COVID-19 Bulletin: November 30

Good Afternoon,

More news relevant to the plastics industry:

Some sources linked are subscription services.

Supply

- Crude prices were lower in early trading today, with the WTI down 1.1% at $45.04/bbl and Brent down 1.4% at $47.49/bbl. Natural gas was 2.9% higher at $2.93/MMBtu.

- OPEC+ members are meeting Monday and Tuesday to consider extending pandemic-induced production cuts into 2021. Pre-meeting comments by some countries suggest growing tension among the consortium of 24 oil-producing nations.

- After breakneck growth in the U.S. shale industry in recent years, OPEC countries are once again taking the lead in the global oil market, with shale industry leaders expecting flat production through 2021 and limited growth until 2022 or 2023.

- U.K.-based energy supplier Centrica, the owner of British Gas, is in talks to sell its liquefied natural gas business amid market volatility that could require Centrica to pay a buyer to take the business off its hands.

- Goldman Sachs projects that global spending on renewable power production will exceed spending on oil and gas drilling for the first time next year, with a growing list of “clean supermajors” emerging.

- Solar-farm development is expecting to increase rapidly in Texas, where wind power already makes the state the leading renewable energy producer in the U.S.

Supply Chain

- More than 16,000 southern California homes had their power cut off on Thanksgiving as strong winds increased the region’s wildfire risk.

- With the official hurricane season ending today, 2020 will surpass 2005 as the busiest season on record with 30 named storms forming in the Atlantic basin since June 1.

- A newly digitized supply chain management system has helped GE Appliances deal with a surge in demand in home appliances during the lockdown, employing real-time data and artificial intelligence to anticipate disruptions and help allocate scarce supplies.

- Canada will follow the lead of New York City in capping delivery fees that third-party deliverers such as Uber and DoorDash may charge.

- Startup Gatik will give Canada its first autonomous vehicle delivery fleet, announcing a partnership with grocer giant Loblaw to deliver online orders in the Toronto area.

- With tight freight capacity nationwide and supply constraints with many plastic resins, clients are advised to provide expanded lead times on orders to help ensure delivery dates.

Markets

- There were 155,596 new COVID-19 cases and 1,189 fatalities in the U.S. yesterday, the 27th consecutive day of more than 100,000 new infections as health officials fear travelers returning from the holidays will unleash “a natural disaster” impacting all 50 states at once.

- On Friday, the U.S. passed a record-setting daily case threshold of 200,000 new COVID-19 infections, pushing total infections above 13 million.

- Looking at factors such as a lack of testing options, asymptomatic cases and poor tallies, the CDC estimates that roughly 16% of Americans had COVID-19 by the end of September, far higher than the official number of reported cases.

- Colorado’s governor became the sixth U.S. governor to test positive for COVID-19.

- National COVID-19 hospitalizations nearly doubled in November, with rural hospitals facing particularly difficult circumstances due to the lack of resources and inability to send patients to larger hospitals, which are also full.

- Moderna will seek emergency use authorization for its COVID-19 vaccine from the FDA today.

- Facing criticism for errors in late-stage trials of its COVID-19 vaccine, AstraZeneca will likely run a new trial to confirm the vaccine’s 90% effectiveness rate.

- United Airlines is starting to ship doses of Pfizer’s COVID-19 vaccine, one link in a massive supply chain operation to quickly distribute the vaccine once finally approved.

- Dental problems, including the loss of teeth, are plaguing some COVID-19 survivors suffering prolonged symptoms.

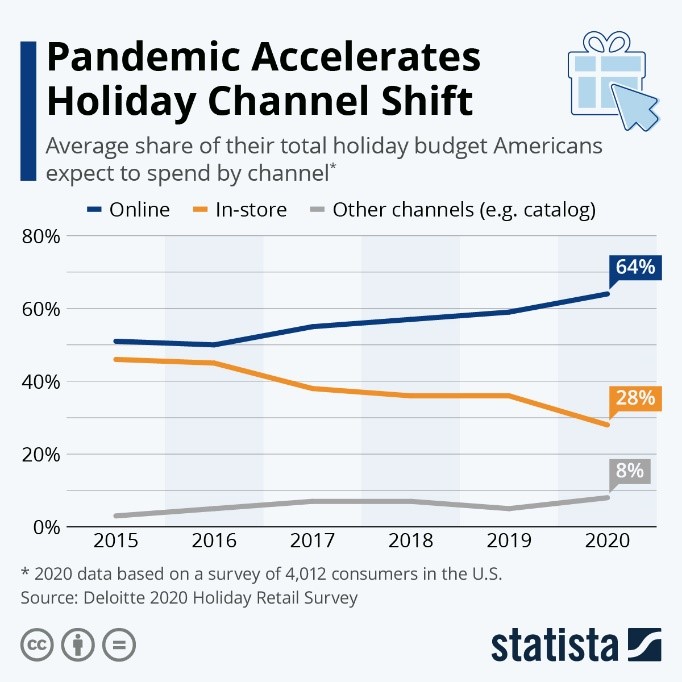

- Normally the busiest shopping day of the year, Black Friday saw a 52% reduction in retail store visits as consumers stayed home and shopped online, evidenced by a 22% increase in online orders from the same time last year.

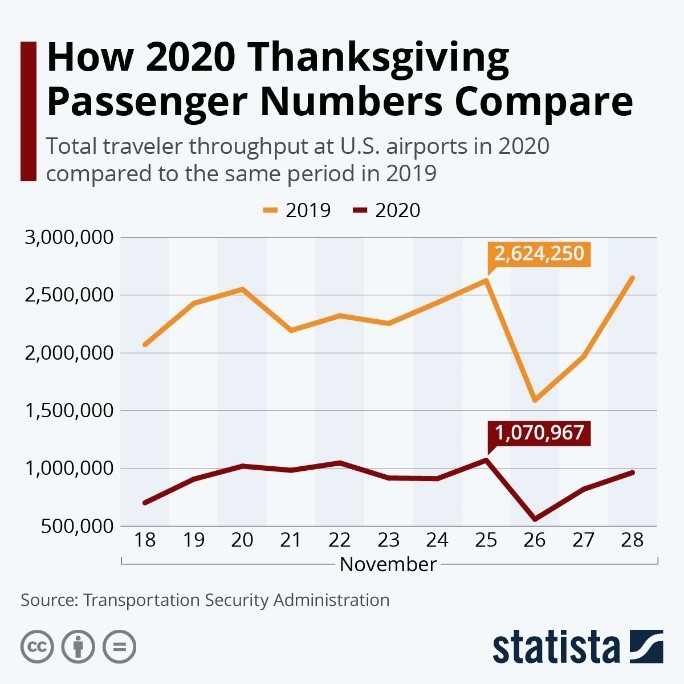

- An estimated 50 million Americans made a holiday journey between November 25-29, despite official warnings not to travel. The number is down 10% from records set last year, but still was the busiest travel period of 2020.

- On Thanksgiving Eve, U.S. airports saw their highest one-day number of travelers since mid-March, a level still 60% lower than the same time last year.

- U.S. companies and the federal government issued $9.7 trillion in debt so far this year to blunt the economic impact of the pandemic. Global debt rose by $15 trillion in the first nine months to $272 trillion, or 365% of global GDP.

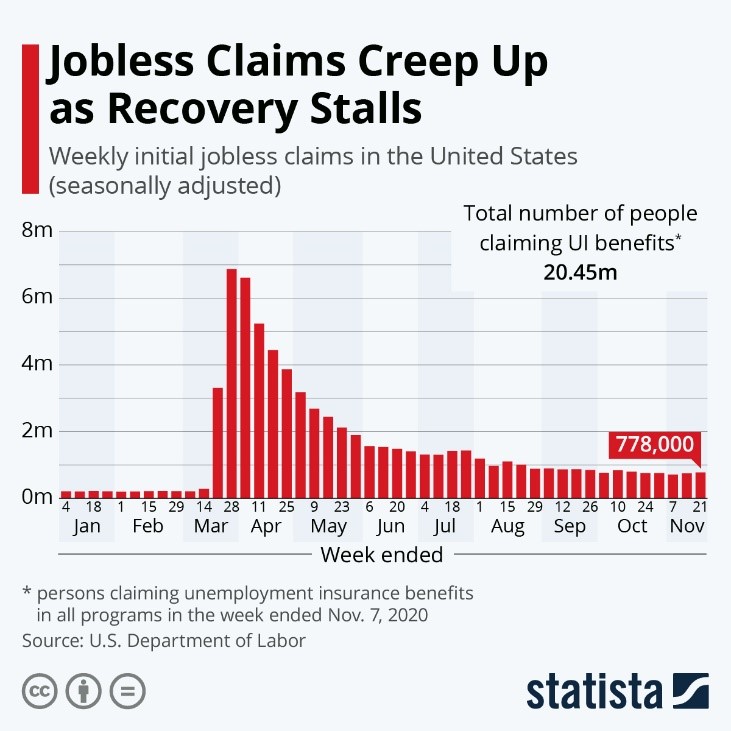

- U.S. unemployment claims rose to 778,000 for the week of Thanksgiving, the first time since July that new claims rose for two consecutive weeks.

- Renewed lockdowns have prompted a chorus of calls from governors for more federal aid for struggling businesses.

- A “K-shaped” recovery is emerging in the U.S., with wealthy Americans benefiting from rising asset values while the pandemic threatens to erase decades of gains against poverty, as unemployment benefits for millions expire next month.

- Amazon is on a historic hiring spree this year, growing its workforce by more than 50% to 1.2 million people, averaging 1,400 new hires a day.

- Disney has upped its layoff count by 4,000 from initial plans announced in September. The company now plans to cut 32,000 jobs by March on pandemic-induced hits to its theme-park business.

- Young college graduates face higher levels of unemployment than other age groups, with a quarter of employers removing or rescinding job opportunities after the pandemic struck.

- The post-pandemic landscape for offices and shopping malls could look very different after many industry leaders expect a permanent consumer shift to remote work and e-commerce.

- Volkswagen is culling traditional vehicle models to free funds to accelerate electric vehicle production, with plans to introduce an all-electric compact car for under $36,000 as early as 2023.

- Tesla has plans to produce and begin distributing electric semitrailer trucks in 2021.

- GM backed away from its agreement to take an interest in Nikola after the electric vehicle startup scuttled plans for one of its marquee projects, the Badger, an electric/hydrogen powered pickup truck.

- Polaris is aligning with Zero Motorcycles to accelerate development of electric off-road vehicles, with plans to introduce electric versions of its vehicles and snowmobiles by 2023.

- Manufacturers are introducing new face mask designs for general use to fill the effectiveness gap between cloth masks and medical grade N-95 masks.

- Market research giant S&P Global is in talks to acquire rival IHS Markit in a deal worth $39 billion as soaring demand for data drives consolidation in the market information industry.

- Phone calls are seeing a renaissance as the preferred method of work communication, which many professionals see as a happy medium between taxing video calls and unnuanced text communication.

- The NFL shut all training facilities Monday and Tuesday of this week after a rash of COVID-19 infections across the league played havoc with the Thanksgiving weekend schedule.

International

- Mexico and Germany became the 11th and 12th countries, respectively, to top the 1 million threshold for COVID-19 infections.

- COVID-19 deaths in Europe topped 400,000 over the weekend, making it the second worst-hit region for fatalities after Latin America and the Caribbean.

- National lockdowns in England decreased coronavirus infections by as much as 30%, data shows. The country is expected to be first in approving experimental vaccines from Pfizer/BioNTech.

- COVID-19 infections in Italy are on a downward trend, with 6,000 fewer cases reported Sunday than the day before.

- Global trade flows in the third quarter were 12.5% higher than in the second quarter and only 2% lower than levels at the end of 2019. The rebound has been led by increasing exports from China.

- Led by an increase in industrial output, Mexico’s economy followed its record second-quarter contraction with a 12.1% jump in GDP in the third quarter.

- India’s third-quarter GDP contracted 7.5% compared to the year-ago period, a blow to one of the world’s fastest growing economies before the pandemic.

- To encourage plastics recycling, China is imposing new regulations to force retailers, e-commerce businesses and delivery firms to report their use of single-use plastics and to have formal recycling plans.

Our Operations

- Our latest Founders Series video is a tribute to Joan Holland, co-founder and matriarch of M. Holland, who recently passed away.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets. To arrange a videoconference or meeting with any of our Market Managers, please visit our website.

- To access 3D Printing training, order parts and seek technical assistance, visit our online resource.

Thank you,

M. Holland Company

We will provide further COVID-19 bulletins as circumstances dictate. For all COVID-19 updates and notices, please refer to the M. Holland website.