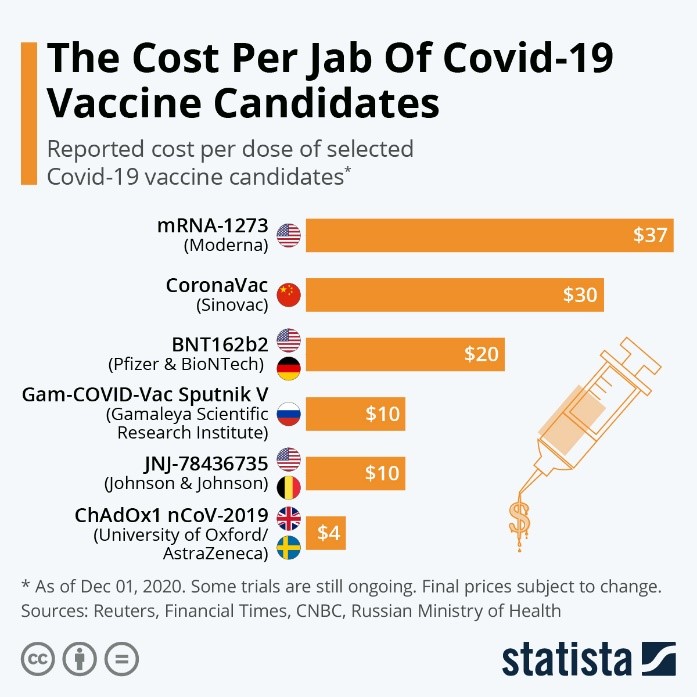

- Preliminary estimates suggest COVID-19 vaccines will be relatively affordable:

- Talks between top lawmakers and the White House over additional coronavirus aid resumed on Tuesday.

- The pandemic could be worse than the Great Recession for companies that had high levels of indebtedness at the start of the outbreak, according to Federal Reserve economists in New York.

- Gains in online shopping were not enough to offset declines in retail store visits during the five-day period including Black Friday and Cyber Monday, with total sales down 14% compared to the year-ago period.

- November’s surge in COVID-19 cases has stalled many employees from returning to the office, a trend that picked up after Labor Day.

- Business and industry leaders diverge sharply in their views of the post-pandemic future of business travel, a prospect complicated by slashed travel budgets and the unforeseen utility of virtual meetings. The pandemic could result in a permanent 36% reduction in business travel.

- U.S. automobile sales among Asian car companies were down nearly 10% in November from the prior-year period, when there were three more sales days on the calendar.

- Tech devices and video games comprise 8 of the top 10 requested holiday gifts for children as the pandemic accelerates tech’s dominance over traditional toys.

- U.S. construction spending increased by a higher-than-expected 1.3% in October, the fifth consecutive monthly increase, with residential construction up 2.9%.

- Mortgage applications were up 9% last week and are 28% higher for the year.

- For the first time ever, more than half of U.S. spending on advertisements will go to digital platforms such as Google and Facebook, where advertisers enjoy cheaper rates and better targeting and performance measures than with traditional ad forms.

- Office space availability in Manhattan grew to 13.5% in November, the highest rate since at least 2003.

- Three-quarters of work-from-home (WFH) workers hope to return to the office in some form in the future, with half preferring a hybrid WFH/office schedule and a quarter hoping to return full time.

- Over 40 major U.S. corporations sent a letter to Congress and the president-elect urging cooperation in addressing climate change.

International

- Global COVID-19 cases topped 64 million yesterday, with nearly 1.5 million fatalities.

- Poland became the 13th nation with more than 1 million total COVID-19 cases.

- Hong Kong is increasing restrictions to deal with rising COVID-19 case numbers, including limiting gatherings to no more than two people and ordering compulsory testing of some workers.

- Vietnam reported its first local transmission of COVID-19 in almost three months.

- The U.K. authorized the Pfizer/BioNTech vaccine for use, the first western country to approve a vaccine.

- Japanese lawmakers passed a bill to provide free COVID-19 vaccinations to the public.

- Manufacturing is proving to be a lifeline to economic recovery from the pandemic, with indexes of manufacturing activity in the U.S., China and parts of Asia improving in November, alongside expansion in Germany and rising exports in South Korea.

- China will likely emerge as the big economic winner when the global economy comes back, a new report from the international Organization for Economic Cooperation and Development says.

Our Operations

- We are pleased to introduce M. Holland’s new Application Development Engineer for Sustainability, Debbie Prenatt. With 20+ years in the plastics industry, Debbie will focus on developing our portfolio and expanding our expertise in the Sustainability segment to better serve our clients.

- Our latest Founders Series video is a tribute to Joan Holland, co-founder and matriarch of M. Holland, who recently passed away.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.